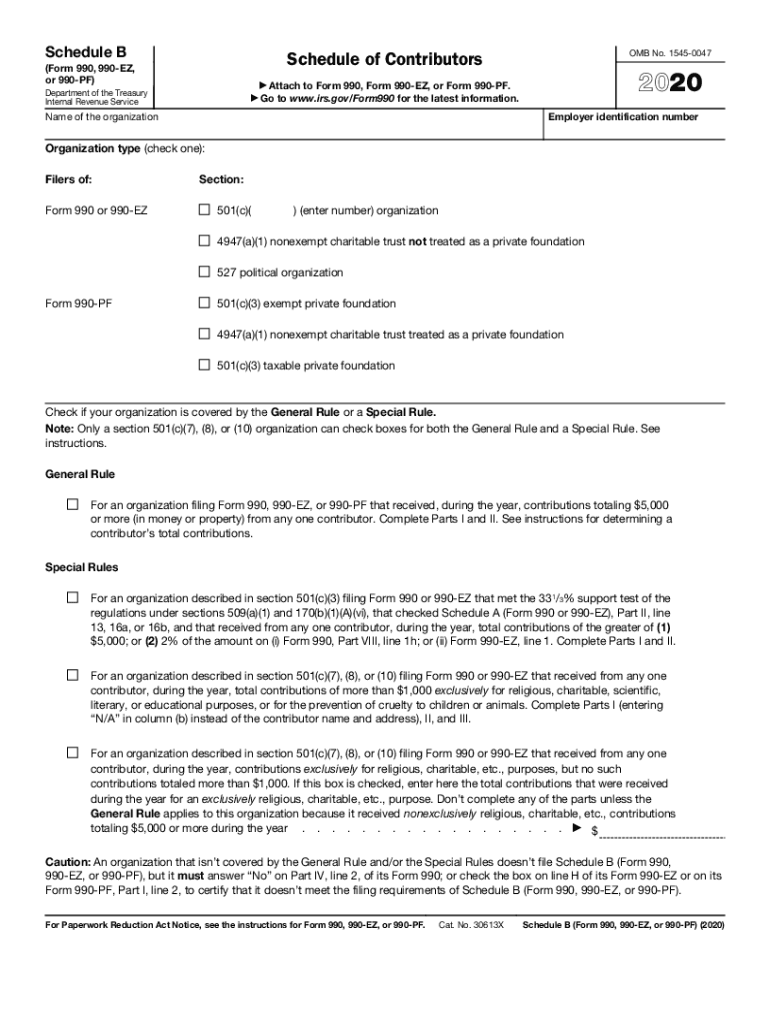

2021 Form 990 Instructions

2021 Form 990 Instructions - Web june 2021 in brief the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: And form 4720, return of. • to figure the tax based on investment income, and • to report charitable distributions and activities. Complete, edit or print tax forms instantly. Web ey has prepared annotated versions of the 2021 form 990 (return of organization exempt from income tax), schedules, and instructions and annotated versions of the 2021. Web for tax year ending on or after december 31, 2021 and before december 31, 2022, use the 2021 form. Add lines 5b, 6c, and 7b to line 9 to determine gross receipts. If the due date falls on a saturday, sunday, or legal. Web see instructions form (2021) form 990 (2021) page check if schedule o contains a response or note to any line in this part viii. Web pwc is pleased to make available our annotated version of the 2021 form 990 and schedules and instructions for 2021 form 990.

