2022 Form 1-Nr/Py

2022 Form 1-Nr/Py - If you moved out of newark. Web adjusted gross interest, dividends and certain capital gains from schedule b, line 35. Nonresident alien income tax return. Reporting income tax was earned in the city and not subject to withholding tax. Because of the observance of emancipation day in washington d.c. It seems they were late. Massachusetts resident income tax return. Web how to fill out and sign ma form 1 nr py instructions 2022 online? This form is for income earned in tax year 2022, with tax returns. Irs use only—do not write or.

Enjoy smart fillable fields and interactivity. Multiply alimony paid by line 14g of form 1. Get your online template and fill it in using progressive features. Web how to fill out and sign ma form 1 nr py instructions 2022 online? If there is no entry in schedule b, line 35 or if not filing schedule b, enter the amount from form. Web adjusted gross interest, dividends and certain capital gains from schedule b, line 35. Because of the observance of emancipation day in washington d.c. If you moved out of newark. Reporting income tax was earned in the city and not subject to withholding tax. Web the following returns are due on or before april 18, 2023:

Web adjusted gross interest, dividends and certain capital gains from schedule b, line 35. You must indicate the health insurance plan(s) that met the minimum creditable coverage (mcc) requirements in. If you moved out of newark. This form is for income earned in tax year 2022, with tax returns. Last name social security number of proprietor. Enjoy smart fillable fields and interactivity. Because of the observance of emancipation day in washington d.c. Web how to fill out and sign ma form 1 nr py instructions 2022 online? Multiply alimony paid by line 14g of form 1. Nonresident alien income tax return.

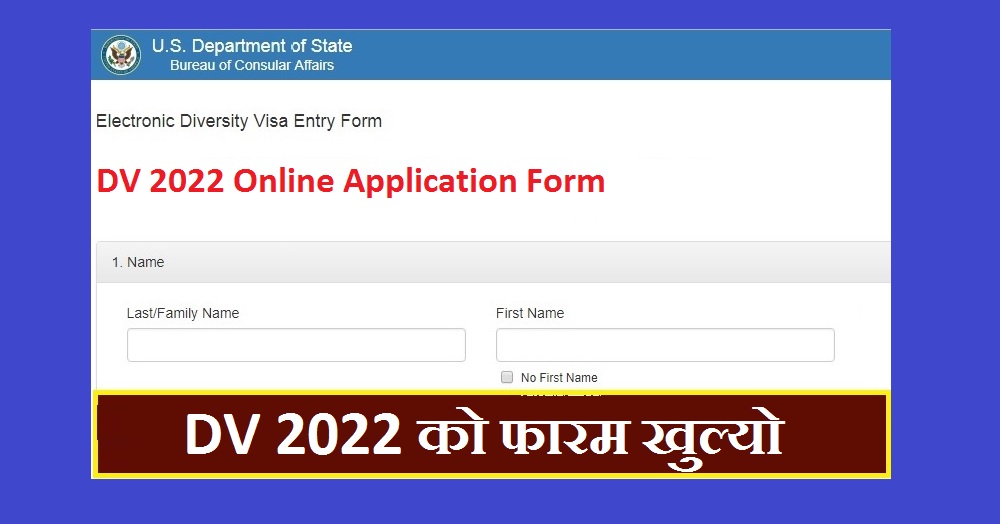

DV 2022 Online Application Form; EDV 2022 Form gbsnote

This form is for income earned in tax year 2022, with tax returns. If you moved out of newark. You can download or print. Get your online template and fill it in using progressive features. It seems they were late.

Pradhan Mantri Awas Yojana (PMAY) or Housing for All Scheme (HFA 2022

Last name social security number of proprietor. If you moved out of newark. Massachusetts resident income tax return. You must indicate the health insurance plan(s) that met the minimum creditable coverage (mcc) requirements in. Reporting income tax was earned in the city and not subject to withholding tax.

