8995 Tax Form

8995 Tax Form - Web get the 8995 tax form and fill out qbid for the 2022 year. Web see the instructions for form 1041, u.s. Web the irs form 8995 is a crucial income tax document that taxpayers need to understand and complete accurately. Electing small business trusts (esbt). This form calculates the qualified business income (qbi) deduction for eligible taxpayers with pass. Web we are sending you letter 12c because we need more information to process your individual income tax return. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Web 8995 federal — qualified business income deduction simplified computation download this form print this form it appears you don't have a pdf plugin for this browser. Web the missouri department of revenue administers missouri's business tax laws, and collects sales and use tax, employer withholding, motor fuel tax, cigarette tax, financial. In this article, we will walk you through.

Ad register and subscribe now to work on your irs qualified business income deduction form. Electing small business trusts (esbt). Web what is form 8995? Web we are sending you letter 12c because we need more information to process your individual income tax return. Income tax return for estates and trusts. Web 8995 federal — qualified business income deduction simplified computation download this form print this form it appears you don't have a pdf plugin for this browser. Web when mailing your federal amended return, you will need to send the following: This form calculates the qualified business income (qbi) deduction for eligible taxpayers with pass. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or.

The newest instructions for business owners & examples. Web 8995 federal — qualified business income deduction simplified computation download this form print this form it appears you don't have a pdf plugin for this browser. Web form 8995 is the simplified form and is used if all of the following are true: The computation of the federal qualified business income. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). In order to understand form 8995, business owners should first understand the qualified business income tax (qbit) deduction. Web when mailing your federal amended return, you will need to send the following: In this article, we will walk you through. Web what is the purpose of the irs form 8995, and when do you need to use it? It has four parts and four additional schedules designed to help.

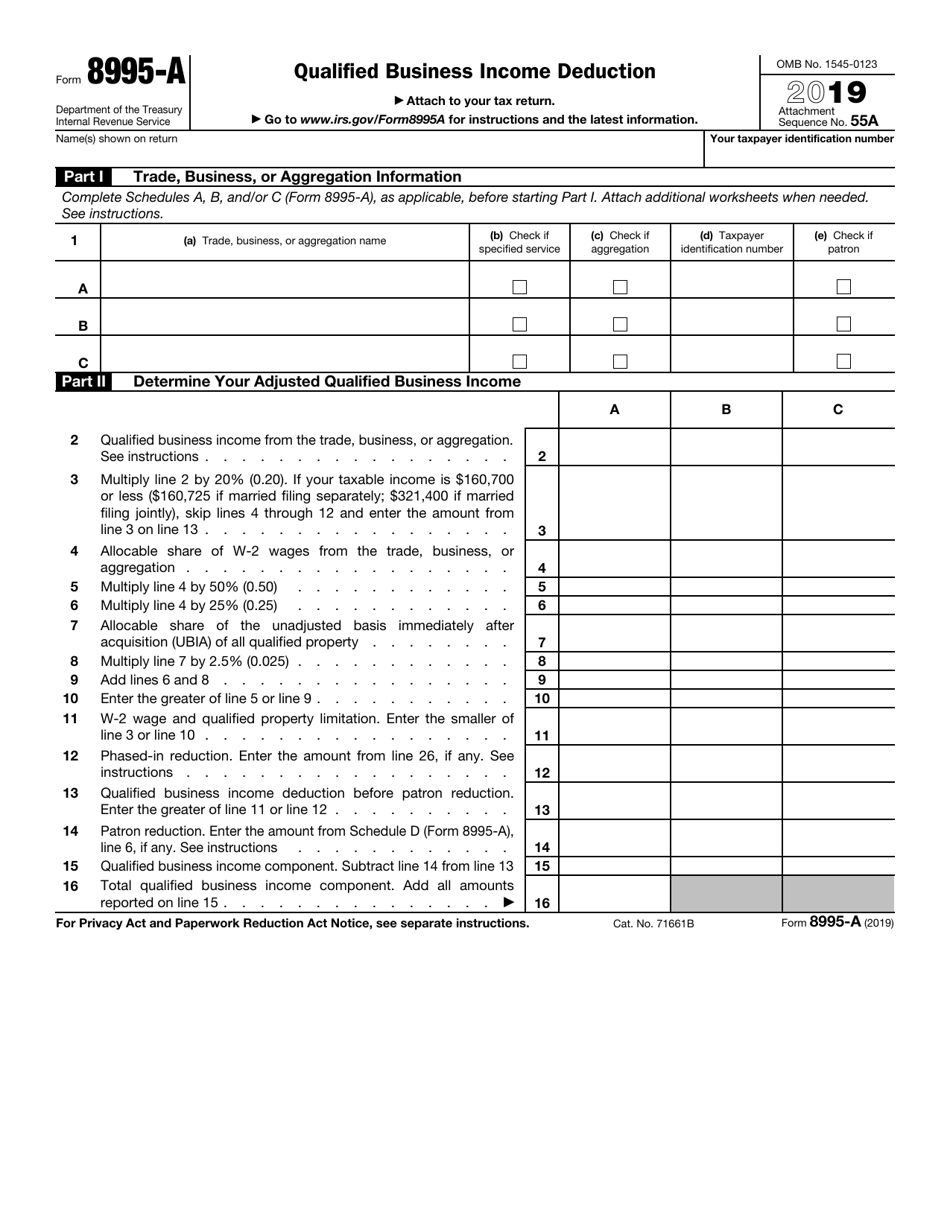

IRS Form 8995A Download Fillable PDF or Fill Online Qualified Business

In order to understand form 8995, business owners should first understand the qualified business income tax (qbit) deduction. Complete, edit or print tax forms instantly. Web get the 8995 tax form and fill out qbid for the 2022 year. Web what is the purpose of the irs form 8995, and when do you need to use it? Web the missouri.

What is Form 8995A? TurboTax Tax Tips & Videos

In this article, we will walk you through. Web when mailing your federal amended return, you will need to send the following: The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or. This form calculates the qualified business income (qbi) deduction for eligible taxpayers with pass. Web one such document is the federal tax form.

Form 8995 Fill Out and Sign Printable PDF Template signNow

Web what is the purpose of the irs form 8995, and when do you need to use it? Ad register and subscribe now to work on your irs qualified business income deduction form. An esbt must compute the qbi deduction separately for. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid)..

