2020 Form 941 X

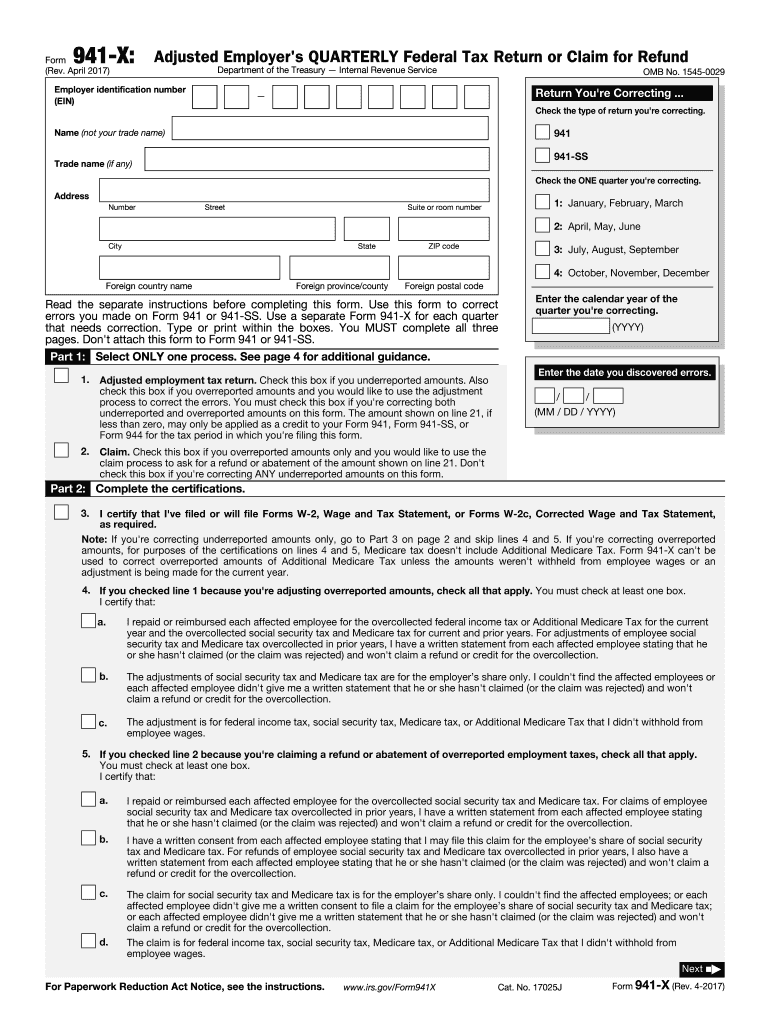

2020 Form 941 X - Web you determined that your company is eligible for the employee retention credit (“erc”) and you have calculated the 2020 erc based on the qualified wages and. Web for 2020, the erc can be claimed by eligible employers who paid qualified wages after march 12, 2020, and before january 1, 2021, and who experienced a full or. October 2020) employer identification number (ein) department of the treasury —. Upload, modify or create forms. Form 941 instructions, december 2021 revision pdf for additional information related to the erc for quarters in 2021;. Form 941 is used by employers. Try it for free now! Adjusted employer’s quarterly federal tax return or claim for refund (rev. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Web form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on or after september 1, 2020,.