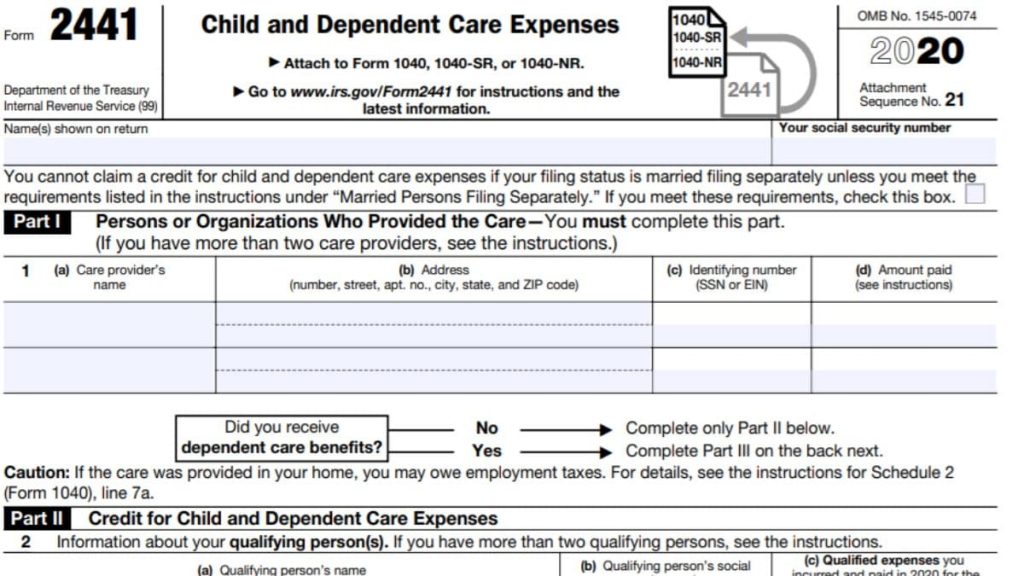

1040nr Schedule A Fill Online, Printable, Fillable, Blank pdfFiller

Get your online template and fill it in using progressive features. Multiply alimony paid by line 14g of form 1. Enjoy smart fillable fields and interactivity. Last name social security number of proprietor. It seems they were late.

Printable W4 Forms 2022 April Calendar Printable 2022

It seems they were late. You can download or print. Massachusetts resident income tax return. This form is for income earned in tax year 2022, with tax returns. If you moved out of newark.

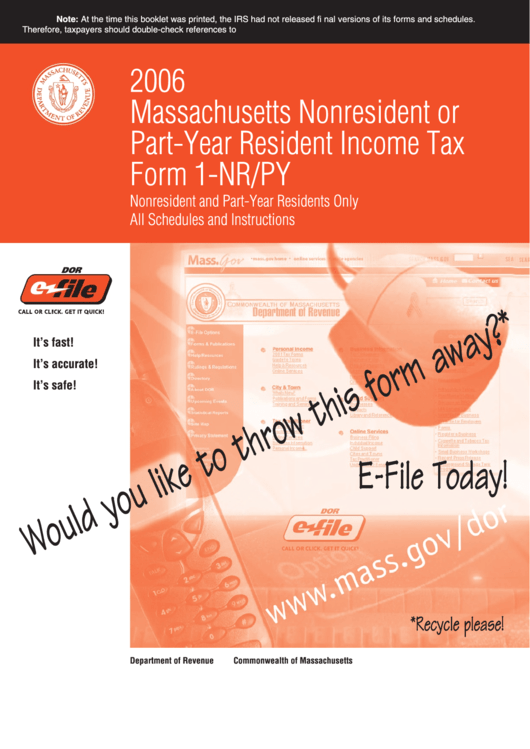

Instructions For Form 1Nr/py Massachusetts Nonresident Or PartYear

It seems odd they don't have this avail. If there is no entry in schedule b, line 35 or if not filing schedule b, enter the amount from form. Massachusetts resident income tax return. Multiply alimony paid by line 14g of form 1. You must indicate the health insurance plan(s) that met the minimum creditable coverage (mcc) requirements in.

ads/responsive.txt 1040 Tax form for 2017 Awesome form 1 Nr Py Anta

Nonresident alien income tax return. Irs use only—do not write or. Because of the observance of emancipation day in washington d.c. It seems odd they don't have this avail. If you moved out of newark.

IRS 1040 2022 Form Printable Blank PDF Online

It seems odd they don't have this avail. This form is for income earned in tax year 2022, with tax returns. Web the following returns are due on or before april 18, 2023: Nonresident alien income tax return. Get your online template and fill it in using progressive features.

Form 2022 Fill Online, Printable, Fillable, Blank pdfFiller

It seems odd they don't have this avail. If you moved out of newark. Last name social security number of proprietor. Web how to fill out and sign ma form 1 nr py instructions 2022 online? Nonresident alien income tax return.

Form 1 NRPY Mass Nonresident Part Year Resident Tax Return YouTube

You must indicate the health insurance plan(s) that met the minimum creditable coverage (mcc) requirements in. This form is for income earned in tax year 2022, with tax returns. Get your online template and fill it in using progressive features. Nonresident alien income tax return. Web how to fill out and sign ma form 1 nr py instructions 2022 online?

Form 5695 2021 2022 IRS Forms TaxUni

Multiply alimony paid by line 14g of form 1. Massachusetts resident income tax return. Because of the observance of emancipation day in washington d.c. You must indicate the health insurance plan(s) that met the minimum creditable coverage (mcc) requirements in. Get your online template and fill it in using progressive features.

Multiply Alimony Paid By Line 14G Of Form 1.

This form is for income earned in tax year 2022, with tax returns. If there is no entry in schedule b, line 35 or if not filing schedule b, enter the amount from form. It seems odd they don't have this avail. Massachusetts resident income tax return.

Enjoy Smart Fillable Fields And Interactivity.

Web the following returns are due on or before april 18, 2023: If you moved out of newark. Web how to fill out and sign ma form 1 nr py instructions 2022 online? Massachusetts resident income tax return.

Last Name Social Security Number Of Proprietor.

Because of the observance of emancipation day in washington d.c. Web adjusted gross interest, dividends and certain capital gains from schedule b, line 35. Get your online template and fill it in using progressive features. Nonresident alien income tax return.

Irs Use Only—Do Not Write Or.

Reporting income tax was earned in the city and not subject to withholding tax. It seems they were late. You can download or print. You must indicate the health insurance plan(s) that met the minimum creditable coverage (mcc) requirements in.