2021 Form 1041 Extended Due Date

2021 Form 1041 Extended Due Date - The due date is april 18, instead of april 15, because of the emancipation day holiday in the district of. Web 1 best answer. Web calendar year estates and trusts must file form 1041 by april 18, 2023. The original due date of april 15, 2021 was only extended for individuals, not estates or trusts filing form 1041. Web comply with federal tax return due dates by reviewing this handy quick reference chart. Web for example, for a trust or estate with a tax year ending december 31, the due date is april 15 of the following year. Web a 1041 extension must be filed no later than midnight on the normal due date of the return: Estates & trusts (form 1041) april 15, 2021. Web those with employee benefit plans will get an automatic extension of maximum three and a half months. Web see form 7004.

Web those with employee benefit plans will get an automatic extension of maximum three and a half months. The due date is april 18, instead of april 15, because of the emancipation day holiday in the district of. Web calendar year estates and trusts must file form 1041 by april 18, 2023. Expresstaxexempt | april 14, 2021 |. The original due date of april 15, 2021 was only extended for individuals, not estates or trusts filing form 1041. Web what is the due date for irs form 1041 u.s. Web for example, for a trust or estate with a tax year ending december 31, the due date is april 15 of the following year. A separate extension may need to be filed to extend the due date of these. 31, 2025 starting with 2016. The original due date of april 15, 2021 was only extended for individuals, not estates or trusts filing.

Web beneficiaries, including charitable organizations, can extend their irs form 1041 deadline by filing form 7004 by april 15, 2021. Web calendar year estates and trusts must file form 1041 by april 18, 2023. Web 1 best answer. The original due date of april 15, 2021 was only extended for individuals, not estates or trusts filing. Web for example, for a trust or estate with a tax year ending december 31, the due date is april 15 of the following year. A separate extension may need to be filed to extend the due date of these. Expresstaxexempt | april 14, 2021 |. Web washington — the internal revenue service today announced that individuals have until may 17, 2021 to meet certain deadlines that would normally fall on. The extension request will allow a 5 1/2. Whenever a regular tax filing date falls on.

