1099 Form For International Contractors

1099 Form For International Contractors - All current and past 1099 forms are stored in rippling. Taxpayer and all of the contracted work was performed outside of the u.s., you do not need to file a form 1099. Expat business owners may need to file form 1099 when working with contractors. If the foreign contractor is not a u.s. Staples provides custom solutions to help organizations achieve their goals. Web key takeaways form 1099 is used to report payments made to an independent contractor. Official site | smart tools. You can also link credit cards to. Web if your foreign contractor is not a u.s. Web manage contractors, 1099 workers and freelancers from a single source of record.

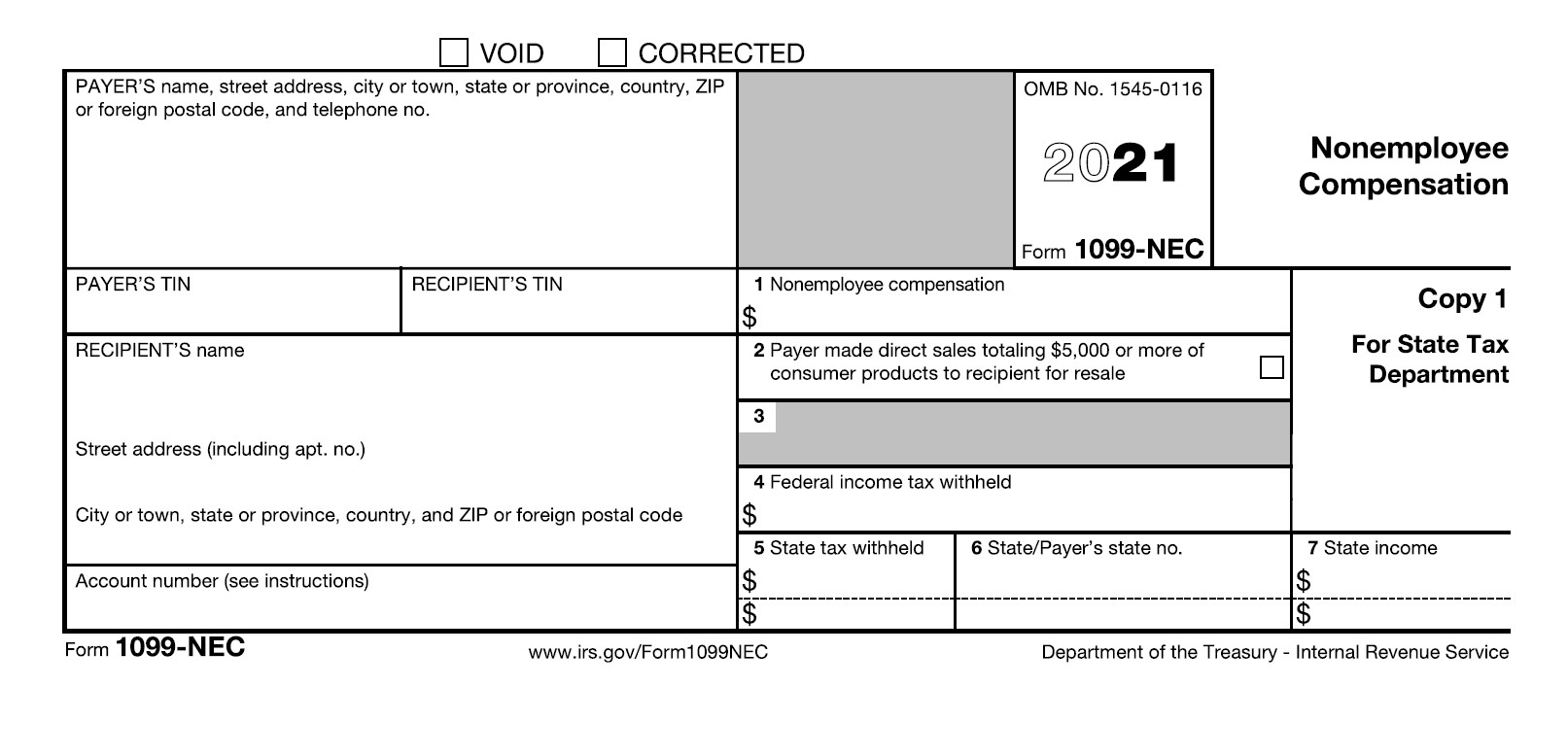

We’re here to clear up any confusion you may have. Official site | smart tools. Staples provides custom solutions to help organizations achieve their goals. Expat business owners may need to file form 1099 when working with contractors. Web federal 1099 tax form for international contractors. Web key takeaways form 1099 is used to report payments made to an independent contractor. Web at the end of the year, rippling will automatically generate and distribute 1099 tax forms to your contractors. Web contractors are often known as 1099 employees, as businesses use the 1099 tax form to report payments to the internal revenue service (irs).² contractors use the. File 1099 online for the current tax year. Ad our international tax services can be customized to fit your specific business needs.

Taxpayer and all of the contracted work was performed outside of the u.s., you do not need to file a form 1099. Most importantly, a foreign contractor must be a us. Web federal 1099 tax form for international contractors. Web key takeaways form 1099 is used to report payments made to an independent contractor. You can also link credit cards to. We’re here to clear up any confusion you may have. Ad our international tax services can be customized to fit your specific business needs. Web if your foreign contractor is not a u.s. Taxpayer, and all of the contracted services were performed outside the u.s., a. Staples provides custom solutions to help organizations achieve their goals.

