941 Form 2019

941 Form 2019 - Certain employers whose annual payroll tax and withholding. Edit your 2018 form 941 fillable online. Try it for free now! Complete, edit or print tax forms instantly. Web christopher wood, cpp. For medicare, the tax equals 2.9 percent on the full amount of the. February 28, 2022 · 9 minute read. Employee's withholding certificate form 941; Ad access irs tax forms. You must file irs form 941 if you operate a business and have employees working for you.

We need it to figure and collect the right amount of tax. Type text, add images, blackout confidential details, add comments, highlights and more. You must file irs form 941 if you operate a business and have employees working for you. This form reports withholding of federal income taxes from employees’ wages or salaries, as well as. Ad access irs tax forms. Upload, modify or create forms. Employers engaged in a trade or business who. Web for 2019, the social security tax equals 12.4 percent of the first $132,900 of compensation. Employers use this form to report income. Form 941 is used by employers.

Employers use this form to report income. For more details about filing federal forms in quickbooks online, see the. We need it to figure and collect the right amount of tax. You must file form 941 by. Type text, add images, blackout confidential details, add comments, highlights and more. Complete, edit or print tax forms instantly. Form 941 is a quarterly form, meaning employers are required to file it on a quarterly basis. You must file irs form 941 if you operate a business and have employees working for you. Form 941 is used by employers. For employers who withhold taxes from employee's paychecks or who must pay the.

Form 941

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web an employer that owes employment taxes of $1,000 or less for the year can file form 944, employer’s annual federal tax return if given irs permission to do so. Web form 941 (2021) employer's quarterly federal tax return.

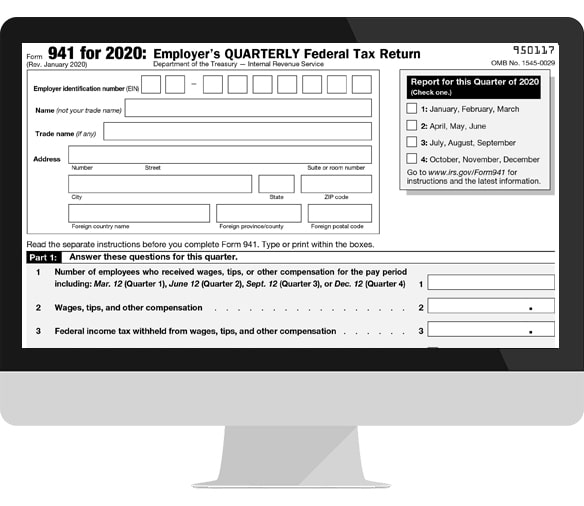

File Form 941 Online for 2019 Express941

You must file form 941 by. For employers who withhold taxes from employee's paychecks or who must pay the. Web an employer that owes employment taxes of $1,000 or less for the year can file form 944, employer’s annual federal tax return if given irs permission to do so. Employers engaged in a trade or business who. Complete, edit or.