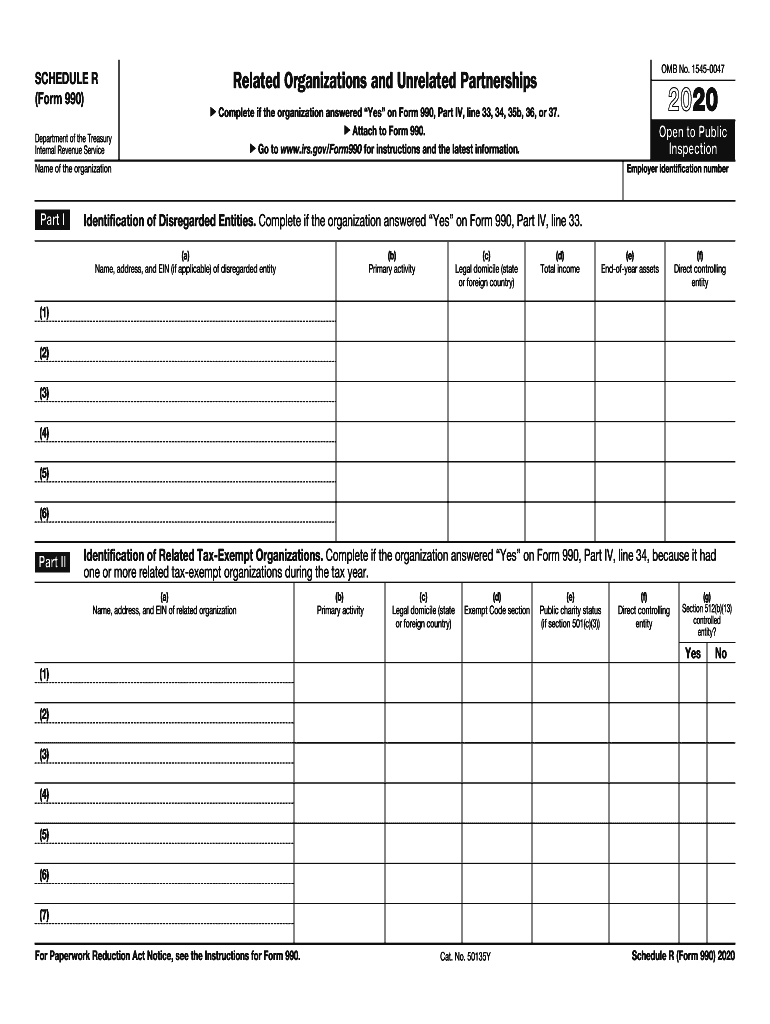

Upload, modify or create forms. Using the wrong form will delay the processing of your return. Web pwc is pleased to make available our annotated version of the 2021 form 990 and schedules and instructions for 2021 form 990. Complete, edit or print tax forms instantly. Web for tax year ending on or after december 31, 2021 and before december 31, 2022, use the 2021 form. Ad get ready for tax season deadlines by completing any required tax forms today. Web part i (see instructions.) $ schedule b (form 990) (2021) schedule b (form 990) (2021) electronic filing only page 4 name of organization employer identification number. Instructions for these schedules are. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions.

Web for paperwork reduction act notice, see the separate instructions. Try it for free now! • to figure the tax based on investment income, and • to report charitable distributions and activities. Complete, edit or print tax forms instantly. Web for tax year ending on or after december 31, 2021 and before december 31, 2022, use the 2021 form. For paperwork reduction act notice, see. Web june 2021 in brief the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Upload, modify or create forms. If gross receipts are $200,000 or more, or if total. Instructions for these schedules are.

form 990 schedule m instructions 2017 Fill Online, Printable

Try it for free now! Instructions for these schedules are. • to figure the tax based on investment income, and • to report charitable distributions and activities. Web see instructions form (2021) form 990 (2021) page check if schedule o contains a response or note to any line in this part viii. And form 4720, return of.

