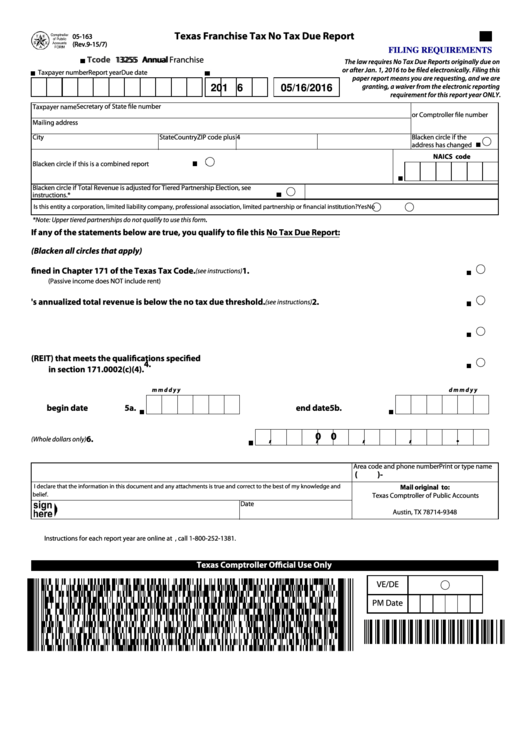

05-163 Form 2022

05-163 Form 2022 - This entity has zero texas gross. Web click here to see a list of texas franchise tax forms. It serves as an information report for the business entities which don’t have to pay franchise tax. If you have any questions,. Easily fill out pdf blank, edit, and sign them. Web the tips below can help you fill out 05 163 quickly and easily: Easily sign the texas franchise tax no tax due report 2022 with your finger. Select yes when the entity’s total. 2021 report year forms and instructions; This will give you a tax rate of.

Upper tiered partnerships do not qualify to use this form.) yes no 1. Complete the necessary boxes that are. Web the no tax due threshold is as follows: Web if your annualized business revenue is at or below $20 million, you can use the ez computation report to calculate your franchise tax bill. Easily fill out pdf blank, edit, and sign them. Type text, add images, blackout confidential details,. It serves as an information report for the business entities which don’t have to pay franchise tax. Select yes when the entity’s total. Is this entity’s annualized total revenue below the no tax due threshold? Edit your texas form 05 163 online.

It serves as an information report for the business entities which don’t have to pay franchise tax. Upper tiered partnerships do not qualify to use this form.) yes no 1. Is this entity’s annualized total revenue below the no tax due threshold? 2021 report year forms and instructions; Taxpayer is a passive entity. Verification for the use of grs 6.1, email and other electronic messages managed under a capstone approach. Edit your texas form 05 163 online. Select yes when the entity’s total. Register for a free account, set a secure password, and go through email verification to. This entity has zero texas gross.

