2020 California Form 568

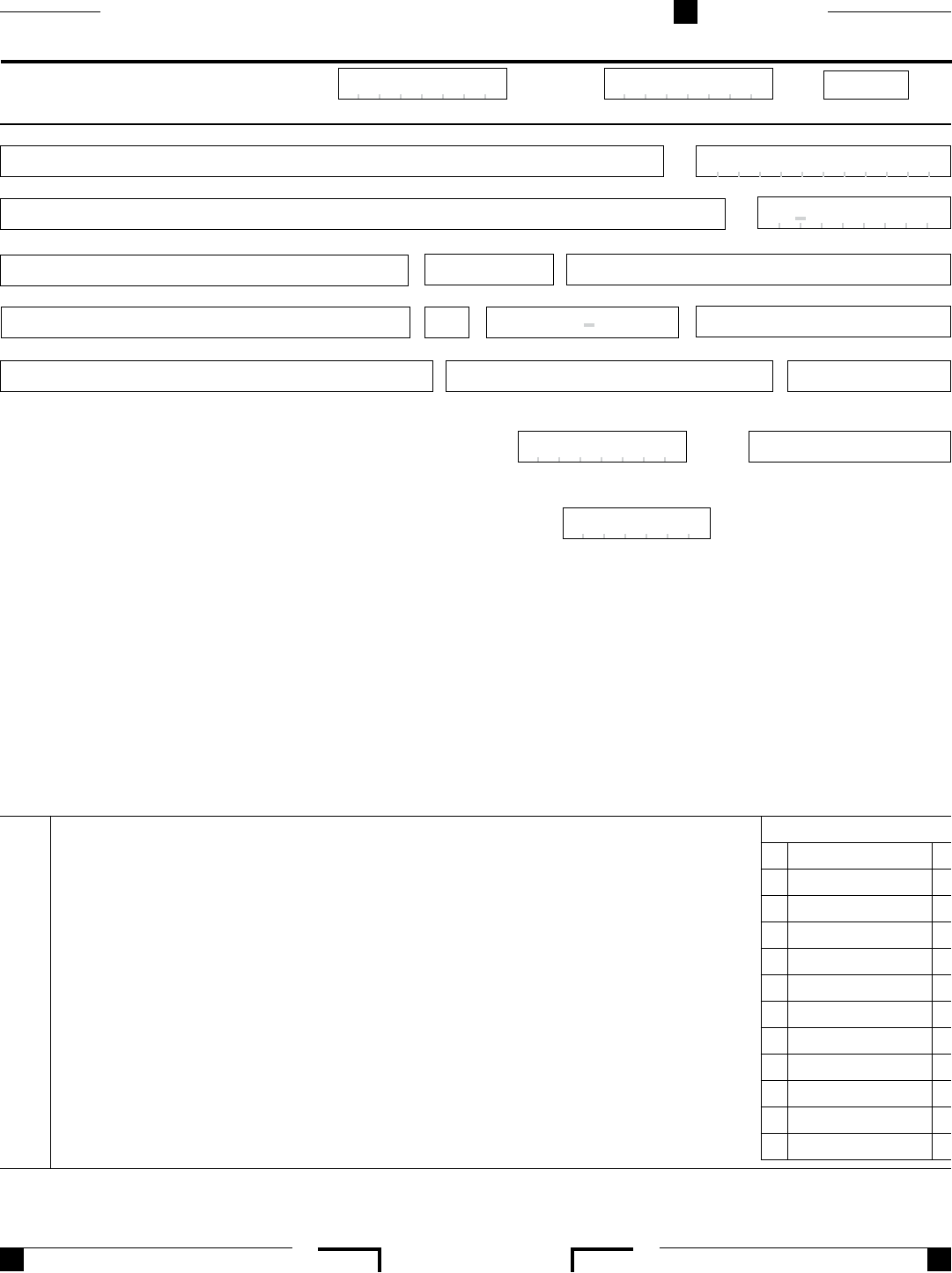

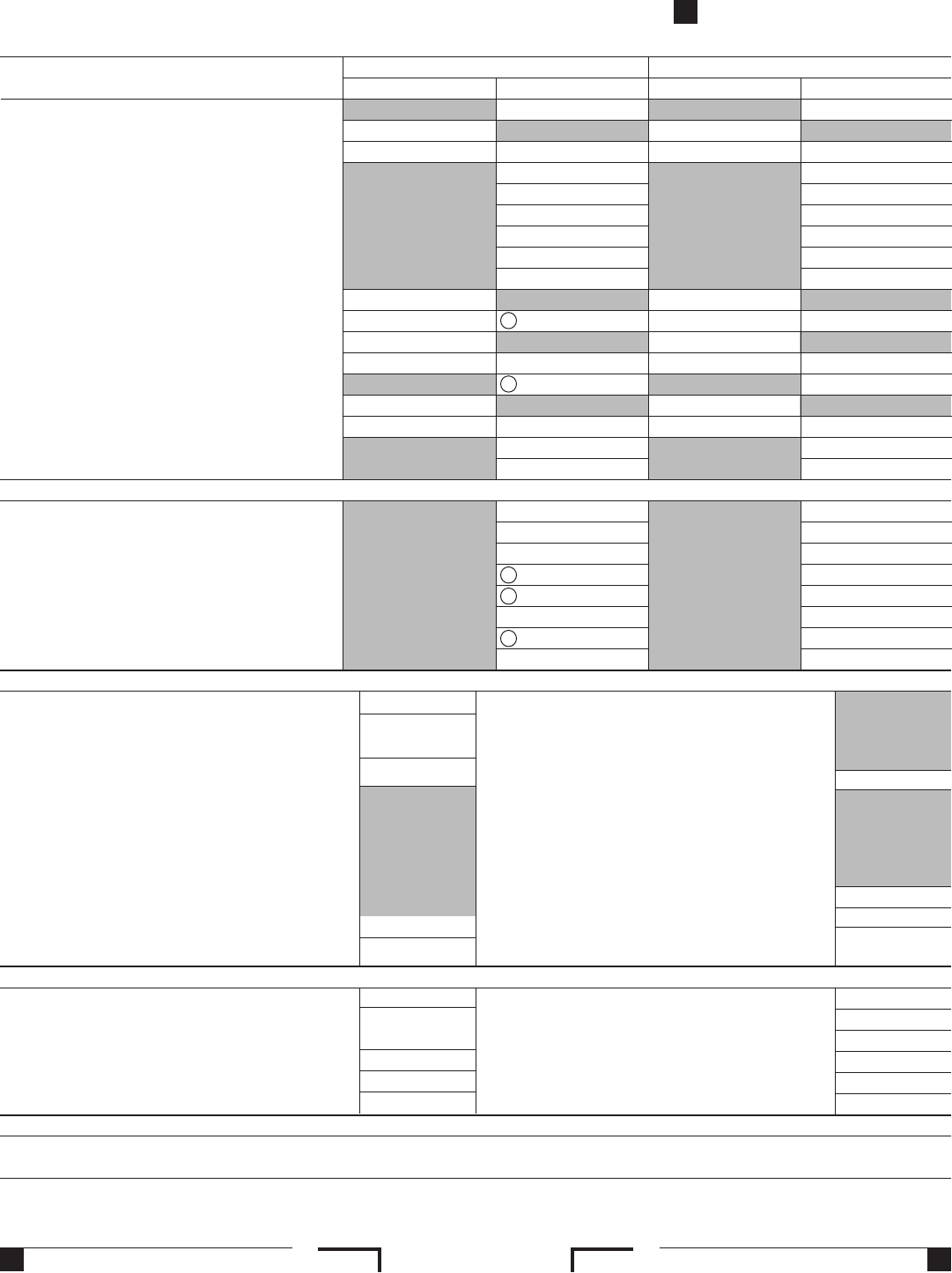

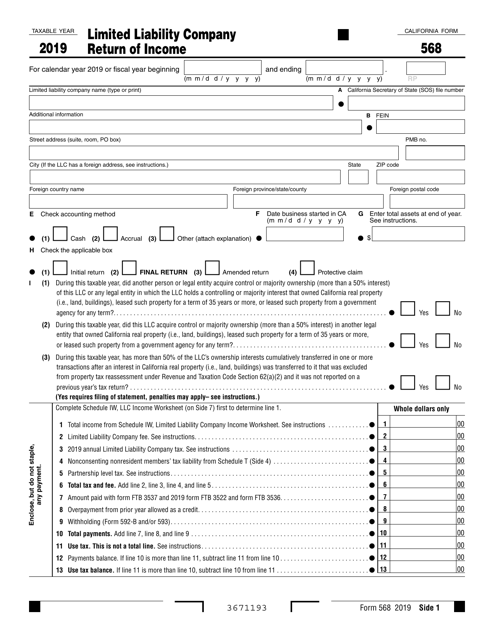

2020 California Form 568 - Web i (1)during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc. Web to create an llc unit, enter a state use code 3 form 568: Web enter the llc’s “total california income” as computed on line 17 of schedule iw. Web since the limited liability company is doing business in both nevada and california, it must file a california form 568, limited liability company return of income and use. Web to generate form 568, limited liability company return of income, choose file > client properties, click the california tab, and mark the limited liability company option. California form 568 i (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50%. 540 form (pdf) | 540 booklet (instructions included) 540 2ez form (pdf) |. Web 568 form (pdf) | 568 booklet april 15, 2023 2022 personal income tax returns due and tax due state: Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. The llc is doing business in california.

How to fill in california form 568 if you have an llc, here’s how to fill in the california form 568:. Web 568 form (pdf) | 568 booklet april 15, 2023 2022 personal income tax returns due and tax due state: The llc is doing business in california. Web form 568, limited liability company return of income • form 565, partnership return of income • form 100, california corporation franchise or income tax return, including. Web visit limited liability company tax booklet (568 booklet) for more information; Web to create an llc unit, enter a state use code 3 form 568: 540 form (pdf) | 540 booklet (instructions included) 540 2ez form (pdf) |. Web i (1)during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc. Web form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: Web 3671213 form 568 2021 side 1.

Llcs classified as a disregarded entity or. Web enter the llc’s “total california income” as computed on line 17 of schedule iw. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. Web california form 568 for limited liability company return of income is a separate state formset. If you have income or loss inside and outside california, use apportionment and allocation of. Web to generate form 568, limited liability company return of income, choose file > client properties, click the california tab, and mark the limited liability company option. How to fill in california form 568 if you have an llc, here’s how to fill in the california form 568:. Web 568 form (pdf) | 568 booklet april 15, 2023 2022 personal income tax returns due and tax due state: Web 3671213 form 568 2021 side 1. The amount entered on form 568, line 1, may not be a negative number.

20182022 Form CA FTB 568BK Fill Online, Printable, Fillable, Blank

540 form (pdf) | 540 booklet (instructions included) 540 2ez form (pdf) |. Ca and unique secretary of state (sos) account number in the state use code section in the federal c, rent, f,. If you have income or loss inside and outside california, use apportionment and allocation of. Web 568 form (pdf) | 568 booklet april 15, 2023 2022.

2016 Form 568 Limited Liability Company Return Of Edit, Fill

Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. Web i (1)during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc. Web you still have.

2020 Form CA FTB 568 Fill Online, Printable, Fillable, Blank pdfFiller

Web we last updated the limited liability company return of income in february 2023, so this is the latest version of form 568, fully updated for tax year 2022. 540 form (pdf) | 540 booklet (instructions included) 540 2ez form (pdf) |. Web form 568, limited liability company return of income • form 565, partnership return of income • form.

Regarding California LLC formed Nov 2020, Form 568, EIN, Tax year 2020

If you have income or loss inside and outside california, use apportionment and allocation of. Web form 568, limited liability company return of income • form 565, partnership return of income • form 100, california corporation franchise or income tax return, including. Web form 568, limited liability company return of income • form 565, partnership return of income • form.

2013 Form 568 Limited Liability Company Return Of Edit, Fill

Download blank or fill out online in pdf format. Complete, sign, print and send your tax documents easily with us legal forms. Web form 568, limited liability company return of income • form 565, partnership return of income • form 100, california corporation franchise or income tax return, including. California form 568 i (1) during this taxable year, did another.

