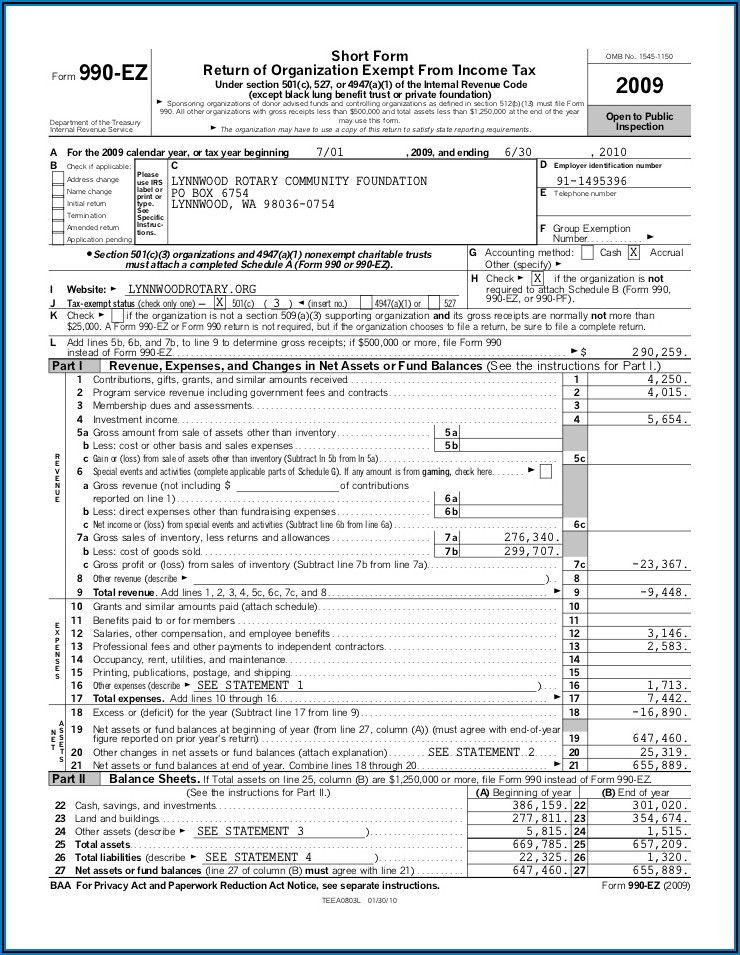

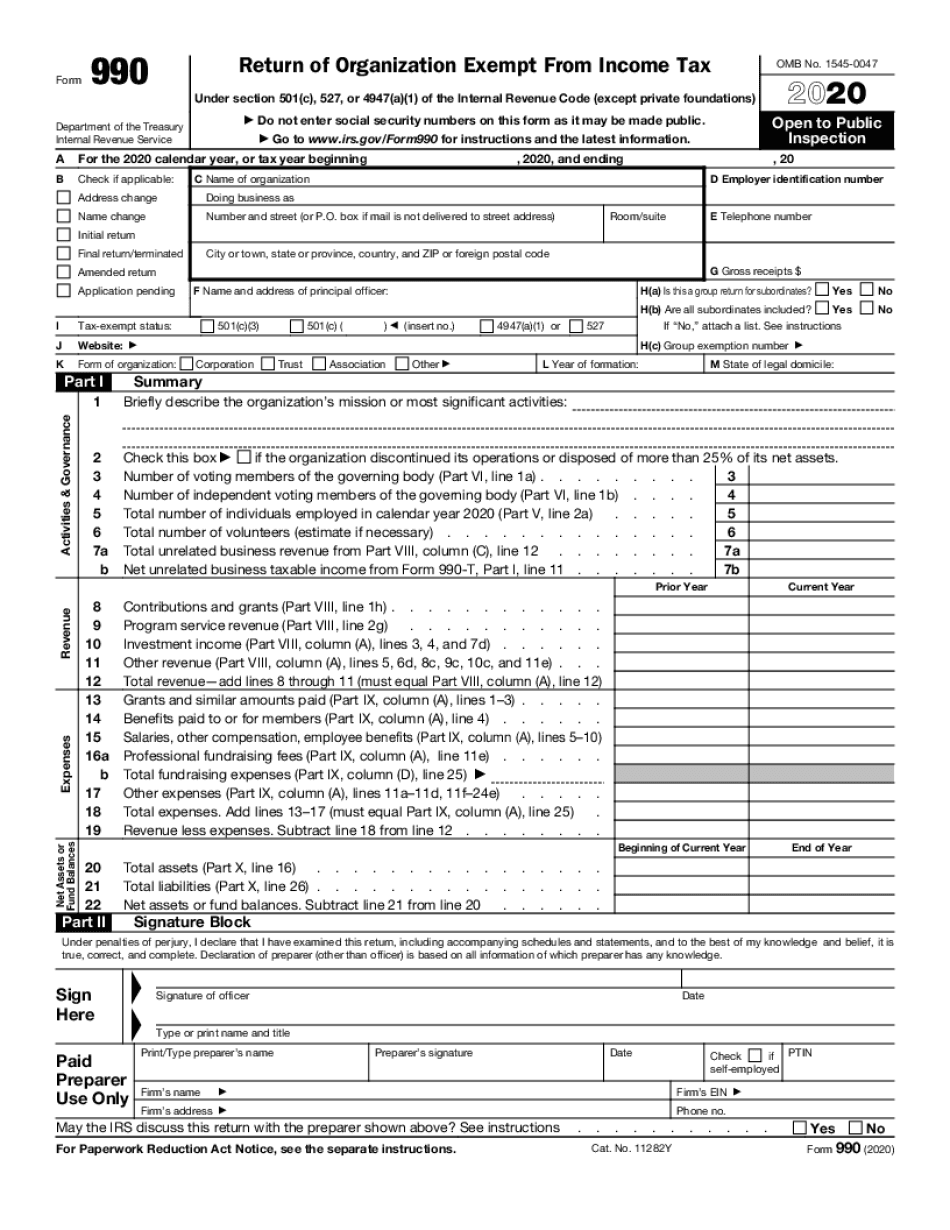

2021 Form 990-Ez

2021 Form 990-Ez - Get ready for tax season deadlines by completing any required tax forms today. Web video instructions and help with filling out and completing irs form 990 ez 2021. Form 4562 (2017) (a) classification of property (e). Director (term ended 5/2021) 0 147,005 3.00 4.00 0 president and director 0 188,818 0 0. For organizations with gross receipts greater than $100,000, we have a sliding scale fee. Review & approval system for board members. If the organization follows a calendar tax year, the due. Use our simple instructions for the rapid and easy submitting of the 2021 990 ez form. Complete, edit or print tax forms instantly. Web tax990 will make your filing easy, secure, and accurate with exclusive features.

