8615 Tax Form

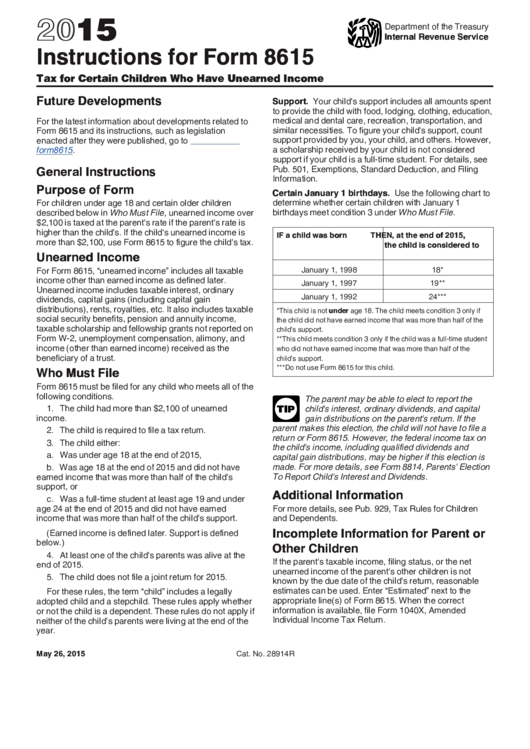

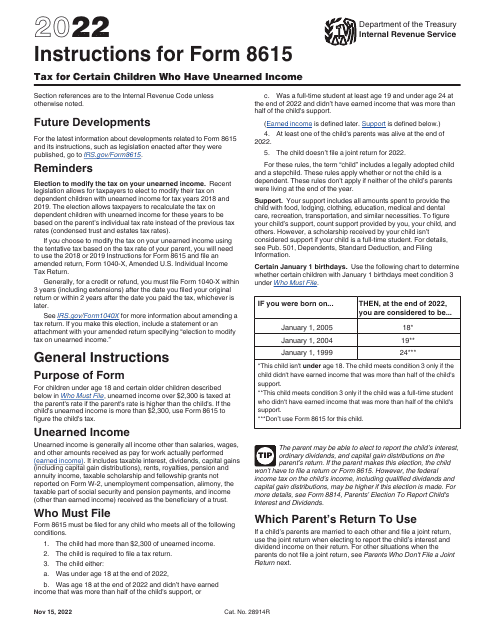

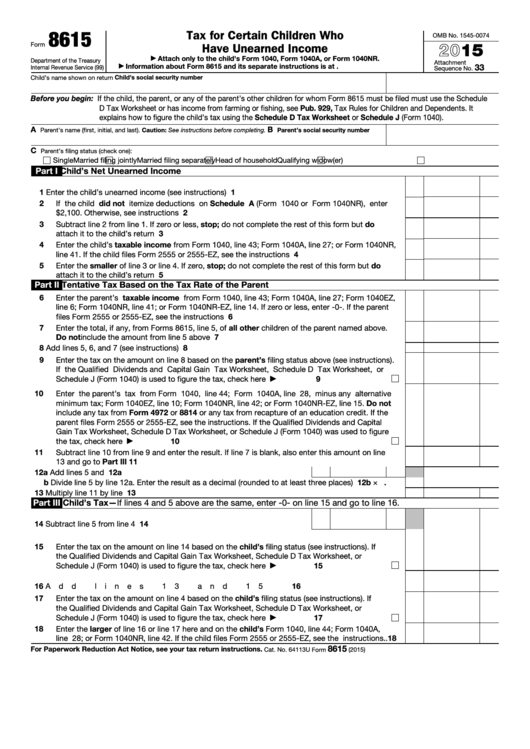

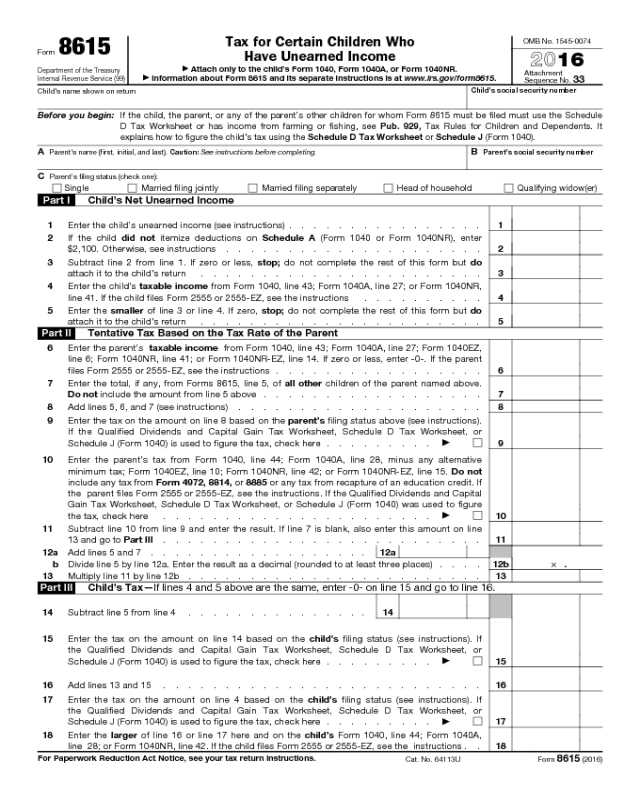

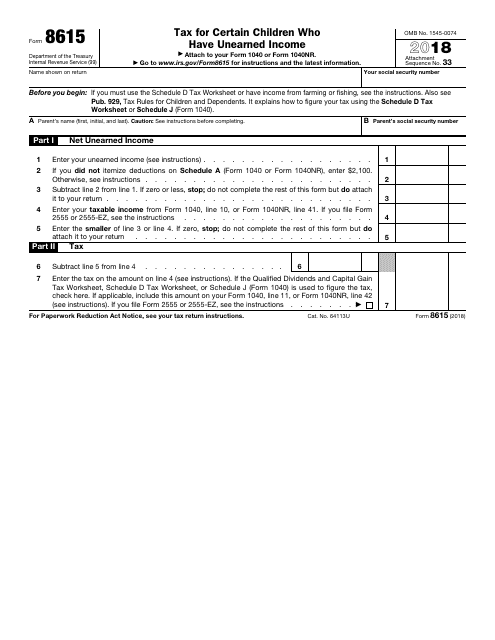

8615 Tax Form - Web form 8615 must be filed with the child’s tax return if all of the following apply: Web form 4506 (novmeber 2021) department of the treasury internal revenue service. Request for copy of tax return. Web use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. The child had more than $2,300 of unearned income. Web form 8615 must be filed for any child who meets all of the following conditions. The child is required to file a tax return. For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the parent's. For children under age 18 and certain older children described below in who must file, unearned income over $2,200 is taxed. Attach the completed form to the.

Web this tax is calculated on form 8615, tax for certain children who have unearned income. As opposed to earned income, which is received for work actually performed, unearned. For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the parent's. Web for form 8615, “unearned income” includes all taxable income other than earned income. See who must file, later. 12th st.) or at the water services department (4800 e. Web water bills can be paid online or in person at city hall (414 e. Unearned income includes taxable interest, ordinary dividends, capital gains (including. The child is required to file a tax return. 63rd st.) using cash, check or credit card.

As opposed to earned income, which is received for work actually performed, unearned. Web form 8615 must be filed for any child who meets all of the following conditions. Web form 8615 must be filed with the child’s tax return if all of the following apply: Web per irs instructions for form 8615: 12th st.) or at the water services department (4800 e. Web form 8615 must be filed for any child who meets all of the following conditions. The child had more than $2,000 of unearned income. 63rd st.) using cash, check or credit card. The child had more than $2,300 of unearned income. For children under age 18 and certain older children described below in who must file, unearned income over $2,200 is taxed.

