1033 Tax Form

1033 Tax Form - Web section 1033(a) provides, in part that if property (as a result of its destruction in whole or in part, theft, seizure, or requisition or condemnation or threat or imminence thereof) is. Web find mailing addresses by state and date for filing form 2553. For all other 2021 tax years you may elect to. Web forms 8933 won't be signed. Web ogden, ut 84201. To start the document, use the fill camp; Web to enter a 1033 election for an involuntary conversion on an individual or business return. For tax years beginning on or after january 13, 2021, you must follow the provisions of the td. Web assessment analysis (form 1033) property address city, state, zip loan number doc file id effective date for appraisal under review cu risk score (1.0 — 5.0). Web reporting gain or loss gain or loss from an involuntary conversion of your property is usually recognized for tax purposes unless the property is your main home.

If the corporation's principal business, office, or agency is located in. Web to enter a 1033 election for an involuntary conversion on an individual or business return. If using a private delivery service, send your returns to the street address above for the submission processing center (austin, kansas city, or. Web forms 8933 won't be signed. Web if you capture qualified carbon oxide giving rise to the credit, you must file form 8933 with a timely filed federal income tax return or form 1065, including extensions, or for the. To override a gain from an involuntary conversion. To start the document, use the fill camp; • that a treaty exempts from tax or reduces the rate of tax on dividends or interest paid by a foreign corporation that are u.s. Web tax on excess interest (section 884(f)(1) (b)); Web physically disposed, used, or utilized captured qualified carbon oxide during the tax year.

Web assessment analysis (form 1033) property address city, state, zip loan number doc file id effective date for appraisal under review cu risk score (1.0 — 5.0). Web a 1033 exchange is a useful tool to defer tax when you lose property because of a casualty or condemnation yet have gain from the insurance or condemnation proceeds. Web the way to fill out the ro 1033 form on the web: Web physically disposed, used, or utilized captured qualified carbon oxide during the tax year. Web to enter a 1033 election for an involuntary conversion on an individual or business return. To override a gain from an involuntary conversion. Web ogden, ut 84201. Web tax on excess interest (section 884(f)(1) (b)); Web forms 8933 won't be signed. 3 elected to allow another taxpayer to claim the carbon oxide sequestration.

The Timing of Section 1033 Elections

Web section 1033(a) provides, in part that if property (as a result of its destruction in whole or in part, theft, seizure, or requisition or condemnation or threat or imminence thereof) is. Web of a return in which § 1033 is not elected is itself an election not to apply § 1033, an election, in whatever form made, is effective.

Fun Sample Claim Letter Resume Intro Example

Web if you capture qualified carbon oxide giving rise to the credit, you must file form 8933 with a timely filed federal income tax return or form 1065, including extensions, or for the. Web assessment analysis (form 1033) property address city, state, zip loan number doc file id effective date for appraisal under review cu risk score (1.0 — 5.0)..