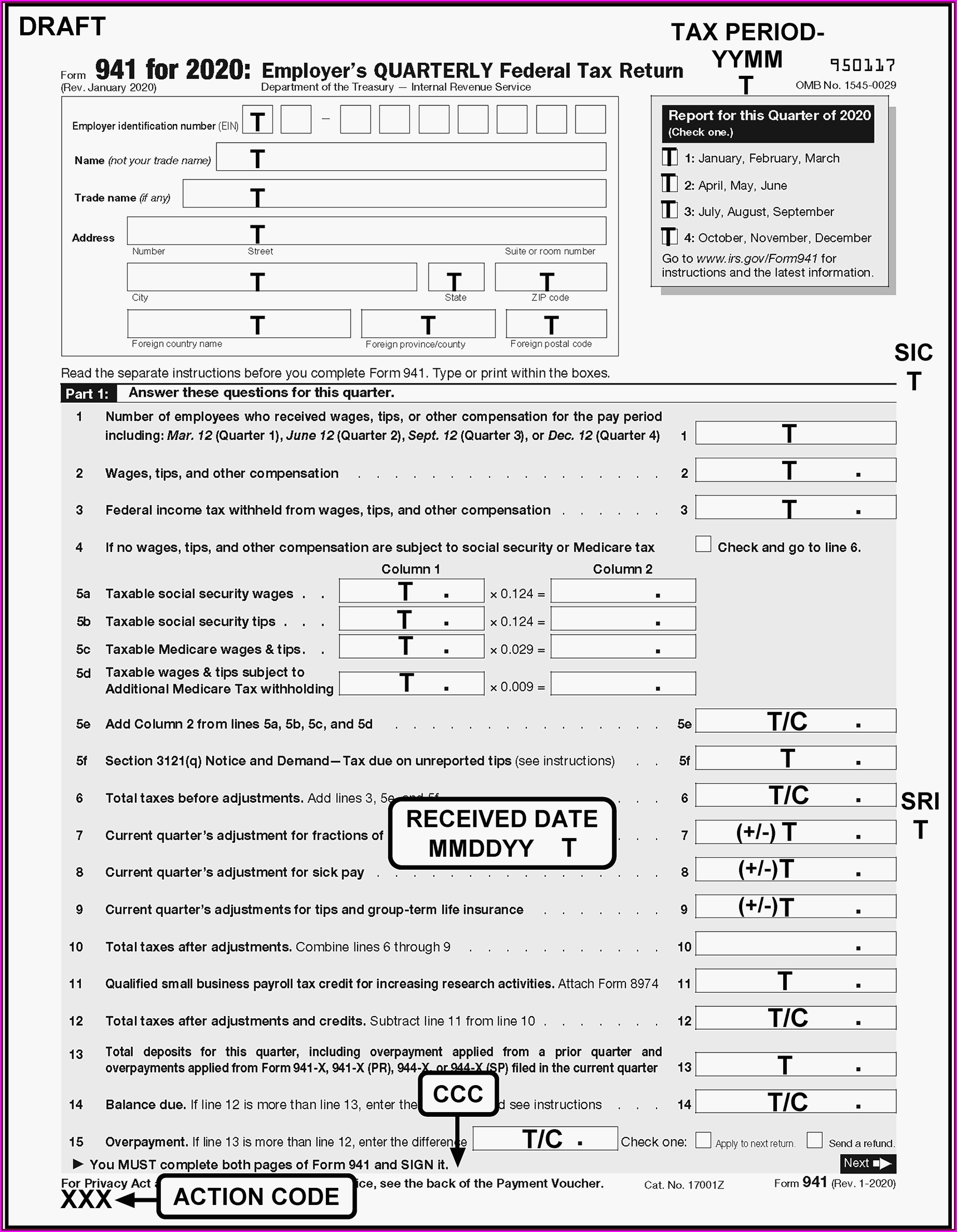

Form 941 instructions, december 2021 revision pdf for additional information related to the erc for quarters in 2021;. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Adjusted employer’s quarterly federal tax return or claim for refund (rev. Web you determined that your company is eligible for the employee retention credit (“erc”) and you have calculated the 2020 erc based on the qualified wages and. Try it for free now! Web for 2020, the erc can be claimed by eligible employers who paid qualified wages after march 12, 2020, and before january 1, 2021, and who experienced a full or. Adjusted employer's quarterly federal tax return or claim for refund keywords: Web form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on or after september 1, 2020,. Form 941 is used by employers.

