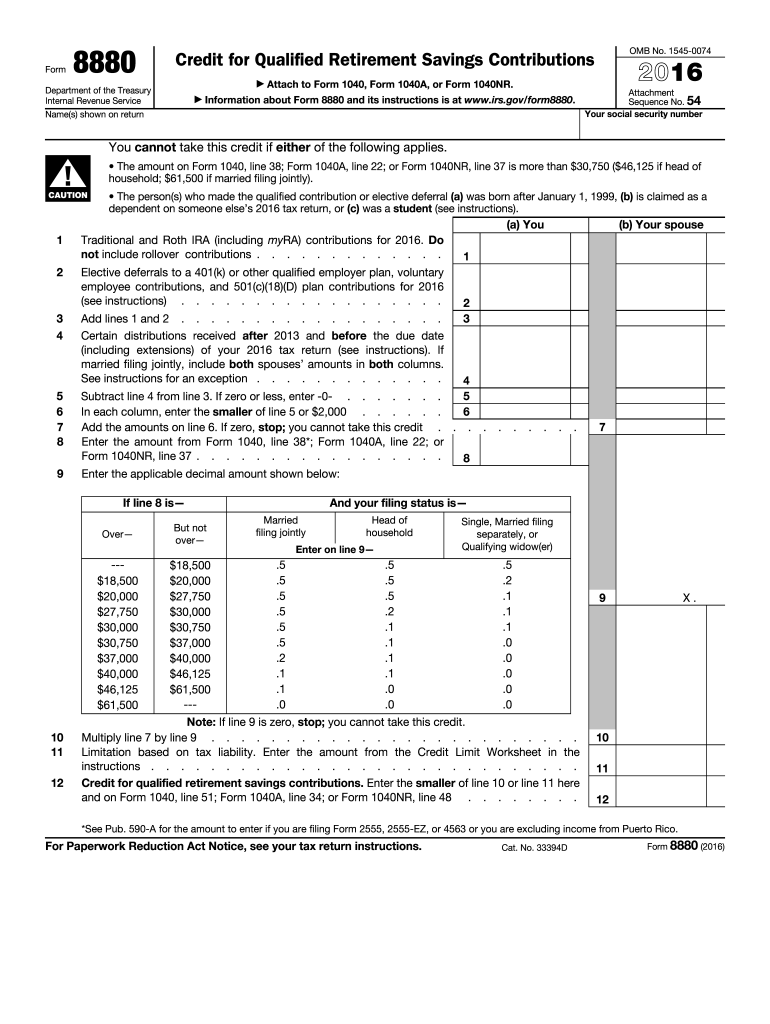

8880 Tax Form

8880 Tax Form - Web form 8880, credit for qualified retirement savings contributions, is used to claim this credit. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in missouri. Web based on form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross income. Amount of the credit depending on your adjusted gross income. As of 2023, the credit is available to single taxpayers with a. Complete, edit or print tax forms instantly. Web form 8880 is used to figure the amount, if any, of your retirement savings contributions credit that can be claimed in the current year. Web irs form 8880 is used specifically for the retirement saver’s credit. To claim the credit, you must complete irs form 8880 and include it with your tax return. These where to file addresses.

Web 8880 you cannot take this credit if either of the following applies. Web in order to claim the saver’s credit, you’ll need to complete irs form 8880, and attach it to your 1040, 1040a or 1040nr when you file your tax return. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in missouri. Complete irs tax forms online or print government tax documents. Complete irs tax forms online or print government tax documents. Taxpayers may be eligible for. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver's credit). Ad access irs tax forms. Web the internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some forms can come even later. As of 2023, the credit is available to single taxpayers with a.

Web a foreign country, u.s. Web the following replaces the “where to file” addresses on page 2 of form 8822 (rev. Complete, edit or print tax forms instantly. Complete irs tax forms online or print government tax documents. These where to file addresses. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver's credit). Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). To claim the credit, you must complete irs form 8880 and include it with your tax return. Complete, edit or print tax forms instantly. Two key pieces of information you need before.

SimpleTax Form 8880 YouTube

Ad access irs tax forms. Complete irs tax forms online or print government tax documents. Taxpayers may be eligible for. Web preparing form 8880. To claim the credit, you must complete irs form 8880 and include it with your tax return.

Mattress Protector Vinyl Alpha First Aid

Ad access irs tax forms. Ad access irs tax forms. Taxpayers may be eligible for. Complete irs tax forms online or print government tax documents. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit).

Form 8880 Credit for Qualified Retirement Savings Contributions (2015

This credit can be claimed in addition to any ira. Complete, edit or print tax forms instantly. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in missouri. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver's credit). Web.

Irs.gov 2014 Form 8880 Universal Network

To claim the credit, you must complete irs form 8880 and include it with your tax return. Web 8880 you cannot take this credit if either of the following applies. Web form 8880 is used to figure the amount, if any, of your retirement savings contributions credit that can be claimed in the current year. Complete, edit or print tax.

IRS 8880 2016 Fill out Tax Template Online US Legal Forms

As of 2023, the credit is available to single taxpayers with a. If you checked the box on line 2, send form 8822 to:. Web based on form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross income. Web form 8880 is used to figure the amount, if any, of your.

