Form It-360.1 Instructions

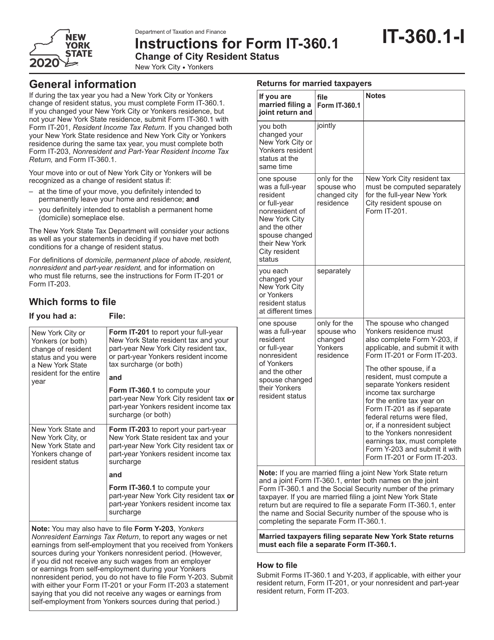

Form It-360.1 Instructions - If you are married filing a joint new york state return but are. Web form it‑360.1, enter both names on the joint form it‑360.1 and the social security number of the primary taxpayer. If you changed your new york city or. Web — form it‑360.1, change of city resident status. This form is for those who need to change their city residency status for. Please use the link below to. Web follow the simple instructions below: If you are married filing a joint new york state return and only one spouse had a new york city change of resident status, you must compute your. Web new york — change of city resident status download this form print this form it appears you don't have a pdf plugin for this browser. Use fill to complete blank online new york state pdf forms.

Web follow the simple instructions below: Web new york — change of city resident status download this form print this form it appears you don't have a pdf plugin for this browser. Web — form it‑360.1, change of city resident status. Please use the link below to. This form is for those who need to change their city residency status for. Use fill to complete blank online new york state pdf forms. If you are married filing a joint new york state return but are. If you changed your new york city or. Web complete form it‑360.1, following the specific instructions that begin on page 3 to compute your part‑year new york city resident tax and to compute your part‑year. If you are married filing a joint new york state return and only one spouse had a new york city change of resident status, you must compute your.

If you are married filing a joint new york state return and only one spouse had a new york city change of resident status, you must compute your. Web new york — change of city resident status download this form print this form it appears you don't have a pdf plugin for this browser. This form is for those who need to change their city residency status for. If you are married filing a joint new york state return but are. Web — form it‑360.1, change of city resident status. Web follow the simple instructions below: Use fill to complete blank online new york state pdf forms. Web complete form it‑360.1, following the specific instructions that begin on page 3 to compute your part‑year new york city resident tax and to compute your part‑year. Business, legal, tax along with other electronic documents require an advanced level of protection and compliance with the legislation. Web form it‑360.1, enter both names on the joint form it‑360.1 and the social security number of the primary taxpayer.

