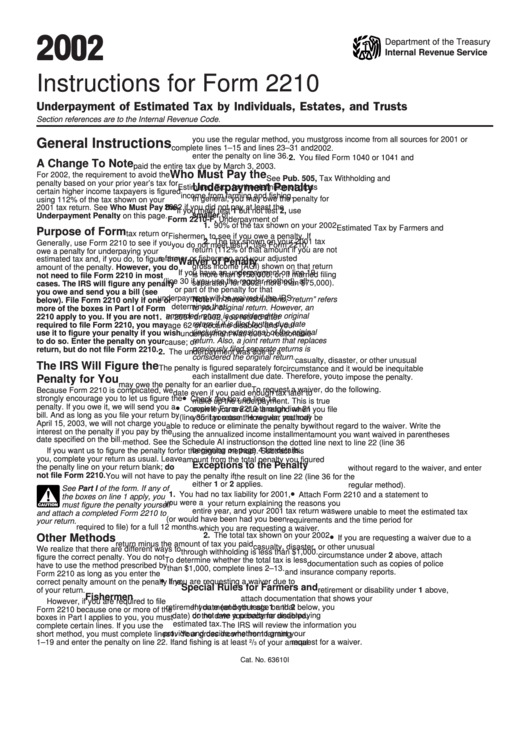

2210 Form Instructions

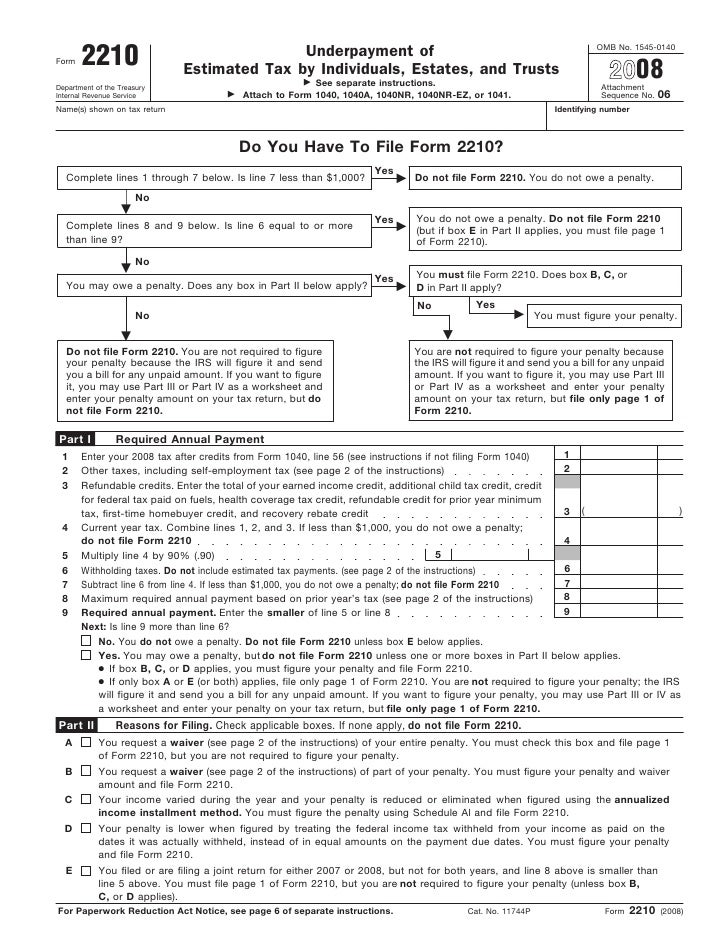

2210 Form Instructions - Please print in ink or type. Name(s) as shown on page. You are not required to complete it since the irs will figure the penalty, if any, and let you. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated for tax year. Web form 2210 notifies the irs that income was not earned evenly and reports the periods that income was earned so that any penalties or interest are mitigated. Even if you are not. This form allows you to figure penalties you may owe if you did not make timely. This form contains both a short. Special rules for farmers, fishermen, and : Generally, use form 2210 to see if you owe a penalty for underpaying your estimated tax and, if you do, to figure the amount of the penalty.

