982 Form Instructions

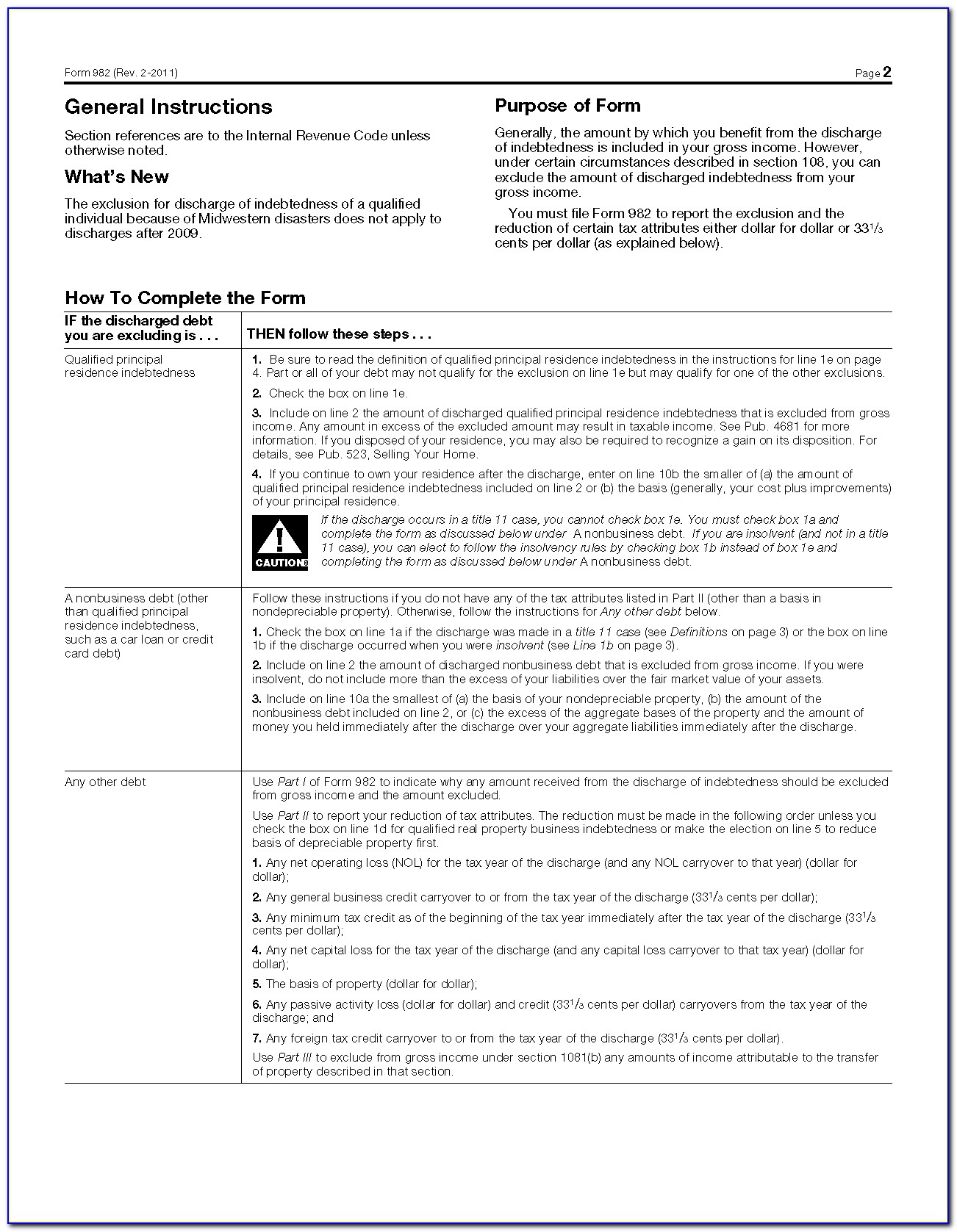

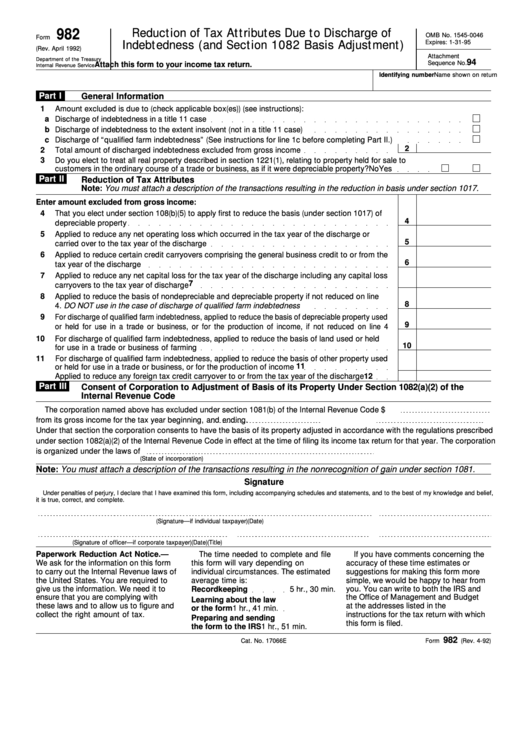

982 Form Instructions - Debt cancelled in a title 11 bankruptcy; Cancellation of qualified principal residence indebtedness, aka mortgage debt relief; Unless your debt forgiveness falls into a defined category, line 1b may help relieve you of your tax burden. Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to excluded from taxable income. Web irs form 982 instructions by forrest baumhover may 9, 2023 reading time: Web learn five ways to reduce or eliminate your cancellation of debt income and avoid the inherent trap tax with the form 982. However, ensure you read the instructions. Web instructions for form 982 (rev. Obtain the form at the irs website. Write your name and the identifying number in the column provided for both.