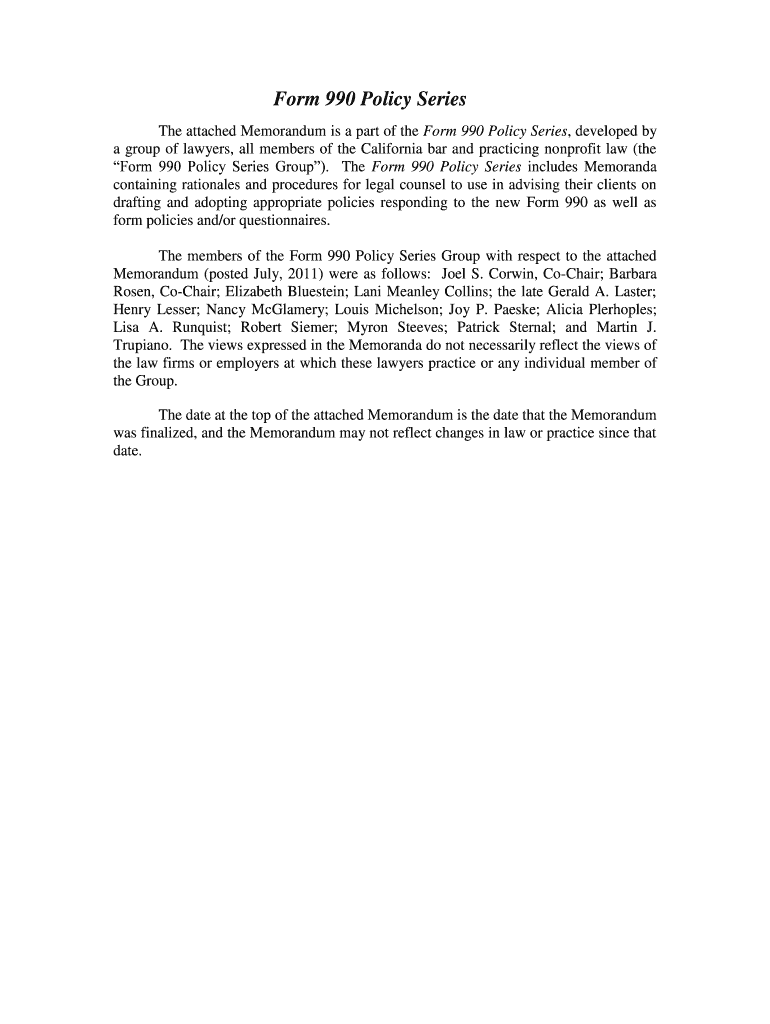

Form 990 Series Fill Out and Sign Printable PDF Template signNow

Complete, edit or print tax forms instantly. And form 4720, return of. Ad get ready for tax season deadlines by completing any required tax forms today. Web for paperwork reduction act notice, see the separate instructions. • to figure the tax based on investment income, and • to report charitable distributions and activities.

irs form 990 instructions Fill Online, Printable, Fillable Blank

Web form 990 return of organization exempt from income tax 2021 under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) department of. If gross receipts are $200,000 or more, or if total. Try it for free now! Complete, edit or print tax forms instantly. If the due date falls on a saturday, sunday, or legal.