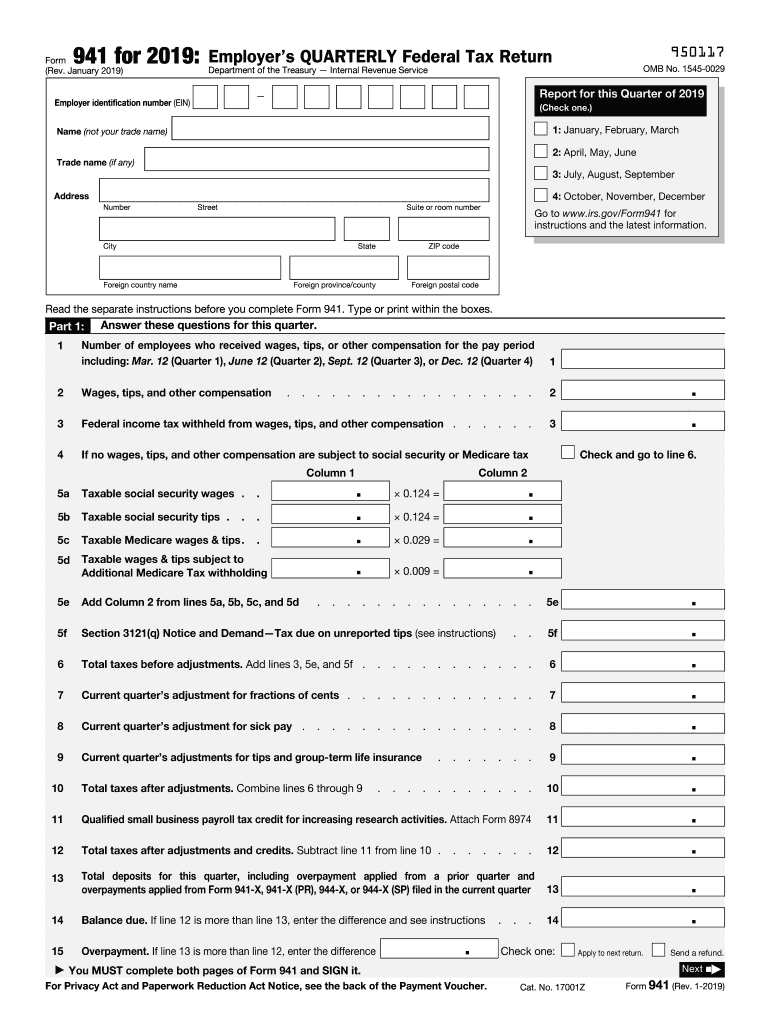

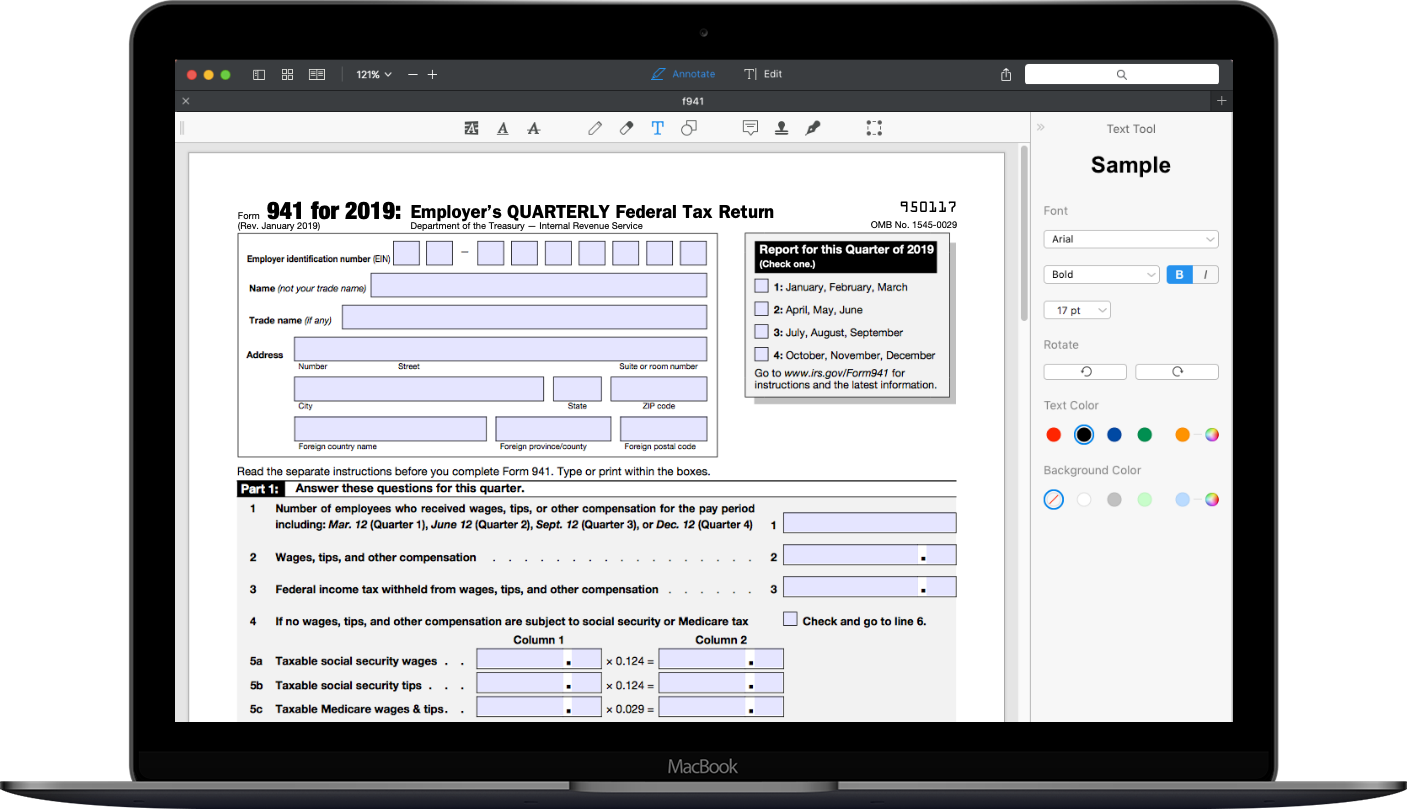

How to fill out IRS Form 941 2019 PDF Expert

Ad access irs tax forms. You must file form 941 by. January 2019) employer’s quarterly federal tax returndepartment of the treasury — internal revenue service 950117 omb no. Web irs form 941 is the employer’s quarterly tax return. You must file irs form 941 if you operate a business and have employees working for you.

printable 941 form 2019 PrintableTemplates

For employers who withhold taxes from employee's paychecks or who must pay the. Form 941 is a quarterly form, meaning employers are required to file it on a quarterly basis. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web form 941 (2021) employer's quarterly federal tax return.

