7004 Tax Form

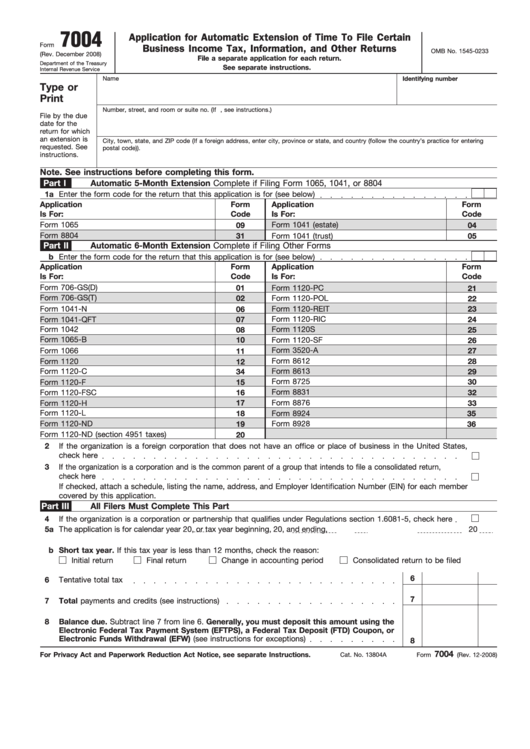

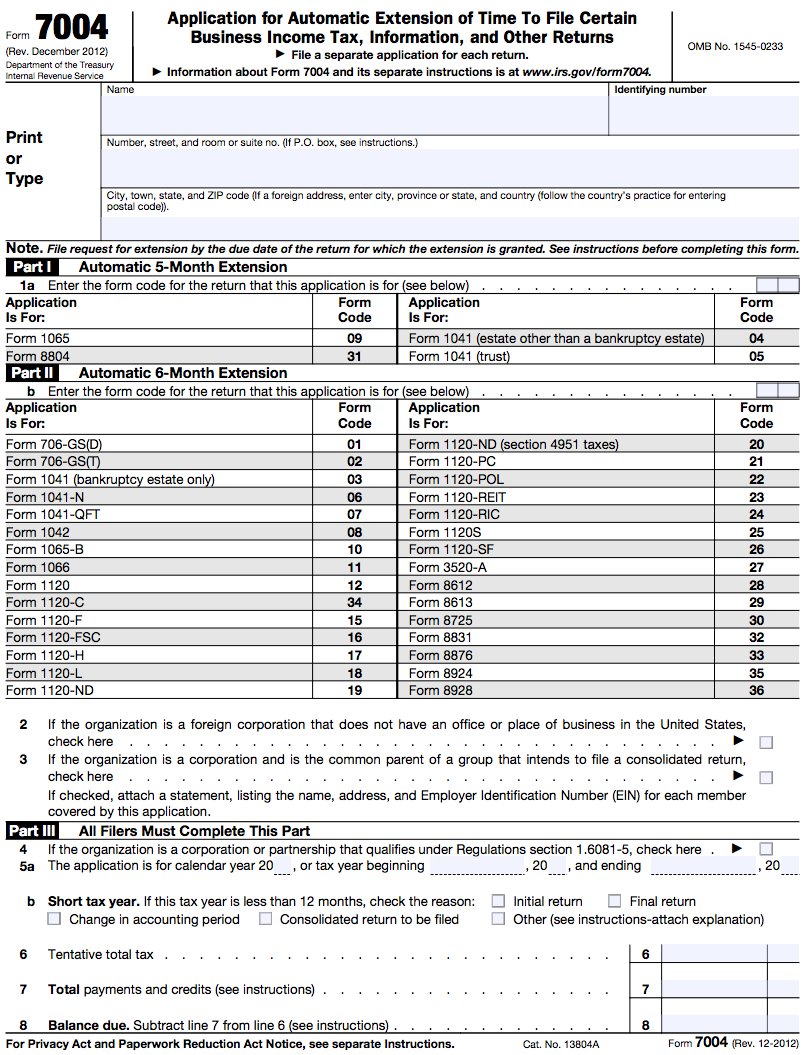

7004 Tax Form - There are three different parts to this tax form. This can be particularly beneficial for those who need more time to gather financial records and. Select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business income tax, information, and other returns Choose form 7004 and select the form for which you need an extension. Web the purpose of form 7004: Web form 7004, application for automatic extension of time to file certain business income tax, information, and other returns. Web the 7004 form is an irs document used by businesses to request an automatic extension for filing their tax returns. Form 7004 is used to request an automatic extension to file the certain returns. The irs may charge penalties and. Web attach form 7004 to the corporation’s tax return.