The first 13 lines of the 2210 form determine how much tax the taxpayer should have paid. Web for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2210. This form contains both a short. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated for tax year. Web for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2210. Web form 2210 notifies the irs that income was not earned evenly and reports the periods that income was earned so that any penalties or interest are mitigated. Please print in ink or type. The second part of the 2210 form determines what the. Web either the ia 2210 or ia 2210s is used to determine if an individual taxpayer paid income tax sufficiently throughout the year. Even if you are not.

Web form 2210 (or form 2220 for corporations) will help you determine the penalty amount. The first 13 lines of the 2210 form determine how much tax the taxpayer should have paid. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. Generally, use form 2210 to see if you owe a penalty for underpaying your estimated tax and, if you do, to figure the amount of the penalty. Special rules for farmers, fishermen, and : You should figure out the amount of tax you have underpaid. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated for tax year. This form allows you to figure penalties you may owe if you did not make timely. Web form 2210 notifies the irs that income was not earned evenly and reports the periods that income was earned so that any penalties or interest are mitigated. Name(s) as shown on page.

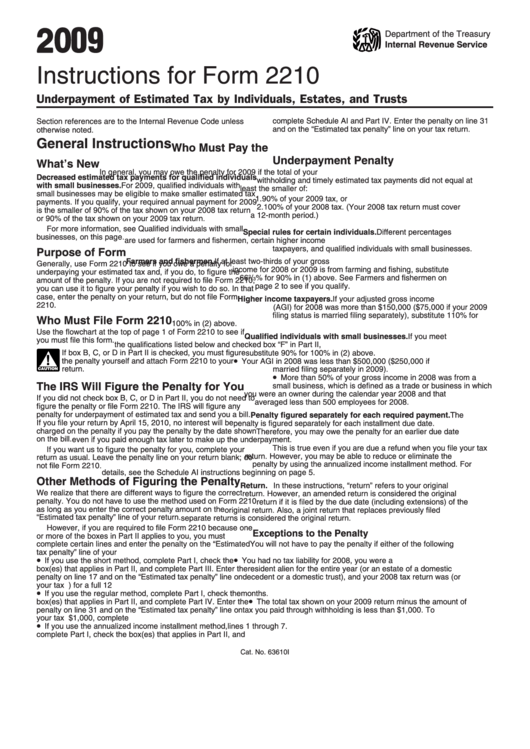

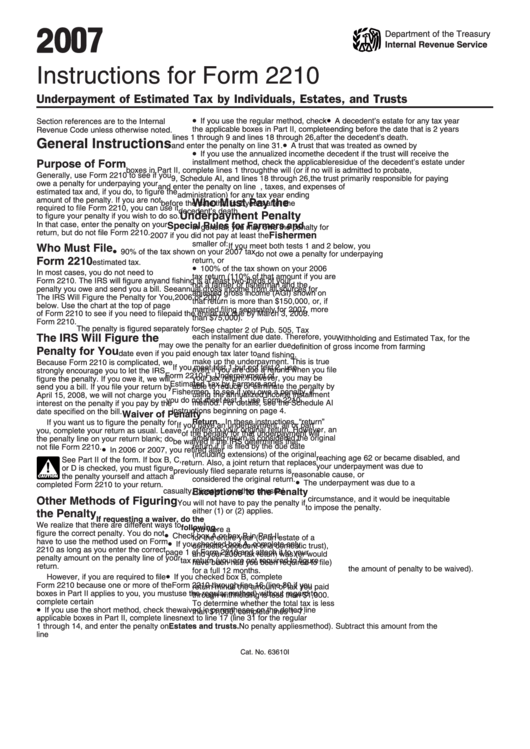

Instructions For Form 2210 Underpayment Of Estimated Tax By

You are not required to complete it since the irs will figure the penalty, if any, and let you. Web learn about the ia 2210 form. Web form 2210 is irs form that relates to underpayment of estimated taxes. You should figure out the amount of tax you have underpaid. Special rules for farmers, fishermen, and :

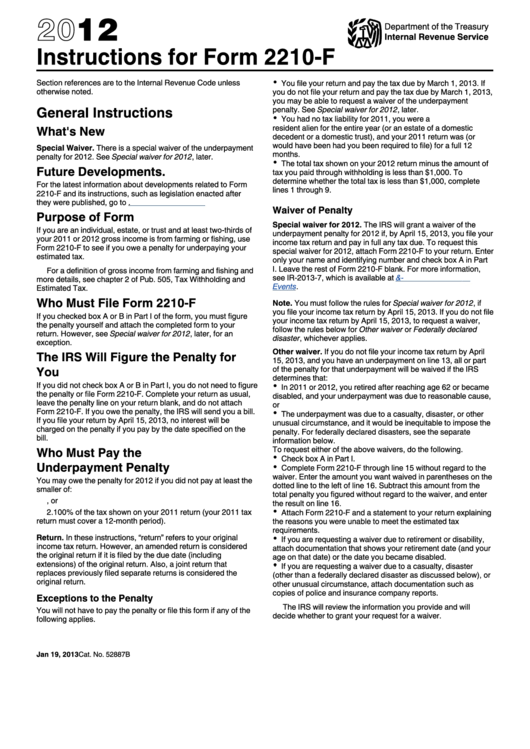

Instructions For Form 2210F Underpayment Of Estimated Tax By Farmers

Web learn about the ia 2210 form. The first 13 lines of the 2210 form determine how much tax the taxpayer should have paid. This form is used to calculate any penalty due. This form contains both a short. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the.

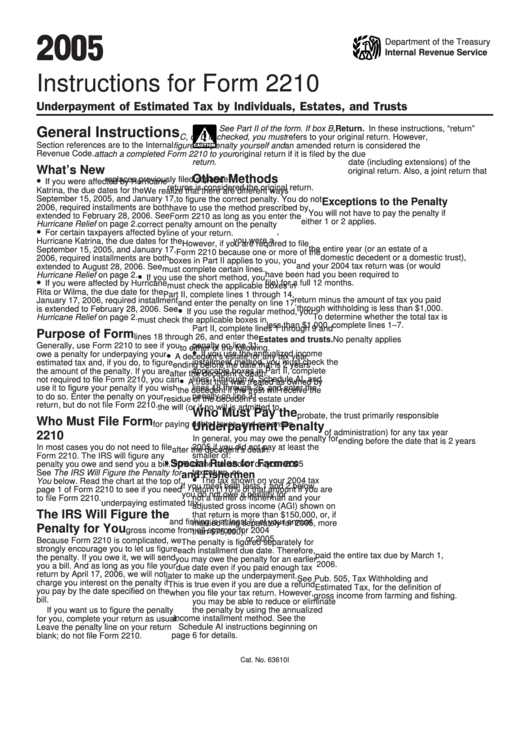

Instructions For Form 2210 Underpayment Of Estimated Tax By

This form is used to calculate any penalty due. The first 13 lines of the 2210 form determine how much tax the taxpayer should have paid. Web form 2210 (or form 2220 for corporations) will help you determine the penalty amount. Name(s) as shown on page. Web learn about the ia 2210 form.

