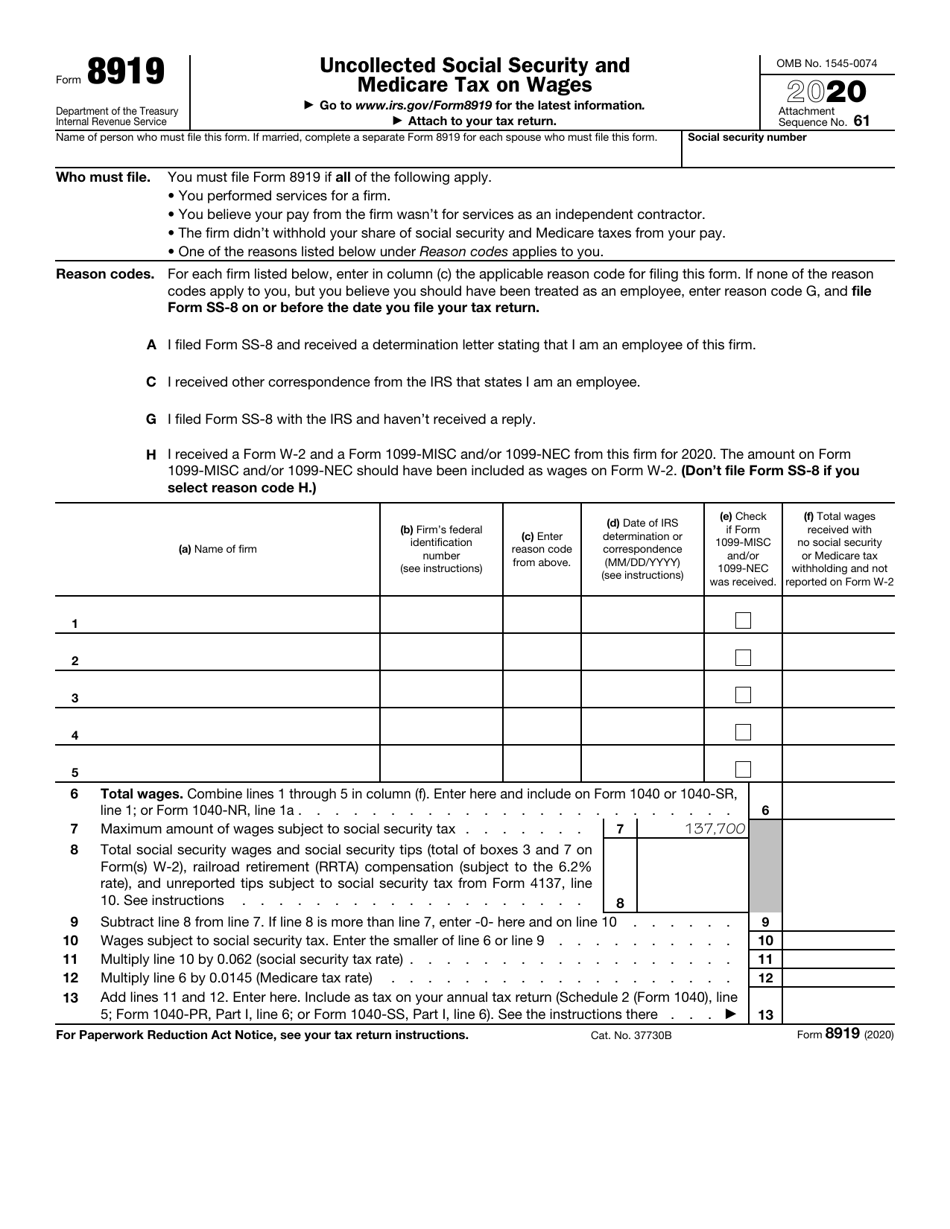

2022 Form 8919

2022 Form 8919 - Web general instructions purpose of form use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your. Web why am i being asked to fill out form 8919? I am a full time employee who earns a salary and pays taxes on my income abroad. Annual irs & ssa announcements; If married, complete a separate form 8919 for each spouse who must file this form. Line 1 has been expanded into 9 separate lines to categorize the income that was previously. You performed services for a firm. Web if the employer disagrees, you can have the irs make the determination. Web 1 best answer anthonyc level 7 this information is entered in a different area of the program then regular w2s. Web in short, workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes.

