2022 Form 8812 Instructions

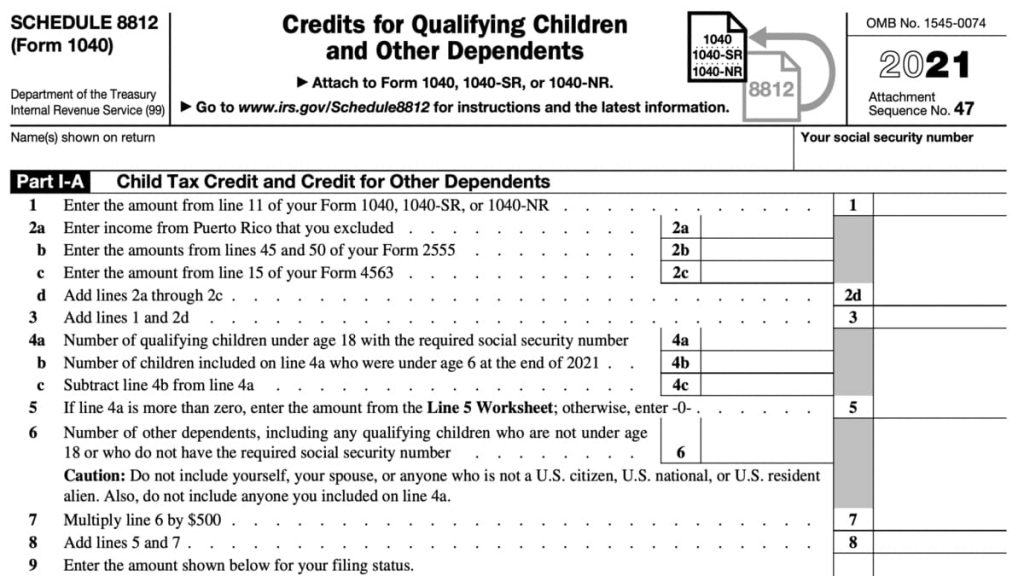

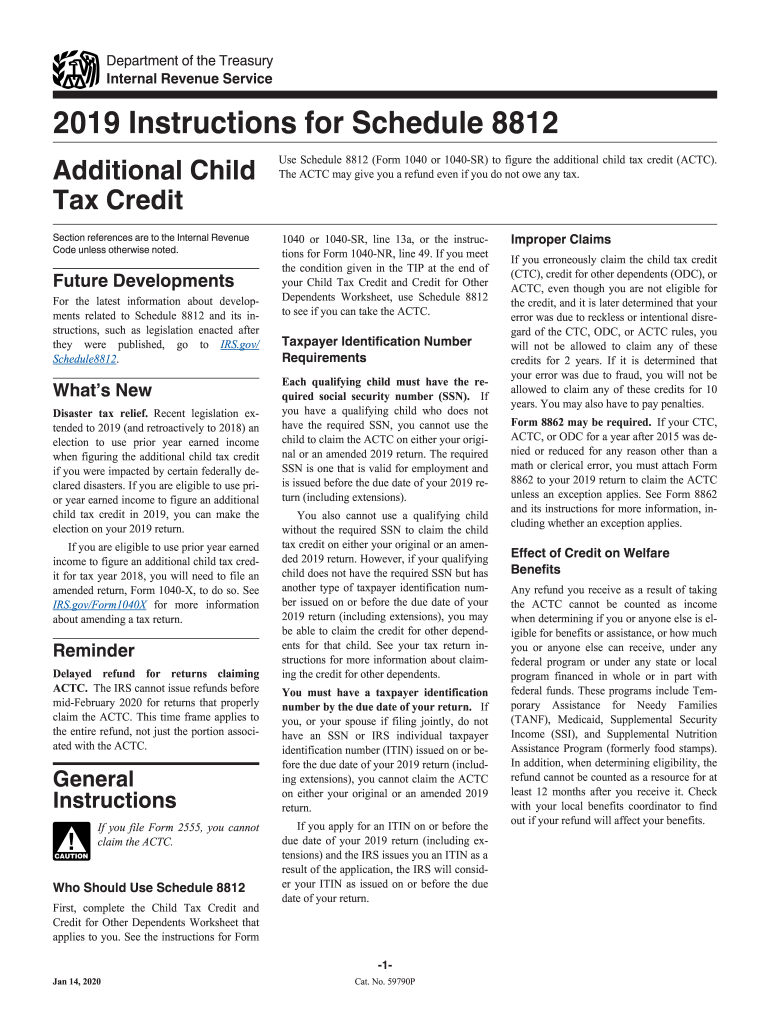

2022 Form 8812 Instructions - Web solved • by turbotax • 3264 • updated january 25, 2023. Web get the instructions to file schedule 8812 here from the irs website. Or form 1040nr, line 7c; Web we last updated the child tax credit in december 2022, so this is the latest version of 1040 (schedule 8812), fully updated for tax year 2022. Schedule 8812 (child tax credit) is used to claim the child tax credit (ctc), credit for other dependents. Web for instructions and the latest information. The child tax credit is a partially refundable. If you’re looking for a simpler version, read our instructions to file schedule 8812 instead. From july 2021 to december 2021, taxpayers may have received an advance payment of the child tax credit equal to 50%. Web you should complete file irs schedule 8812 (form 1040) when you complete your irs tax forms each year.

