941 Form 2018

941 Form 2018 - Web you must file irs form 941 if you operate a business and have employees working for you. Web year to complete ohio it 941, the annual reconciliation. Report income taxes, social security tax, or medicare tax withheld from. Web form 941 for 2023: January 2018) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. A tax transcript to detail the filings and payments made on. Foreign account tax compliance act (fatca) registration 2018 form 8957. Employers in puerto rico use this form to: Web employer's quarterly federal tax return for 2021. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file.

Report income taxes, social security tax, or medicare tax withheld from. Web you must file irs form 941 if you operate a business and have employees working for you. We need it to figure and collect the right amount of tax. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Web 2018 form 4419 application for filing information returns electronically template. Web form 941 for 2023: Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who. January 2018) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122.

January 2018) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Certain employers whose annual payroll tax and withholding liabilities. Foreign account tax compliance act (fatca) registration 2018 form 8957. Web form 941 for 2023: For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of. Web you must file irs form 941 if you operate a business and have employees working for you. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Report income taxes, social security tax, or medicare tax withheld from. Web employer's quarterly federal tax return for 2021.

Gallery of Il 941 form 2018 Lovely Anthracene Based Semiconductors for

Web see the box to the right. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Web you must file irs form 941 if you operate a business and have employees working for you. Web 2018 form 4419 application for filing information returns electronically template. Report income taxes, social security tax, or medicare.

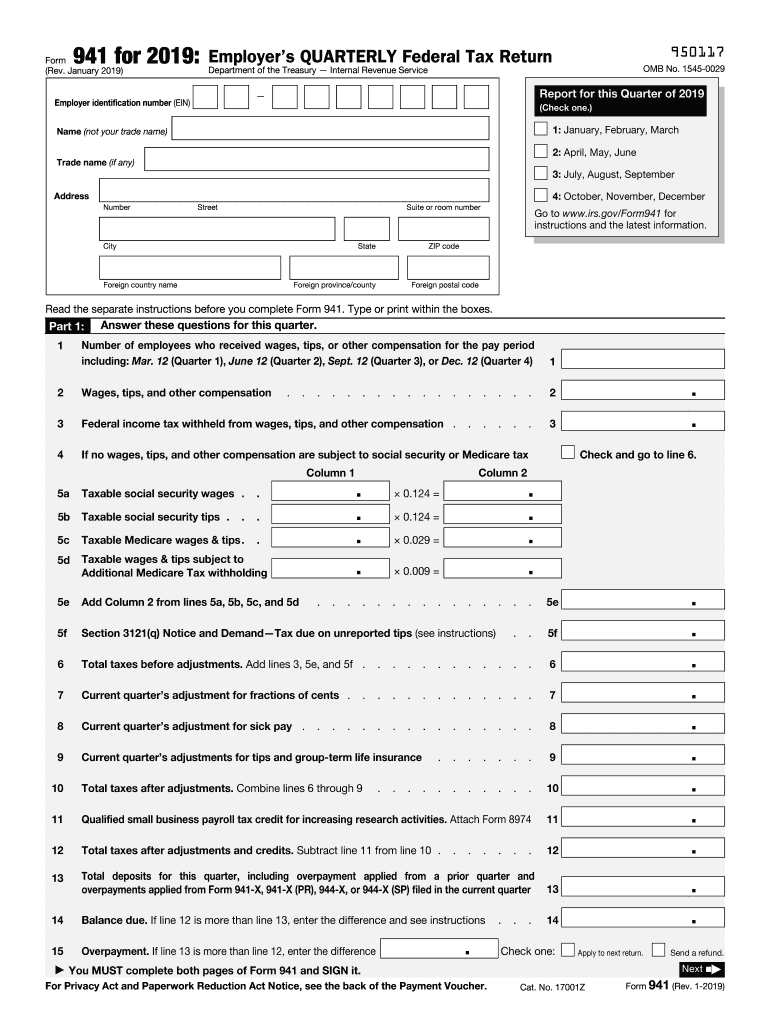

How to fill out IRS Form 941 2019 PDF Expert

Web form 941 employer's quarterly federal tax return. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Web about form 941 (pr), employer's quarterly federal tax. Web see the box to the right. Web we ask for the information on form 941 to carry out the internal revenue laws.