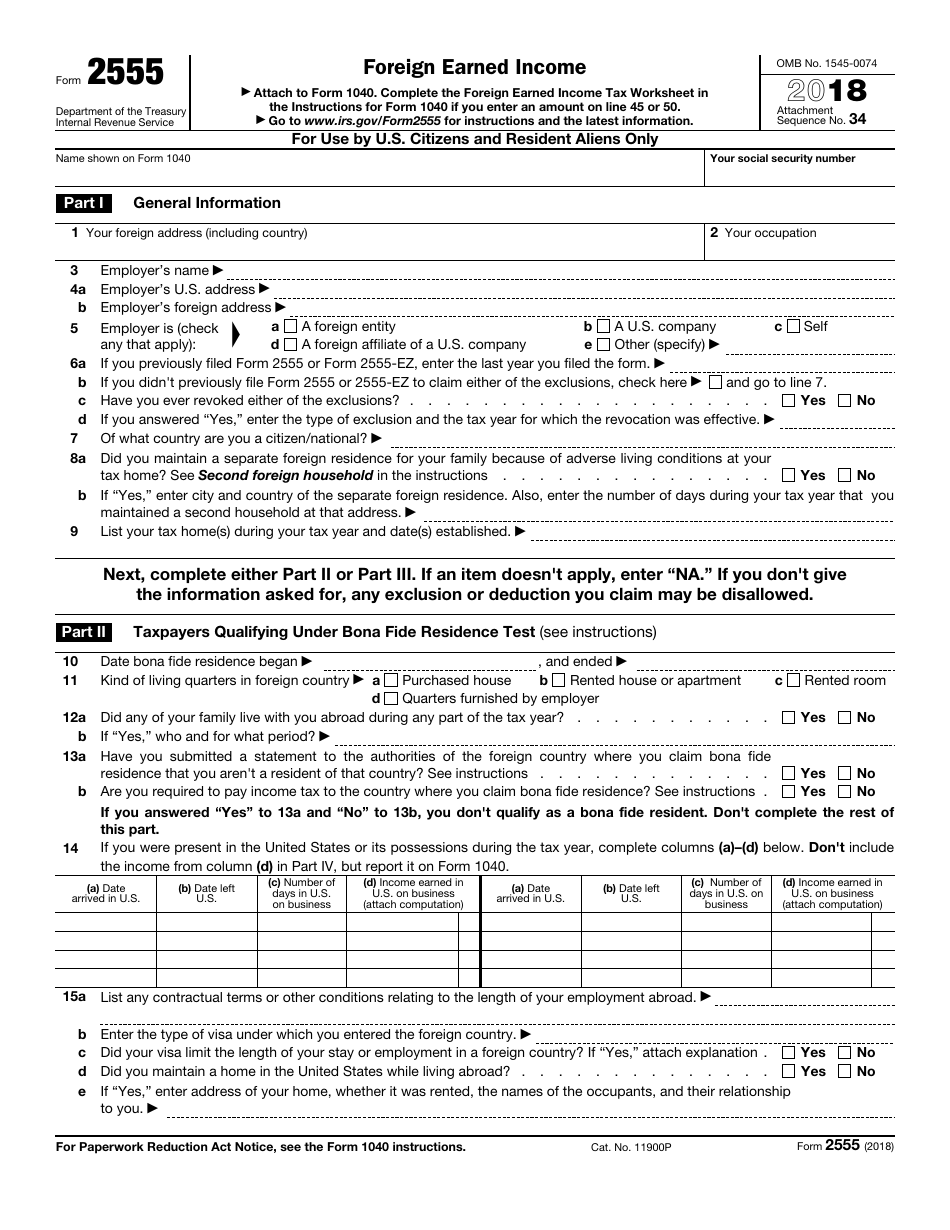

Instructions for IRS Form 2555 Foreign Earned Download

The child is required to file a tax return. Unearned income includes taxable interest, ordinary dividends, capital gains (including. Complete, edit or print tax forms instantly. Do not sign this form unless all applicable lines have. Register and subscribe now to work on your irs 8615 form & more fillable forms.

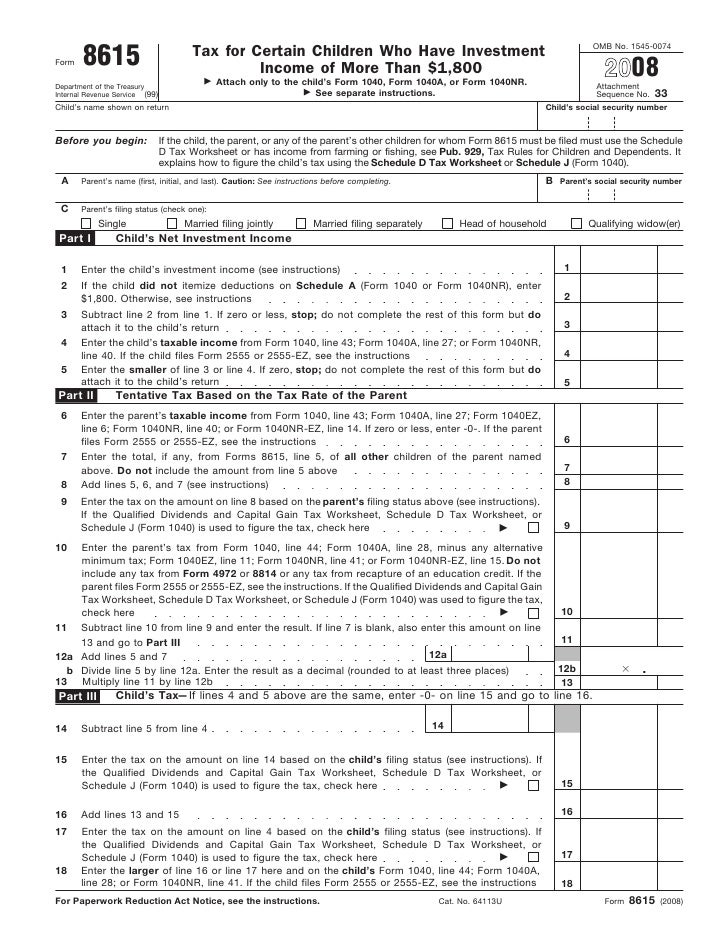

Form 8615 Instructions (2015) printable pdf download

Web form 4506 (novmeber 2021) department of the treasury internal revenue service. Web form 8615 must be filed for any child who meets all of the following conditions. Register and subscribe now to work on your irs 8615 form & more fillable forms. Request for copy of tax return. For children under age 18 and certain older children described below.

DSC_8615 Gundersons Bookkeeping

Web form 8615 must be filed with the child’s tax return if all of the following apply: Web for form 8615, “unearned income” includes all taxable income other than earned income. Unearned income includes taxable interest, ordinary dividends, capital gains (including. The child is required to file a tax return. Request for copy of tax return.

Download Instructions for IRS Form 8615 Tax for Certain Children Who

For children under age 18 and certain older children described below in who must file, unearned income over $2,200 is taxed. The child had more than $2,300 of unearned income. Do not sign this form unless all applicable lines have. You are required to file a tax return. As opposed to earned income, which is received for work actually performed,.

Fillable Form 8615 Tax For Certain Children Who Have Unearned

Web form 4506 (novmeber 2021) department of the treasury internal revenue service. If using a private delivery service, send your returns to the street. Web this tax is calculated on form 8615, tax for certain children who have unearned income. Register and subscribe now to work on your irs 8615 form & more fillable forms. Unearned income includes taxable interest,.

Form 8615 Edit, Fill, Sign Online Handypdf

Web per irs instructions for form 8615: Complete, edit or print tax forms instantly. 12th st.) or at the water services department (4800 e. Do not sign this form unless all applicable lines have. Web if the parent doesn't or can't choose to include the child's income on the parent's return, use form 8615 to figure the child's tax.

4506 Form 2021 IRS Forms Zrivo

Web this tax is calculated on form 8615, tax for certain children who have unearned income. 63rd st.) using cash, check or credit card. Do not sign this form unless all applicable lines have. Complete, edit or print tax forms instantly. For children under age 18 and certain older children described below in who must file , unearned income over.

IRS Form 2555 Download Fillable PDF or Fill Online Foreign Earned

Web form 8615 must be filed for any child who meets all of the following conditions. Web this tax is calculated on form 8615, tax for certain children who have unearned income. See who must file, later. Unearned income includes taxable interest, ordinary dividends, capital gains (including. Web for form 8615, “unearned income” includes all taxable income other than earned.

Form 8615Tax for Children Under Age 14 With Investment of Mor…

Web for form 8615, “unearned income” includes all taxable income other than earned income. Complete, edit or print tax forms instantly. For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the parent's. See who must file, later. Web use form 8615 to.

IRS Form 8615 Download Fillable PDF or Fill Online Tax for Certain

You had more than $2,300 of unearned income. Web form 8615 must be filed with the child’s tax return if all of the following apply: Web this tax is calculated on form 8615, tax for certain children who have unearned income. If using a private delivery service, send your returns to the street. Web per irs instructions for form 8615:

Attach The Completed Form To The.

Web form 4506 (novmeber 2021) department of the treasury internal revenue service. The child is required to file a tax return. Net investment income tax a child whose tax is figured on form. For children under age 18 and certain older children described below in who must file, unearned income over $2,200 is taxed.

Complete, Edit Or Print Tax Forms Instantly.

The child had more than $2,000 of unearned income. See who must file, later. Web form 8615 must be filed with the child’s tax return if all of the following apply: Web per irs instructions for form 8615:

12Th St.) Or At The Water Services Department (4800 E.

Register and edit, fill, sign now your irs 8615 form & more fillable forms. The child had more than $2,300 of unearned income. Web use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. Complete, edit or print tax forms instantly.

You Are Required To File A Tax Return.

Request for copy of tax return. Web water bills can be paid online or in person at city hall (414 e. The child is required to file a tax return. If using a private delivery service, send your returns to the street.