1098 T Form Northeastern University

1098 T Form Northeastern University - Web these forms are documents that may be needed to complete your application or to update your student account. This form is not needed and can not be used for a nonresident tax return because nras are not eligible to claim education expense tax credits. Can be accessed electronically in the student If you haven’t submitted all the documents we require, you may download the appropriate ones below and submit them to our office. Check payments for past due balances Please note, you may not be required to submit any of these documents. Specific instructions for students and authorized users are listed below. What's new (s) in student financial services? Box 5 contains any financial aid payments posted in the calendar year. If i fail to provide my ssn or tin to northeastern, i agree to pay any and all irs fines assessed as a result of my missing ssn/tin.

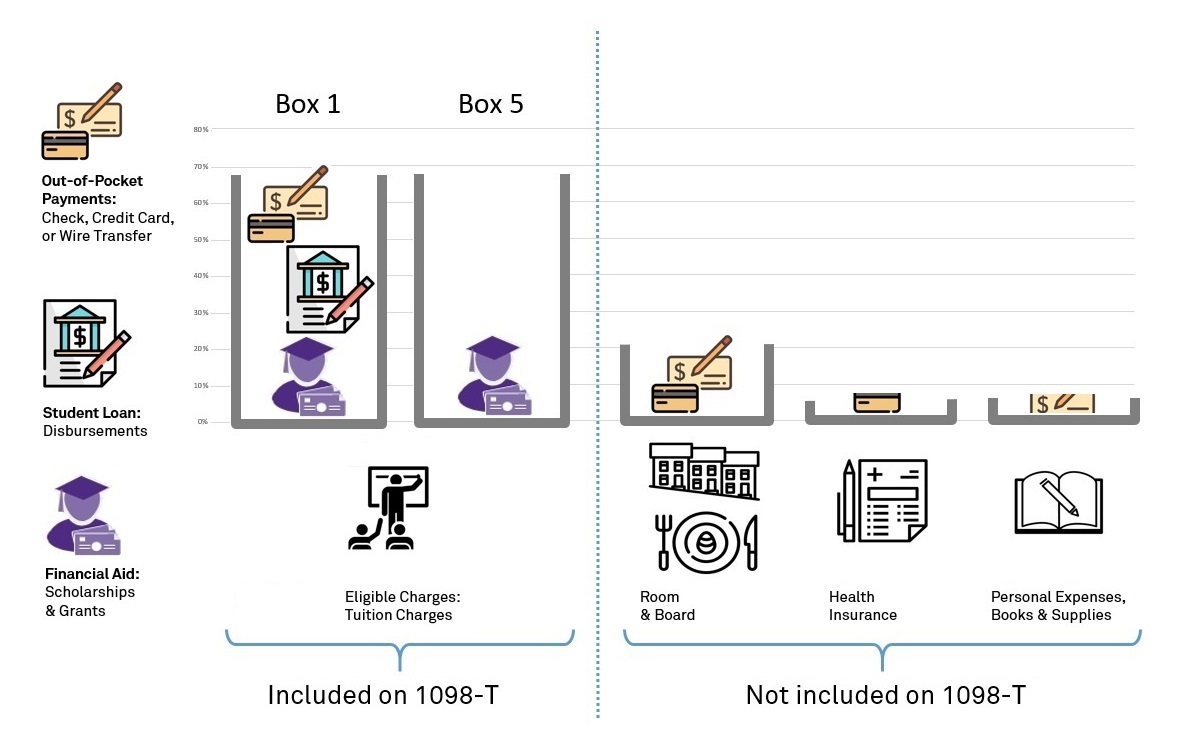

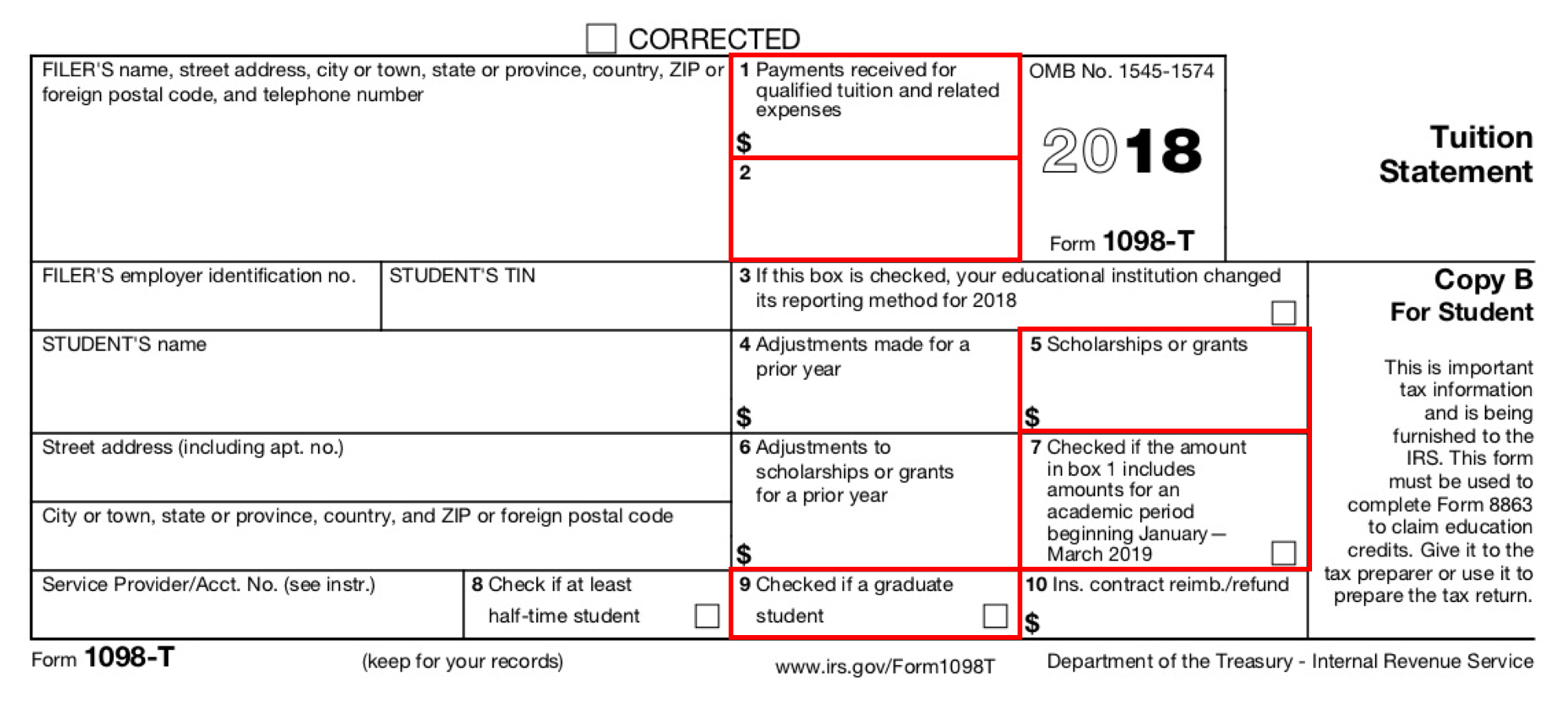

You must file for each student you enroll and for whom a reportable transaction is made. Please note, you may not be required to submit any of these documents. Box 5 contains any financial aid payments posted in the calendar year. Web these forms are documents that may be needed to complete your application or to update your student account. This form is not needed and can not be used for a nonresident tax return because nras are not eligible to claim education expense tax credits. If i fail to provide my ssn or tin to northeastern, i agree to pay any and all irs fines assessed as a result of my missing ssn/tin. Gradsfs@northeastern.edu college of professional studies phone: Box 1 contains any financial aid, loan, check, credit card, or wire transfer payments. If you haven’t submitted all the documents we require, you may download the appropriate ones below and submit them to our office. Web learn more about tuition, fees, and estimated program expenses at northeastern university.

If i fail to provide my ssn or tin to northeastern, i agree to pay any and all irs fines assessed as a result of my missing ssn/tin. You must file for each student you enroll and for whom a reportable transaction is made. What's new (s) in student financial services? If you haven’t submitted all the documents we require, you may download the appropriate ones below and submit them to our office. Gradsfs@northeastern.edu college of professional studies phone: This form is not needed and can not be used for a nonresident tax return because nras are not eligible to claim education expense tax credits. Box 5 contains any financial aid payments posted in the calendar year. Specific instructions for students and authorized users are listed below. Web view and download important forms related to northeastern university's finance division, including applications, requests and legal forms. Can be accessed electronically in the student

Form 1098 T Tuition Statement Fill Out and Sign Printable PDF

Box 5 contains any financial aid payments posted in the calendar year. If i fail to provide my ssn or tin to northeastern, i agree to pay any and all irs fines assessed as a result of my missing ssn/tin. Information for students and parents with federal direct student loans. To update your ssn or tin, please complete the social.