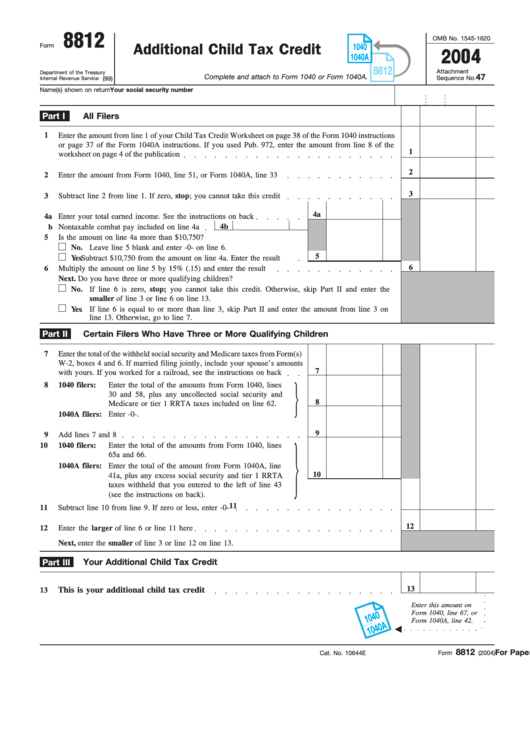

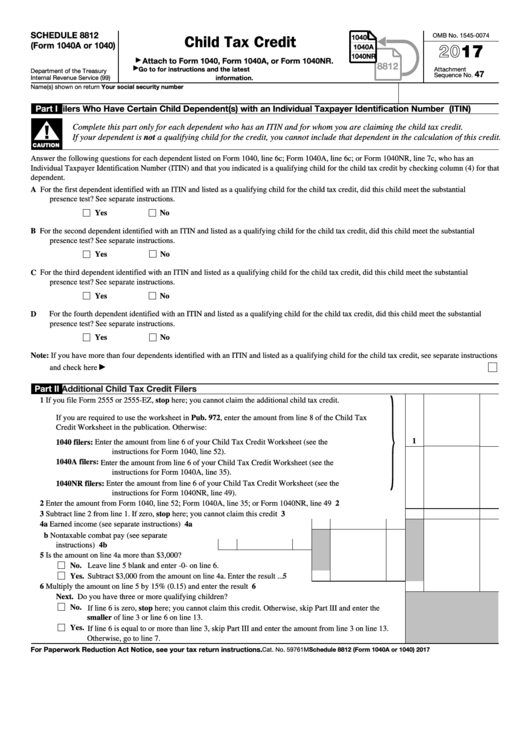

Choose the correct version of the editable pdf. If you did not complete schedule 8812, refer to the earned income chart and related worksheet in the. Schedule 8812 (child tax credit) is used to claim the child tax credit (ctc), credit for other dependents. January 2021) additional child use schedule 8812 (form 1040) to figure the additional child tax credit. If you’re looking for a simpler version, read our instructions to file schedule 8812 instead. Should be completed by all filers to claim the basic. Web use part i of schedule 8812 to document that any child for whom you entered an itin on form 1040, line 6c; For 2022, there are two parts to this form: For tax years 2020 and prior: Web information about schedule 8812 (form 1040), additional child tax credit, including recent updates, related forms, and instructions on how to file.