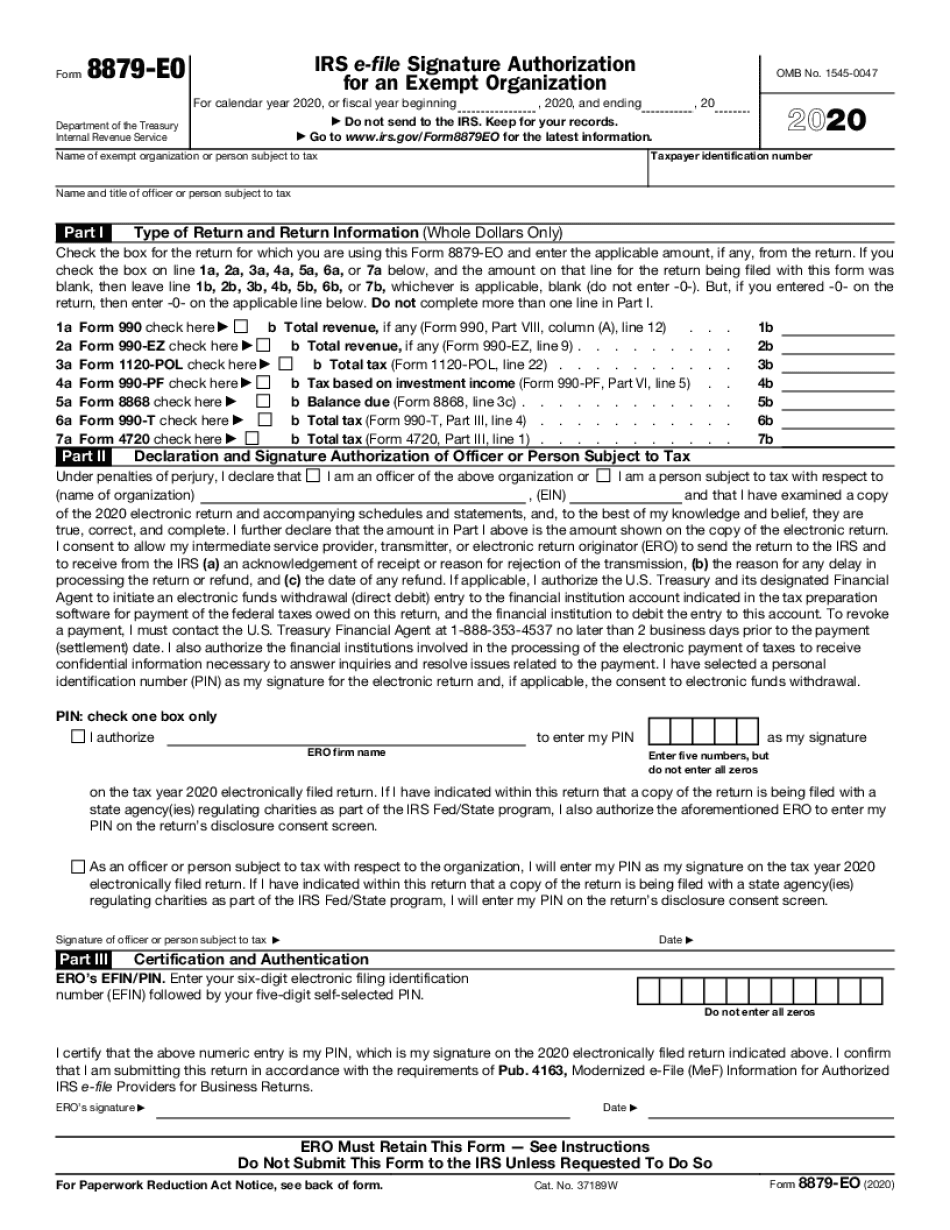

Form 990 Schedule R Fill Out and Sign Printable PDF Template signNow

Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Complete, edit or print tax forms instantly. Using the wrong form will delay the processing of your return. If gross receipts are $200,000 or more, or if total. Upload, modify or create forms.

199N E Postcard Fill Out and Sign Printable PDF Template signNow

Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Add lines 5b, 6c, and 7b to line 9 to determine gross receipts. Web ey has prepared annotated versions of the 2021 form 990 (return of organization exempt from income tax), schedules, and instructions and annotated versions of the 2021. Try.

form 990 ez 2022 Fill Online, Printable, Fillable Blank form990ez

Web pwc is pleased to make available our annotated version of the 2021 form 990 and schedules and instructions for 2021 form 990. Web form 990 return of organization exempt from income tax 2021 under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) department of. And form 4720, return of. Web the following schedules to.