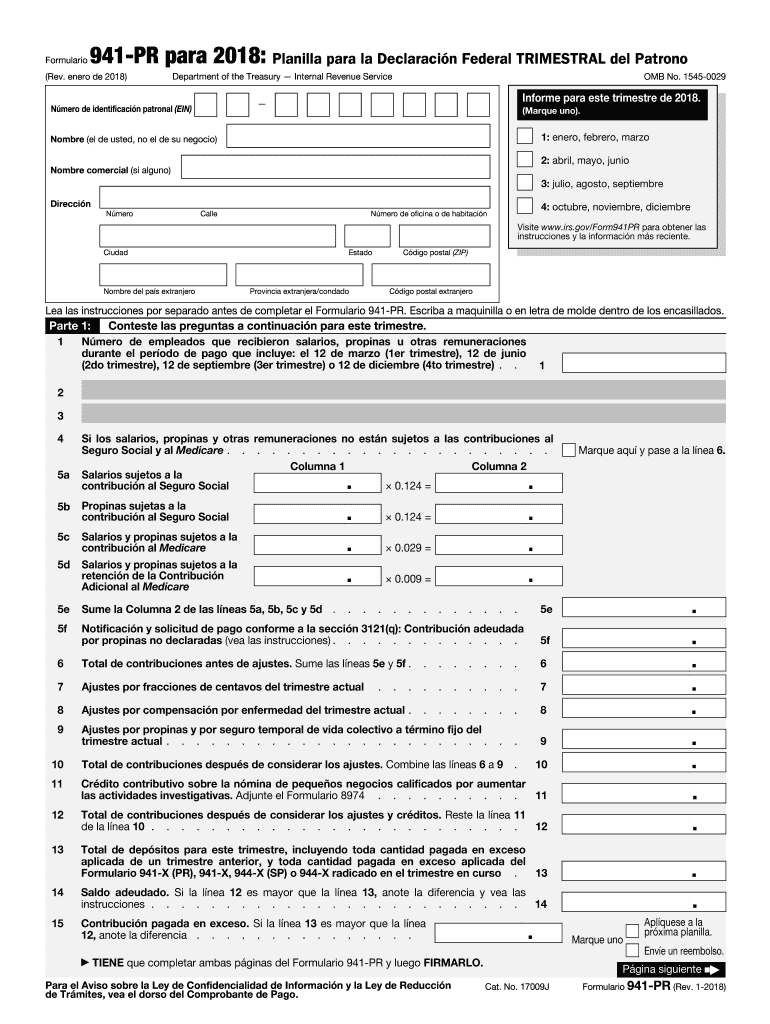

2018 Form IRS 941PR Fill Online, Printable, Fillable, Blank PDFfiller

Web employer's quarterly federal tax return for 2021. Web form 941 for 2018: January 2018) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Certain employers whose annual payroll tax and withholding liabilities. April, may, june read the separate instructions before completing this form.

3.11.13 Employment Tax Returns Internal Revenue Service

Web you must file irs form 941 if you operate a business and have employees working for you. Web employer's quarterly federal tax return for 2021. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. Certain employers whose annual payroll tax and withholding liabilities. Federal tax return american samoa,.

Form 941 Instructions & FICA Tax Rate [+ Mailing Address]

Form 941 is used by employers. Web form 941 for 2023: Federal tax return american samoa, guam, the commonwealth of the northern department of the treasury — internal revenue service — mariana islands,. We need it to figure and collect the right amount of tax. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion.