Claim your child tax credit along with your other credits for. Web the schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and credit for other dependents. If you’re looking for a simpler version, read our instructions to file schedule 8812 instead. Or form 1040nr, line 7c; Web use part i of schedule 8812 to document that any child for whom you entered an itin on form 1040, line 6c; Web get the instructions to file schedule 8812 here from the irs website. Web if you completed schedule 8812, enter the amount from line 18a of that form. You can download or print current or. For 2022, there are two parts to this form: Web irs instructions for form 8812.

Qualified Dividends And Capital Gains Worksheet 2018 —

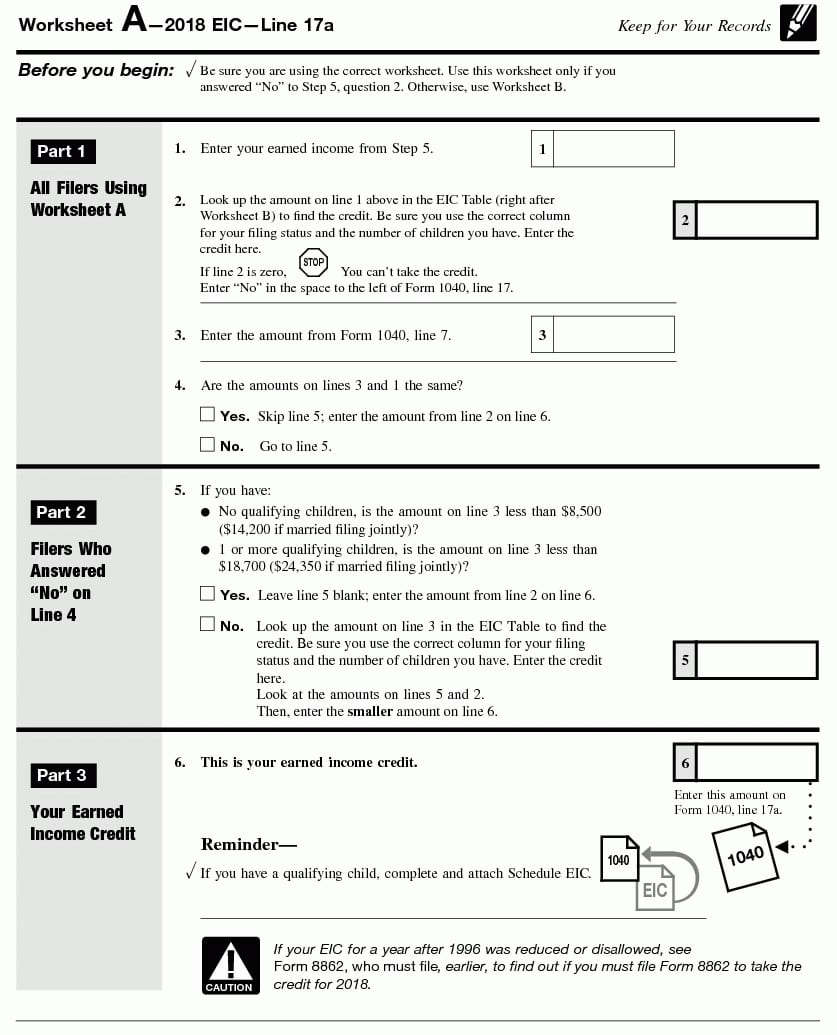

If you did not complete schedule 8812, refer to the earned income chart and related worksheet in the. Web if you completed schedule 8812, enter the amount from line 18a of that form. Edit your 8812 instructions child tax credit online type text, add images, blackout confidential details, add comments, highlights and more. Web irs instructions for form 8812. For.