Tax Deduction Spreadsheet pertaining to Itemized Deductions Worksheet

Amount of the credit depending on your adjusted gross income. Complete irs tax forms online or print government tax documents. These where to file addresses. As of 2023, the credit is available to single taxpayers with a. Web irs form 8880 is used specifically for the retirement saver’s credit.

What is IRS Form 990?

Web the following replaces the “where to file” addresses on page 2 of form 8822 (rev. Tip this credit can be claimed in. Web see form 8880, credit for qualified retirement savings contributions, for more information. Web 8880 you cannot take this credit if either of the following applies. Web find irs mailing addresses for taxpayers and tax professionals filing.

Form 8880 Credit for Qualified Retirement Savings Contributions (2015

Web preparing form 8880. Web a foreign country, u.s. As of 2023, the credit is available to single taxpayers with a. Amount of the credit depending on your adjusted gross income. Tip this credit can be claimed in.

IRS 8288 20182022 Fill and Sign Printable Template Online US Legal

As of 2023, the credit is available to single taxpayers with a. Tip this credit can be claimed in. Web the internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some forms can come even later. Web a foreign country, u.s. Web taxpayers use irs form 8880 for the.

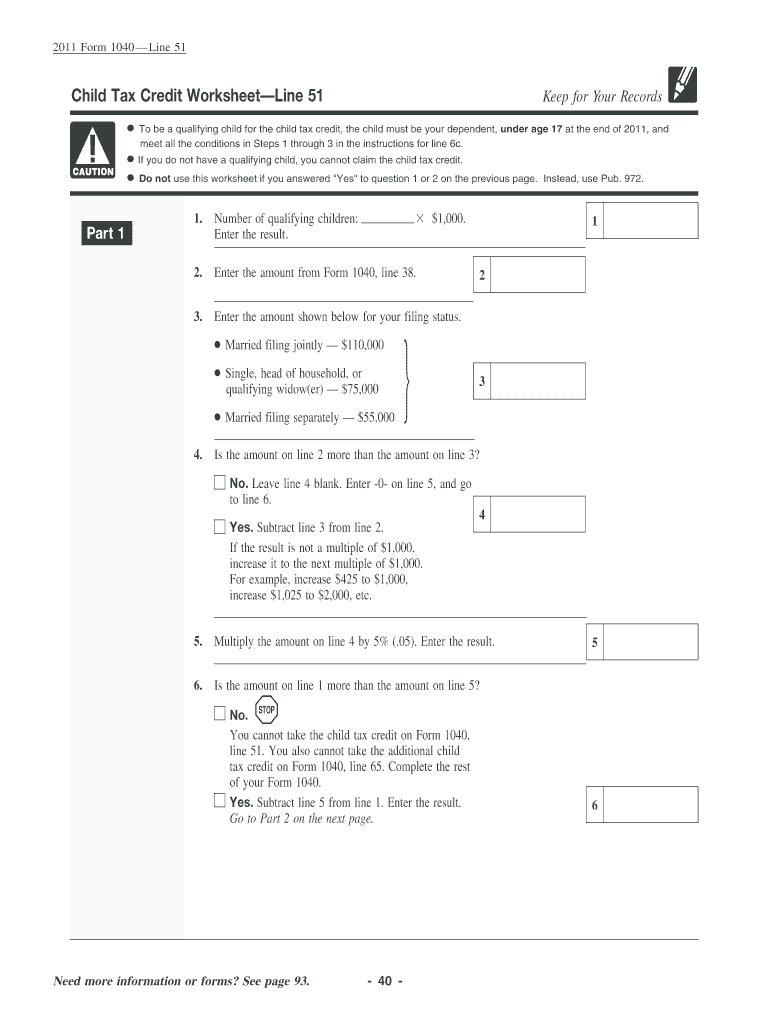

Child Tax Credit Worksheet Parents, this is what happens to your

To claim the credit, you must complete irs form 8880 and include it with your tax return. Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file. Web in order to claim the saver’s credit, you’ll need to complete irs form 8880, and attach it to your 1040,.

Web Find Irs Mailing Addresses For Taxpayers And Tax Professionals Filing Individual Federal Tax Returns For Their Clients In Missouri.

Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Web based on form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross income. Web form 8880 is used to figure the amount, if any, of your retirement savings contributions credit that can be claimed in the current year. Taxpayers may be eligible for.

Web 8880 You Cannot Take This Credit If Either Of The Following Applies.

Complete, edit or print tax forms instantly. This credit can be claimed in addition to any ira. Complete irs tax forms online or print government tax documents. Amount of the credit depending on your adjusted gross income.

Web Irs Form 8880 Is Used Specifically For The Retirement Saver’s Credit.

This credit can be claimed in addition to any ira. Web see form 8880, credit for qualified retirement savings contributions, for more information. To claim the credit, you must complete irs form 8880 and include it with your tax return. Tip this credit can be claimed in.

Complete, Edit Or Print Tax Forms Instantly.

Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Web taxpayers use irs form 8880 for the qualified retirement savings contribution credit. Web in order to claim the saver’s credit, you’ll need to complete irs form 8880, and attach it to your 1040, 1040a or 1040nr when you file your tax return. As of 2023, the credit is available to single taxpayers with a.