1099 Composite Form

1099 Composite Form - Web a composite has more than one type of 1099. Find out if you will receive 1099 forms from employers or. The document should contain three separate tax documents that you need to report: Go to www.irs.gov/freefile to see if you. Web what is a 1099 form? Web how do i enter information from a 1099 composite? Web if you have questions about the amounts reported on this form, contact the filer whose information is shown in the upper left corner on the front of this form. Web a 1099 form is a tax record that an entity or person — not your employer — gave or paid you money. Web your form 1099 composite may include the following internal revenue service (irs) forms: There are more than a dozen different varieties of 1099 forms, and the reporting requirements for each is different.

Those will be mailed no later than the. Web what is a 1099 form? Web learn what a 1099 irs tax form is, and the different types of 1099 forms with the experts at h&r block. Web if you have questions about the amounts reported on this form, contact the filer whose information is shown in the upper left corner on the front of this form. At least $10 in royalties or broker. Please see this answer from richardg. The irs compares reported income. Web charles schwab 1099 composite form just report it as it is reported to you by schwab; The irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that. Go to www.irs.gov/freefile to see if you.

Please see this answer from richardg. There are more than a dozen different varieties of 1099 forms, and the reporting requirements for each is different. The irs compares reported income. Web learn what a 1099 irs tax form is, and the different types of 1099 forms with the experts at h&r block. The document should contain three separate tax documents that you need to. The irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that. Web a 1099 form is a tax record that an entity or person — not your employer — gave or paid you money. This includes the associated cost basis. Web the composite 1099 form is a consolidation of various forms 1099 and summarizes relevant account information for the past year. The document should contain three separate tax documents that you need to report:

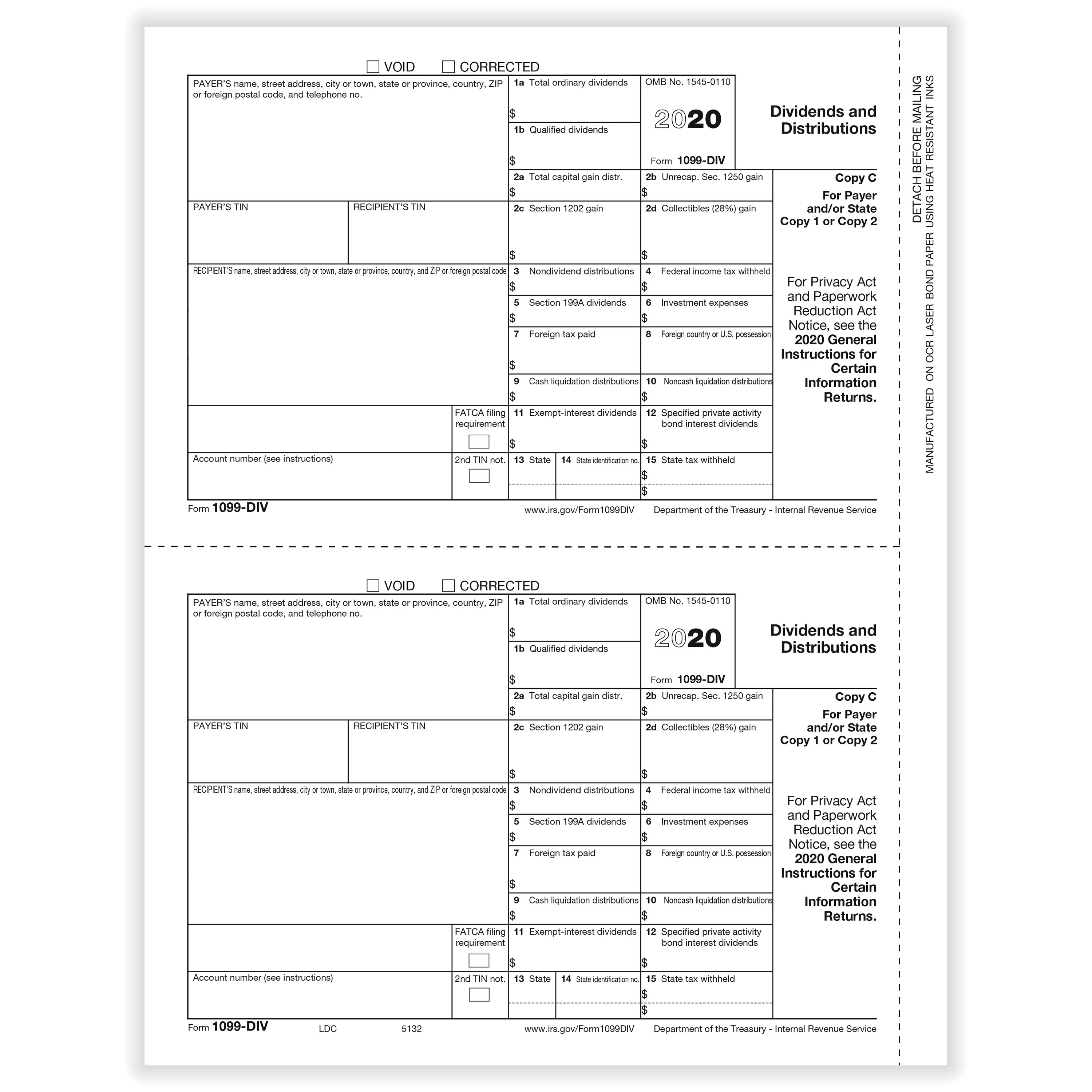

Form 1099DIV, Dividends and Distributions, State Copy 1

This includes the associated cost basis. Most often, multiple forms 1099. Web what is a 1099 form? The document should contain three separate tax documents that you need to report: Web a composite has more than one type of 1099.

united states Why no 1099 for short term capital gains from stocks

Web how do i enter information from a 1099 composite? The irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that. There are more than a dozen different varieties of 1099 forms, and the reporting requirements for each is different. The document should contain three separate tax documents.

IRS Form 1099 Reporting for Small Business Owners

Go to www.irs.gov/freefile to see if you. Web the composite 1099 form is a consolidation of various forms 1099 and summarizes relevant account information for the past year. The irs compares reported income. At least $10 in royalties or broker. Those will be mailed no later than the.

united states Why no 1099 for short term capital gains from stocks

Web a 1099 form is a tax record that an entity or person — not your employer — gave or paid you money. Please see this answer from richardg. The document should contain three separate tax documents that you need to report: The irs 1099 form is a collection of tax forms documenting different types of payments made by an.

1099INT A Quick Guide to This Key Tax Form The Motley Fool

There is no need to report each mutual fund separately if schwab is reporting. Web your form 1099 composite may include the following internal revenue service (irs) forms: Web the primary forms of income you'll need to include in your tax filing are contained in the following three sections of your 1099 composite: The document should contain three separate tax.

【ベストコレクション】 1099 composite vs 1099 r 1985841099 composite vs 1099 r

The document should contain three separate tax documents that you need to report: Those will be mailed no later than the. The document should contain three separate tax documents that you need to. The irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that. There are more than.

Form 1099

Web how do i enter information from a 1099 composite? Most often, multiple forms 1099. Web the primary forms of income you'll need to include in your tax filing are contained in the following three sections of your 1099 composite: The irs compares reported income. This includes the associated cost basis.

1099DIV Payer and State Copies Formstax

Web charles schwab 1099 composite form just report it as it is reported to you by schwab; The irs compares reported income. Web a 1099 composite is a consolidated statement listing the 1099s that have been issued by a financial institution to the taxpayer. The document should contain three separate tax documents that you need to report: The document should.

【ベストコレクション】 1099 composite vs 1099 r 1985841099 composite vs 1099 r

Web the primary forms of income you'll need to include in your tax filing are contained in the following three sections of your 1099 composite: Web what is a 1099 form? There are more than a dozen different varieties of 1099 forms, and the reporting requirements for each is different. The irs 1099 form is a collection of tax forms.

Web What Is A 1099 Form?

Find out if you will receive 1099 forms from employers or. Web what is a 1099 form? This includes the associated cost basis. Please see this answer from richardg.

Most Often, Multiple Forms 1099.

Web a 1099 composite is a consolidated statement listing the 1099s that have been issued by a financial institution to the taxpayer. Those will be mailed no later than the. Web the composite 1099 form is a consolidation of various forms 1099 and summarizes relevant account information for the past year. Web your form 1099 composite may include the following internal revenue service (irs) forms:

Go To Www.irs.gov/Freefile To See If You.

The document should contain three separate tax documents that you need to report: Web a 1099 form is a tax record that an entity or person — not your employer — gave or paid you money. There is no need to report each mutual fund separately if schwab is reporting. The document should contain three separate tax documents that you need to.

Web If You Have Questions About The Amounts Reported On This Form, Contact The Filer Whose Information Is Shown In The Upper Left Corner On The Front Of This Form.

Web a composite has more than one type of 1099. See how various types of irs form 1099 work. The irs compares reported income. Web the primary forms of income you'll need to include in your tax filing are contained in the following three sections of your 1099 composite:

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg)