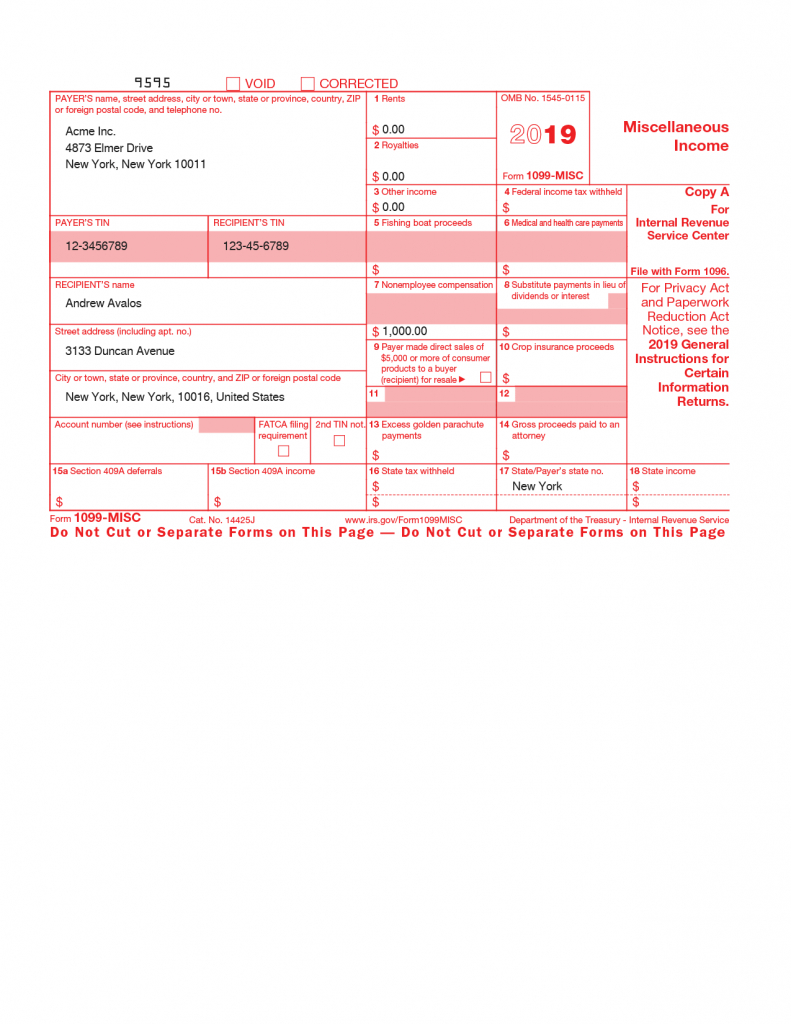

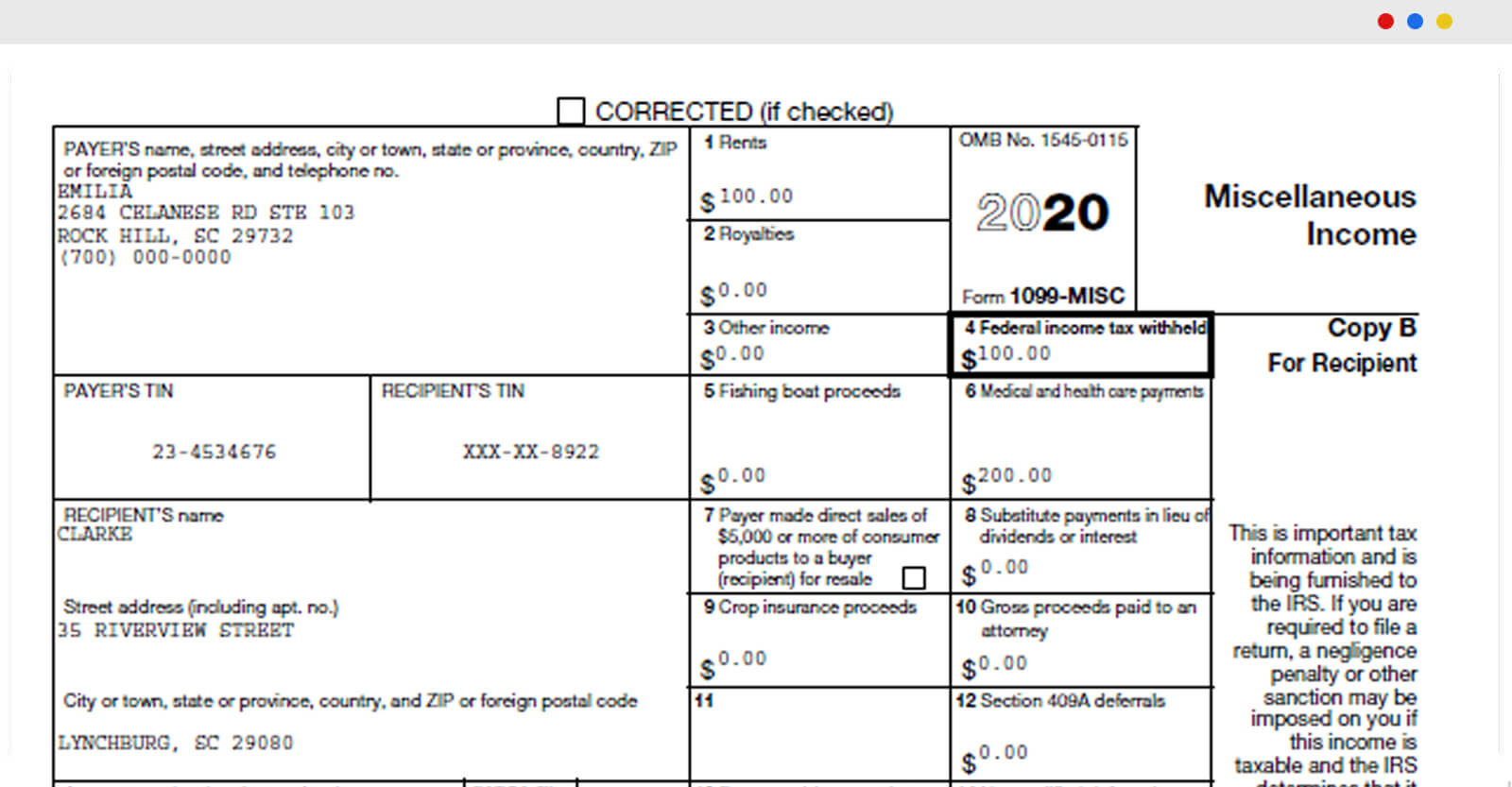

2020 Form 1099-Misc

2020 Form 1099-Misc - All you have to do is enter the required details. Try it for free now! Fill in the empty areas; Do not miss the deadline If you have not already entered the applicable. If your business paid at least. Web if you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. Ad get the latest 1099 misc online. These amounts are generally reported on schedule c. If the real estate was not your main home, report the transaction on form 4797, form 6252, and/or the schedule d for the appropriate.

Involved parties names, places of residence and phone. Try it for free now! Ad get the latest 1099 misc online. If you have not already entered the applicable. All you have to do is enter the required details. Ad get ready for tax season deadlines by completing any required tax forms today. More specifically, the irs has split the form 1099 into two separate forms: Web create a 1099 misc 2020 tax form online in minutes. If your business paid at least. Web if you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported.