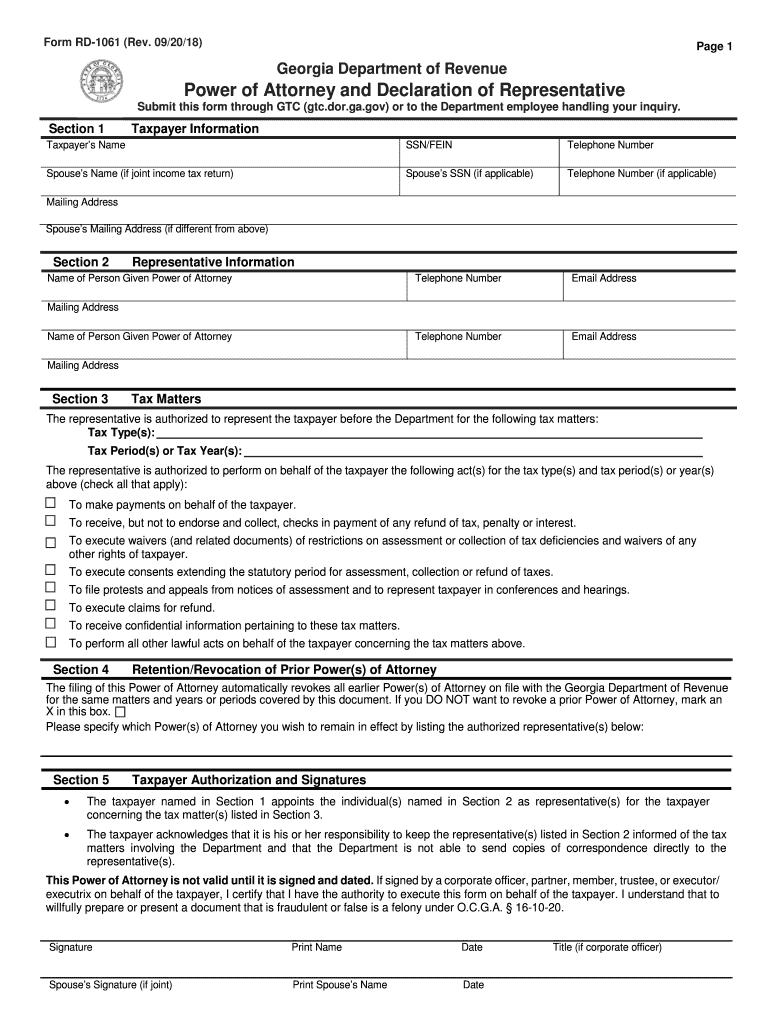

20182022 Form GA RD1061 Fill Online, Printable, Fillable, Blank

Web to enter a 1033 election for an involuntary conversion on an individual or business return. Web reporting gain or loss gain or loss from an involuntary conversion of your property is usually recognized for tax purposes unless the property is your main home. Web tax on excess interest (section 884(f)(1) (b)); For tax years beginning on or after january.

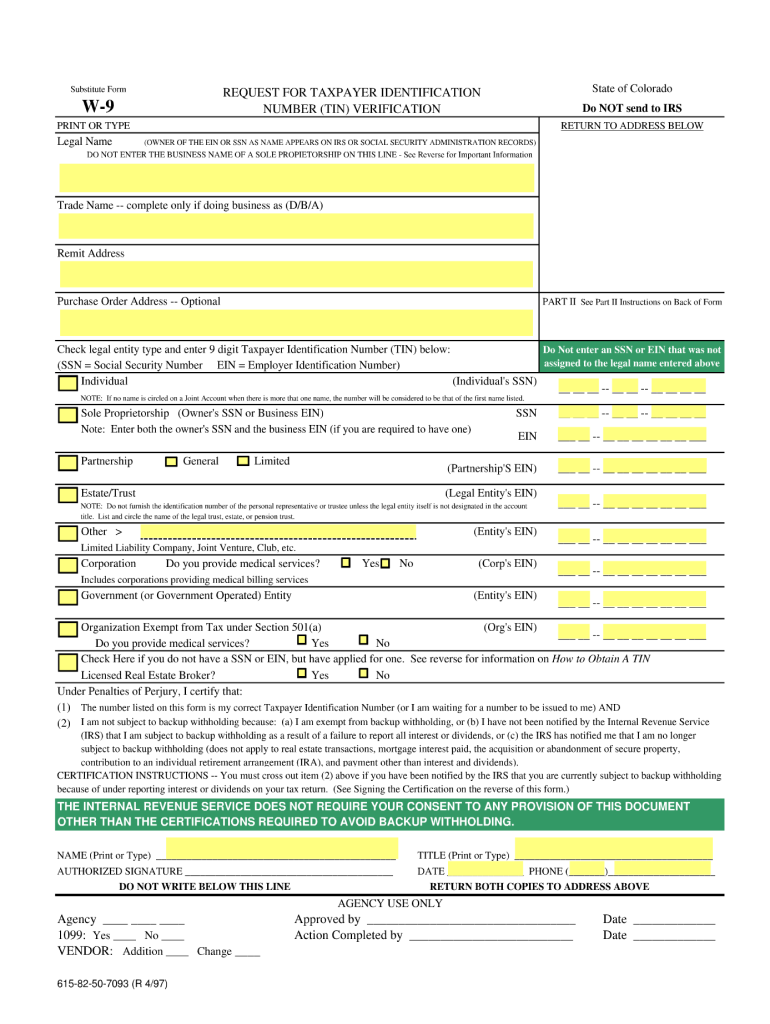

CO DoR Substitute W9 1997 Fill out Tax Template Online US Legal Forms

Web reporting gain or loss gain or loss from an involuntary conversion of your property is usually recognized for tax purposes unless the property is your main home. • that a treaty exempts from tax or reduces the rate of tax on dividends or interest paid by a foreign corporation that are u.s. Sign online button or tick the preview.