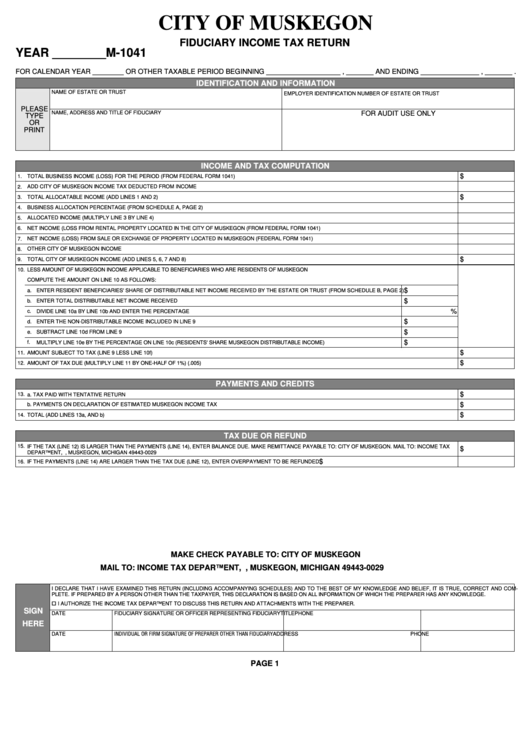

Form M1041 Fiduciary Tax Return printable pdf download

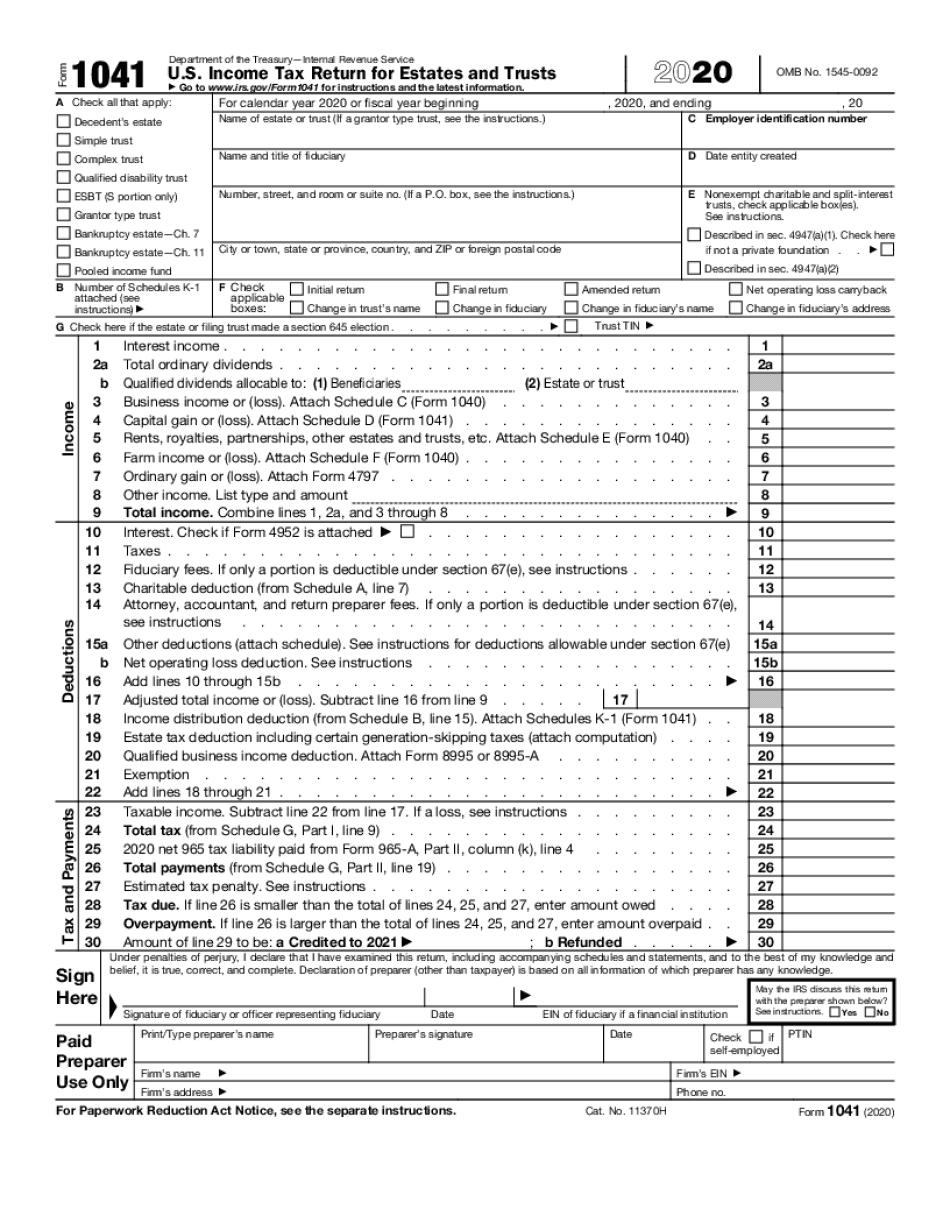

31, 2025 starting with 2016. Web for fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month following the close of the tax year. Web what is the due date for irs form 1041 u.s. Web go to www.irs.gov/form1041 for instructions and the latest information. The original due date of april 15, 2021 was.

Form 1041 and Other Tax Forms Still Due April 15, 2021 YouTube

Web calendar year estates and trusts must file form 1041 by april 18, 2023. A trust or estate with a tax year that ends june. Web december 22, 2020 mark your calendars! 30 c corporation (calendar year) form 1120 march 15 sept.15 before jan. Web for example, for a trust or estate with a tax year ending december 31, the.