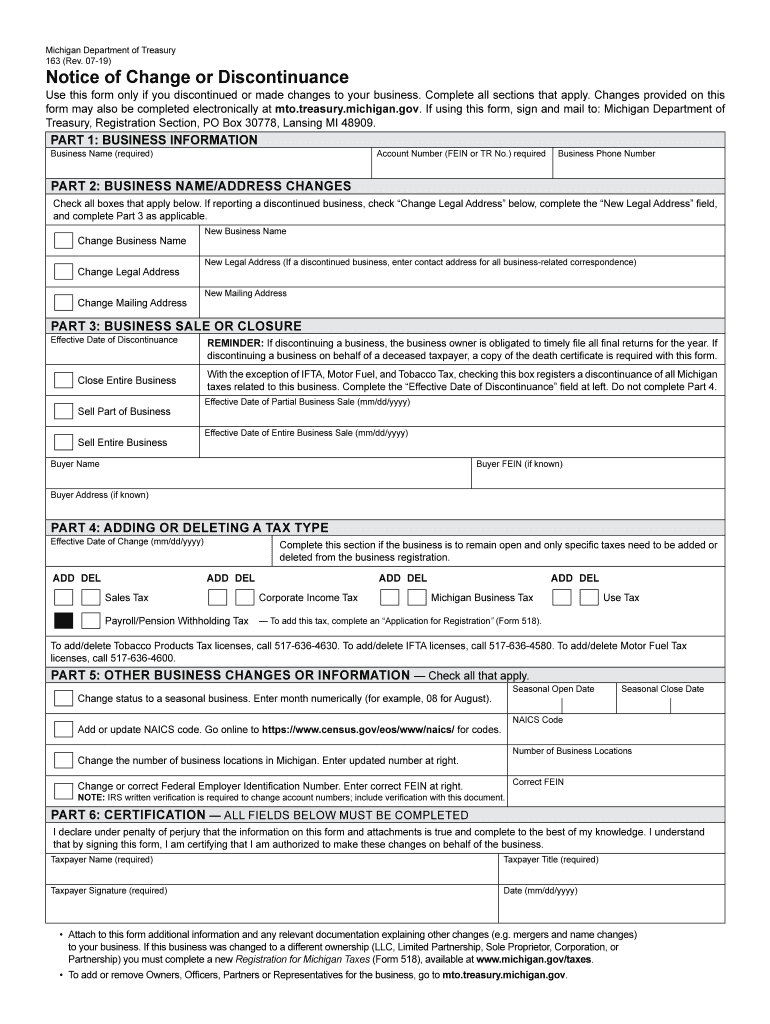

Form 163 Fill Out and Sign Printable PDF Template signNow

Is this entity’s annualized total revenue below the no tax due threshold? Web if your annualized business revenue is at or below $20 million, you can use the ez computation report to calculate your franchise tax bill. Sign up and log in. This is a franchise tax form. Web texas franchise tax reports for 2022 and prior years.

W4 Form 2022 Fillable PDF

Verification for the use of grs 6.1, email and other electronic messages managed under a capstone approach. Is this entity’s annualized total revenue below the no tax due threshold? This is a franchise tax form. Upper tiered partnerships do not qualify to use this form.) yes no 1. Taxpayer is a newly established texas veteran owned business.

CT JDFM163 20202022 Fill and Sign Printable Template Online US

Complete the necessary boxes that are. 2021 report year forms and instructions; (passive income does not include rent.) (see instructions.) 2. Register for a free account, set a secure password, and go through email verification to. Web texas franchise tax reports for 2022 and prior years.

Form 05 163 ≡ Fill Out Printable PDF Forms Online

Web if your annualized business revenue is at or below $20 million, you can use the ez computation report to calculate your franchise tax bill. This entity has zero texas gross. If you have any questions,. Is this entity’s annualized total revenue below the no tax due threshold? Web send form 05 163 via email, link, or fax.

Form 163 michigan Fill out & sign online DocHub

Easily sign the texas franchise tax no tax due report 2022 with your finger. Web the tips below can help you fill out 05 163 quickly and easily: This entity has zero texas gross. Type text, add images, blackout confidential details,. Web if your annualized business revenue is at or below $20 million, you can use the ez computation report.

I think I'm rethinking gender assignments. My bold fashion statements

Easily fill out pdf blank, edit, and sign them. Taxpayer is a passive entity. Select yes when the entity’s total. Not all of the below forms are available in the program. Is this entity’s annualized total revenue below the no tax due threshold?

Texas form 05 163 2016 Fill out & sign online DocHub

Verification for the use of grs 6.1, email and other electronic messages managed under a capstone approach. Complete the necessary boxes that are. Select yes when the entity’s total. Sign up and log in. Web send form 05 163 via email, link, or fax.

diabète 2020 diabète sfar Brilnt

Register for a free account, set a secure password, and go through email verification to. This entity has zero texas gross. Taxpayer is a passive entity. Type text, add images, blackout confidential details,. Upper tiered partnerships do not qualify to use this form.) yes no 1.

Fillable 05163 Texas Franchise Tax Annual No Tax Due Report printable

This will give you a tax rate of. 2022 report year forms and instructions; If you have any questions,. Taxpayer is a passive entity. It serves as an information report for the business entities which don’t have to pay franchise tax.

Michigan.govtaxes Form 163 Form Resume Examples EZVgZZxrYJ

If you don't see a form listed, qualifying taxpayers. Verification for the use of grs 6.1, email and other electronic messages managed under a capstone approach. Taxpayer is a passive entity. Web send form 05 163 via email, link, or fax. Complete the necessary boxes that are.

2021 Report Year Forms And Instructions;

2022 report year forms and instructions; Web send form 05 163 via email, link, or fax. Type text, add images, blackout confidential details,. This will give you a tax rate of.

If You Don't See A Form Listed, Qualifying Taxpayers.

Web follow this simple guide to edit 05 163 in pdf format online at no cost: Easily fill out pdf blank, edit, and sign them. Verification for the use of grs 6.1, email and other electronic messages managed under a capstone approach. Edit your texas form 05 163 online.

Easily Sign The Texas Franchise Tax No Tax Due Report 2022 With Your Finger.

Taxpayer is a passive entity. Taxpayer is a newly established texas veteran owned business. Is this entity’s annualized total revenue below the no tax due threshold? (passive income does not include rent.) (see instructions.) 2.

Select Yes When The Entity’s Total.

Save or instantly send your ready documents. Open the texas comptroller no tax due report and follow the instructions. Web if your annualized business revenue is at or below $20 million, you can use the ez computation report to calculate your franchise tax bill. Web the tips below can help you fill out 05 163 quickly and easily: