501C3 Donation Form

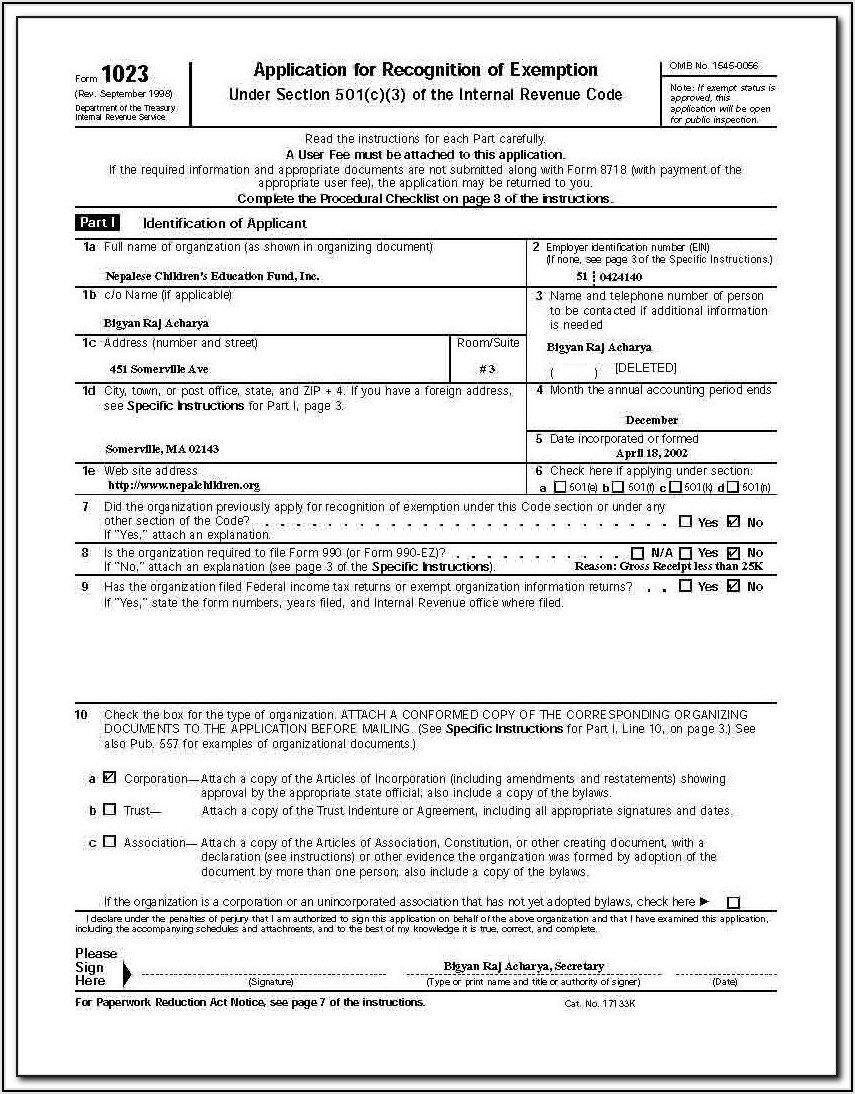

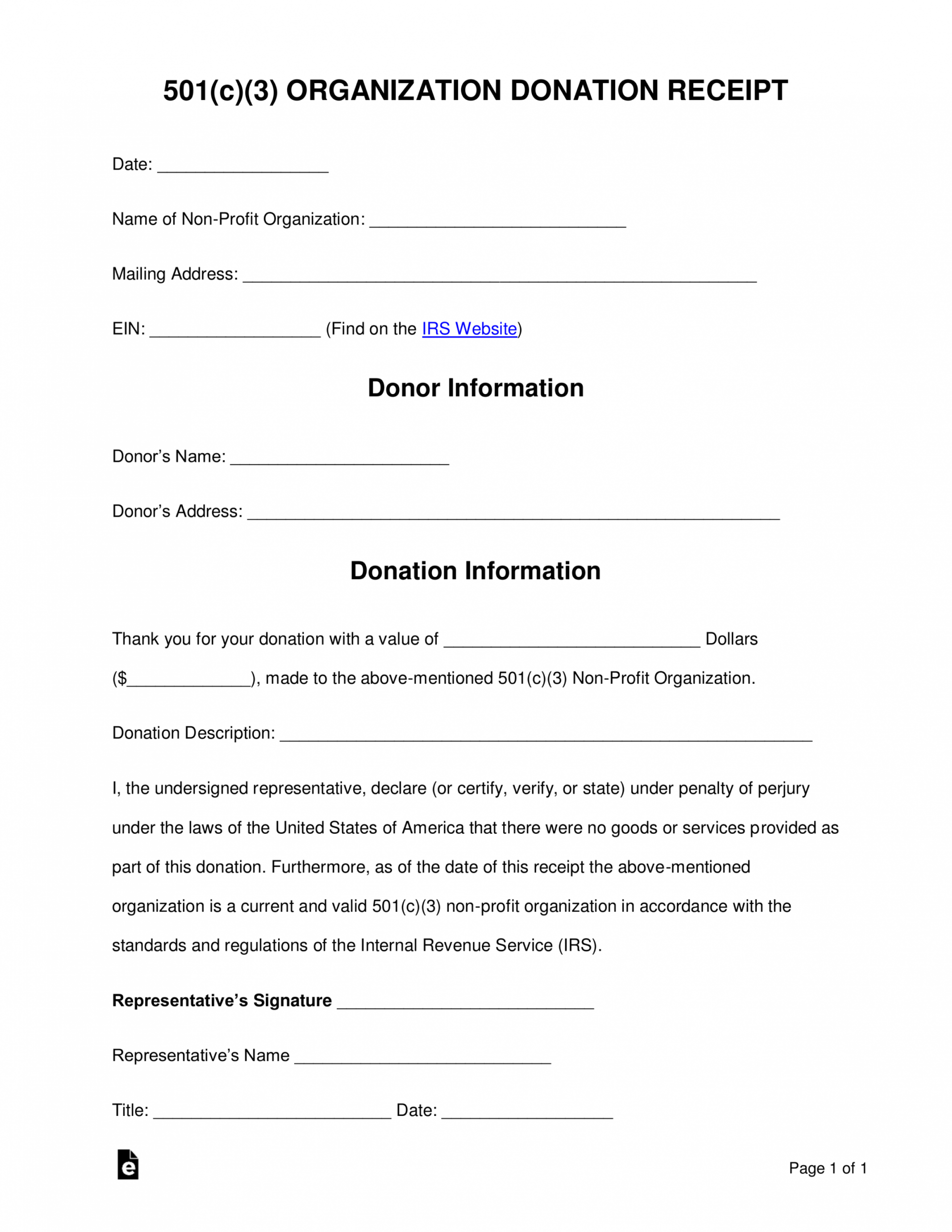

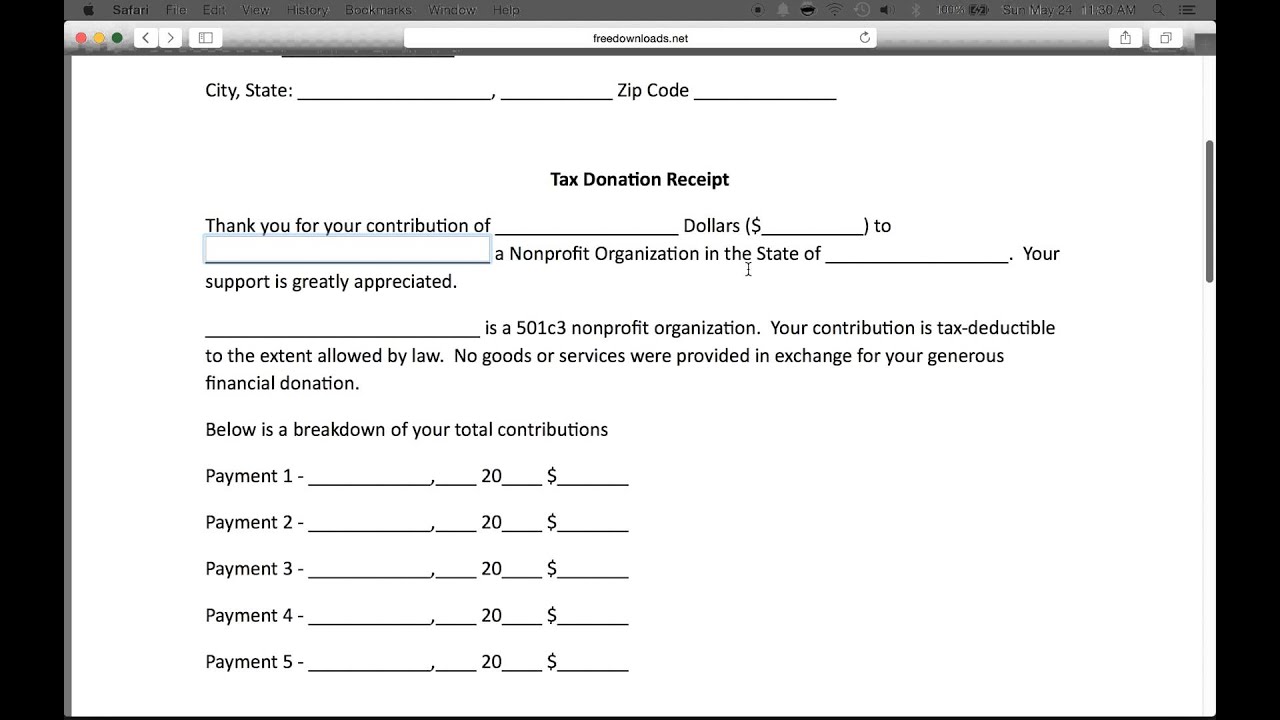

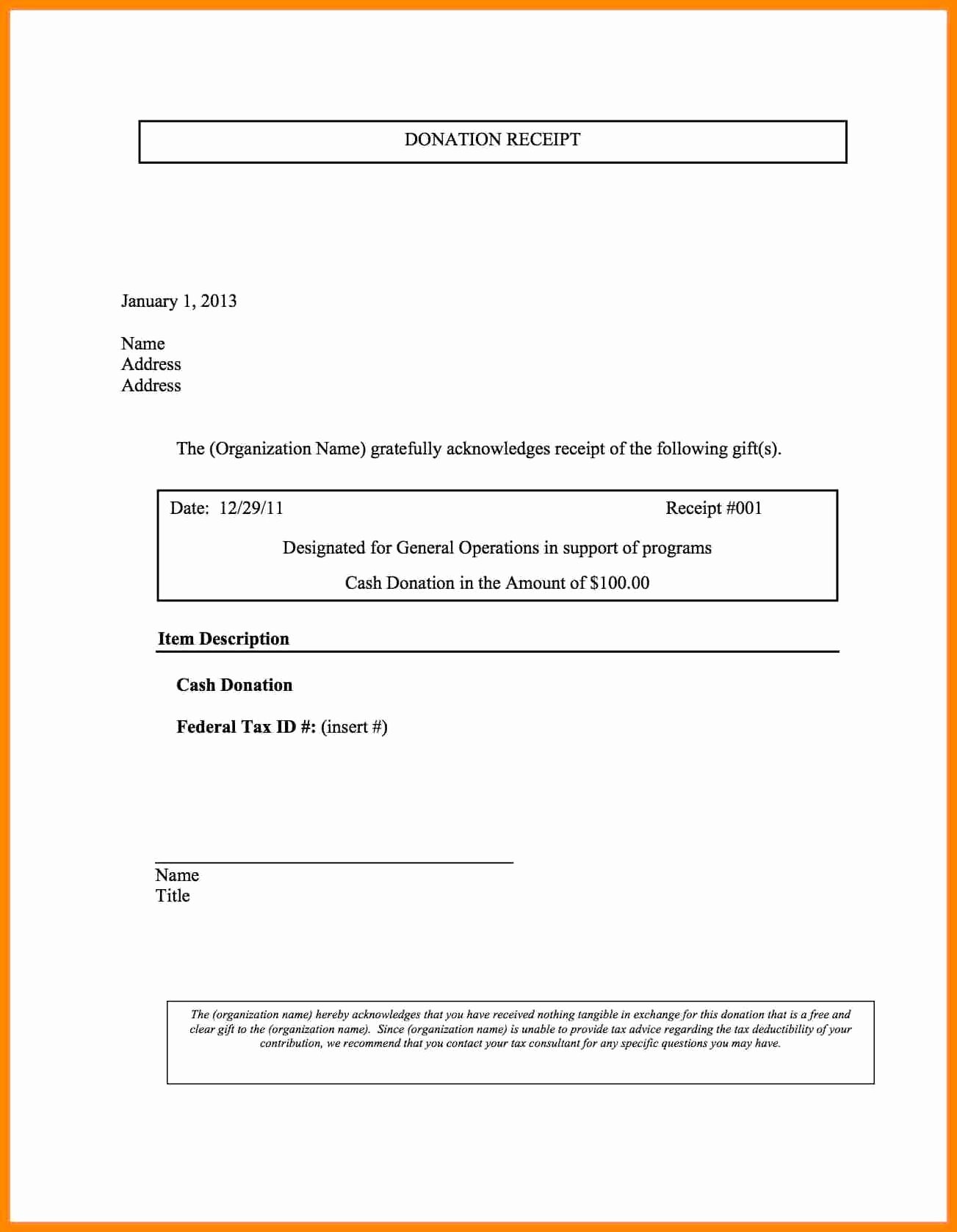

501C3 Donation Form - Learn more information about our community. Web a 501 (c) (3) donation receipt is a written document stating or acknowledging that a donation has been made and received from one party to another party (an individual or. Once completed, upload below along with a copy of your 501 (c)3 and please fill out the. Web a donation form can help nonprofits educate and convince donors to give more than they initially planned. As an alternative to applying for exemption, an organization may. Web 501 (c) (3) donation rules: Web your request must be submitted via the online donation form and must be received at least six (6) weeks in advance of the charitable event date. Irs 501(c)(3) recognition is (usually) effective retroactively to the earlier of 1) the organization’s legal formation or 2) the commencement of its. Web 501c3 nonprofits must have charitable, religious, scientific, educational, literary purposes, or provide testing for public safety, foster national or international amateur. Web 501(c)(3) donation receipt template page 1 of 3 501(c)(3) organization donation receipt date:

As the 2023/2024 school year draws near, parents are looking at a bigger school supplies bill than ever before. Organizations described in section 501 (c) (3), other than. Irs 501(c)(3) recognition is (usually) effective retroactively to the earlier of 1) the organization’s legal formation or 2) the commencement of its. Web 501 (c) (3) donation rules: Web a 501 (c) (3) donation receipt is a written document stating or acknowledging that a donation has been made and received from one party to another party (an individual or. Web this guide to nonprofit donation forms offers more than 20 tips for building an effective online donation form that drives conversions and secures more financial support for. It can also drive donors away if it’s hard to understand. Access legal documents to help you invoice clients, hire employees, gain funding & more. Web a donation form can help nonprofits educate and convince donors to give more than they initially planned. Once completed, upload below along with a copy of your 501 (c)3 and please fill out the.

Learn more information about our community. Web organizations described in section 501 (c) (3) are commonly referred to as charitable organizations. Web exempt organization types. Publication 4220 is neither comprehensive nor intended to address every situation. Web irs forms with instructions. Ad create professional, legal documents for starting & running your business. Web 501(c)(3) donation receipt template page 1 of 3 501(c)(3) organization donation receipt date: 501 (c) (3) donation rules are crucial for any nonprofit organization to. Charitable organizations — irc 501 (c) (3) organizations that are organized and operated exclusively for religious, charitable,. Web to request the feld donation document, please email customerservice@feldinc.com.

501c3 Donation Receipt Template Addictionary

Web a donation form can help nonprofits educate and convince donors to give more than they initially planned. Web organizations described in section 501 (c) (3) are commonly referred to as charitable organizations. Access legal documents to help you invoice clients, hire employees, gain funding & more. Furthermore, as of the date of this receipt the above. Web your request.

Ca Dmv Car Donation Form Form Resume Examples 0g27lxZG9P

Learn more information about our community. Charitable organizations — irc 501 (c) (3) organizations that are organized and operated exclusively for religious, charitable,. 501 (c) (3) donation rules are crucial for any nonprofit organization to. Web this guide to nonprofit donation forms offers more than 20 tips for building an effective online donation form that drives conversions and secures more.