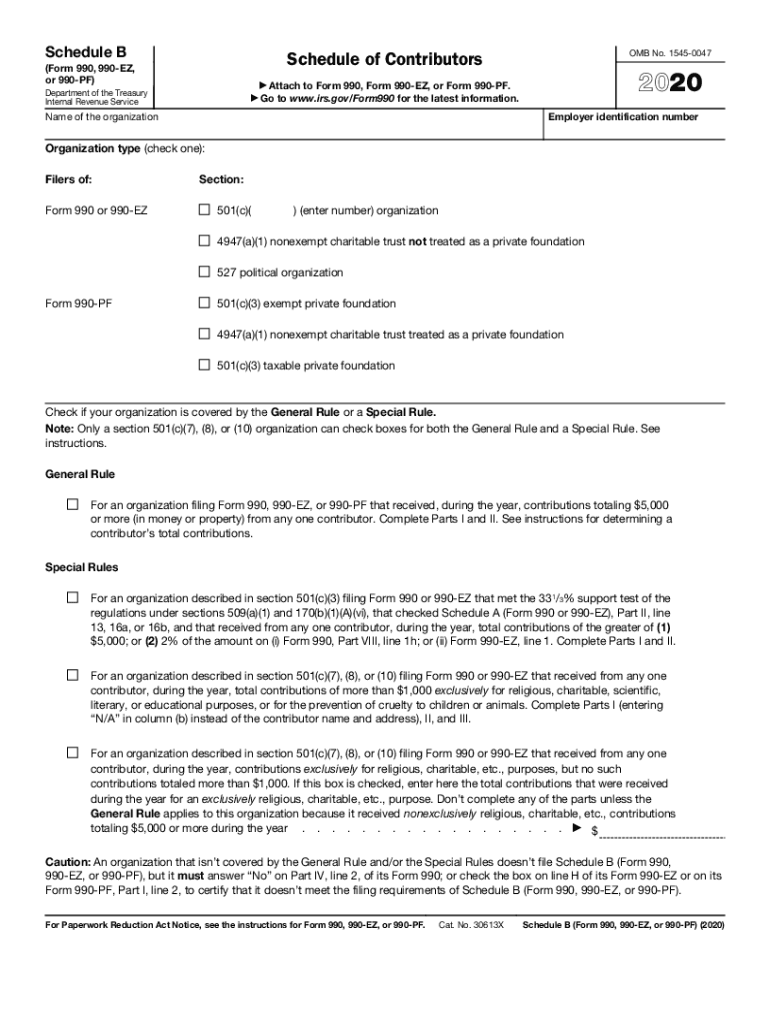

On this page you may download the 990 series filings on record for 2021. Review & approval system for board members. For organizations with gross receipts greater than $100,000, we have a sliding scale fee. Complete, edit or print tax forms instantly. Web f group exemption number g accounting method: Get ready for tax season deadlines by completing any required tax forms today. Web tax990 will make your filing easy, secure, and accurate with exclusive features. H check if the organization is not required to attach schedule b (form 990). If the organization follows a calendar tax year, the due. Use our simple instructions for the rapid and easy submitting of the 2021 990 ez form.

Use our simple instructions for the rapid and easy submitting of the 2021 990 ez form. Web tax990 will make your filing easy, secure, and accurate with exclusive features. Web video instructions and help with filling out and completing irs form 990 ez 2021. Form 4562 (2017) (a) classification of property (e). Director (term ended 5/2021) 0 147,005 3.00 4.00 0 president and director 0 188,818 0 0. Web the 990ez is an annual tax information filing completed by many organizations that fall under the 501 (c) series of statuses of the tax code, exempting. H check if the organization is not required to attach schedule b (form 990). Web f group exemption number g accounting method: Complete, edit or print tax forms instantly. If the organization follows a calendar tax year, the due.

