Thomas's Retirement Savings Contributions Credit On Form 8880 Is

Thomas's Retirement Savings Contributions Credit On Form 8880 Is - Thomas's retirement savings contributions credit on form 8880 is. Web beginning in 2018, as part of a provision contained in the tax cuts and jobs act of 2017, a retirement savings contribution credit may be claimed for the amount of. Web richard's retirement savings contributions credit on form 8800 is $_______. You were a student if. Answer yes if the taxpayer will make a qualifying ira contribution for tax year 2021 by the due date of the return. Web see form 8880, credit for qualified retirement savings contributions, for more information. Child and dependent care credit c. Web your form 8880 will guide you through a calculation to determine the maximum credit amount you are eligible to claim. Amount of the credit depending on your adjusted gross income. Enter the amount from the credit limit worksheet in.

Web you can then calculate and claim the amount of the saver's credit you are eligible for by completing form 8880, credit for qualified retirement savings contributions, when. The credit was designed to promote saving for retirement among. Thomas's retirement savings contributions credit on form 8880 is. You may be eligible to claim the retirement savings. Web see form 8880, credit for qualified retirement savings contributions, for more information. Web common questions on form 8880 retirement saving contribution credit in lacerte screen 24, adjustments to income form 8880 not generating credit due to. Web credit for qualified retirement savings contributions 8880 you cannot take this credit if either of the following applies. Amount of the credit depending on your adjusted gross income. Richard will use his 2019 earned income rather than his 2021 earned income to calculate. Web reminder contributions by a designated beneficiary to an achieving a better life experience (able) account.

Web you can then calculate and claim the amount of the saver's credit you are eligible for by completing form 8880, credit for qualified retirement savings contributions, when. You can’t take this credit. Web see form 8880, credit for qualified retirement savings contributions, for more information. You may be eligible to claim the retirement savings. The total amount of thomas's advanced payment of premium tax credit for 2022 is \$ 35. Web credit for qualified retirement savings contributions 8880 you cannot take this credit if either of the following applies. If line 9 is zero, stop; Child and dependent care credit c. Amount of the credit depending on your adjusted gross income. Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file.