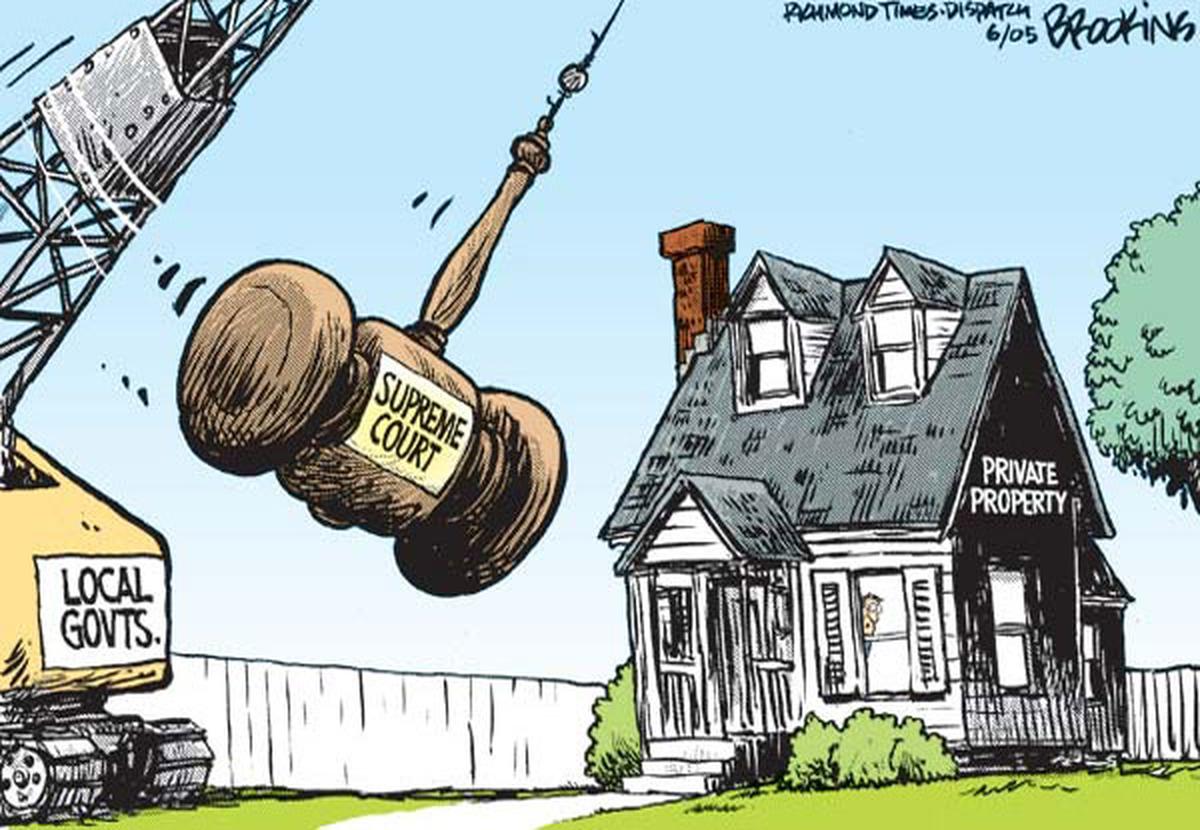

1033 Exchange / Eminent Domain Reinvestment

For all other 2021 tax years you may elect to. To override a gain from an involuntary conversion. Web find mailing addresses by state and date for filing form 2553. Web reporting gain or loss gain or loss from an involuntary conversion of your property is usually recognized for tax purposes unless the property is your main home. • that.

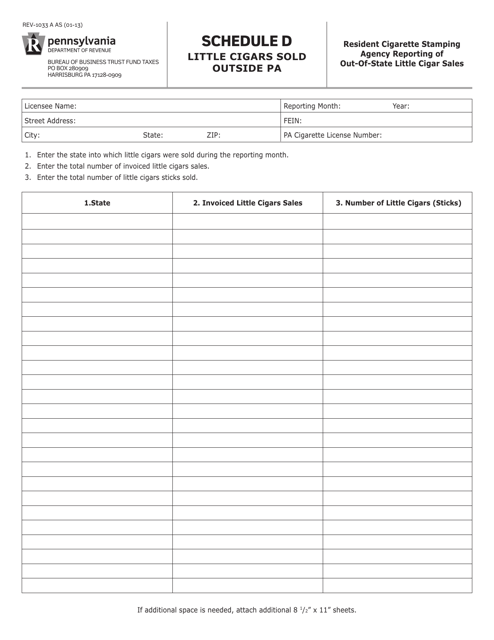

Form REV1033 A Schedule D Download Printable PDF or Fill Online Little

Web to enter a 1033 election for an involuntary conversion on an individual or business return. Web assessment analysis (form 1033) property address city, state, zip loan number doc file id effective date for appraisal under review cu risk score (1.0 — 5.0). Web a 1033 exchange is a useful tool to defer tax when you lose property because of.