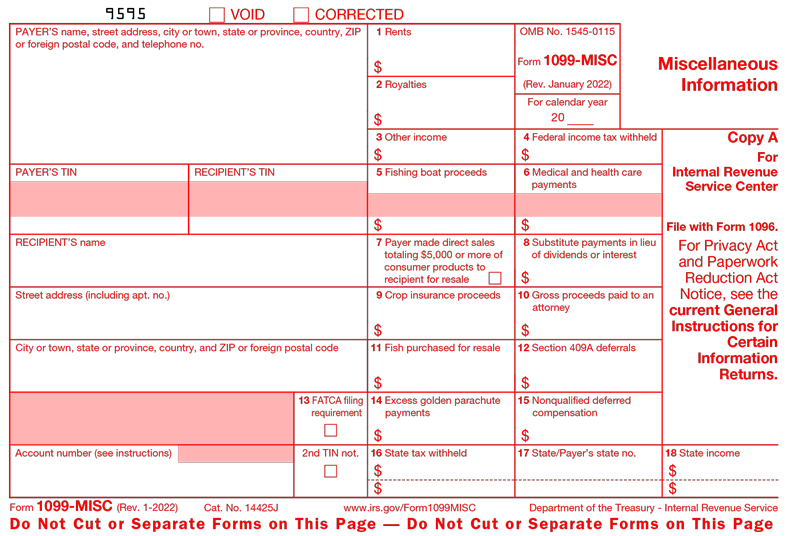

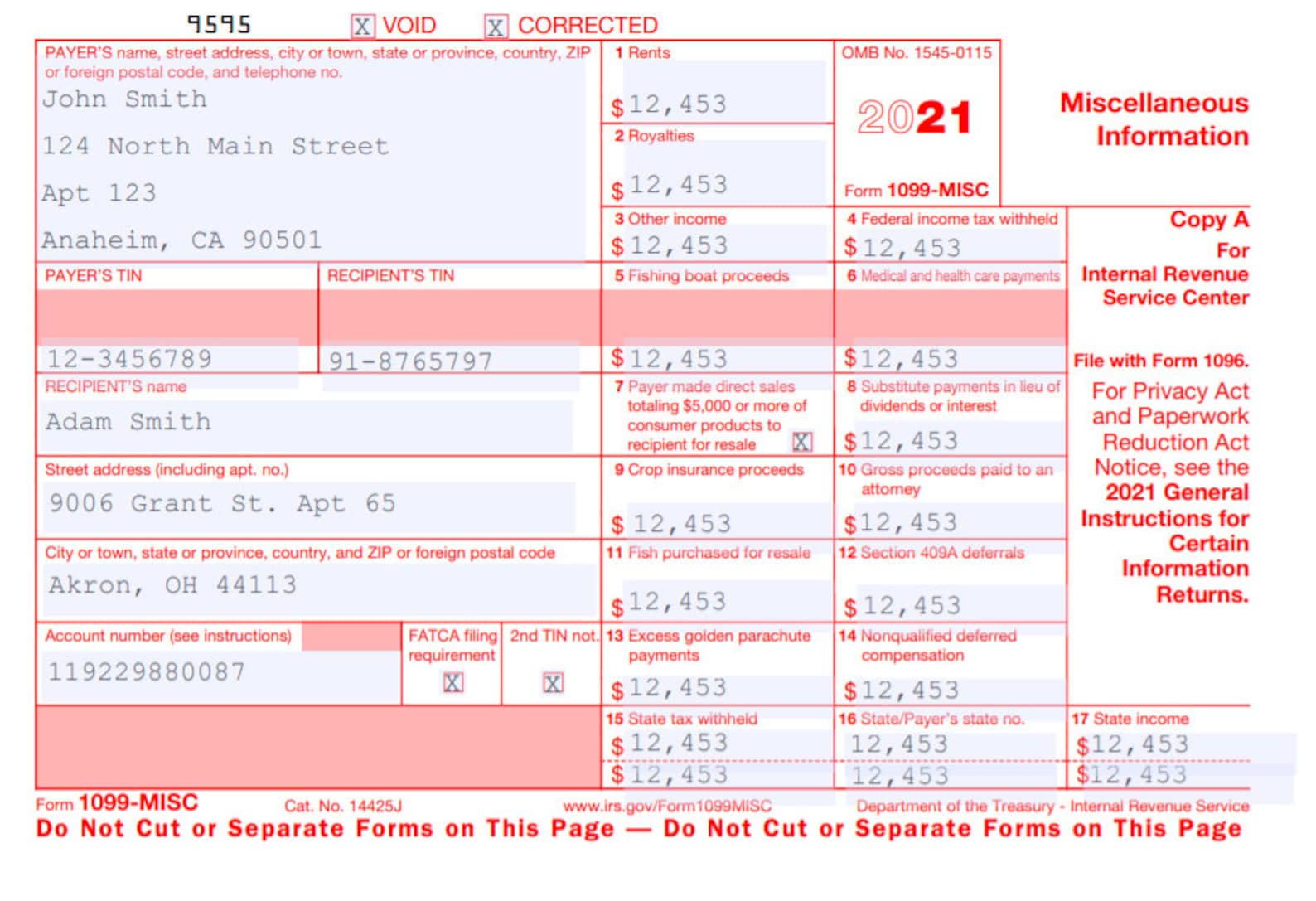

Ad get the latest 1099 misc online. More specifically, the irs has split the form 1099 into two separate forms: All you have to do is enter the required details. Fill in the empty areas; Ad get ready for tax season deadlines by completing any required tax forms today. If the real estate was not your main home, report the transaction on form 4797, form 6252, and/or the schedule d for the appropriate. If you have not already entered the applicable. If