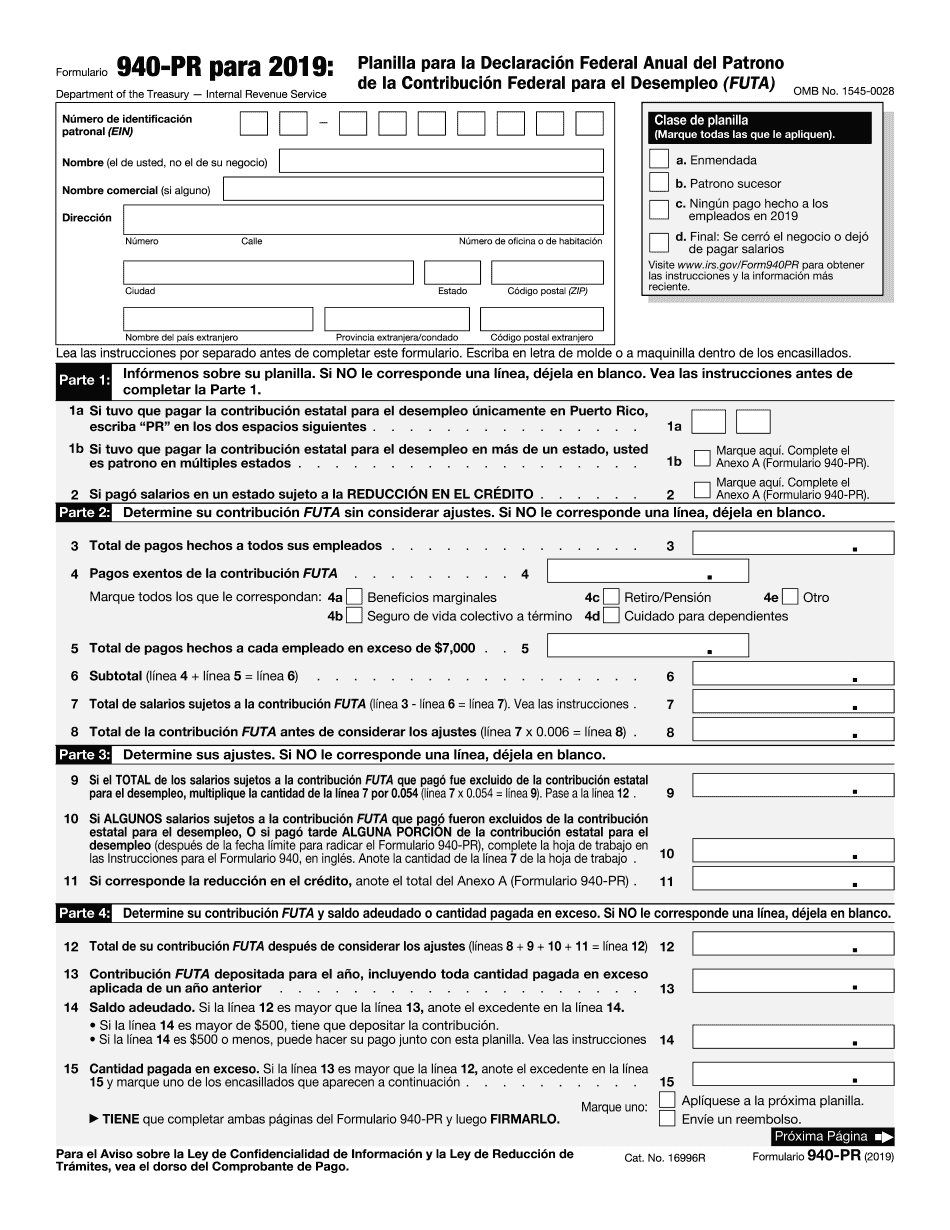

941 pr 2019 2020 Fill Online, Printable, Fillable Blank form940

Certain employers whose annual payroll tax and withholding. Web march 28, 2019 form 941 is a internal revenue service (irs) tax form for employers in the u.s. Complete, edit or print tax forms instantly. Web form 941 for 2021: Form 941 is used by employers.

