1099 C Fillable Form

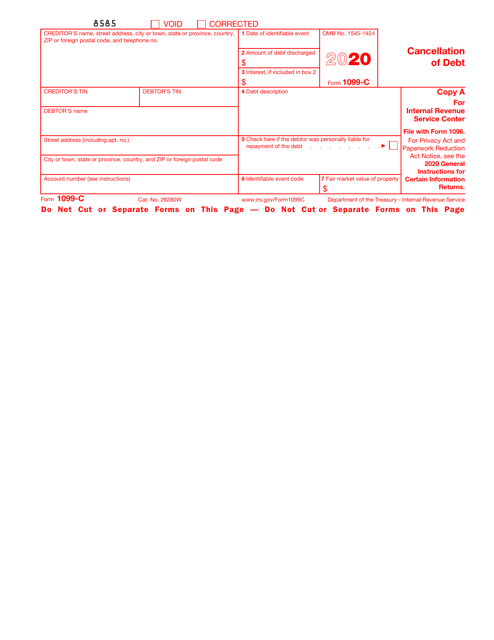

1099 C Fillable Form - How to avoid taxes for canceled debt? Cancellation of debt 8585 void corrected (irs) form. According to the irs, nearly any debt you owe that is canceled, forgiven or discharged becomes taxable income to you. The payer fills out the 1099 form and sends copies to you and the. Full name, address, contact number, etc. Use fill to complete blank online irs pdf forms for free. Web a 1099 form is a record that an entity or person other than your employer gave or paid you money. Get ready for tax season deadlines by completing any required tax forms today. Web welcome to pdfrun! Quickly add and underline text, insert images, checkmarks, and symbols, drop new fillable fields, and rearrange or delete pages from your paperwork.

Use fill to complete blank online irs pdf forms for free. Web www.irs.gov/form1099c instructions for debtor you received this form because a federal government agency or an applicable financial entity (a creditor) has discharged. Complete, edit or print tax forms instantly. Ad access irs tax forms. Full name, address, contact number, etc. However, if you file both forms. Draw your signature, type it,. How to avoid taxes for canceled debt? According to the irs, nearly any debt you owe that is canceled, forgiven or discharged becomes taxable income to you. Web a 1099 form is a record that an entity or person other than your employer gave or paid you money.

In particular, the irs requires lenders to. Ad access irs tax forms. Web www.irs.gov/form1099c instructions for debtor you received this form because a federal government agency or an applicable financial entity (a creditor) has discharged. According to the irs, nearly any debt you owe that is canceled, forgiven or discharged becomes taxable income to you. Complete, edit or print tax forms instantly. Use fill to complete blank online irs pdf forms for free. However, if you file both forms. Draw your signature, type it,. You should receive a form 1099. Web click the fill out form button above.

Form1099NEC

Get ready for tax season deadlines by completing any required tax forms today. However, if you file both forms. In particular, the irs requires lenders to. Type text, add images, blackout confidential details, add comments, highlights and more. Quickly add and underline text, insert images, checkmarks, and symbols, drop new fillable fields, and rearrange or delete pages from your paperwork.

Form 1099 Misc Fillable Universal Network

The lender creates and mails this form to the debtor. Web welcome to pdfrun! You should receive a form 1099. Web www.irs.gov/form1099c instructions for debtor you received this form because a federal government agency or an applicable financial entity (a creditor) has discharged. Use fill to complete blank online irs pdf forms for free.

√100以上 1099c form 2020 157485How to complete a 1099c form

The payer fills out the 1099 form and sends copies to you and the. You should receive a form 1099. Type text, add images, blackout confidential details, add comments, highlights and more. Draw your signature, type it,. However, if you file both forms.

1099 MISC Form 2022 1099 Forms TaxUni

You should receive a form 1099. Ad access irs tax forms. How to avoid taxes for canceled debt? According to the irs, nearly any debt you owe that is canceled, forgiven or discharged becomes taxable income to you. Get ready for tax season deadlines by completing any required tax forms today.

[最も好ましい] 1099 c form 2020 1663152020 form 1099c cancellation of debt

In particular, the irs requires lenders to. Get ready for tax season deadlines by completing any required tax forms today. Full name, address, contact number, etc. Draw your signature, type it,. Cancellation of debt 8585 void corrected (irs) form.

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

Edit your 1099 c online. Sign it in a few clicks. The first section of the printable form provides information about a lender and a borrower: Type text, add images, blackout confidential details, add comments, highlights and more. However, if you file both forms.

Form 1099 Fillable Form Resume Examples yKVBbLrgVM

Web welcome to pdfrun! Web www.irs.gov/form1099c instructions for debtor you received this form because a federal government agency or an applicable financial entity (a creditor) has discharged. Quickly add and underline text, insert images, checkmarks, and symbols, drop new fillable fields, and rearrange or delete pages from your paperwork. Complete, edit or print tax forms instantly. You should receive a.

√100以上 1099c form 2020 157485How to complete a 1099c form

Web a 1099 form is a record that an entity or person other than your employer gave or paid you money. Cancellation of debt 8585 void corrected (irs) form. You should receive a form 1099. Web welcome to pdfrun! However, if you file both forms.

What Is Form 1099MISC? When Do I Need to File a 1099MISC? Gusto

How to avoid taxes for canceled debt? The first section of the printable form provides information about a lender and a borrower: Web www.irs.gov/form1099c instructions for debtor you received this form because a federal government agency or an applicable financial entity (a creditor) has discharged. Full name, address, contact number, etc. Get ready for tax season deadlines by completing any.

Irs Form 1099 Contract Labor Form Resume Examples

However, if you file both forms. Full name, address, contact number, etc. Draw your signature, type it,. Use fill to complete blank online irs pdf forms for free. Web a 1099 form is a record that an entity or person other than your employer gave or paid you money.

Full Name, Address, Contact Number, Etc.

Quickly add and underline text, insert images, checkmarks, and symbols, drop new fillable fields, and rearrange or delete pages from your paperwork. Sign it in a few clicks. Get ready for tax season deadlines by completing any required tax forms today. Edit your 1099 c online.

Use Fill To Complete Blank Online Irs Pdf Forms For Free.

According to the irs, nearly any debt you owe that is canceled, forgiven or discharged becomes taxable income to you. Web a 1099 form is a record that an entity or person other than your employer gave or paid you money. Ad access irs tax forms. You should receive a form 1099.

Cancellation Of Debt 8585 Void Corrected (Irs) Form.

The first section of the printable form provides information about a lender and a borrower: How to avoid taxes for canceled debt? Web welcome to pdfrun! Draw your signature, type it,.

Web Click The Fill Out Form Button Above.

The payer fills out the 1099 form and sends copies to you and the. In particular, the irs requires lenders to. The lender creates and mails this form to the debtor. Type text, add images, blackout confidential details, add comments, highlights and more.