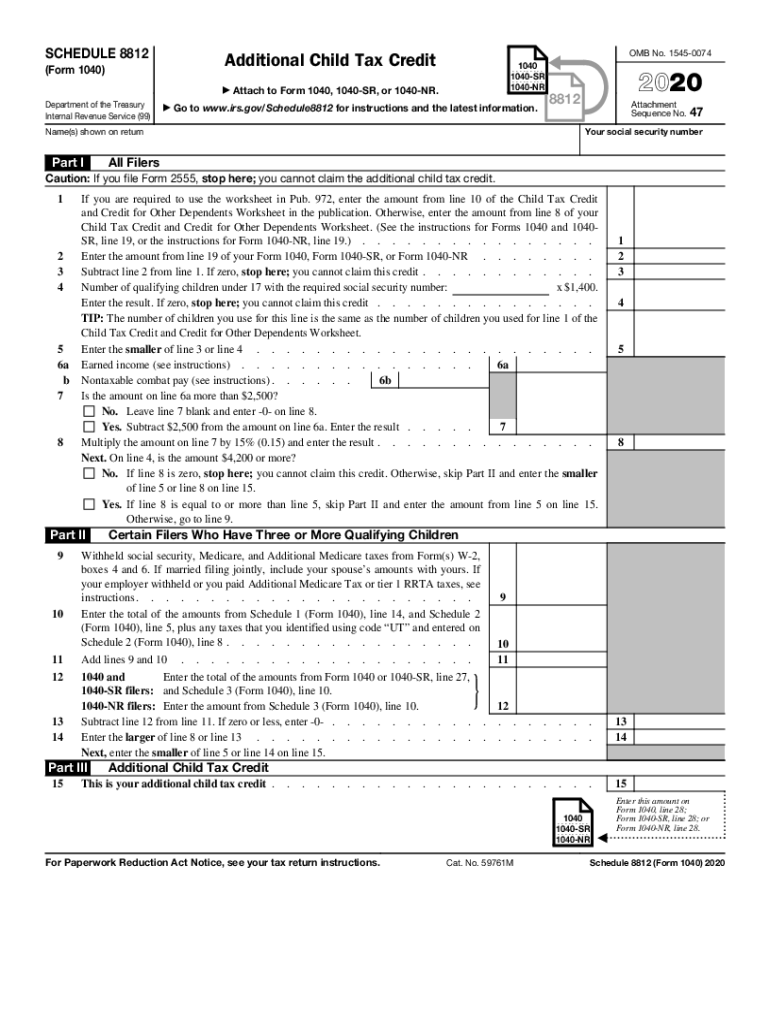

Form 8812Additional Child Tax Credit

Web we last updated the child tax credit in december 2022, so this is the latest version of 1040 (schedule 8812), fully updated for tax year 2022. If you did not complete schedule 8812, refer to the earned income chart and related worksheet in the. The child tax credit is a partially refundable. Web you'll use form 8812 to calculate.

2023 Schedule 3 2022 Online File PDF Schedules TaxUni

Web you should complete file irs schedule 8812 (form 1040) when you complete your irs tax forms each year. Web irs instructions for form 8812. Web you'll use form 8812 to calculate your additional child tax credit. Web the schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child.

Fillable Form 8812 Additional Child Tax Credit printable pdf download

Web for instructions and the latest information. Should be completed by all filers to claim the basic. Web you should complete file irs schedule 8812 (form 1040) when you complete your irs tax forms each year. Web solved • by turbotax • 3264 • updated january 25, 2023. The child tax credit is a partially refundable.