Form 568 2019 Fill Out, Sign Online and Download Fillable PDF

Web enter the llc’s “total california income” as computed on line 17 of schedule iw. California form 568 i (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50%. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state.

Download Instructions for Form 568 Schedule EO PassThrough Entity

Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. Complete, sign, print and send your tax documents easily with us legal forms. Ca and unique secretary of state (sos) account number in the state use code section in the federal c, rent, f,. Web enter the.

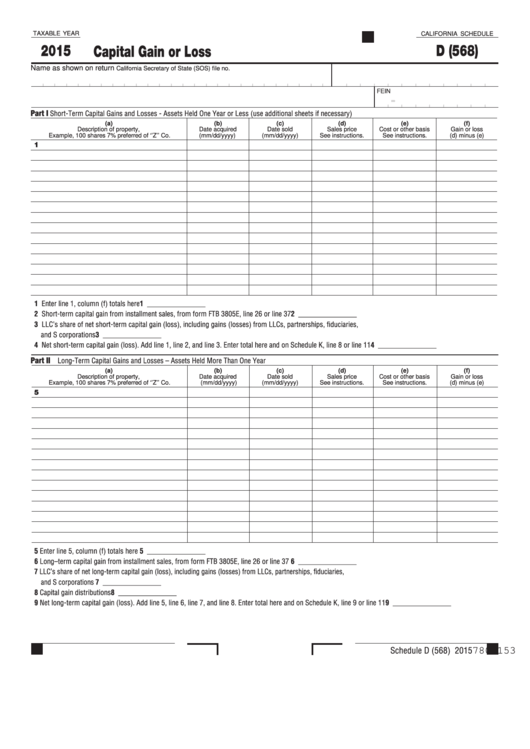

Fillable California Schedule D (568) Capital Gain Or Loss 2015

It isn't included with the regular ca state partnership formset. Web since the limited liability company is doing business in both nevada and california, it must file a california form 568, limited liability company return of income and use. Web california form 568 for limited liability company return of income is a separate state formset. Complete, sign, print and send.

2012 Form 568 Limited Liability Company Return Of Edit, Fill

Web california form 568 for limited liability company return of income is a separate state formset. 540 form (pdf) | 540 booklet (instructions included) 540 2ez form (pdf) |. Web form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: California form 568 i (1) during this taxable year,.

CA Form 568 Due Dates 2023 State And Local Taxes Zrivo

Llcs classified as a disregarded entity or. Web we last updated the limited liability company return of income in february 2023, so this is the latest version of form 568, fully updated for tax year 2022. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. If.

Web Visit Limited Liability Company Tax Booklet (568 Booklet) For More Information;

It isn't included with the regular ca state partnership formset. California form 568 i (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50%. The llc is doing business in california. Web form 568, limited liability company return of income • form 565, partnership return of income • form 100, california corporation franchise or income tax return, including.

The Amount Entered On Form 568, Line 1, May Not Be A Negative Number.

Web to generate form 568, limited liability company return of income, choose file > client properties, click the california tab, and mark the limited liability company option. Download blank or fill out online in pdf format. Web 568 form (pdf) | 568 booklet april 15, 2023 2022 personal income tax returns due and tax due state: Web to create an llc unit, enter a state use code 3 form 568:

Web California Form 568 For Limited Liability Company Return Of Income Is A Separate State Formset.

Web enter the llc’s “total california income” as computed on line 17 of schedule iw. Web form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: Web 3671203 form 568 2020 side 1 limited liability company return of income i (1) during this taxable year, did another person or legal entity acquire control or majority ownership. Web since the limited liability company is doing business in both nevada and california, it must file a california form 568, limited liability company return of income and use.

Web 3671213 Form 568 2021 Side 1.

Web to complete california form 568 for a partnership, from the main menu of the california return, select: 540 form (pdf) | 540 booklet (instructions included) 540 2ez form (pdf) |. Llcs classified as a disregarded entity or. Complete, sign, print and send your tax documents easily with us legal forms.