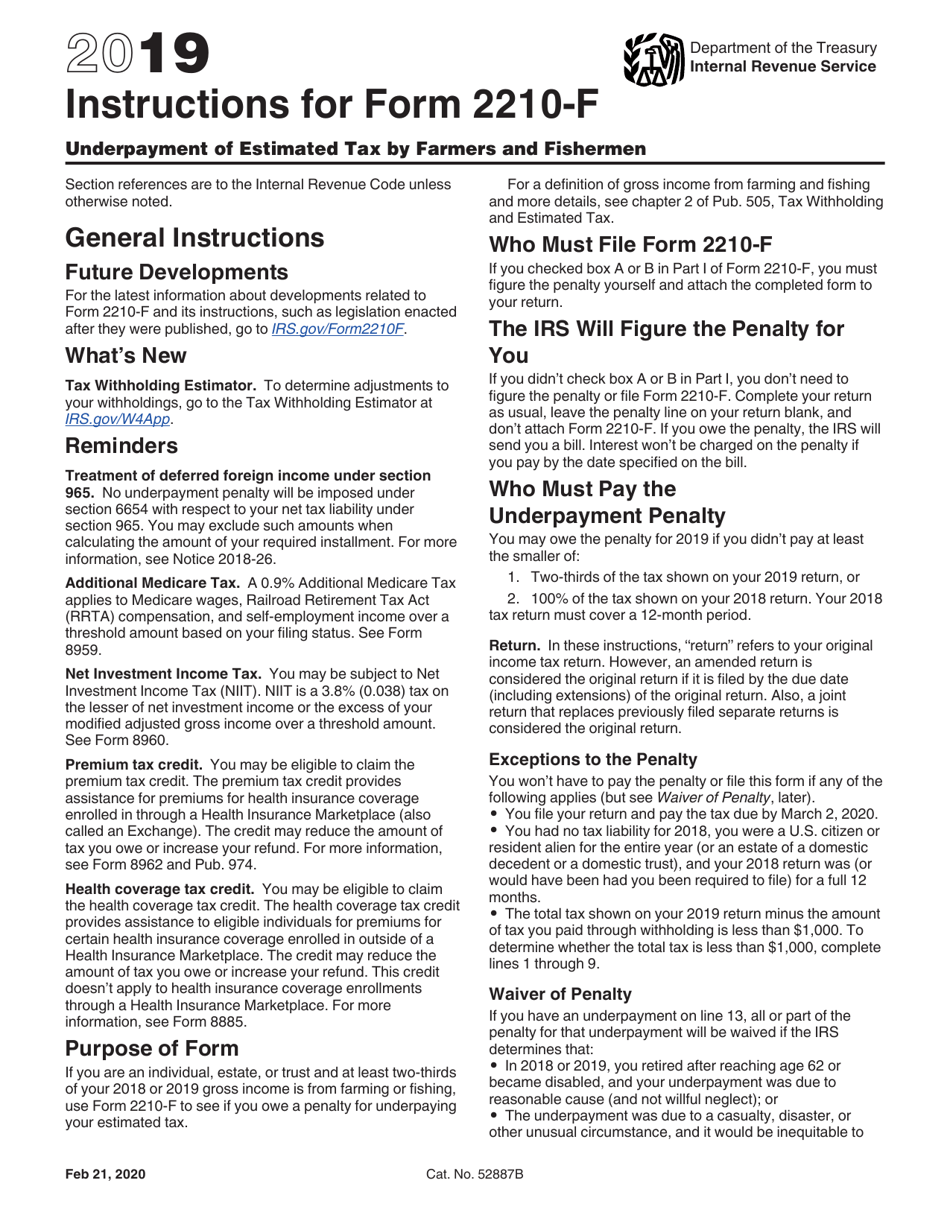

Download Instructions for IRS Form 2210F Underpayment of Estimated Tax

This form is used to calculate any penalty due. Web for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2210. Web form 2210 is irs form that relates to underpayment of estimated taxes. The second part of the 2210 form determines what the. Web either the.

IRS Form 2210Fill it with the Best Form Filler

Generally, use form 2210 to see if you owe a penalty for underpaying your estimated tax and, if you do, to figure the amount of the penalty. Even if you are not. Web form 2210 (or form 2220 for corporations) will help you determine the penalty amount. Name(s) as shown on page. Web form 2210 is irs form that relates.