your business paid at least. Insurance contracts, etc., are reported to. Try it for free now!

Form 1099 Overview and FAQ Buildium Help Center

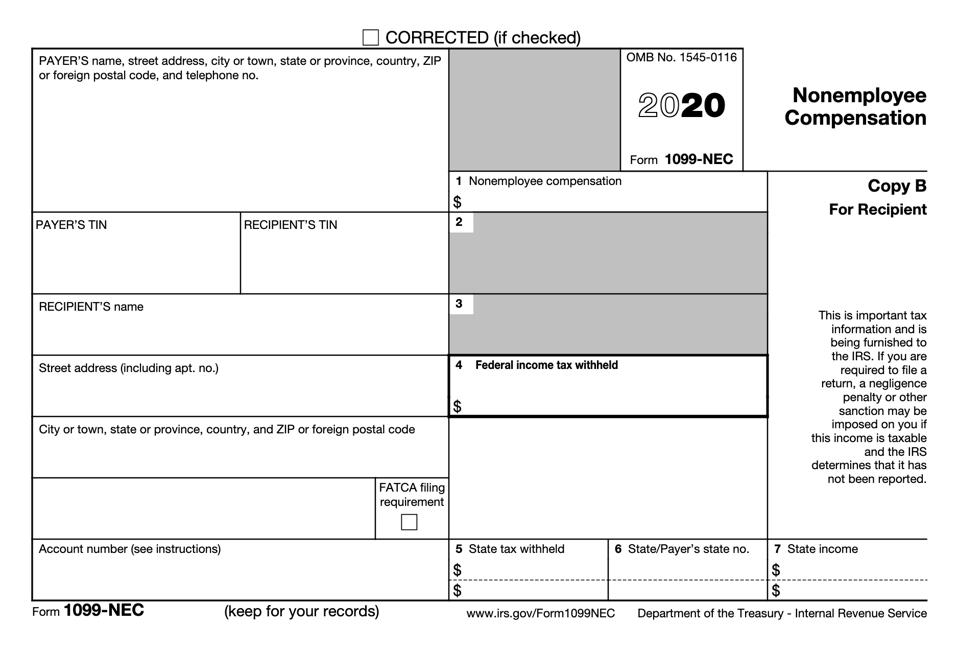

Fill in the empty areas; If you have not already entered the applicable. If the real estate was not your main home, report the transaction on form 4797, form 6252, and/or the schedule d for the appropriate. These amounts are generally reported on schedule c. Web if you are required to file a return, a negligence penalty or other sanction.

