2022 Form 945

2022 Form 945 - Web the most common reason you’ll file form 945 is to report backup withholding for an independent contractor. Use this form to report your federal tax liability (based on the dates payments were made or wages were. However, if you made deposits on time in full payment of the taxes for the year, you may file the return by february 10, 2023. Web form 945 pertains only to what the irs calls nonpayroll payments. this form is commonly used for payments to certain independent contractors, as well as for. The irs has made available a draft 2022 form 945 annual return of withheld federal income tax. Ad access irs tax forms. Web don't report on form 945 withholding that is required to be reported on form 1042, annual withholding tax return for u.s. Business entities may not need to file form 945 with the irs every. Annual return of withheld federal income tax completed. Ad download or email form 945 & more fillable forms, register and subscribe now!

Annual return of withheld federal income tax completed. Web by filling this irs form 945, the employer informs the irs about the withheld backup if they deduct this tax from the individuals’ payment. Try it for free now! Web form 945 pertains only to what the irs calls nonpayroll payments. this form is commonly used for payments to certain independent contractors, as well as for. Web form 945 instructions for 2022. Web irs releases 2022 draft form 945 by erisa news | june 27 2022 the irs has made available a draft 2022 form 945 annual return of withheld federal income. Web futureplan erisa team june 27 2022. Web efile your federal tax return now efiling is easier, faster, and safer than filling out paper tax forms. Web don't report on form 945 withholding that is required to be reported on form 1042, annual withholding tax return for u.s. Download your updated document, export it to the cloud, print it from the editor, or share.

Business entities may not need to file form 945 with the irs every. Web get the 2022 form 945. The irs has made available a draft 2022 form 945 annual return of withheld federal income tax. Source income of foreign persons. Web don't report on form 945 withholding that is required to be reported on form 1042, annual withholding tax return for u.s. Web futureplan erisa team june 27 2022. Ad download or email form 945 & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. December 2020) department of the treasury internal revenue service annual record of federal tax liability go to. Web the most common reason you’ll file form 945 is to report backup withholding for an independent contractor.

File Form 945 Online Efile 945 Form 945 2020 945 Schedule A

Web don't report on form 945 withholding that is required to be reported on form 1042, annual withholding tax return for u.s. If you file form 945,. Ad download or email form 945 & more fillable forms, register and subscribe now! Business entities may not need to file form 945 with the irs every. Web quick and accurate reporting state.

Form 945X Adjusted Annual Return of Withheld Federal Tax or

File your federal and federal tax returns online with turbotax in minutes. December 2020) department of the treasury internal revenue service annual record of federal tax liability go to. Web futureplan erisa team june 27 2022. Web efile your federal tax return now efiling is easier, faster, and safer than filling out paper tax forms. Web the most common reason.

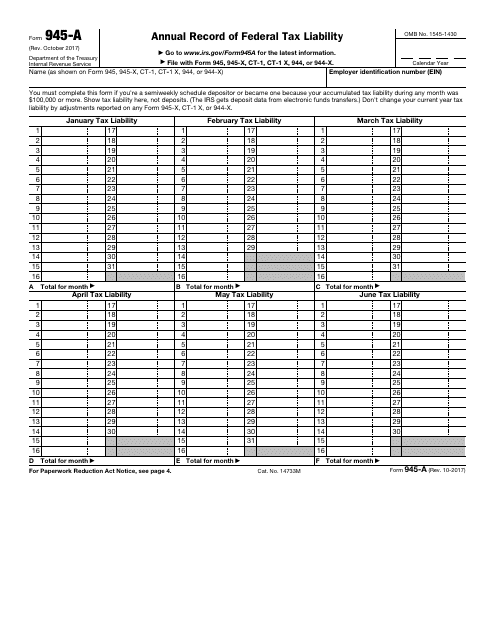

IRS Form 945A Download Fillable PDF or Fill Online Annual Record of

2022 form 945, annual return of withheld federal income tax. If you file form 945,. Web quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile now more salient features what is 945 form?. Fill out form 945 when you withhold federal. Web the most common reason you’ll file form 945 is to report.

2022 irs form 945 instructions Fill Online, Printable, Fillable Blank

Web form 945 pertains only to what the irs calls nonpayroll payments. this form is commonly used for payments to certain independent contractors, as well as for. Web get the 2022 form 945. Web for 2022, file form 945 by january 31, 2023. Use this form to report your federal tax liability (based on the dates payments were made or.

2022 Form 945. Annual Return of Withheld Federal Tax Fill out

Web efile your federal tax return now efiling is easier, faster, and safer than filling out paper tax forms. Web quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile now more salient features what is 945 form?. Web form 945 pertains only to what the irs calls nonpayroll payments. this form is commonly.

Form 945X Adjusted Annual Return of Withheld Federal Tax or

Use this form to report your federal tax liability (based on the dates payments were made or wages were. Web form 945 instructions for 2022. Ad access irs tax forms. Web futureplan erisa team june 27 2022. Web form 945 pertains only to what the irs calls nonpayroll payments. this form is commonly used for payments to certain independent contractors,.

Form 945 Edit, Fill, Sign Online Handypdf

Web form 945 instructions for 2022. Annual return of withheld federal income tax completed. Complete, edit or print tax forms instantly. Download your updated document, export it to the cloud, print it from the editor, or share. Fill out form 945 when you withhold federal.

File Form 945 Online Efile 945 Form 945 2020 945 Schedule A

December 2020) department of the treasury internal revenue service annual record of federal tax liability go to. 2022 form 945, annual return of withheld federal income tax. Web futureplan erisa team june 27 2022. Web the most common reason you’ll file form 945 is to report backup withholding for an independent contractor. Source income of foreign persons.

IRS W3PR 20202022 Fill and Sign Printable Template Online US

Web for 2022, file form 945 by january 31, 2023. Web by filling this irs form 945, the employer informs the irs about the withheld backup if they deduct this tax from the individuals’ payment. Source income of foreign persons. The irs has made available a draft 2022 form 945 annual return of withheld federal income tax. Annual return of.

FORM 945 Instructions On How To File Form 945

Use this form to report your federal tax liability (based on the dates payments were made or wages were. Ad access irs tax forms. Web efile your federal tax return now efiling is easier, faster, and safer than filling out paper tax forms. This form is used to. December 2020) department of the treasury internal revenue service annual record of.

Ad Access Irs Tax Forms.

You can download or print. Web quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile now more salient features what is 945 form?. Fill out form 945 when you withhold federal. Source income of foreign persons.

Web For 2022, File Form 945 By January 31, 2023.

Web don't report on form 945 withholding that is required to be reported on form 1042, annual withholding tax return for u.s. Web irs releases 2022 draft form 945 by erisa news | june 27 2022 the irs has made available a draft 2022 form 945 annual return of withheld federal income. Try it for free now! Web get the 2022 form 945.

Web The Most Common Reason You’ll File Form 945 Is To Report Backup Withholding For An Independent Contractor.

However, if you made deposits on time in full payment of the taxes for the year, you may file the return by february 10, 2023. 2022 form 945, annual return of withheld federal income tax. Web efile your federal tax return now efiling is easier, faster, and safer than filling out paper tax forms. File your federal and federal tax returns online with turbotax in minutes.

Complete, Edit Or Print Tax Forms Instantly.

Business entities may not need to file form 945 with the irs every. If you file form 945,. Web information about form 945, annual return of withheld federal income tax, including recent updates, related forms and instructions on how to file. Use this form to report your federal tax liability (based on the dates payments were made or wages were.