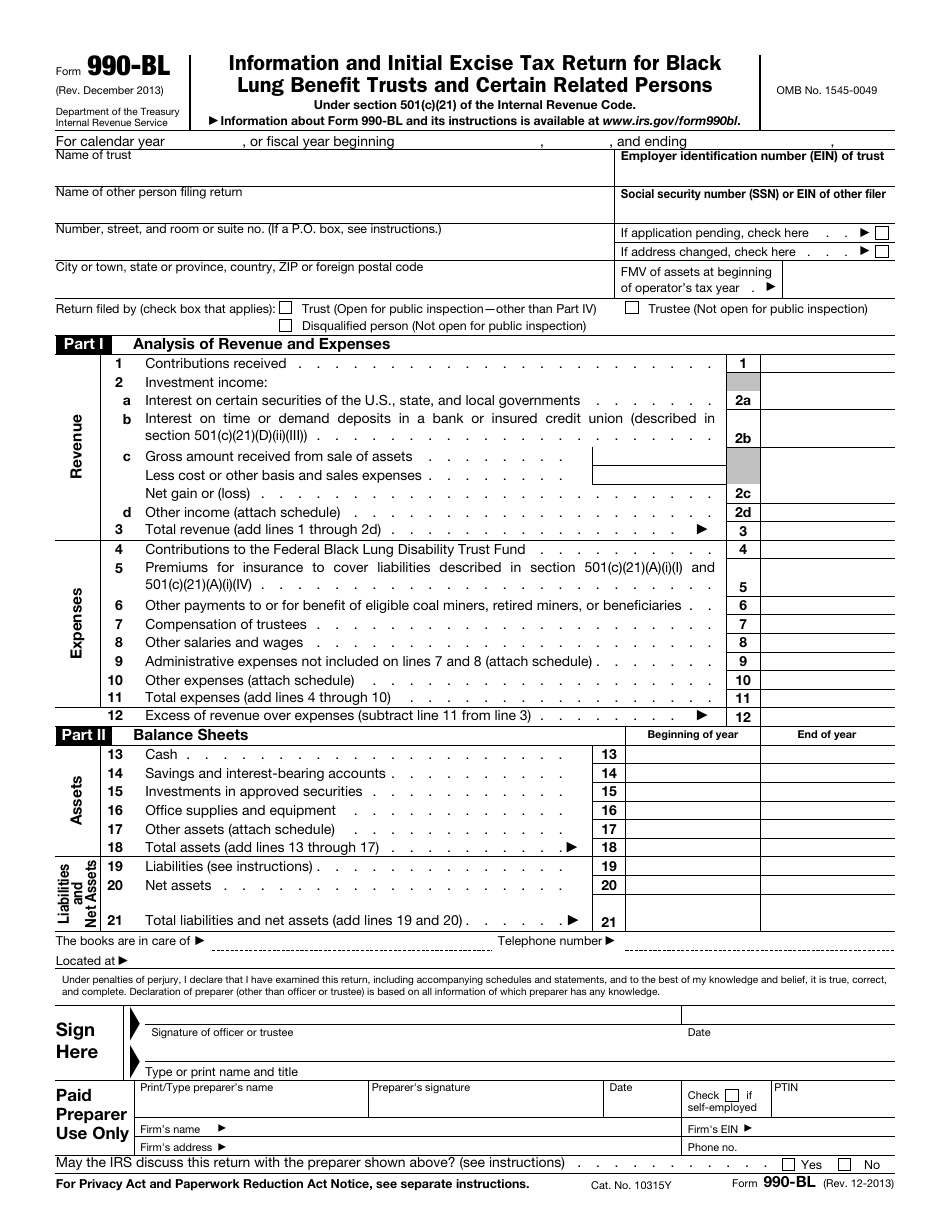

IRS Form 990BL Download Fillable PDF or Fill Online Information and

The download files are organized by month. Director (term ended 5/2021) 0 147,005 3.00 4.00 0 president and director 0 188,818 0 0. H check if the organization is not required to attach schedule b (form 990). Web tax990 will make your filing easy, secure, and accurate with exclusive features. Web the 990ez is an annual tax information filing completed.