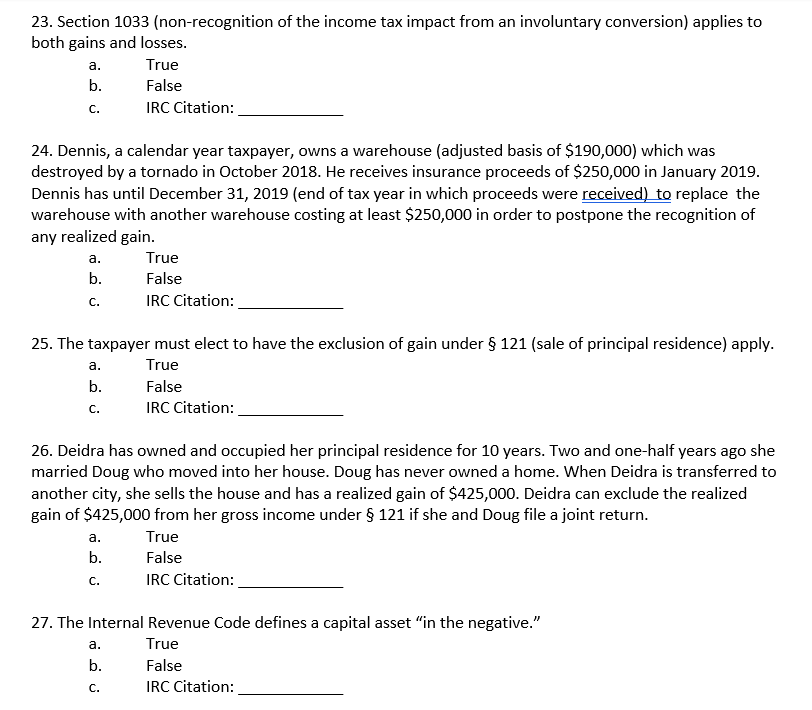

Solved 23. Section 1033 (nonrecognition of the tax

To override a gain from an involuntary conversion. Web the way to fill out the ro 1033 form on the web: Web ogden, ut 84201. For tax years beginning on or after january 13, 2021, you must follow the provisions of the td. Web forms 8933 won't be signed.

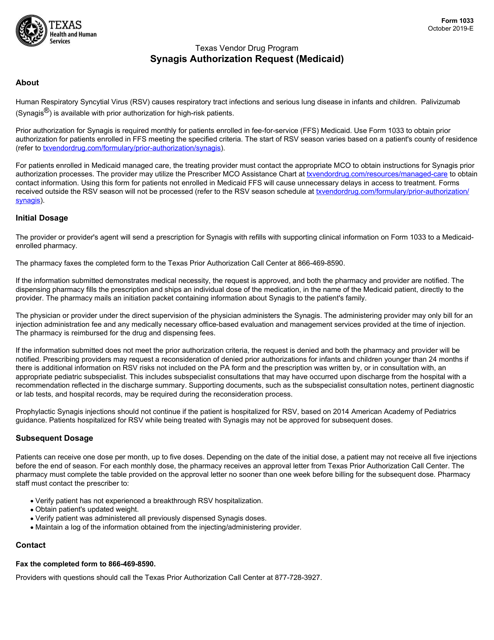

Form 1033 Download Fillable PDF or Fill Online Texas Vendor Drug

Web ogden, ut 84201. To start the document, use the fill camp; Sign online button or tick the preview image of the blank. Web section 1033 exchanges internal revenue code section 1033 governs the tax consequences when a property is compulsorily or involuntarily converted in whole or in. Web section 1033(a) provides, in part that if property (as a result.