Schedule 8812 Instructions Fill Out and Sign Printable PDF Template

Web get the instructions to file schedule 8812 here from the irs website. Web if you completed schedule 8812, enter the amount from line 18a of that form. The child tax credit is a partially refundable. Web use part i of schedule 8812 to document that any child for whom you entered an itin on form 1040, line 6c; Edit.

8812 Instructions Tax Form Fill Out and Sign Printable PDF Template

From july 2021 to december 2021, taxpayers may have received an advance payment of the child tax credit equal to 50%. You can download or print current or. For tax years 2020 and prior: The child tax credit is a partially refundable. Web you'll use form 8812 to calculate your additional child tax credit.

IRS 1040 Schedule 8812 Instructions 2012 Fill out Tax Template Online

January 2021) additional child use schedule 8812 (form 1040) to figure the additional child tax credit. The child tax credit is a partially refundable. Choose the correct version of the editable pdf. Or form 1040nr, line 7c; Edit your 8812 instructions child tax credit online type text, add images, blackout confidential details, add comments, highlights and more.

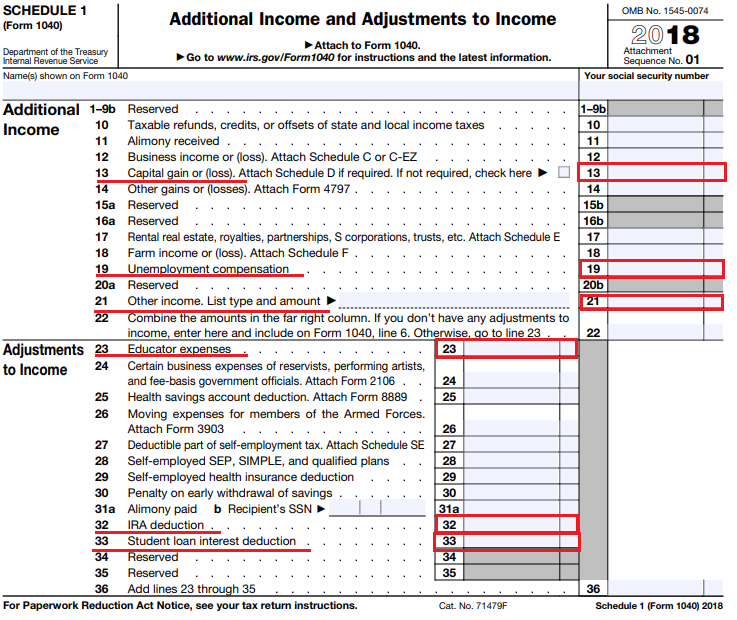

Did Or Will You File A Schedule 1 With Your 2018 Tax 2021 Tax Forms

Web solved • by turbotax • 3264 • updated january 25, 2023. From july 2021 to december 2021, taxpayers may have received an advance payment of the child tax credit equal to 50%. Web for instructions and the latest information. For 2022, there are two parts to this form: The child tax credit is a partially refundable.