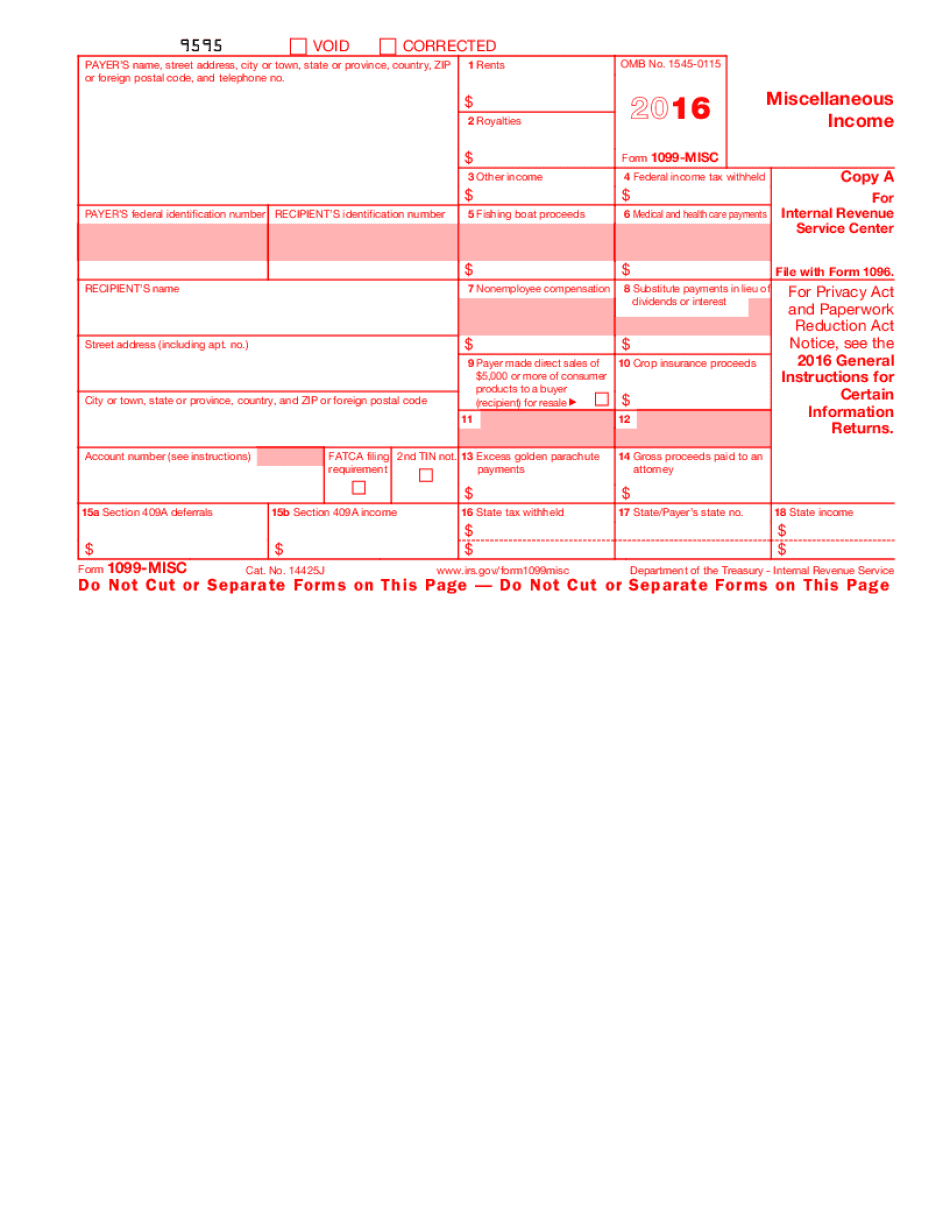

Form 1099MISC Requirements, Deadlines, and Penalties eFile360

If the foreign contractor is not a u.s. Here’s what you need to know about 1099s for us citizens living abroad. Taxpayer and all of the contracted work was performed outside of the u.s., you do not need to file a form 1099. Official site | smart tools. Taxpayer, and all of the contracted services were performed outside the u.s.,.