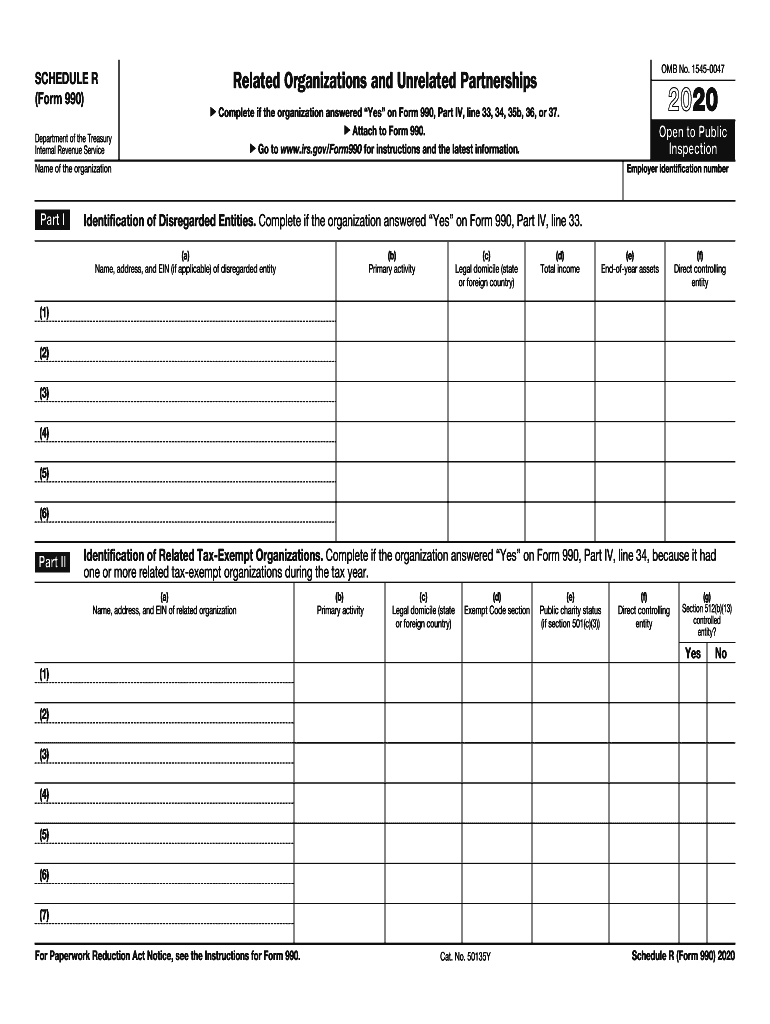

Form 990 Schedule R Fill Out and Sign Printable PDF Template signNow

The download files are organized by month. Form 4562 (2017) (a) classification of property (e). On this page you may download the 990 series filings on record for 2021. Web tax990 will make your filing easy, secure, and accurate with exclusive features. Complete, edit or print tax forms instantly.

IRS 990EZ 2022 Form Printable Blank PDF Online

On this page you may download the 990 series filings on record for 2021. H check if the organization is not required to attach schedule b (form 990). Web tax990 will make your filing easy, secure, and accurate with exclusive features. Director (term ended 5/2021) 0 147,005 3.00 4.00 0 president and director 0 188,818 0 0. If you qualify.

Form 990EZ for nonprofits updated Accounting Today

Get ready for tax season deadlines by completing any required tax forms today. Web tax990 will make your filing easy, secure, and accurate with exclusive features. Web the 990ez is an annual tax information filing completed by many organizations that fall under the 501 (c) series of statuses of the tax code, exempting. H check if the organization is not.

199N E Postcard Fill Out and Sign Printable PDF Template signNow

If you qualify for the 990ez , you. Director (term ended 5/2021) 0 147,005 3.00 4.00 0 president and director 0 188,818 0 0. Web f group exemption number g accounting method: On this page you may download the 990 series filings on record for 2021. Complete, edit or print tax forms instantly.

Federal Tax Form 990 Ez Instructions Form Resume Examples 0g27lBAx9P

Use our simple instructions for the rapid and easy submitting of the 2021 990 ez form. Form 4562 (2017) (a) classification of property (e). If the organization follows a calendar tax year, the due. For organizations with gross receipts greater than $100,000, we have a sliding scale fee. The download files are organized by month.