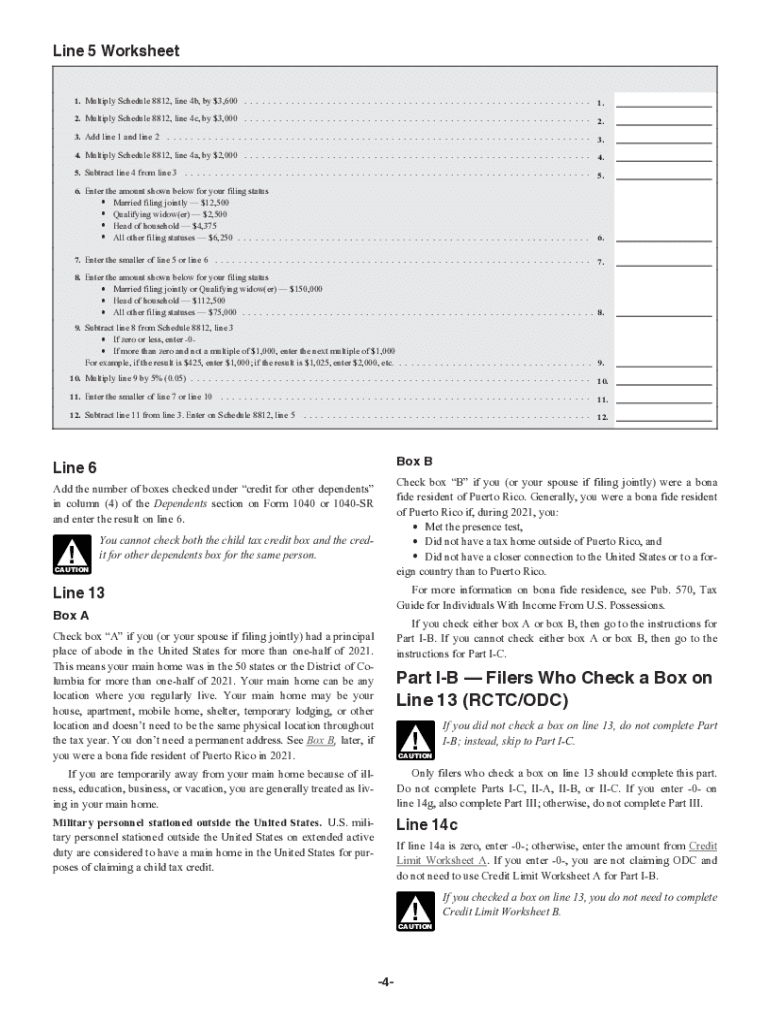

Form 8812 Line 5 Worksheet

Web internal revenue service 2020 instructions for schedule 8812 (rev. Should be completed by all filers to claim the basic. You can download or print current or. Web the schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and credit for other dependents. From july 2021.

Fillable Schedule 8812 (Form 1040a Or 1040) Child Tax Credit 2016

Web you'll use form 8812 to calculate your additional child tax credit. Web for instructions and the latest information. Web get the instructions to file schedule 8812 here from the irs website. Sign it in a few clicks draw. Web you should complete file irs schedule 8812 (form 1040) when you complete your irs tax forms each year.

Edit Your 8812 Instructions Child Tax Credit Online Type Text, Add Images, Blackout Confidential Details, Add Comments, Highlights And More.

Web irs instructions for form 8812. Web you should complete file irs schedule 8812 (form 1040) when you complete your irs tax forms each year. Web for more information on the child tax credit for 2021, please refer to form 8812 instructions. Web the schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and credit for other dependents.

For 2022, There Are Two Parts To This Form:

Web if you completed schedule 8812, enter the amount from line 18a of that form. Choose the correct version of the editable pdf. Web solved • by turbotax • 3264 • updated january 25, 2023. Web use part i of schedule 8812 to document that any child for whom you entered an itin on form 1040, line 6c;

Web We Last Updated The Child Tax Credit In December 2022, So This Is The Latest Version Of 1040 (Schedule 8812), Fully Updated For Tax Year 2022.

Web get the instructions to file schedule 8812 here from the irs website. January 2021) additional child use schedule 8812 (form 1040) to figure the additional child tax credit. Schedule 8812 (child tax credit) is used to claim the child tax credit (ctc), credit for other dependents. If you’re looking for a simpler version, read our instructions to file schedule 8812 instead.

If You Did Not Complete Schedule 8812, Refer To The Earned Income Chart And Related Worksheet In The.

Web you'll use form 8812 to calculate your additional child tax credit. Web internal revenue service 2020 instructions for schedule 8812 (rev. Claim your child tax credit along with your other credits for. From july 2021 to december 2021, taxpayers may have received an advance payment of the child tax credit equal to 50%.