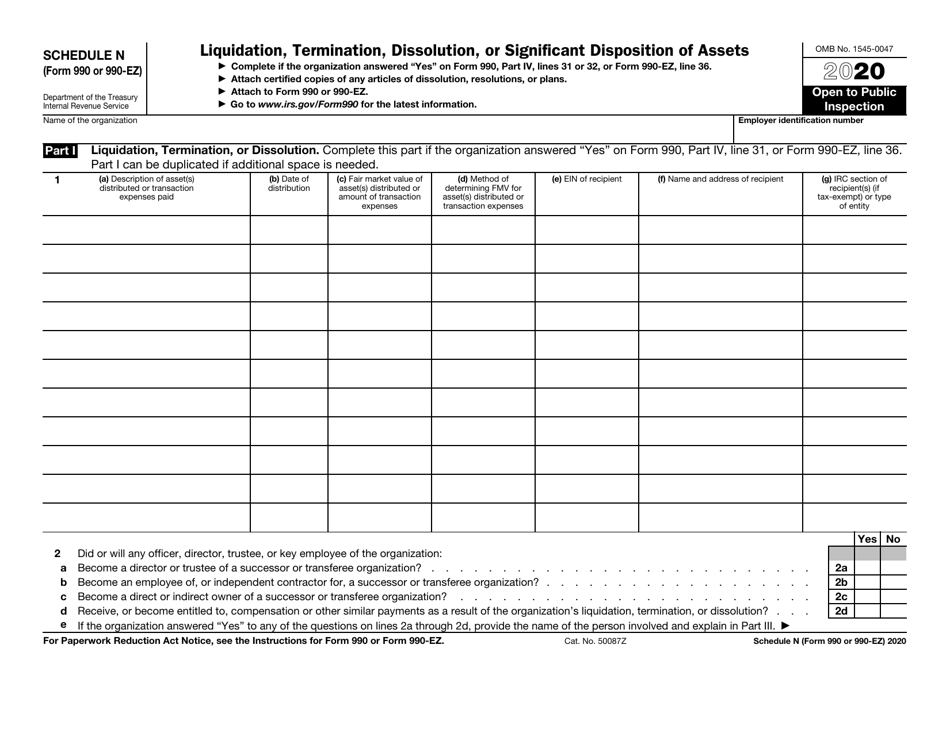

IRS Form 990 (990EZ) Schedule N Download Fillable PDF or Fill Online

Web pwc is pleased to make available our annotated version of the 2021 form 990 and schedules and instructions for 2021 form 990. If the due date falls on a saturday, sunday, or legal. Web for paperwork reduction act notice, see the separate instructions. Web information about form 990, return of organization exempt from income tax, including recent updates, related.