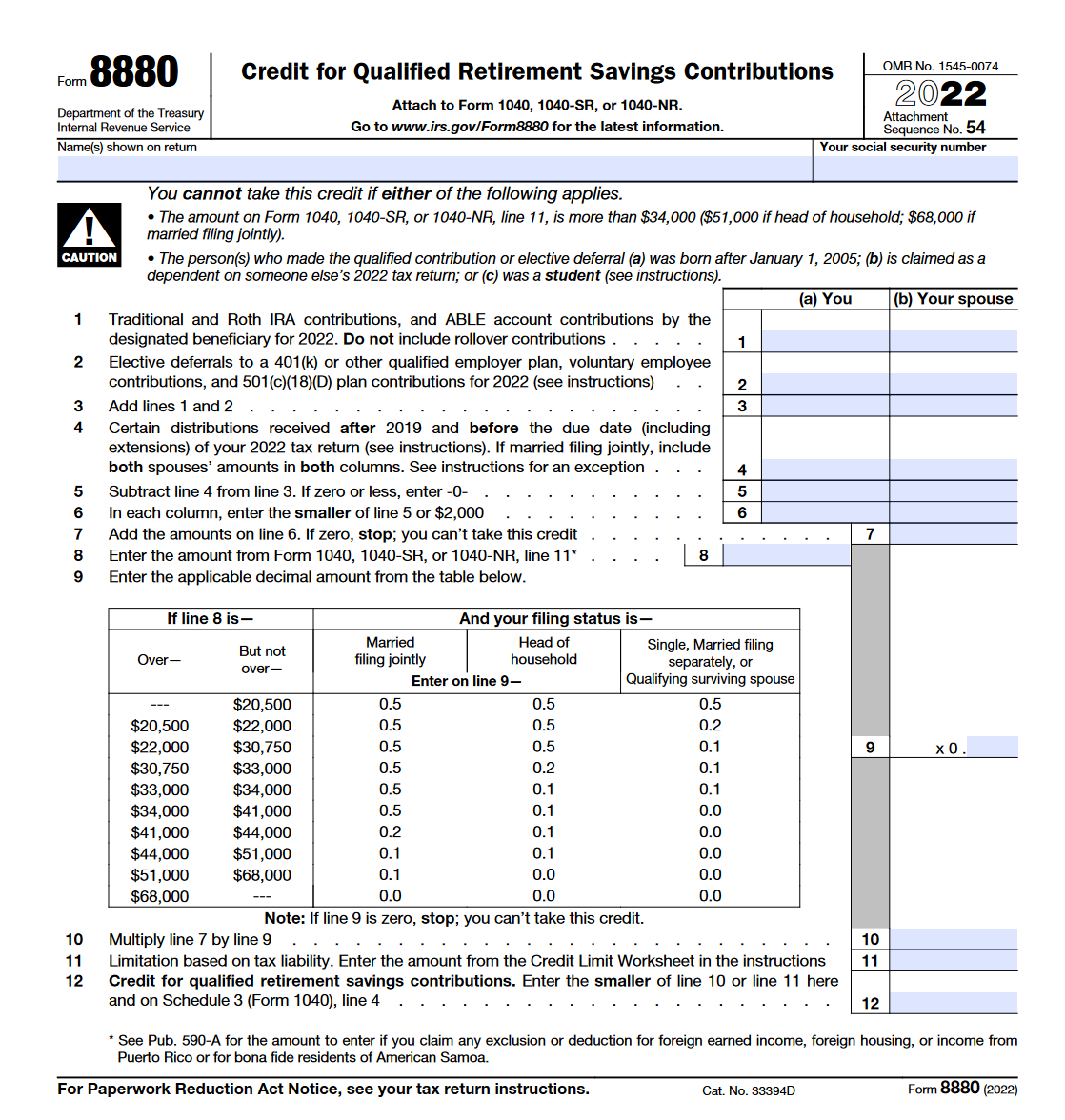

IRS Form 8880. Credit for Qualified Retirement Savings Contributions

You may be eligible to claim the retirement savings. Web your form 8880 will guide you through a calculation to determine the maximum credit amount you are eligible to claim. Web plans that qualify are listed on form 8880. Web common questions on form 8880 retirement saving contribution credit in lacerte screen 24, adjustments to income form 8880 not generating.

Business Concept about Form 8880 Credit for Qualified Retirement

Amount of the credit depending on your adjusted gross income. Web see form 8880, credit for qualified retirement savings contributions, for more information. Web reminder contributions by a designated beneficiary to an achieving a better life experience (able) account. Thomas's retirement savings contributions credit on form 8880 is. This is where you’ll report your income to determine eligibility and all.

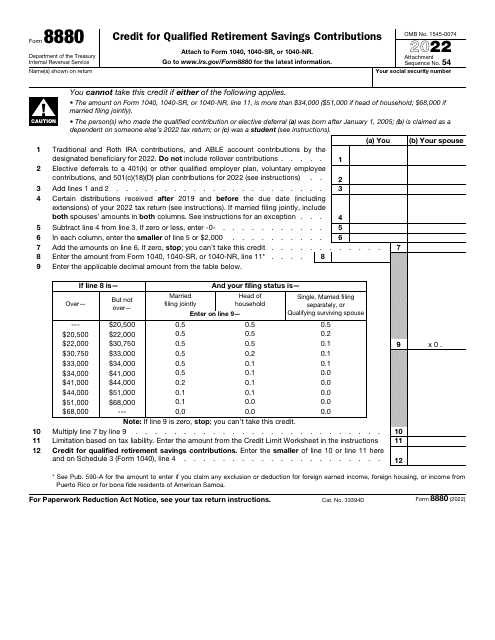

IRS Form 8880 Download Fillable PDF or Fill Online Credit for Qualified

Web reminder contributions by a designated beneficiary to an achieving a better life experience (able) account. The total amount of thomas's advanced payment of premium tax credit for 2022 is \$ 35. The credit was designed to promote saving for retirement among. Web see form 8880, credit for qualified retirement savings contributions, for more information. Web plans that qualify are.

RC Post Count Shame (Page 575 of 1076)