Form 941 Fill Out and Sign Printable PDF Template signNow

Web for 2019, the social security tax equals 12.4 percent of the first $132,900 of compensation. Web form 941 (2021) employer's quarterly federal tax return for 2021. Employee's withholding certificate form 941; For employers who withhold taxes from employee's paychecks or who must pay the. Type text, add images, blackout confidential details, add comments, highlights and more.

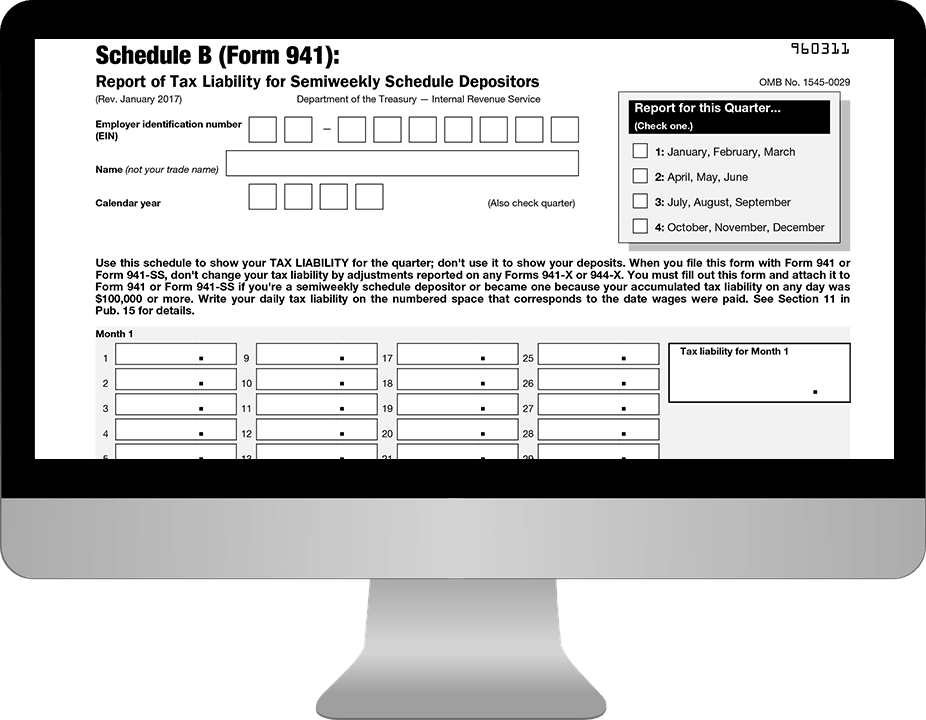

Fillable Form 941 Schedule B 2020 Download Printable 941 for Free

Web form 941 for 2021: Form 941 is used by employers. Upload, modify or create forms. February 28, 2022 · 9 minute read. Web form 941 (2021) employer's quarterly federal tax return for 2021.

How to fill out IRS Form 941 2019 PDF Expert

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web an employer that owes employment taxes of $1,000 or less for the year can file form 944, employer’s annual federal tax return if given irs permission to do so. Ad access irs tax forms. Certain employers whose annual.

10 Form Where To Mail 10 How 10 Form Where To Mail 10 Can Increase Your

Certain employers whose annual payroll tax and withholding. For more details about filing federal forms in quickbooks online, see the. Web form 941 for 2023: Try it for free now! Web for 2019, the social security tax equals 12.4 percent of the first $132,900 of compensation.

printable 941 form 2019 PrintableTemplates

July 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) name. Web an employer that owes employment taxes of $1,000 or less for the year can file form 944, employer’s annual federal tax return if given irs permission to do so. Complete, edit or print tax forms instantly. You must file.

Web Christopher Wood, Cpp.

Complete, edit or print tax forms instantly. For employers who withhold taxes from employee's paychecks or who must pay the. Sign it in a few clicks. Employee's withholding certificate form 941;

For Medicare, The Tax Equals 2.9 Percent On The Full Amount Of The.

Web form 941 for 2021: Try it for free now! For more details about filing federal forms in quickbooks online, see the. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number.

Upload, Modify Or Create Forms.

Employers use this form to report income. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number. Web form 941 (2021) employer's quarterly federal tax return for 2021. January 2019) employer’s quarterly federal tax returndepartment of the treasury — internal revenue service 950117 omb no.

February 28, 2022 · 9 Minute Read.

You must file form 941 by. Employers engaged in a trade or business who. Web march 28, 2019 form 941 is a internal revenue service (irs) tax form for employers in the u.s. Web they can pull up your account and help you get the 2019's 941 forms you've previously filed.