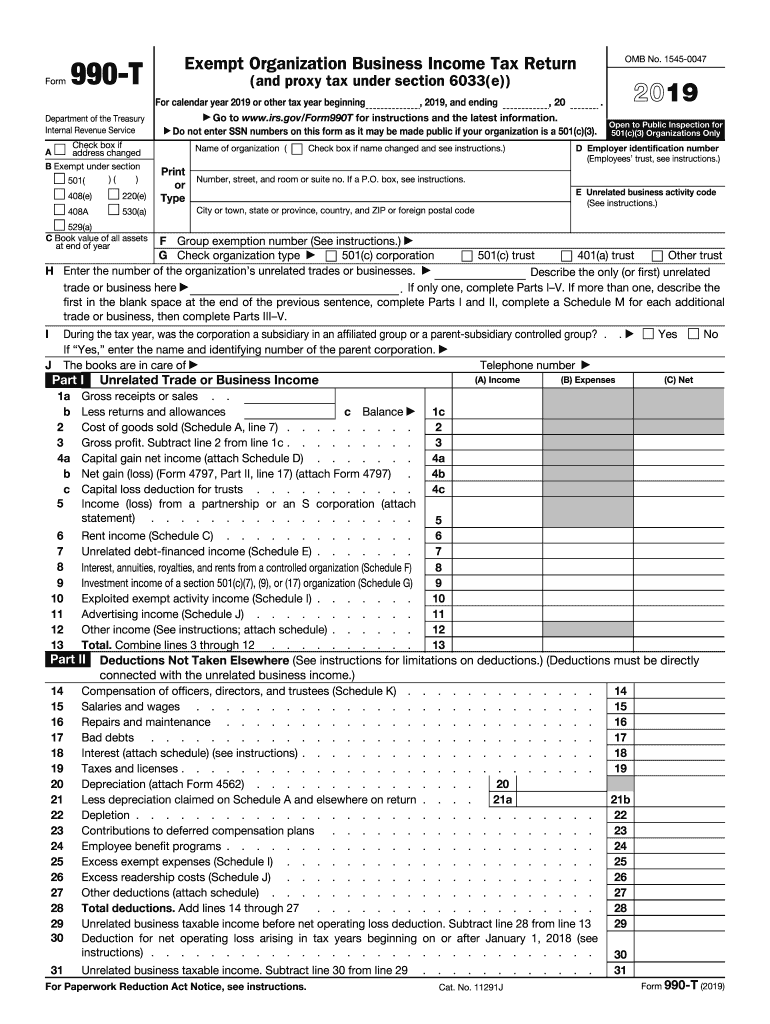

990 T Fill Out and Sign Printable PDF Template signNow

Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web form 990 return of organization exempt from income tax 2021 under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) department of. Complete, edit or print tax forms instantly. Try it for free now! For paperwork.

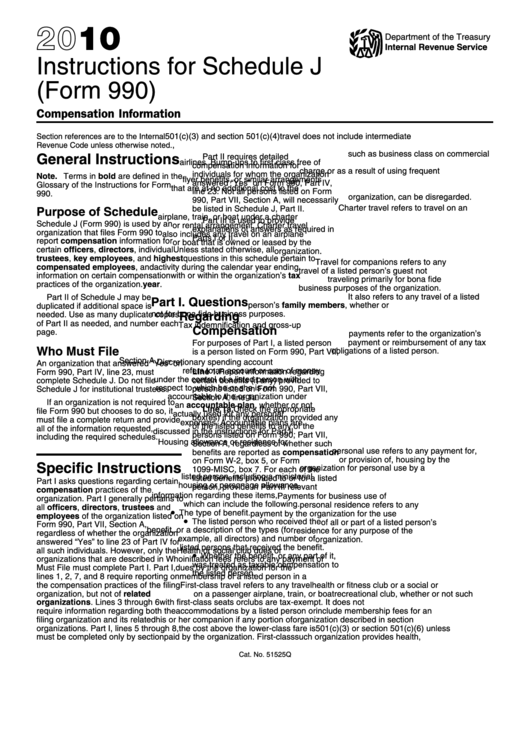

Form 990 Instructions For Schedule J printable pdf download

Web part i (see instructions.) $ schedule b (form 990) (2021) schedule b (form 990) (2021) electronic filing only page 4 name of organization employer identification number. Try it for free now! Complete, edit or print tax forms instantly. • to figure the tax based on investment income, and • to report charitable distributions and activities. Web the following schedules.