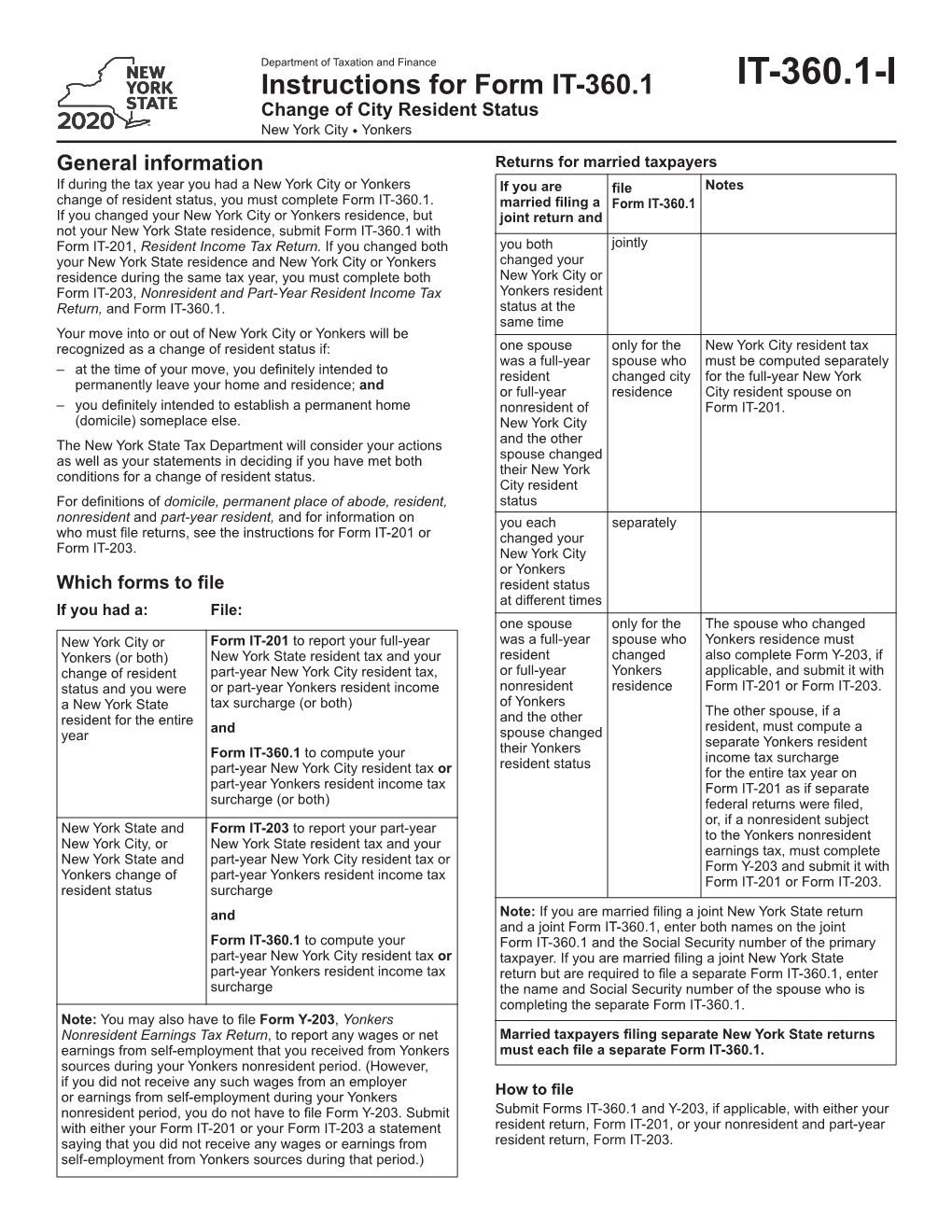

Instructions for Form IT360.1 DocsLib

Web form it‑360.1, enter both names on the joint form it‑360.1 and the social security number of the primary taxpayer. Please use the link below to. Web new york — change of city resident status download this form print this form it appears you don't have a pdf plugin for this browser. Use fill to complete blank online new york.

Online Registration & Scheduling Student Affairs

This form is for those who need to change their city residency status for. Web new york — change of city resident status download this form print this form it appears you don't have a pdf plugin for this browser. If you changed your new york city or. If you are married filing a joint new york state return but.

I wish that the completed games section from the 360 makes a comeback

Web follow the simple instructions below: Use fill to complete blank online new york state pdf forms. If you are married filing a joint new york state return and only one spouse had a new york city change of resident status, you must compute your. Web complete form it‑360.1, following the specific instructions that begin on page 3 to compute.

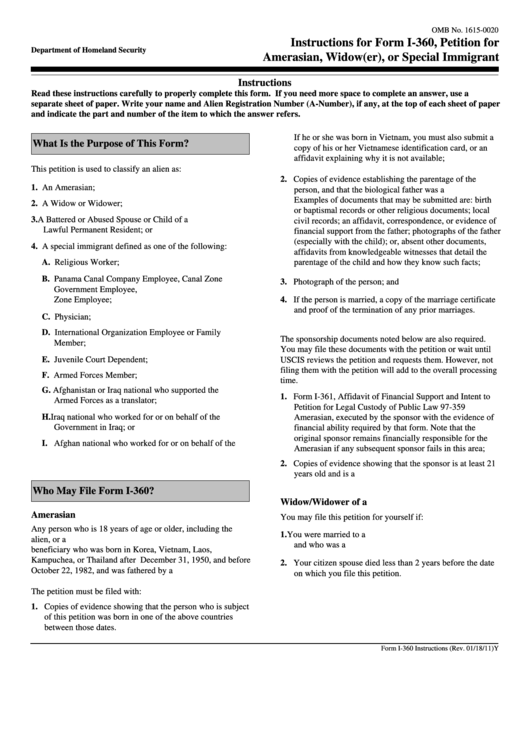

Instructions For Form I360, Petition For Amerasian, Widow(Er), Or

If you are married filing a joint new york state return and only one spouse had a new york city change of resident status, you must compute your. If you changed your new york city or. This form is for those who need to change their city residency status for. Please use the link below to. Web — form it‑360.1,.