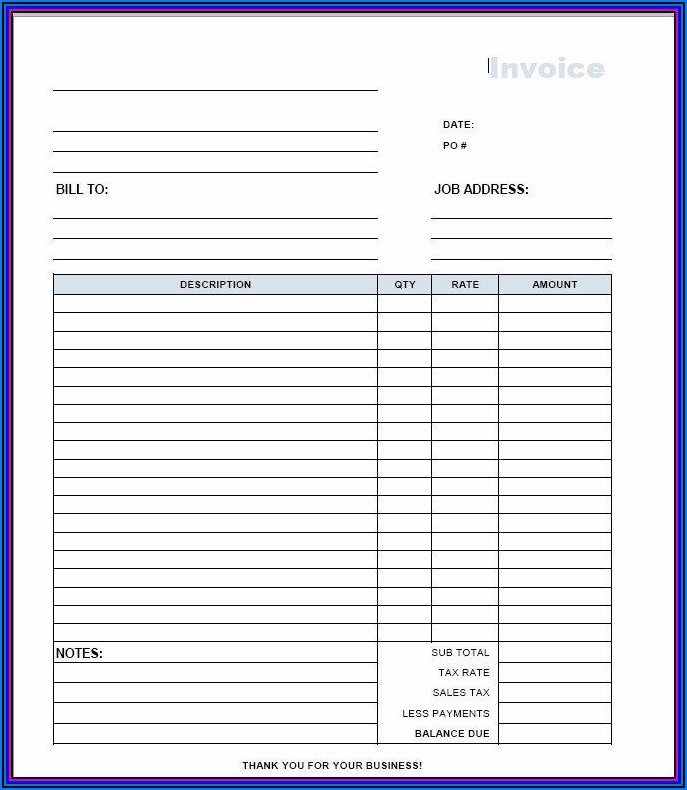

1099 Form Independent Contractor Pdf / How to Do Taxes if You're a 1099

Taxpayer, and all of the contracted services were performed outside the u.s., a. Ad discover a wide selection of 1099 tax forms at staples®. Taxpayer and all of the contracted work was performed outside of the u.s., you do not need to file a form 1099. You can also link credit cards to. Ad our international tax services can be.