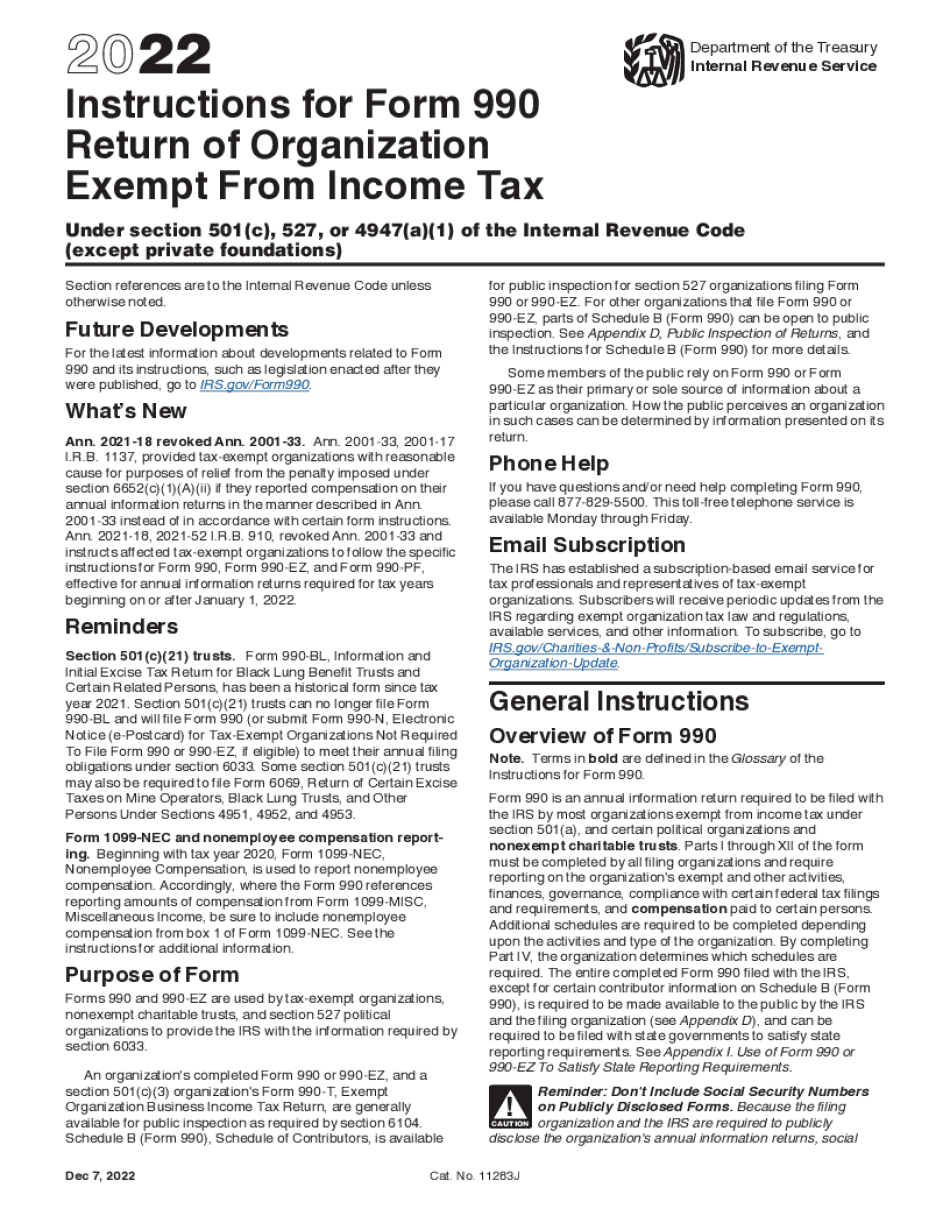

Instructions for Form 990EZ (2023)

Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Web part i (see instructions.) $ schedule b (form 990) (2021) schedule b (form 990) (2021) electronic filing only page 4 name of organization employer identification number. Try it for free now! Web ey has prepared annotated.

Web The Following Schedules To Form 990, Return Of Organization Exempt From Income Tax, Do Not Have Separate Instructions.

Web see instructions form (2021) form 990 (2021) page check if schedule o contains a response or note to any line in this part viii. If the due date falls on a saturday, sunday, or legal. Web for paperwork reduction act notice, see the separate instructions. Web part i (see instructions.) $ schedule b (form 990) (2021) schedule b (form 990) (2021) electronic filing only page 4 name of organization employer identification number.

Try It For Free Now!

Web for tax year ending on or after december 31, 2021 and before december 31, 2022, use the 2021 form. And form 4720, return of. Upload, modify or create forms. Using the wrong form will delay the processing of your return.

If Gross Receipts Are $200,000 Or More, Or If Total.

Web ey has prepared annotated versions of the 2021 form 990 (return of organization exempt from income tax), schedules, and instructions and annotated versions of the 2021. Complete, edit or print tax forms instantly. For paperwork reduction act notice, see. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal.

Complete, Edit Or Print Tax Forms Instantly.

Instructions for these schedules are. Add lines 5b, 6c, and 7b to line 9 to determine gross receipts. • to figure the tax based on investment income, and • to report charitable distributions and activities. Ad get ready for tax season deadlines by completing any required tax forms today.