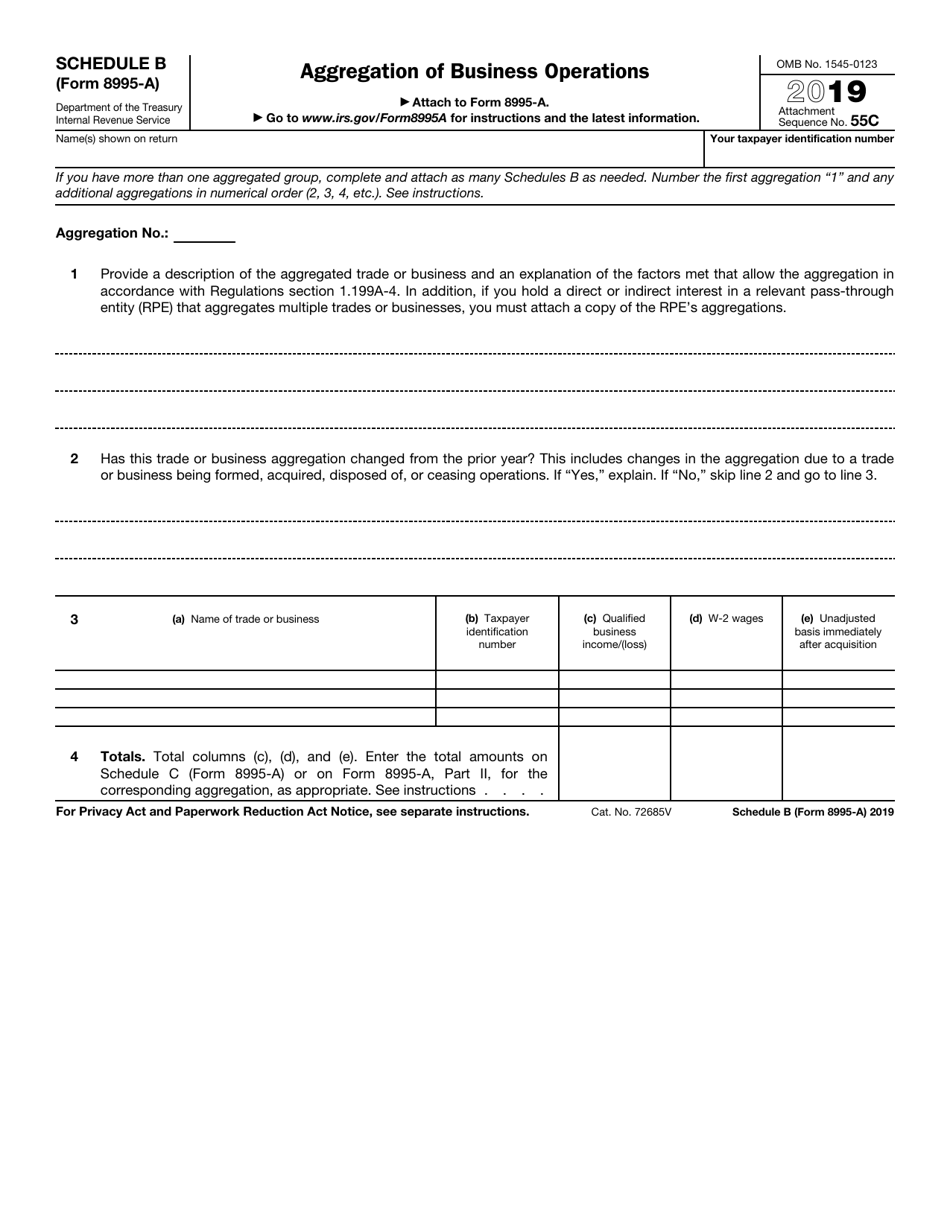

IRS Form 8995A Schedule B Download Fillable PDF or Fill Online

Web we are sending you letter 12c because we need more information to process your individual income tax return. An esbt must compute the qbi deduction separately for. The newest instructions for business owners & examples. Ad register and subscribe now to work on your irs qualified business income deduction form. In order to understand form 8995, business owners should.

IRS Form 8995 Download Fillable PDF or Fill Online Qualified Business

Complete, edit or print tax forms instantly. This form calculates the qualified business income (qbi) deduction for eligible taxpayers with pass. Web the missouri department of revenue administers missouri's business tax laws, and collects sales and use tax, employer withholding, motor fuel tax, cigarette tax, financial. Web form 8995 department of the treasury internal revenue service qualified business income deduction.

Staying on Top of Changes to the 20 QBI Deduction (199A) One Year

Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. In order to understand form 8995, business owners should first understand the qualified business income tax (qbit) deduction. Deduction as if the affected business entity was. The newest instructions for business owners & examples. An esbt must compute the.

QBI gets 'formified'

Complete, edit or print tax forms instantly. The computation of the federal qualified business income. Ad register and subscribe now to work on your irs qualified business income deduction form. The newest instructions for business owners & examples. Web we are sending you letter 12c because we need more information to process your individual income tax return.

IRS Form 8995 Instructions Your Simplified QBI Deduction

The document pertains to calculating and documenting the. Income tax return for estates and trusts. Web one such document is the federal tax form 8995, which is required for taxpayers who want to claim the qualified business income deduction. Web what is form 8995? Web form 8995 is the simplified form and is used if all of the following are.

Form 8995 Basics & Beyond

This form calculates the qualified business income (qbi) deduction for eligible taxpayers with pass. Web what is form 8995? Web the irs form 8995 is a crucial income tax document that taxpayers need to understand and complete accurately. The document pertains to calculating and documenting the. The newest instructions for business owners & examples.

Other Version Form 8995A 8995 Form Product Blog

In order to understand form 8995, business owners should first understand the qualified business income tax (qbit) deduction. Complete, edit or print tax forms instantly. This form calculates the qualified business income (qbi) deduction for eligible taxpayers with pass. Web when mailing your federal amended return, you will need to send the following: Electing small business trusts (esbt).

It Has Four Parts And Four Additional Schedules Designed To Help.

The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or. Web what is form 8995? In order to understand form 8995, business owners should first understand the qualified business income tax (qbit) deduction. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid).

Web Form 8995 Department Of The Treasury Internal Revenue Service Qualified Business Income Deduction Simplified Computation Attach To Your Tax Return.

The computation of the federal qualified business income. This form calculates the qualified business income (qbi) deduction for eligible taxpayers with pass. Web when mailing your federal amended return, you will need to send the following: Electing small business trusts (esbt).

Deduction As If The Affected Business Entity Was.

Web the irs form 8995 is a crucial income tax document that taxpayers need to understand and complete accurately. Web the missouri department of revenue administers missouri's business tax laws, and collects sales and use tax, employer withholding, motor fuel tax, cigarette tax, financial. Web one such document is the federal tax form 8995, which is required for taxpayers who want to claim the qualified business income deduction. Income tax return for estates and trusts.

Web We Are Sending You Letter 12C Because We Need More Information To Process Your Individual Income Tax Return.

Web form 8995 is the simplified form and is used if all of the following are true: Web get the 8995 tax form and fill out qbid for the 2022 year. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. An esbt must compute the qbi deduction separately for.