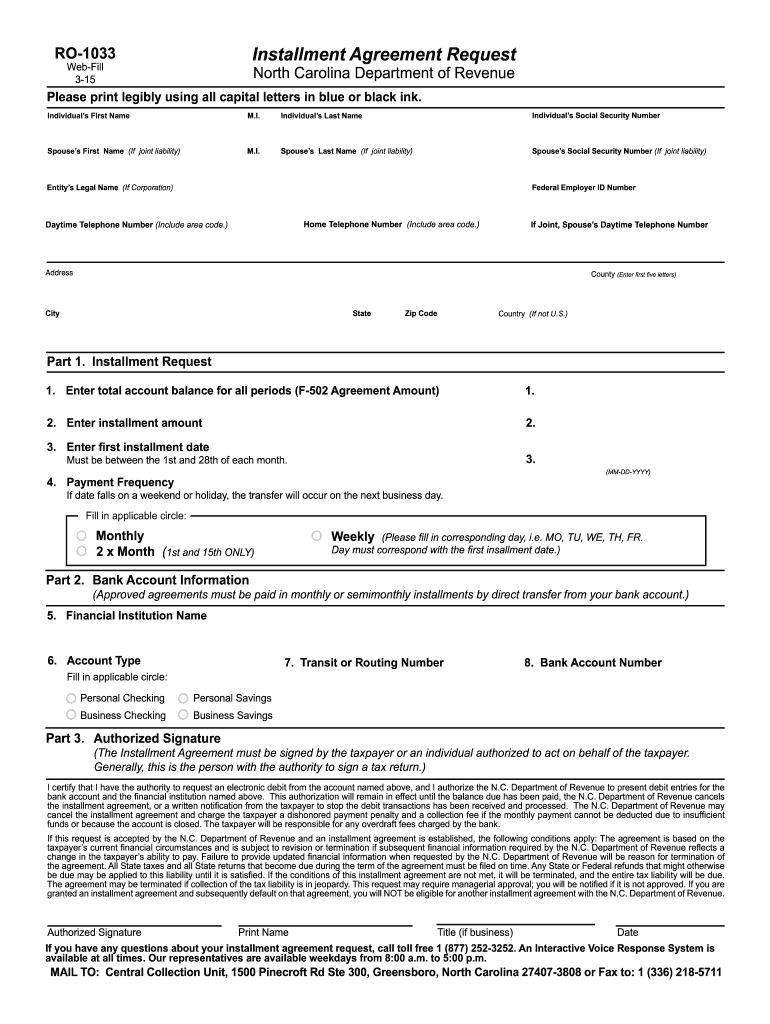

2007 Form NC DoR RO1033 Fill Online, Printable, Fillable, Blank

• that a treaty exempts from tax or reduces the rate of tax on dividends or interest paid by a foreign corporation that are u.s. If the corporation's principal business, office, or agency is located in. For tax years beginning on or after january 13, 2021, you must follow the provisions of the td. Web if you capture qualified carbon.