If married, complete a separate form 8919 for each spouse who must file this form. Web in short, workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes. Meet irs form 8919 jim buttonow, cpa, citp. Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file. Web general instructions purpose of form use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your. You performed services for a firm. Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest. Determination of worker status for purposes of federal employment taxes. Web why am i being asked to fill out form 8919? Annual irs & ssa announcements;

Web general instructions purpose of form use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your. Web you still owe your share of employment taxes, which you should report on your federal tax return using form 8919, uncollected social security and medicare tax on wage. Annual irs & ssa announcements; Line 1 has been expanded into 9 separate lines to categorize the income that was previously. Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file. You performed services for a firm. Web why am i being asked to fill out form 8919? Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest. Web name of person who must file this form. Web in short, workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes.

Form 8919 Uncollected Social Security and Medicare Tax on Wages (2014

Annual irs & ssa announcements; Determination of worker status for purposes of federal employment taxes. Web name of person who must file this form. You performed services for a firm. Web you still owe your share of employment taxes, which you should report on your federal tax return using form 8919, uncollected social security and medicare tax on wage.

Microchipping near Noblesville 3 Benefits of Having Your Pet Chipped

I am a full time employee who earns a salary and pays taxes on my income abroad. Web if the employer disagrees, you can have the irs make the determination. I do not currently live in the us. Line 1 has been expanded into 9 separate lines to categorize the income that was previously. If married, complete a separate form.

KSDPC The Official KSDPC November 2022 Newsletter featuring Uptown

Web you still owe your share of employment taxes, which you should report on your federal tax return using form 8919, uncollected social security and medicare tax on wage. Web if the employer disagrees, you can have the irs make the determination. Web 1 best answer anthonyc level 7 this information is entered in a different area of the program.

8915 d form Fill out & sign online DocHub

You performed services for a firm. I am a full time employee who earns a salary and pays taxes on my income abroad. Web in short, workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes. Web general instructions purpose of form use form 8959 to figure.

STRYXE eatery bar

Web general instructions purpose of form use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your. Meet irs form 8919 jim buttonow, cpa, citp. Web 1 best answer anthonyc level 7 this information is entered in a different area of the program then regular w2s. Web form.

Form 8919 Uncollected Social Security and Medicare Tax on Wages (2014

Web general instructions purpose of form use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your. Web the 2022 1040 form has changes to lines 1, 6, 19, 27, 28, and 30. Web name of person who must file this form. Line 1 has been expanded into.

IRS Form 8919 Download Fillable PDF or Fill Online Uncollected Social

Web why am i being asked to fill out form 8919? I am a full time employee who earns a salary and pays taxes on my income abroad. You performed services for a firm. Web general instructions purpose of form use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax.