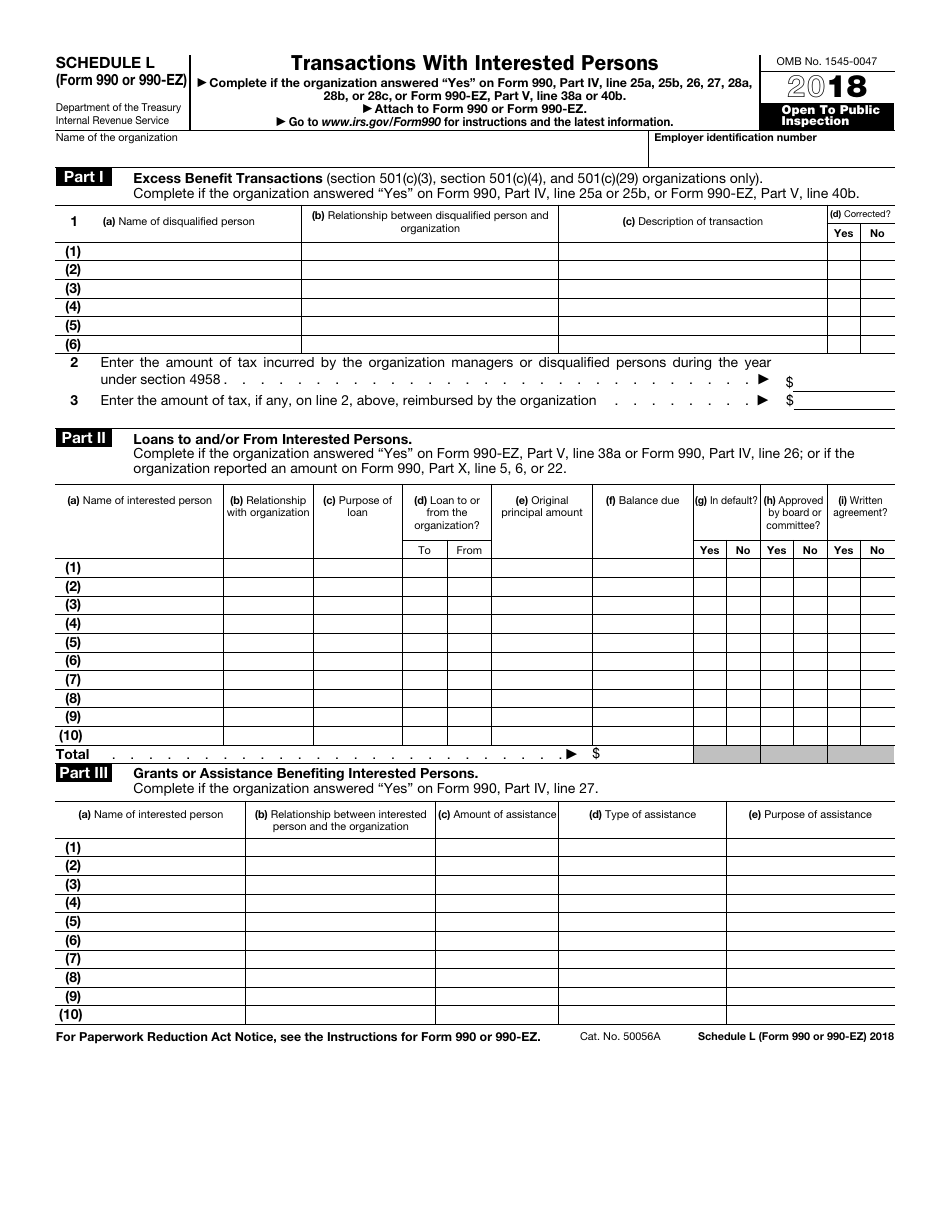

IRS Form 990 (990EZ) Schedule L Download Fillable PDF or Fill Online

Schedule a (form 990) 2021 (all organizations must complete this part.) see. Web tax990 will make your filing easy, secure, and accurate with exclusive features. Use our simple instructions for the rapid and easy submitting of the 2021 990 ez form. Form 4562 (2017) (a) classification of property (e). Get ready for tax season deadlines by completing any required tax.

2013 Irs Form 990 N (e Postcard) Form Resume Examples BpV53Ml91Z

Web f group exemption number g accounting method: Use our simple instructions for the rapid and easy submitting of the 2021 990 ez form. Form 4562 (2017) (a) classification of property (e). Web tax990 will make your filing easy, secure, and accurate with exclusive features. Schedule a (form 990) 2021 (all organizations must complete this part.) see.

Instructions For Schedule A (form 990 Or 990 Ez) Public Charity Status

If you qualify for the 990ez , you. Web f group exemption number g accounting method: For organizations with gross receipts greater than $100,000, we have a sliding scale fee. Web tax990 will make your filing easy, secure, and accurate with exclusive features. The download files are organized by month.

990 ez form Fill Online, Printable, Fillable Blank

Web the 990ez is an annual tax information filing completed by many organizations that fall under the 501 (c) series of statuses of the tax code, exempting. Review & approval system for board members. H check if the organization is not required to attach schedule b (form 990). Get ready for tax season deadlines by completing any required tax forms.

H Check If The Organization Is Not Required To Attach Schedule B (Form 990).

If the organization follows a calendar tax year, the due. Director (term ended 5/2021) 0 147,005 3.00 4.00 0 president and director 0 188,818 0 0. On this page you may download the 990 series filings on record for 2021. Form 4562 (2017) (a) classification of property (e).

Web F Group Exemption Number G Accounting Method:

Complete, edit or print tax forms instantly. Schedule a (form 990) 2021 (all organizations must complete this part.) see. Review & approval system for board members. Get ready for tax season deadlines by completing any required tax forms today.

If You Qualify For The 990Ez , You.

Web tax990 will make your filing easy, secure, and accurate with exclusive features. The download files are organized by month. Web video instructions and help with filling out and completing irs form 990 ez 2021. For organizations with gross receipts greater than $100,000, we have a sliding scale fee.

Web The 990Ez Is An Annual Tax Information Filing Completed By Many Organizations That Fall Under The 501 (C) Series Of Statuses Of The Tax Code, Exempting.

Use our simple instructions for the rapid and easy submitting of the 2021 990 ez form.