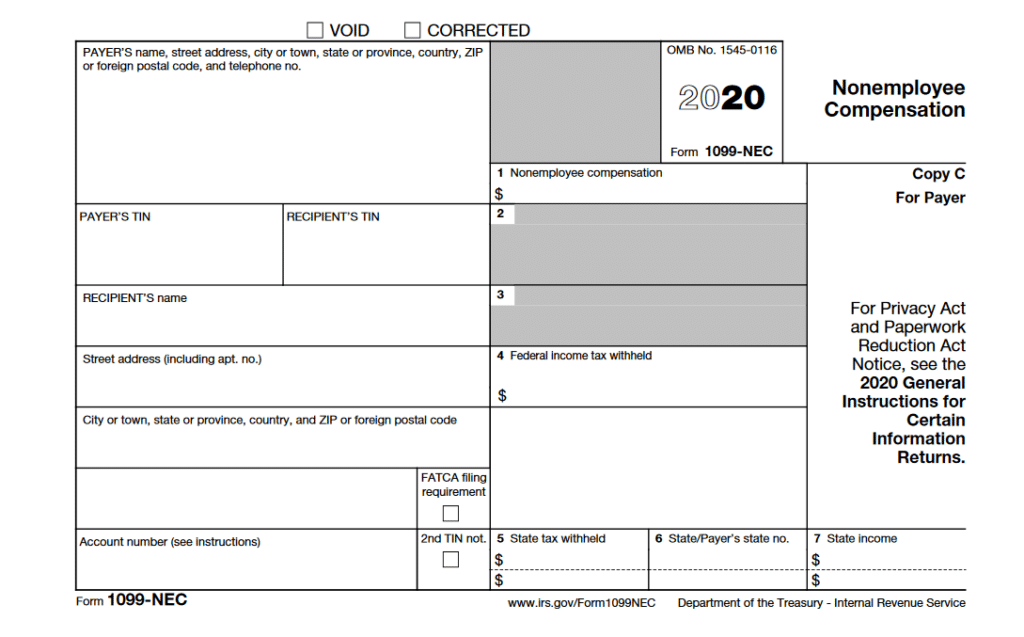

IRS Makes Major Change to Annual Form 1099MISC Information Return GYF

Ad get the latest 1099 misc online. Web create a 1099 misc 2020 tax form online in minutes. Involved parties names, places of residence and phone. Try it for free now! Web if you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines.

For the Love of 1099s! Preparing for JD Edwards YearEnd Circular

Fill in the empty areas; These amounts are generally reported on schedule c. Web create a 1099 misc 2020 tax form online in minutes. Web if you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. Ad.

2020 Form 1099MISC Create Fillable & Printable 1099MISC for Free

Web create a 1099 misc 2020 tax form online in minutes. Insurance contracts, etc., are reported to. Ad get ready for tax season deadlines by completing any required tax forms today. Upload, modify or create forms. Try it for free now!

There’s A New Tax Form With Some Changes For Freelancers & Gig

Do not miss the deadline Web if you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. All you have to do is enter the required details. Web create a 1099 misc 2020 tax form online in.

Pick W9 Form 2020 Printable Pdf Calendar Printables Free Blank

These amounts are generally reported on schedule c. Try it for free now! Web create a 1099 misc 2020 tax form online in minutes. If you have not already entered the applicable. If the real estate was not your main home, report the transaction on form 4797, form 6252, and/or the schedule d for the appropriate.

Efile Form 1099 MISC Online How to File 1099 MISC for 2020

Involved parties names, places of residence and phone. More specifically, the irs has split the form 1099 into two separate forms: Ad get ready for tax season deadlines by completing any required tax forms today. Upload, modify or create forms. Try it for free now!

1099MISC Software to Create, Print and EFile Form 1099MISC Irs

Ad get ready for tax season deadlines by completing any required tax forms today. Do not miss the deadline Fill in the empty areas; Fill, edit, sign, download & print. Try it for free now!

2020 1099MISC IRS Copy A Form Print Template PDF Fillable Etsy

Involved parties names, places of residence and phone. If you have not already entered the applicable. These amounts are generally reported on schedule c. Web create a 1099 misc 2020 tax form online in minutes. More specifically, the irs has split the form 1099 into two separate forms:

Fill, Edit, Sign, Download & Print.

Web if you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. If your business paid at least. Try it for free now! All you have to do is enter the required details.

If You Have Not Already Entered The Applicable.

These amounts are generally reported on schedule c. Upload, modify or create forms. Ad get ready for tax season deadlines by completing any required tax forms today. Fill in the empty areas;

Do Not Miss The Deadline

Ad get the latest 1099 misc online. More specifically, the irs has split the form 1099 into two separate forms: Insurance contracts, etc., are reported to. Involved parties names, places of residence and phone.

If The Real Estate Was Not Your Main Home, Report The Transaction On Form 4797, Form 6252, And/Or The Schedule D For The Appropriate.

Web create a 1099 misc 2020 tax form online in minutes.