Web irs form 7004 instructions are used by various types of businesses to complete the form that extends the filing deadline on their taxes. Form 7004 is an extension form that can be used to get an automatic extension of up to 6 months from the irs for filing your business tax returns. File a separate application for each return. Form 7004 is used to request an automatic extension to file the certain returns. Address to send form 7004 page last reviewed or updated: Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related forms, and instructions on how to file. Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. The first two depend on the kind of tax that needs to have its due date extended, while the third is universal. Businesses use this irs extension form to ask for more time to submit one of their business tax forms. Enter your tax payment details.

Web follow these steps to complete your business tax extension form 7004 using expressextension: This can be particularly beneficial for those who need more time to gather financial records and. Once filed, you will get instant updates from the irs. Web purpose of form use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. For details on electronic filing, visit irs.gov/efile7004. Web use the chart to determine where to file form 7004 based on the tax form you complete. Web federal tax extension form 7004, the “application for automatic extension of time to file certain business income tax, information, and other returns” ( pdf ), is a one page irs form that looks like this: Form 7004 does not extend the time for payment of tax. Web the form 7004 does not extend the time for payment of tax. Partnerships, llcs, and corporations that need extra time to file certain tax documents and returns.

IRS Form 7004 Automatic Extension for Business Tax Returns

The extension will be granted if you complete form 7004 properly, make a proper estimate of the tax (if applicable), file form 7004 by the due date of the return to which the extension is requested, and. Web the 7004 form is an irs document used by businesses to request an automatic extension for filing their tax returns. Irs form.

Irs Fillable Form 7004 Fill online, Printable, Fillable Blank

Address to send form 7004 page last reviewed or updated: Web the form 7004 does not extend the time for payment of tax. By the tax filing due date (april 15th for most businesses) who needs to file: File a separate application for each return. Web follow these steps to complete your business tax extension form 7004 using expressextension:

can i file form 7004 late Extension Tax Blog

A corporation that does not pay the tax when due generally may be penalized 1⁄ 2 of 1% of the unpaid tax for each month or part of a month the tax is not paid, up to a maximum of 25% of the unpaid tax. The irs may charge penalties and. This can be particularly beneficial for those who need.

Tax extension form 7004

Irs form 7004, also known as the application for automatic extension of time to file certain business income tax, information, and other returns, is a crucial document for. Web the form 7004 does not extend the time for payment of tax. Enter your tax payment details. Web irs form 7004 instructions are used by various types of businesses to complete.

Fillable Form 7004 (Rev. December 2008) printable pdf download

Requests for a tax filing extension. December 2018) department of the treasury internal revenue service. The irs may charge penalties and. Form 7004 can be filed on paper or electronically. By the tax filing due date (april 15th for most businesses) who needs to file:

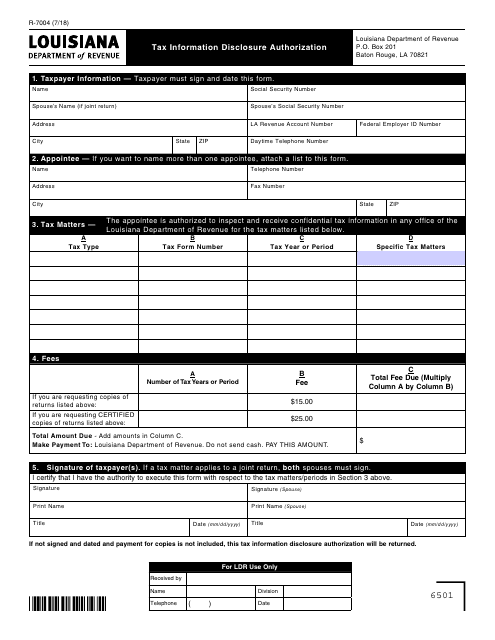

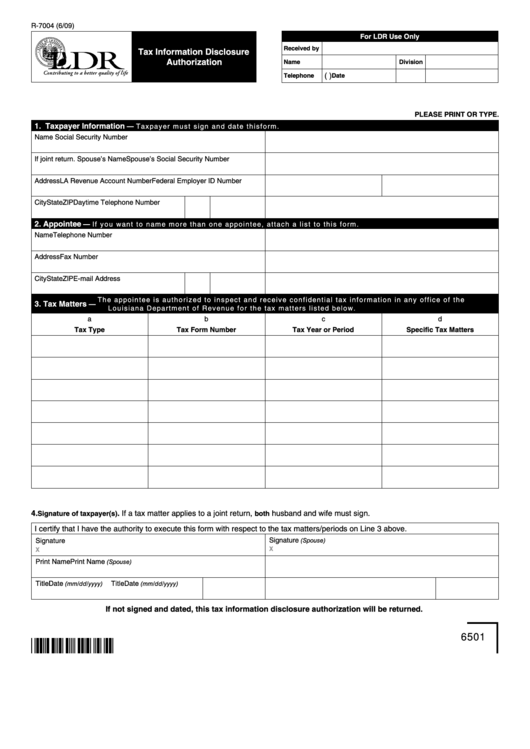

Form R7004 Download Fillable PDF or Fill Online Tax Information

Enter your tax payment details. Web irs form 7004 instructions are used by various types of businesses to complete the form that extends the filing deadline on their taxes. Form 7004 does not extend the time for payment of tax. December 2018) department of the treasury internal revenue service. The extension will be granted if you complete form 7004 properly,.

Fillable Form R7004 Tax Information Disclosure Authorization

Web the form 7004 does not extend the time for payment of tax. Web form 7004 is a federal corporate income tax form. For details on electronic filing, visit irs.gov/efile7004. Web filing the irs form 7004 for 2022 provides businesses and certain individuals with the opportunity to request an extension on their tax return deadlines. Enter your tax payment details.

How to file an LLC extension Form 7004 YouTube

The first two depend on the kind of tax that needs to have its due date extended, while the third is universal. Web the purpose of form 7004: Address to send form 7004 page last reviewed or updated: Web follow these steps to complete your business tax extension form 7004 using expressextension: There are three different parts to this tax.

How to Fill Out Tax Form 7004 FileLater

Application for automatic extension of time to file certain business income tax, information, and other returns. Web filing the irs form 7004 for 2022 provides businesses and certain individuals with the opportunity to request an extension on their tax return deadlines. Web form 7004 can be filed electronically for most returns. Web form 7004 federal — application for automatic extension.

Cheapest Way to File IRS Business Tax Extension With Form 7004 ONLINE

Select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business income tax, information, and other returns Web federal tax extension form 7004, the “application for automatic extension of time to file certain business income tax, information, and other returns” ( pdf ), is a.

Form 7004 Is Used To Request An Automatic Extension To File The Certain Returns.

Web follow these steps to complete your business tax extension form 7004 using expressextension: Web form 7004 can be filed electronically for most returns. Web purpose of form. This can be particularly beneficial for those who need more time to gather financial records and.

Web Form 7004, Application For Automatic Extension Of Time To File Certain Business Income Tax, Information, And Other Returns.

File a separate application for each return. By the tax filing due date (april 15th for most businesses) who needs to file: Web use the chart to determine where to file form 7004 based on the tax form you complete. Review and transmit your 7004 form to the irs.

Get An Extension Of Time To File Business Income Tax.

If you do not file electronically, file form 7004 with the internal revenue service center at the applicable Form 7004 does not extend the time for payment of tax. Application for automatic extension of time to file certain business income tax, information, and other returns. Web irs form 7004 extends the filing deadline for another:

Choose Form 7004 And Select The Form For Which You Need An Extension.

There are three different parts to this tax form. Enter your tax payment details. For details on electronic filing, visit irs.gov/efile7004. Businesses use this irs extension form to ask for more time to submit one of their business tax forms.