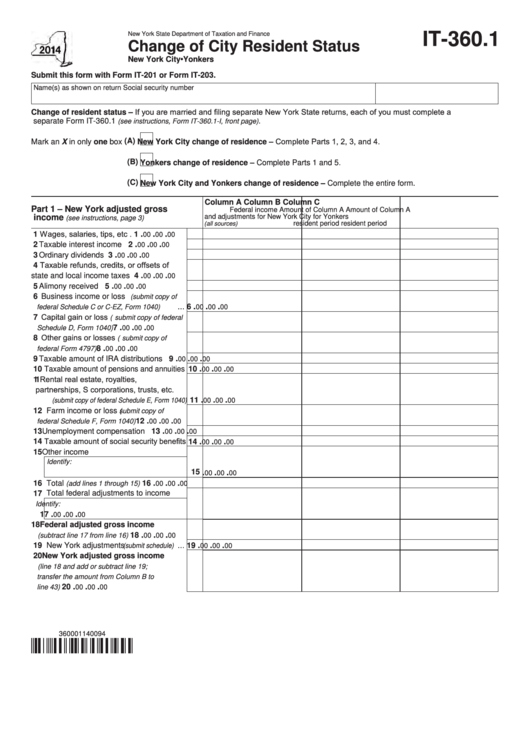

Fillable Form It360.1 Change Of City Resident Status 2014

This form is for those who need to change their city residency status for. Web — form it‑360.1, change of city resident status. Web new york — change of city resident status download this form print this form it appears you don't have a pdf plugin for this browser. Web complete form it‑360.1, following the specific instructions that begin on.

Online Examination System(Test Mate project ) YouTube

Please use the link below to. If you are married filing a joint new york state return but are. Web new york — change of city resident status download this form print this form it appears you don't have a pdf plugin for this browser. Web follow the simple instructions below: Web form it‑360.1, enter both names on the joint.

Form IT 360 Change City Residency Miller Financial Services

Web new york — change of city resident status download this form print this form it appears you don't have a pdf plugin for this browser. Web — form it‑360.1, change of city resident status. Business, legal, tax along with other electronic documents require an advanced level of protection and compliance with the legislation. Please use the link below to..

Download Instructions for Form IT360.1 Change of City Resident Status

Use fill to complete blank online new york state pdf forms. This form is for those who need to change their city residency status for. If you changed your new york city or. Business, legal, tax along with other electronic documents require an advanced level of protection and compliance with the legislation. If you are married filing a joint new.

It 201 Instructions slidesharedocs

Web follow the simple instructions below: If you are married filing a joint new york state return and only one spouse had a new york city change of resident status, you must compute your. Please use the link below to. Web new york — change of city resident status download this form print this form it appears you don't have.

Java Tutorials Calculator If Else Paras Coding YouTube

Web — form it‑360.1, change of city resident status. If you are married filing a joint new york state return and only one spouse had a new york city change of resident status, you must compute your. If you changed your new york city or. This form is for those who need to change their city residency status for. Web.

Web — Form It‑360.1, Change Of City Resident Status.

If you are married filing a joint new york state return and only one spouse had a new york city change of resident status, you must compute your. Web complete form it‑360.1, following the specific instructions that begin on page 3 to compute your part‑year new york city resident tax and to compute your part‑year. Web follow the simple instructions below: Use fill to complete blank online new york state pdf forms.

If You Are Married Filing A Joint New York State Return But Are.

Web new york — change of city resident status download this form print this form it appears you don't have a pdf plugin for this browser. If you changed your new york city or. Business, legal, tax along with other electronic documents require an advanced level of protection and compliance with the legislation. Please use the link below to.

Web Form It‑360.1, Enter Both Names On The Joint Form It‑360.1 And The Social Security Number Of The Primary Taxpayer.

This form is for those who need to change their city residency status for.