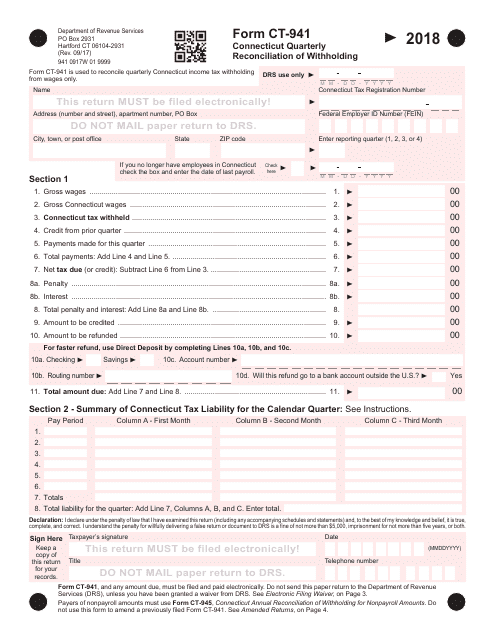

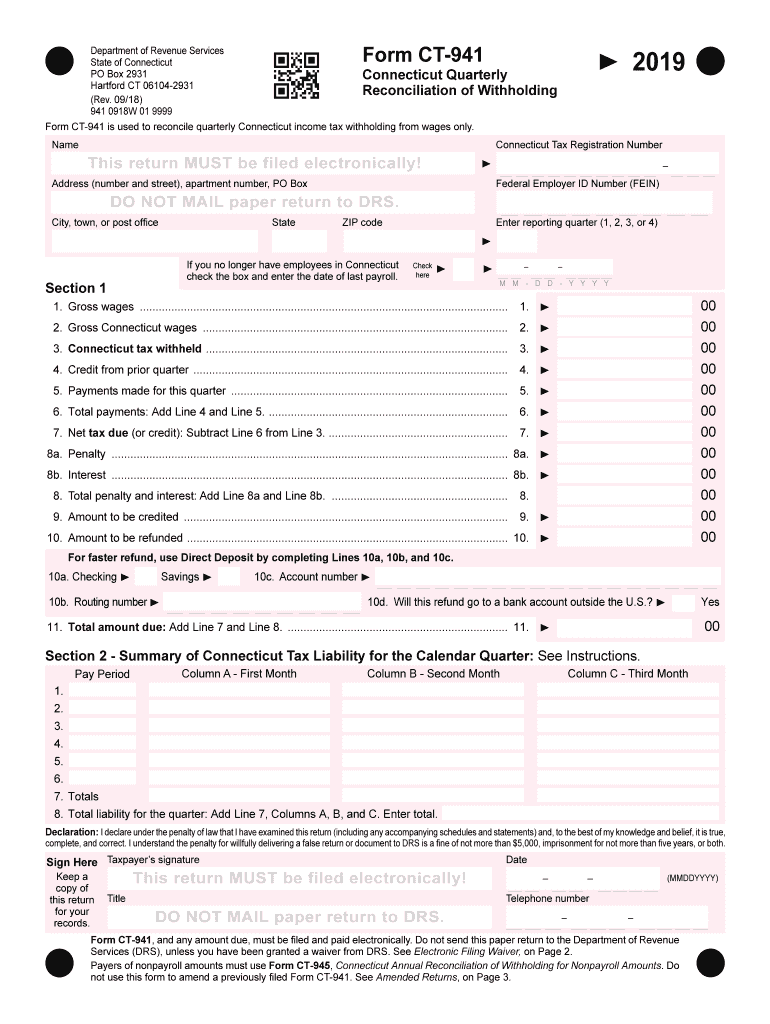

Form CT941 Download Printable PDF or Fill Online Connecticut Quarterly

Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who. A tax transcript to detail the filings and payments made on. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web year to complete ohio it 941, the annual reconciliation. Web about.

Form 941 Fill Out and Sign Printable PDF Template signNow

Form 941 is used by employers. Web employer's quarterly federal tax return for 2021. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of. Web form 941 for 2018: Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file.

CT DRS CT941 2018 Fill out Tax Template Online US Legal Forms

Web see the box to the right. Web employer's quarterly federal tax return for 2021. Web form 941 for 2018: Employers in puerto rico use this form to: Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who.

Form 941

We need it to figure and collect the right amount of tax. January 2018) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Certain employers whose annual payroll tax and withholding liabilities. Federal tax return american samoa, guam, the commonwealth of the northern department of the treasury — internal revenue service — mariana.

Fill Free fillable F941sr Accessible Schedule R (Form 941) (Rev

Web employer's quarterly federal tax return for 2021. Web year to complete ohio it 941, the annual reconciliation. Federal tax return american samoa, guam, the commonwealth of the northern department of the treasury — internal revenue service — mariana islands,. Web an employer that owes employment taxes of $1,000 or less for the year can file form 944, employer’s annual.

Web 2018 Form 4419 Application For Filing Information Returns Electronically Template.

Form 941 is used by employers. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Foreign account tax compliance act (fatca) registration 2018 form 8957. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who.

Web Employer's Quarterly Federal Tax Return For 2021.

Certain employers whose annual payroll tax and withholding liabilities. Web year to complete ohio it 941, the annual reconciliation. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of. Web form 941 for 2018:

Web About Form 941 (Pr), Employer's Quarterly Federal Tax.

Federal tax return american samoa, guam, the commonwealth of the northern department of the treasury — internal revenue service — mariana islands,. January 2018) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Web see the box to the right. Web an employer that owes employment taxes of $1,000 or less for the year can file form 944, employer’s annual federal tax return if given irs permission to do so.

Web We Ask For The Information On Form 941 To Carry Out The Internal Revenue Laws Of The United States.

April, may, june read the separate instructions before completing this form. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Employers in puerto rico use this form to: Web if you discover an overpayment after the year closes, request for the refund on the annual reconciliation form it 941.

![Form 941 Instructions & FICA Tax Rate [+ Mailing Address]](https://fitsmallbusiness.com/wp-content/uploads/2018/02/Form-941-Instructions-FICA-Tax-Rate-2017.png)