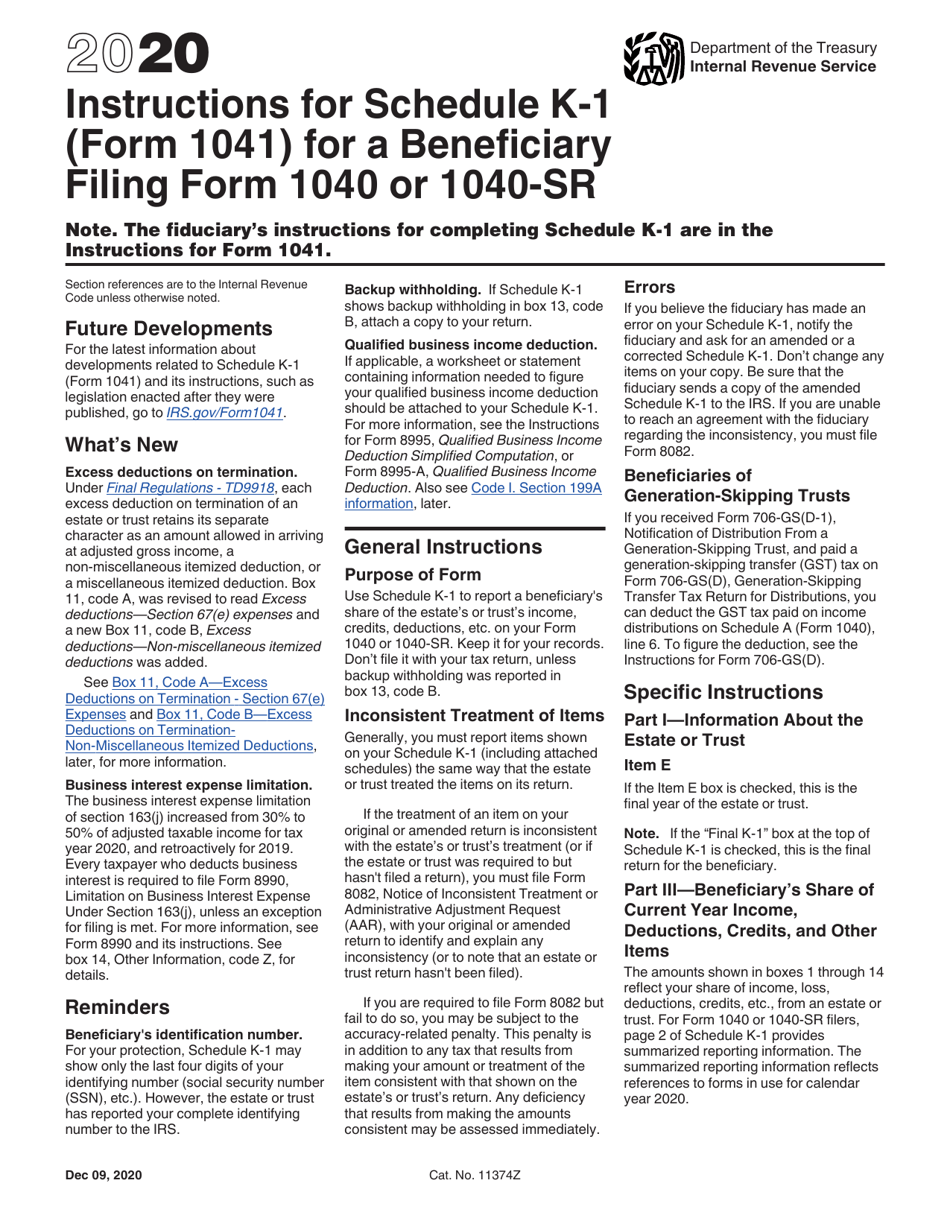

Download Instructions for IRS Form 1041 Schedule K1 Beneficiary's

30 c corporation (calendar year) form 1120 march 15 sept.15 before jan. Income tax return for estates and trusts? Federal tax filing deadlines for tax year 2021 april 21, 2020 |. A trust or estate with a tax year that ends june. A separate extension may need to be filed to extend the due date of these.