Free 501C3 Donation Receipt Template Sample Pdf Charity Donation Form

As an alternative to applying for exemption, an organization may. Web irs forms with instructions. Web organizations described in section 501 (c) (3) are commonly referred to as charitable organizations. Publication 4220 is neither comprehensive nor intended to address every situation. Learn more information about our community.

501c3 Donation Receipt Template Business

Web 501 (c) (3) donation rules: Web organizations described in section 501 (c) (3) are commonly referred to as charitable organizations. Web following special tax law changes made earlier this year, cash donations of up to $300 made before december 31, 2020, are now deductible when people file their taxes in. Irs 501(c)(3) recognition is (usually) effective retroactively to the.

501c3 Tax Deductible Donation Letter Template Business

Web individuals, partnerships, and corporations file form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts. Irs 501(c)(3) recognition is (usually) effective retroactively to the earlier of 1) the organization’s legal formation or 2) the commencement of its. Web 501c3 nonprofits must have charitable, religious, scientific, educational, literary purposes, or provide.

501c3 Donation Receipt Template Addictionary

It can also drive donors away if it’s hard to understand. Web irs forms with instructions. Publication 4220 is neither comprehensive nor intended to address every situation. Web 501c3 nonprofits must have charitable, religious, scientific, educational, literary purposes, or provide testing for public safety, foster national or international amateur. Web 501 (c) (3) donation rules:

How to Write a 501c3 Donation Receipt Letter PDF Word YouTube

Organizations described in section 501 (c) (3), other than. Access legal documents to help you invoice clients, hire employees, gain funding & more. Web 501 (c) (3) donation rules: Web individuals, partnerships, and corporations file form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts. Once completed, upload below along with.

√ 20 501c3 Donation Receipt ™ Dannybarrantes Template

Web 501 (c) (3) donation rules: Web under the laws of the united states of america that there were no goods or services provided as part of this donation. Irs 501(c)(3) recognition is (usually) effective retroactively to the earlier of 1) the organization’s legal formation or 2) the commencement of its. Web your request must be submitted via the online.

35 501c3 Donation Receipt Template Hamiltonplastering

Web to request the feld donation document, please email customerservice@feldinc.com. As an alternative to applying for exemption, an organization may. Web individuals, partnerships, and corporations file form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts. As the 2023/2024 school year draws near, parents are looking at a bigger school supplies.

Addictionary

Access legal documents to help you invoice clients, hire employees, gain funding & more. Web individuals, partnerships, and corporations file form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts. Web 501(c)(3) donation receipt template page 1 of 3 501(c)(3) organization donation receipt date: By the charity cfo | apr 14,.

Irs 501(C)(3) Recognition Is (Usually) Effective Retroactively To The Earlier Of 1) The Organization’s Legal Formation Or 2) The Commencement Of Its.

Web your request must be submitted via the online donation form and must be received at least six (6) weeks in advance of the charitable event date. Organizations described in section 501 (c) (3), other than. Web 501 (c) (3) donation rules: Web 501(c)(3) donation receipt template page 1 of 3 501(c)(3) organization donation receipt date:

Furthermore, As Of The Date Of This Receipt The Above.

Web organizations described in section 501 (c) (3) are commonly referred to as charitable organizations. Web a donation form can help nonprofits educate and convince donors to give more than they initially planned. Web 501c3 nonprofits must have charitable, religious, scientific, educational, literary purposes, or provide testing for public safety, foster national or international amateur. Web exempt organization types.

Web Following Special Tax Law Changes Made Earlier This Year, Cash Donations Of Up To $300 Made Before December 31, 2020, Are Now Deductible When People File Their Taxes In.

Access legal documents to help you invoice clients, hire employees, gain funding & more. Web irs forms with instructions. It can also drive donors away if it’s hard to understand. Web this guide to nonprofit donation forms offers more than 20 tips for building an effective online donation form that drives conversions and secures more financial support for.

Web To Request The Feld Donation Document, Please Email Customerservice@Feldinc.com.

Web under the laws of the united states of america that there were no goods or services provided as part of this donation. Web a 501 (c) (3) donation receipt is a written document stating or acknowledging that a donation has been made and received from one party to another party (an individual or. 501 (c) (3) donation rules are crucial for any nonprofit organization to. Ad create professional, legal documents for starting & running your business.