July 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) name. Try it for free now! Web form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on or after september 1, 2020,. Adjusted employer's quarterly federal tax return or claim for refund keywords: Form 941 instructions, december 2021 revision pdf for additional information related to the erc for quarters in 2021;. October 2020) employer identification number (ein) department of the treasury —. Web for 2020, the erc can be claimed by eligible employers who paid qualified wages after march 12, 2020, and before january 1, 2021, and who experienced a full or. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Adjusted employer’s quarterly federal tax return or claim for refund (rev. Web the instructions, which were earlier revised in july, address additional changes to the form, including the modified line 24, which now is used to correct data.

Complete Form 941X for 2020 with TaxBandits YouTube

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Adjusted employer’s quarterly federal tax return or claim for refund (rev. Web the instructions, which were earlier revised in july, address additional changes to the form, including the modified line 24, which now is used to correct data. Web.

20172020 Form IRS 941X Fill Online, Printable, Fillable, Blank

Upload, modify or create forms. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. July 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) name. January 2020) employer’s quarterly federal tax return department of the treasury — internal.

2020 Form IRS Instructions 941 Fill Online, Printable, Fillable, Blank

January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. July 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) name..

How To Fill Out Form 941 X For Employee Retention Credit In 2020

July 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) name. Web you determined that your company is eligible for the employee retention credit (“erc”) and you have calculated the 2020 erc based on the qualified wages and. Upload, modify or create forms. Complete, edit or print tax forms instantly. Try.

2020 Form IRS 941SS Fill Online, Printable, Fillable, Blank pdfFiller

Upload, modify or create forms. October 2020) employer identification number (ein) department of the treasury —. Web you determined that your company is eligible for the employee retention credit (“erc”) and you have calculated the 2020 erc based on the qualified wages and. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb.

ERC Calculator Tool ERTC Funding

Web the instructions, which were earlier revised in july, address additional changes to the form, including the modified line 24, which now is used to correct data. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Web you determined that your company is eligible for the employee retention credit (“erc”) and.

How to Fill Out 2020 Form 941 Employer’s Quarterly Federal Tax Return

Form 941 instructions, december 2021 revision pdf for additional information related to the erc for quarters in 2021;. July 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) name. Complete, edit or print tax forms instantly. Try it for free now! Web the instructions, which were earlier revised in july, address.

Irs.gov Form 941 X Instructions Form Resume Examples 1ZV8dX3V3X

January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Web for 2020, the erc can be claimed by eligible employers who paid qualified wages after march 12, 2020, and before january 1, 2021, and who experienced a full or. Web form 941 has been revised to allow employers that defer the.

What You Need to Know About Just Released IRS Form 941X Blog

January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Upload, modify or create forms. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Try it for free now! Form 941 instructions, december 2021 revision pdf for additional information.

941 X Form Fill Out and Sign Printable PDF Template signNow

Web you determined that your company is eligible for the employee retention credit (“erc”) and you have calculated the 2020 erc based on the qualified wages and. Web form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on or after september 1, 2020,. Web.

July 2020) Adjusted Employer’s Quarterly Federal Tax Return Or Claim For Refund Department Of The Treasury — Internal Revenue Service Omb No.

Adjusted employer’s quarterly federal tax return or claim for refund (rev. Form 941 is used by employers. Web you determined that your company is eligible for the employee retention credit (“erc”) and you have calculated the 2020 erc based on the qualified wages and. Adjusted employer's quarterly federal tax return or claim for refund keywords:

October 2020) Employer Identification Number (Ein) Department Of The Treasury —.

Web the instructions, which were earlier revised in july, address additional changes to the form, including the modified line 24, which now is used to correct data. Upload, modify or create forms. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Try it for free now!

January 2020) Employer’s Quarterly Federal Tax Return Department Of The Treasury — Internal Revenue Service 950117 Omb No.

Form 941 instructions, december 2021 revision pdf for additional information related to the erc for quarters in 2021;. Complete, edit or print tax forms instantly. Web for 2020, the erc can be claimed by eligible employers who paid qualified wages after march 12, 2020, and before january 1, 2021, and who experienced a full or. Web form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on or after september 1, 2020,.