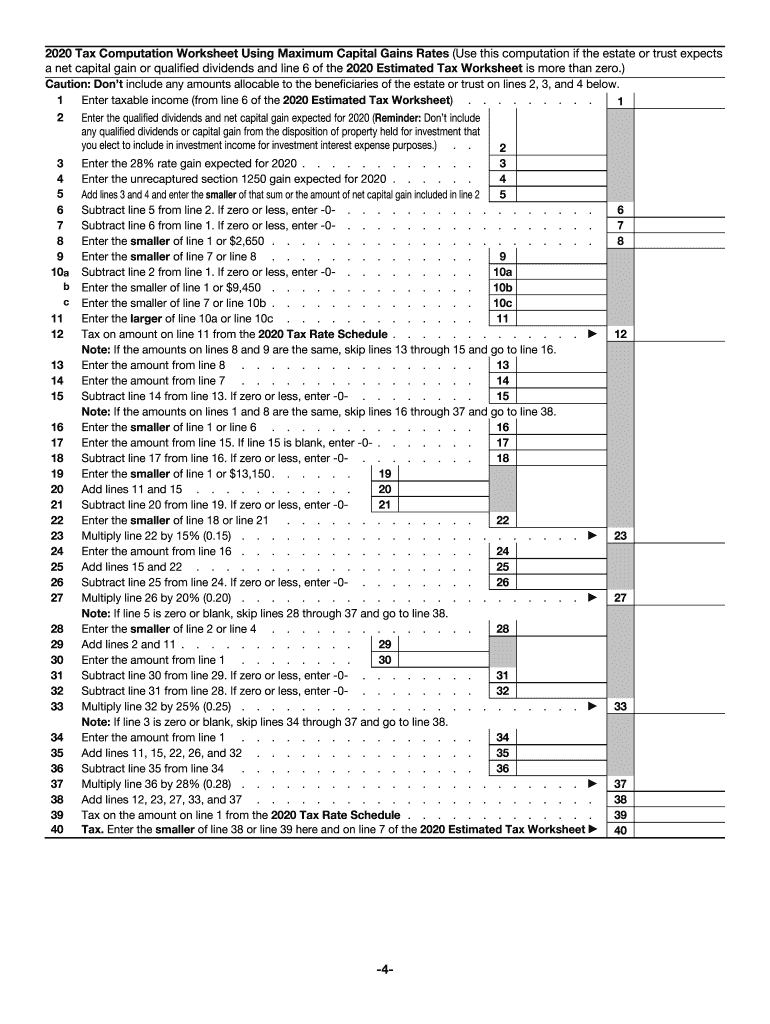

Form 2018 Estimated Fill Out and Sign Printable PDF Template signNow

Web what is the due date for irs form 1041 u.s. Web form 1041 april 15 sept. The original due date of april 15, 2021 was only extended for individuals, not estates or trusts filing form 1041. Web for fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month following the close of the.

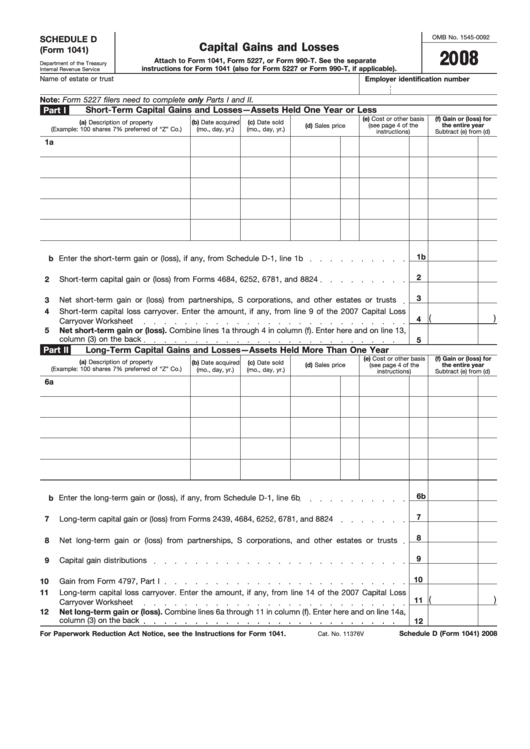

Fillable Form 1041 Schedule D Capital Gains And Losses 2008

Web for fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month following the close of the tax year. Web december 22, 2020 mark your calendars! The 15th day of the 4th month after the end of the tax year for the return. Estates & trusts (form 1041) april 15, 2021. Web comply with.