1098T Ventura County Community College District

Box 5 contains any financial aid payments posted in the calendar year. What's new (s) in student financial services? Before completing this form, please ensure you have updated your ssn or tin on file by completing the social security number update form through the office of the registrar. This form is not needed and can not be used for a.

Form 1098T Information Student Portal

Information for students and parents with federal direct student loans. Before completing this form, please ensure you have updated your ssn or tin on file by completing the social security number update form through the office of the registrar. If i fail to provide my ssn or tin to northeastern, i agree to pay any and all irs fines assessed.

1098T IRS Tax Form Instructions 1098T Forms

Before completing this form, please ensure you have updated your ssn or tin on file by completing the social security number update form through the office of the registrar. What's new (s) in student financial services? To update your ssn or tin, please complete the social security number update form through the registrar's office. If i fail to provide my.

Frequently Asked Questions About the 1098T The City University of

Web view and download important forms related to northeastern university's finance division, including applications, requests and legal forms. Please note, you may not be required to submit any of these documents. What's new (s) in student financial services? To update your ssn or tin, please complete the social security number update form through the registrar's office. Check payments for past.

Learn How to Fill the Form 1098T Tuition Statement YouTube

You must file for each student you enroll and for whom a reportable transaction is made. Box 5 contains any financial aid payments posted in the calendar year. Information for students and parents with federal direct student loans. Check payments for past due balances Web these forms are documents that may be needed to complete your application or to update.

Understanding Your 1098T Student Finance Northwestern University

If i fail to provide my ssn or tin to northeastern, i agree to pay any and all irs fines assessed as a result of my missing ssn/tin. You must file for each student you enroll and for whom a reportable transaction is made. What's new (s) in student financial services? Specific instructions for students and authorized users are listed.

1098T Information Bursar's Office Office of Finance UTHSC

Web learn more about tuition, fees, and estimated program expenses at northeastern university. Web view and download important forms related to northeastern university's finance division, including applications, requests and legal forms. Box 5 contains any financial aid payments posted in the calendar year. If you haven’t submitted all the documents we require, you may download the appropriate ones below and.

Form 1098T, Tuition Statement, Student Copy B

Before completing this form, please ensure you have updated your ssn or tin on file by completing the social security number update form through the office of the registrar. This form is not needed and can not be used for a nonresident tax return because nras are not eligible to claim education expense tax credits. What's new (s) in student.

1098 T Calendar Year Calendar Printables Free Templates

Specific instructions for students and authorized users are listed below. You must file for each student you enroll and for whom a reportable transaction is made. Gradsfs@northeastern.edu college of professional studies phone: Information for students and parents with federal direct student loans. Box 5 contains any financial aid payments posted in the calendar year.

Can Be Accessed Electronically In The Student

Web view and download important forms related to northeastern university's finance division, including applications, requests and legal forms. Box 5 contains any financial aid payments posted in the calendar year. Web these forms are documents that may be needed to complete your application or to update your student account. Specific instructions for students and authorized users are listed below.

To Update Your Ssn Or Tin, Please Complete The Social Security Number Update Form Through The Registrar's Office.

Information for students and parents with federal direct student loans. Please note, you may not be required to submit any of these documents. Gradsfs@northeastern.edu college of professional studies phone: Check payments for past due balances

This Form Is Not Needed And Can Not Be Used For A Nonresident Tax Return Because Nras Are Not Eligible To Claim Education Expense Tax Credits.

Box 1 contains any financial aid, loan, check, credit card, or wire transfer payments. Before completing this form, please ensure you have updated your ssn or tin on file by completing the social security number update form through the office of the registrar. What's new (s) in student financial services? Web learn more about tuition, fees, and estimated program expenses at northeastern university.

If I Fail To Provide My Ssn Or Tin To Northeastern, I Agree To Pay Any And All Irs Fines Assessed As A Result Of My Missing Ssn/Tin.

If you haven’t submitted all the documents we require, you may download the appropriate ones below and submit them to our office. You must file for each student you enroll and for whom a reportable transaction is made.