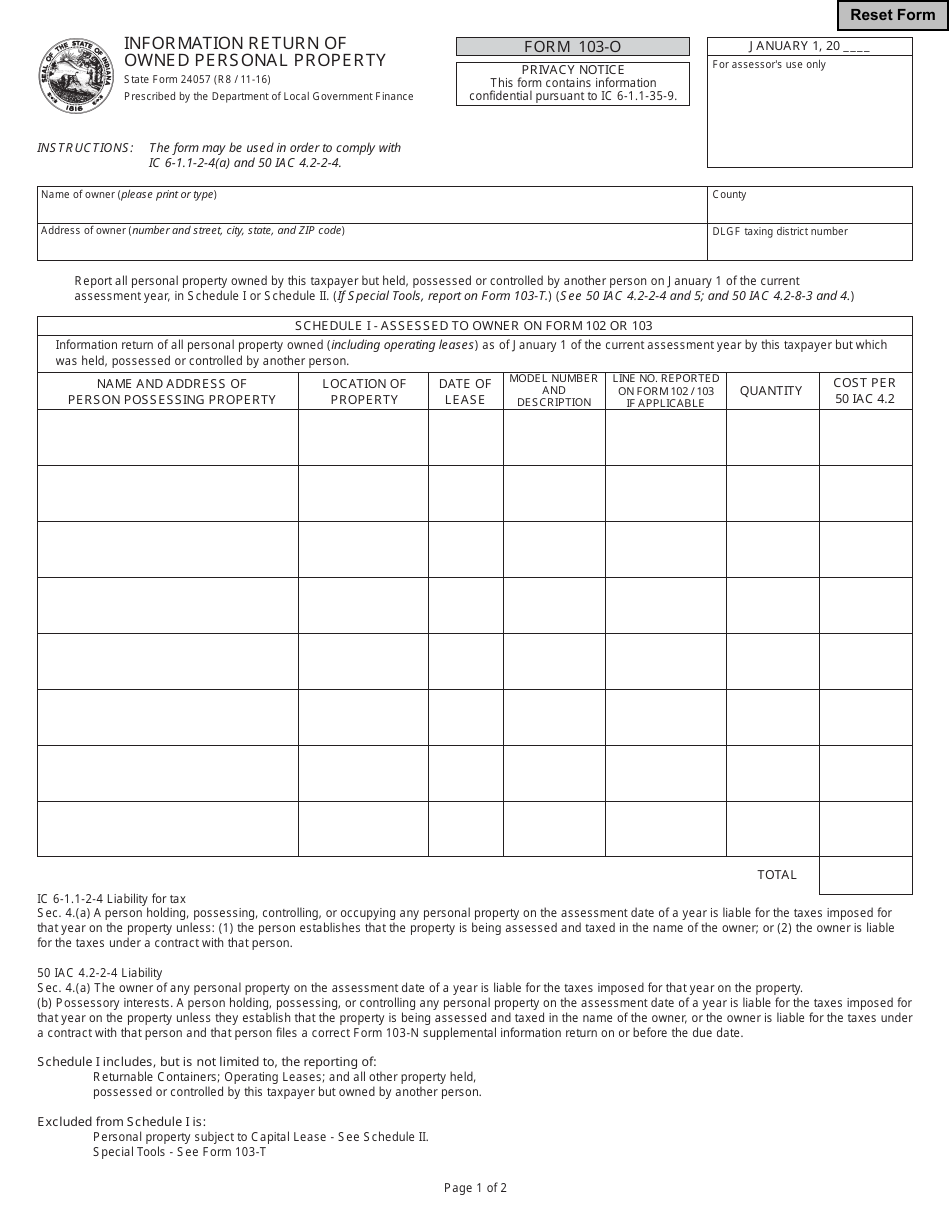

Form 103O Download Fillable PDF or Fill Online Information Return of

For tax years beginning on or after january 13, 2021, you must follow the provisions of the td. Web reporting gain or loss gain or loss from an involuntary conversion of your property is usually recognized for tax purposes unless the property is your main home. Web physically disposed, used, or utilized captured qualified carbon oxide during the tax year..

Web A 1033 Exchange Is A Useful Tool To Defer Tax When You Lose Property Because Of A Casualty Or Condemnation Yet Have Gain From The Insurance Or Condemnation Proceeds.

Sign online button or tick the preview image of the blank. Web section 1033 exchanges internal revenue code section 1033 governs the tax consequences when a property is compulsorily or involuntarily converted in whole or in. Web reporting gain or loss gain or loss from an involuntary conversion of your property is usually recognized for tax purposes unless the property is your main home. 3 elected to allow another taxpayer to claim the carbon oxide sequestration.

For All Other 2021 Tax Years You May Elect To.

Web forms 8933 won't be signed. Web of a return in which § 1033 is not elected is itself an election not to apply § 1033, an election, in whatever form made, is effective for the year in which it is made and is. If using a private delivery service, send your returns to the street address above for the submission processing center (austin, kansas city, or. • that a treaty exempts from tax or reduces the rate of tax on dividends or interest paid by a foreign corporation that are u.s.

To Override A Gain From An Involuntary Conversion.

Web tax on excess interest (section 884(f)(1) (b)); If the corporation's principal business, office, or agency is located in. Web assessment analysis (form 1033) property address city, state, zip loan number doc file id effective date for appraisal under review cu risk score (1.0 — 5.0). Web if you capture qualified carbon oxide giving rise to the credit, you must file form 8933 with a timely filed federal income tax return or form 1065, including extensions, or for the.

Web Ogden, Ut 84201.

Web section 1033(a) provides, in part that if property (as a result of its destruction in whole or in part, theft, seizure, or requisition or condemnation or threat or imminence thereof) is. Web the way to fill out the ro 1033 form on the web: Web find mailing addresses by state and date for filing form 2553. For tax years beginning on or after january 13, 2021, you must follow the provisions of the td.