Understanding the 1099 5 Straightforward Tips to File

Web contractors are often known as 1099 employees, as businesses use the 1099 tax form to report payments to the internal revenue service (irs).² contractors use the. You can also link credit cards to. Web if that sounds complicated, don’t worry. Ad discover a wide selection of 1099 tax forms at staples®. Expat business owners may need to file form.

Free Printable 1099 Misc Forms Free Printable

Beginning with the 2020 tax year, businesses that hire independent contractors must send those contractors a 1099. We have decades of experience with holistic international tax strategies and planning. Expat business owners may need to file form 1099 when working with contractors. All current and past 1099 forms are stored in rippling. Web at the end of the year, rippling.

What is a 1099Misc Form? Financial Strategy Center

We’re here to clear up any confusion you may have. Web the platform is useful for paying international contractors in different currencies, and you can make mass payments for up to 5,000 vendors at a time. Here’s what you need to know about 1099s for us citizens living abroad. You can also link credit cards to. Web if that sounds.

1099 form independent contractor Fill Online, Printable, Fillable

Beginning with the 2020 tax year, businesses that hire independent contractors must send those contractors a 1099. File 1099 online for the current tax year. Web manage contractors, 1099 workers and freelancers from a single source of record. Expat business owners may need to file form 1099 when working with contractors. Staples provides custom solutions to help organizations achieve their.

√画像をダウンロード 1099 misc nonemployee compensation turbotax 827694How to

Ad our international tax services can be customized to fit your specific business needs. Taxpayer and all of the contracted work was performed outside of the u.s., you do not need to file a form 1099. Web if that sounds complicated, don’t worry. Here’s what you need to know about 1099s for us citizens living abroad. Web if your foreign.

When is tax form 1099MISC due to contractors? GoDaddy Blog

Here’s what you need to know about 1099s for us citizens living abroad. Web manage contractors, 1099 workers and freelancers from a single source of record. Taxpayer and all of the contracted work was performed outside of the u.s., you do not need to file a form 1099. Web key takeaways form 1099 is used to report payments made to.

Now is the Time to Start Preparing for Vendor 1099 Forms Innovative

Official site | smart tools. Ad our international tax services can be customized to fit your specific business needs. You can also link credit cards to. Web key takeaways form 1099 is used to report payments made to an independent contractor. Web federal 1099 tax form for international contractors.

Independent Contractor Form 1099 Form Resume Examples QJ9ellWg2m

Web the platform is useful for paying international contractors in different currencies, and you can make mass payments for up to 5,000 vendors at a time. Web key takeaways form 1099 is used to report payments made to an independent contractor. File 1099 online for the current tax year. Expat business owners may need to file form 1099 when working.

You Can Also Link Credit Cards To.

Ad discover a wide selection of 1099 tax forms at staples®. Most importantly, a foreign contractor must be a us. Web if your foreign contractor is not a u.s. Web federal 1099 tax form for international contractors.

Web Key Takeaways Form 1099 Is Used To Report Payments Made To An Independent Contractor.

Expat business owners may need to file form 1099 when working with contractors. Staples provides custom solutions to help organizations achieve their goals. Taxpayer and all of the contracted work was performed outside of the u.s., you do not need to file a form 1099. Web if that sounds complicated, don’t worry.

Taxpayer, And All Of The Contracted Services Were Performed Outside The U.s., A.

Web at the end of the year, rippling will automatically generate and distribute 1099 tax forms to your contractors. Web manage contractors, 1099 workers and freelancers from a single source of record. If the foreign contractor is not a u.s. Ad our international tax services can be customized to fit your specific business needs.

File 1099 Online For The Current Tax Year.

We’re here to clear up any confusion you may have. Web contractors are often known as 1099 employees, as businesses use the 1099 tax form to report payments to the internal revenue service (irs).² contractors use the. Web the platform is useful for paying international contractors in different currencies, and you can make mass payments for up to 5,000 vendors at a time. Here’s what you need to know about 1099s for us citizens living abroad.