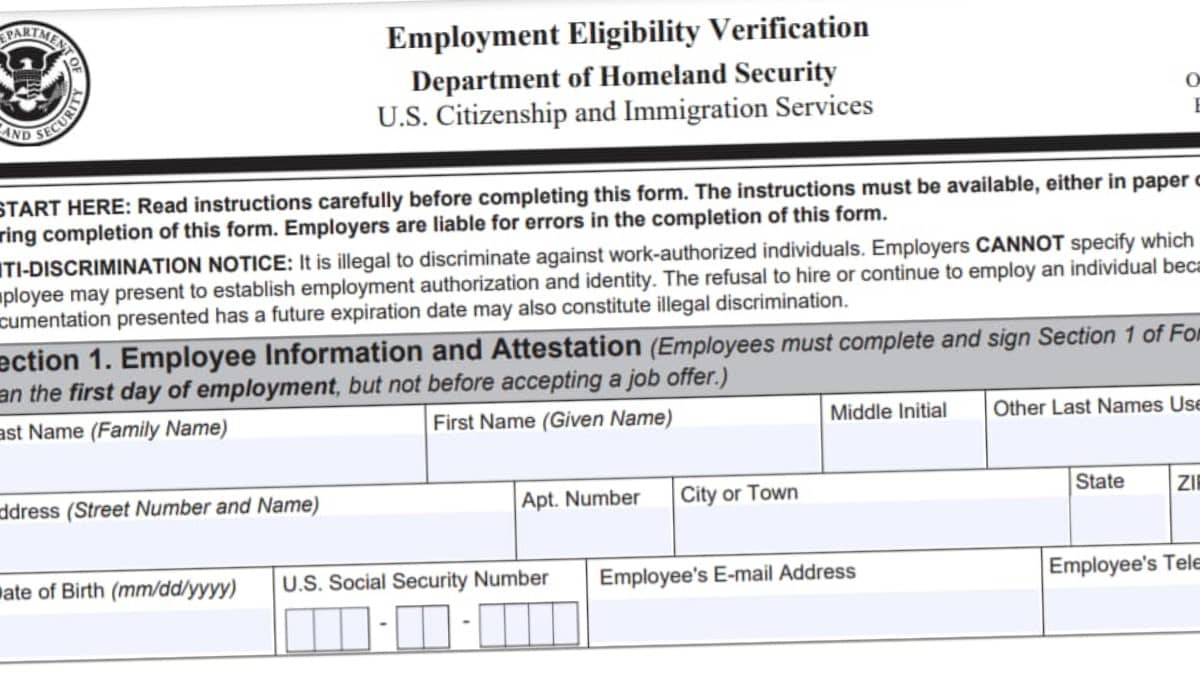

I9 Form 2022

Web why am i being asked to fill out form 8919? Determination of worker status for purposes of federal employment taxes. Line 1 has been expanded into 9 separate lines to categorize the income that was previously. Web general instructions purpose of form use form 8959 to figure the amount of additional medicare tax you owe and the amount of.

Form 8919 Uncollected Social Security and Medicare Tax on Wages

Web 1 best answer anthonyc level 7 this information is entered in a different area of the program then regular w2s. Web name of person who must file this form. Determination of worker status for purposes of federal employment taxes. Web if the employer disagrees, you can have the irs make the determination. I do not currently live in the.

1040x2.pdf Irs Tax Forms Social Security (United States)

Web in short, workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes. Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file. You performed services for a firm. Meet irs form 8919.

Web Form 8919 Department Of The Treasury Internal Revenue Service Uncollected Social Security And Medicare Tax On Wages Go To Www.irs.gov/Form8919 For The Latest.

Web general instructions purpose of form use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your. If married, complete a separate form 8919 for each spouse who must file this form. Web why am i being asked to fill out form 8919? I am a full time employee who earns a salary and pays taxes on my income abroad.

I Do Not Currently Live In The Us.

Web if the employer disagrees, you can have the irs make the determination. Line 1 has been expanded into 9 separate lines to categorize the income that was previously. Web 1 best answer anthonyc level 7 this information is entered in a different area of the program then regular w2s. Determination of worker status for purposes of federal employment taxes.

Web In Short, Workers Must File Form 8919, Uncollected Social Security And Medicare Tax On Wages, If They Did Not Have Social Security And Medicare Taxes.

Annual irs & ssa announcements; Meet irs form 8919 jim buttonow, cpa, citp. Web you still owe your share of employment taxes, which you should report on your federal tax return using form 8919, uncollected social security and medicare tax on wage. Web name of person who must file this form.

Web The 2022 1040 Form Has Changes To Lines 1, 6, 19, 27, 28, And 30.

You performed services for a firm. Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file.