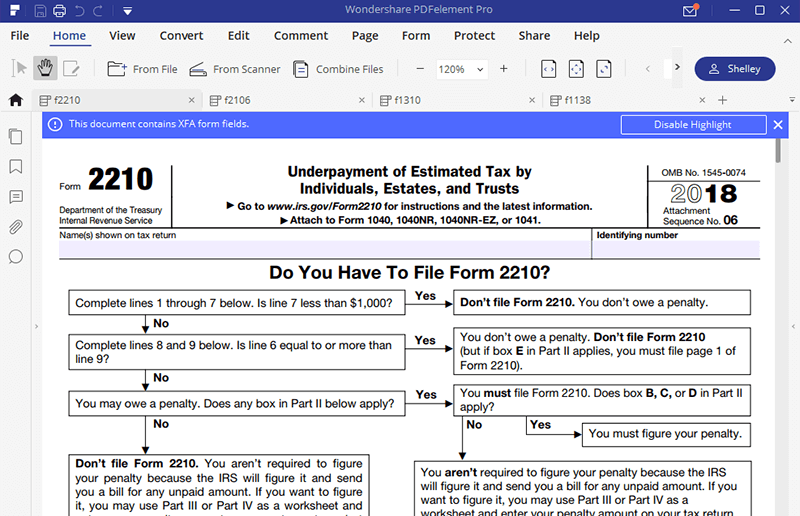

Ssurvivor Form 2210 Instructions 2018

Web for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2210. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated for tax year. Web form 2210 notifies.

Instructions For Form 2210 Underpayment Of Estimated Tax By

Web for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2210. Web learn about the ia 2210 form. The second part of the 2210 form determines what the. This form contains both a short. This form is used to calculate any penalty due.

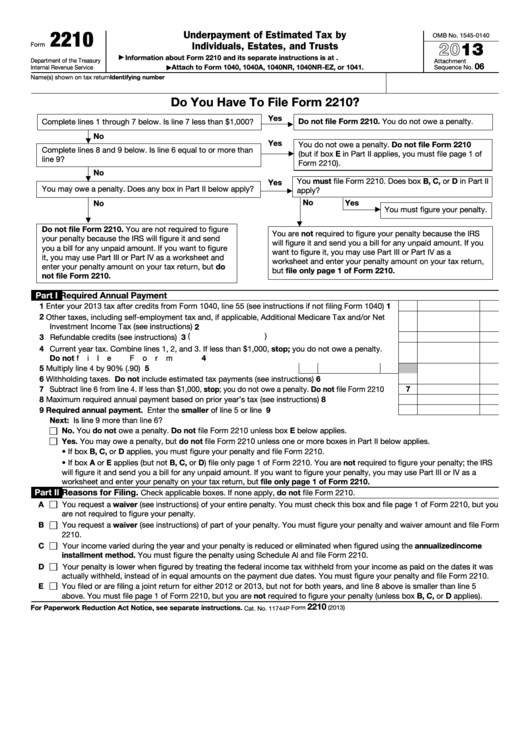

Fillable Form 2210 Underpayment Of Estimated Tax By Individuals

While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. Web for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2210. Generally, use form 2210 to see if you owe a penalty for underpaying your estimated tax and, if.

Instructions For Form 2210 Underpayment Of Estimated Tax By

Web for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2210. Web for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2210. Please print in ink or type. This form is used.

Form 2210Underpayment of Estimated Tax

Name(s) as shown on page. You should figure out the amount of tax you have underpaid. Generally, use form 2210 to see if you owe a penalty for underpaying your estimated tax and, if you do, to figure the amount of the penalty. Web form 2210 is irs form that relates to underpayment of estimated taxes. Web for the latest.

Even If You Are Not.

This form contains both a short. You are not required to complete it since the irs will figure the penalty, if any, and let you. Web either the ia 2210 or ia 2210s is used to determine if an individual taxpayer paid income tax sufficiently throughout the year. Generally, use form 2210 to see if you owe a penalty for underpaying your estimated tax and, if you do, to figure the amount of the penalty.

The First 13 Lines Of The 2210 Form Determine How Much Tax The Taxpayer Should Have Paid.

This form is used to calculate any penalty due. Web for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2210. Please print in ink or type. Web learn about the ia 2210 form.

Special Rules For Farmers, Fishermen, And :

Name(s) as shown on page. You should figure out the amount of tax you have underpaid. Web form 2210 is irs form that relates to underpayment of estimated taxes. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated for tax year.

This Form Allows You To Figure Penalties You May Owe If You Did Not Make Timely.

Web form 2210 (or form 2220 for corporations) will help you determine the penalty amount. Web for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2210. Web form 2210 notifies the irs that income was not earned evenly and reports the periods that income was earned so that any penalties or interest are mitigated. The second part of the 2210 form determines what the.