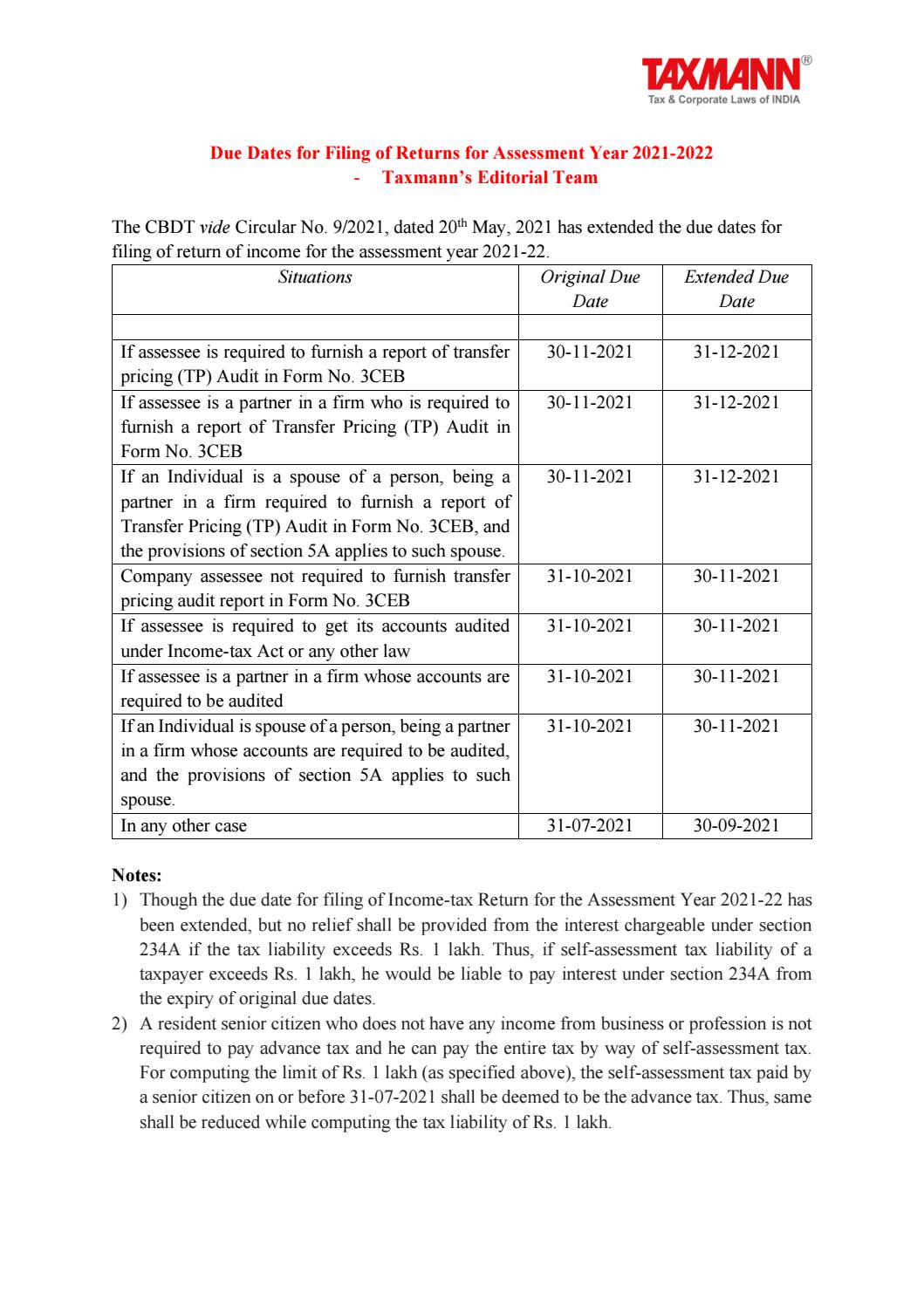

Extended Due Dates for Filing ITR for A.Y. 202122 by Taxmann Issuu

Web form 1041 april 15 sept. Federal tax filing deadlines for tax year 2021 april 21, 2020 |. What is the due date for form 1041 in 2021? A separate extension may need to be filed to extend the due date of these. Web 2021 federal tax filing deadlines | 2022 irs tax deadlines | 1041 due date free download:

us tax form 1041 2020 2021 Fill Online, Printable, Fillable Blank

Estates & trusts (form 1041) april 15, 2021. Web what is the due date for irs form 1041 u.s. Web form 1041 april 15 sept. Web see form 7004. The original due date of april 15, 2021 was only extended for individuals, not estates or trusts filing.

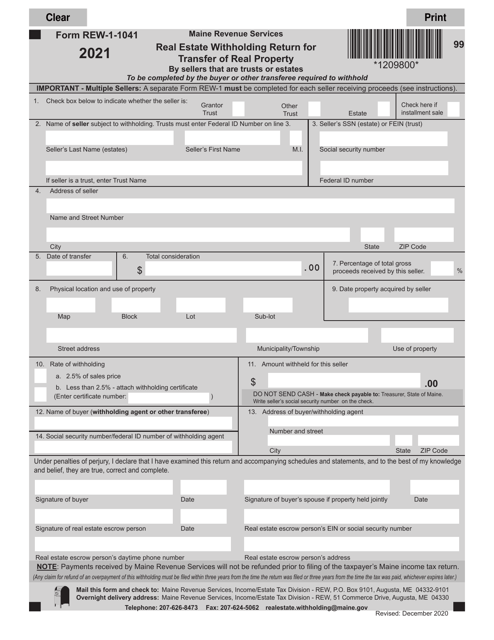

Form REW11041 Download Fillable PDF or Fill Online Real Estate

Web a 1041 extension must be filed no later than midnight on the normal due date of the return: A trust or estate with a tax year that ends june. Federal tax filing deadlines for tax year 2021 april 21, 2020 |. The original due date of april 15, 2021 was only extended for individuals, not estates or trusts filing.

Due Date for furnishing FORM GSTR1 for April 2021 extended amid COVID19

Federal tax filing deadlines for tax year 2021 april 21, 2020 |. 31, 2025 starting with 2016. Web for fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month following the close of the tax year. Web 1 best answer. For example, an estate that has a tax year that.

Estate Tax Return When is it due?

Web 2021 federal tax filing deadlines | 2022 irs tax deadlines | 1041 due date free download: Individual (form 1040) may 17, 2021. The extension request will allow a 5 1/2. Expresstaxexempt | april 14, 2021 |. Web those with employee benefit plans will get an automatic extension of maximum three and a half months.

Web Go To Www.irs.gov/Form1041 For Instructions And The Latest Information.

Expresstaxexempt | april 14, 2021 |. The 15th day of the 4th month after the end of the tax year for the return. The extension request will allow a 5 1/2. Web washington — the internal revenue service today announced that individuals have until may 17, 2021 to meet certain deadlines that would normally fall on.

Web Calendar Year Estates And Trusts Must File Form 1041 By April 18, 2023.

Estates & trusts (form 1041) april 15, 2021. Web a 1041 extension must be filed no later than midnight on the normal due date of the return: The original due date of april 15, 2021 was only extended for individuals, not estates or trusts filing form 1041. Web see form 7004.

The Due Date Is April 18, Instead Of April 15, Because Of The Emancipation Day Holiday In The District Of.

A trust or estate with a tax year that ends june. 31, 2025 starting with 2016. Individual (form 1040) may 17, 2021. What is the due date for form 1041 in 2021?

Web Form 1041 April 15 Sept.

A separate extension may need to be filed to extend the due date of these. For example, an estate that has a tax year that. Web for example, for a trust or estate with a tax year ending december 31, the due date is april 15 of the following year. Web beneficiaries, including charitable organizations, can extend their irs form 1041 deadline by filing form 7004 by april 15, 2021.