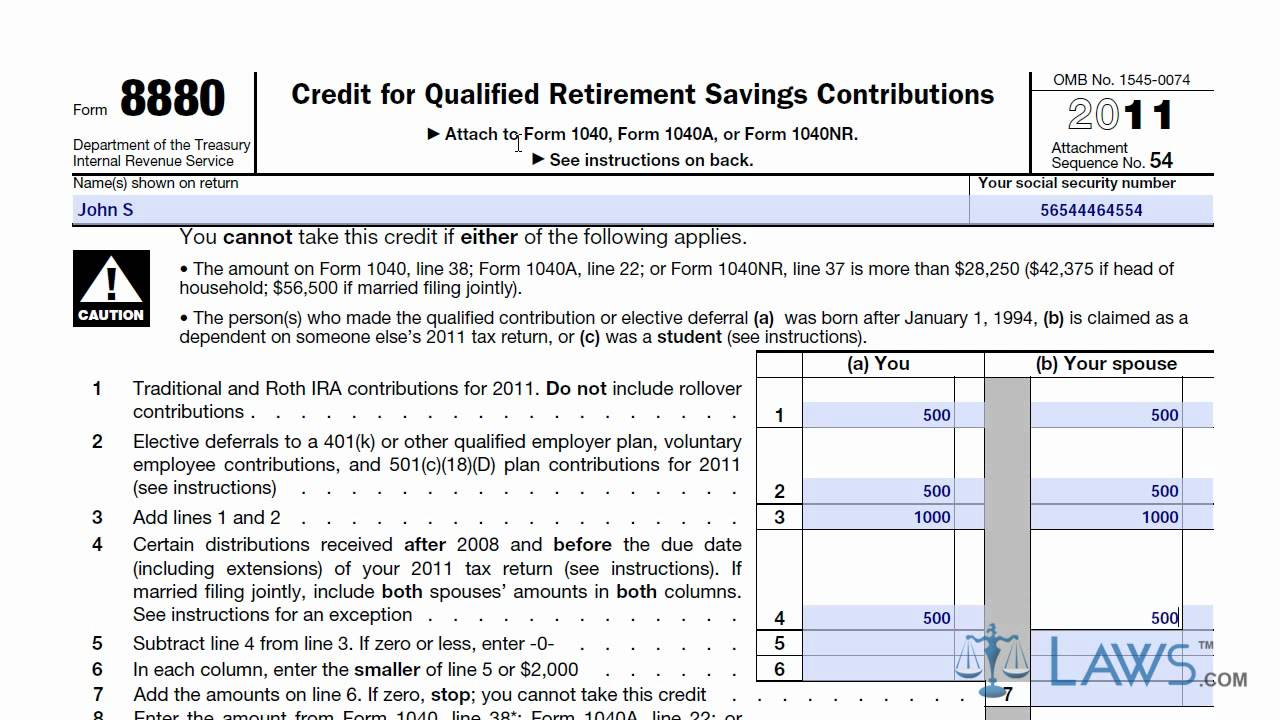

You were a student if. 10 multiply line 7 by line 9.10 11 limitation based on tax liability. The credit was designed to promote saving for retirement among. Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file. Web form 8880 allows you to claim the retirement savings.

Credit Limit Worksheet Form 8880

Web beginning in 2018, as part of a provision contained in the tax cuts and jobs act of 2017, a retirement savings contribution credit may be claimed for the amount of. If these are treated as employer. Web reminder contributions by a designated beneficiary to an achieving a better life experience (able) account. Web information about form 8880, credit for.

Form 8880 Credit for Qualified Retirement Savings Contributions

Web beginning in 2018, as part of a provision contained in the tax cuts and jobs act of 2017, a retirement savings contribution credit may be claimed for the amount of. Web irs form 8880 is used specifically for the retirement saver’s credit. Web your form 8880 will guide you through a calculation to determine the maximum credit amount you.

Credit Limit Worksheet Form 8880

Web based on form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross income. A retirement savings contribution credit may be claimed. Web (c) voluntary employee contributions to a qualified retirement plan as defined in section 4974(c) (including the federal thrift savings plan), or (d) contributions to a. Web irs form.

29) Debbie files as head of household and has AGI of 36,500. During

The total amount of thomas's advanced payment of premium tax credit for 2022 is \$ 35. Web see form 8880, credit for qualified retirement savings contributions, for more information. Web common questions on form 8880 retirement saving contribution credit in lacerte screen 24, adjustments to income form 8880 not generating credit due to. Web credit for qualified retirement savings contributions.

8880 Form ≡ Fill Out Printable PDF Forms Online

Web credit for qualified retirement savings contributions 8880 you cannot take this credit if either of the following applies. The size of your tax credit is a. Web reminder contributions by a designated beneficiary to an achieving a better life experience (able) account. Amount of the credit depending on your adjusted gross income. You may be eligible to claim the.

30++ Credit Limit Worksheet 8880

Web beginning in 2018, as part of a provision contained in the tax cuts and jobs act of 2017, a retirement savings contribution credit may be claimed for the amount of. You can’t take this credit. A retirement savings contribution credit may be claimed. You were a student if. Web your form 8880 will guide you through a calculation to.

A Retirement Savings Contribution Credit May Be Claimed.

Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file. You may be eligible to claim the retirement savings. Web plans that qualify are listed on form 8880. The credit was designed to promote saving for retirement among.

Web Your Form 8880 Will Guide You Through A Calculation To Determine The Maximum Credit Amount You Are Eligible To Claim.

The total amount of thomas's advanced payment of premium tax credit for 2022 is \$ 35. Web you can then calculate and claim the amount of the saver's credit you are eligible for by completing form 8880, credit for qualified retirement savings contributions, when. Web common questions on form 8880 retirement saving contribution credit in lacerte screen 24, adjustments to income form 8880 not generating credit due to. Amount of the credit depending on your adjusted gross income.

The Size Of Your Tax Credit Is A.

You were a student if. Thomas's retirement savings contributions credit on form 8880 is. Web reminder contributions by a designated beneficiary to an achieving a better life experience (able) account. If these are treated as employer.

Web Richard's Retirement Savings Contributions Credit On Form 8800 Is $_______.

Web (c) voluntary employee contributions to a qualified retirement plan as defined in section 4974(c) (including the federal thrift savings plan), or (d) contributions to a. Web based on form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross income. You can’t take this credit. Enter the amount from the credit limit worksheet in.

:max_bytes(150000):strip_icc()/IRSForm8880-7d0c81ec36474e89b8dcbea8c7ced5fc.jpg)