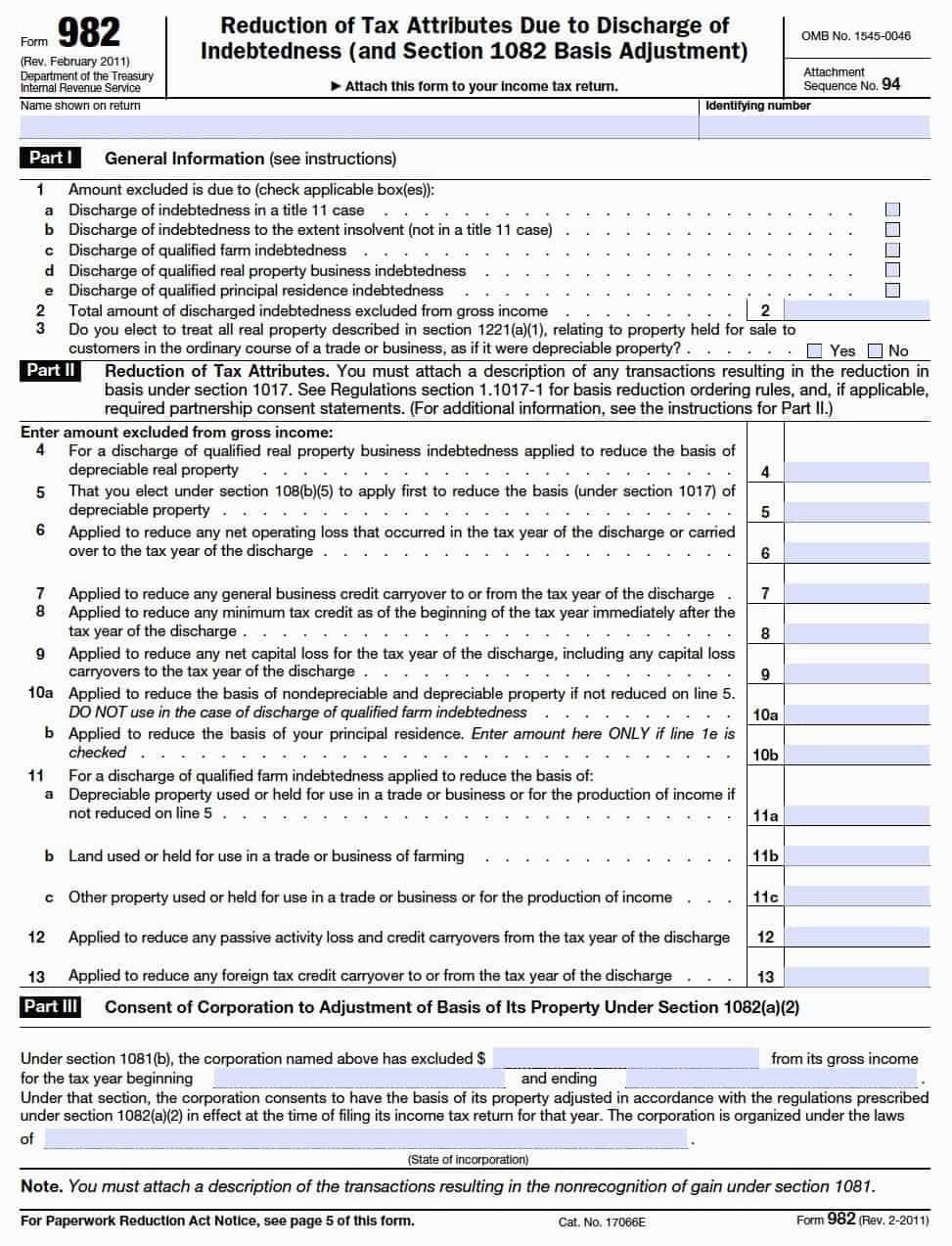

Write your name and the identifying number in the column provided for both. Cancellation of qualified principal residence indebtedness, aka mortgage debt relief; Web irs form 982 instructions by forrest baumhover may 9, 2023 reading time: Get a free tax quote call us: Step by step instructions comments if you have discharged or forgiven debt, the internal revenue service expects you to include that debt as taxable income. Form 982 is used to find the discharged indebtedness amount that can be excluded from gross income. Instructions for form 990 return of organization exempt from income tax (2022) instruction in html. Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to excluded from taxable income. Attach this form to your income tax return. Web form 982, reduction of tax attributes due to discharge of indebtedness at the top of form 982, you’ll find a series of check boxes that indicated why you are filling out this form.

12 minutes watch video get the form! Attach this form to your income tax return. We'll automatically generate form 982 if your cancelled debt is due to: However, ensure you read the instructions. Web form 982, reduction of tax attributes due to discharge of indebtedness at the top of form 982, you’ll find a series of check boxes that indicated why you are filling out this form. Instructions for form 990 return of organization exempt from income tax (2022) download pdf. Reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment). Web irs form 982 instructions by forrest baumhover may 9, 2023 reading time: For instructions and the latest information. Write your name and the identifying number in the column provided for both.

Form 982 Insolvency Worksheet —

Reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment). Web irs form 982 instructions by forrest baumhover may 9, 2023 reading time: Web information about form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment), including recent updates, related forms, and instructions on how to file. Web form 982,.

Irs Insolvency Worksheet Form Printable Worksheets and Activities for

Instructions for form 990 return of organization exempt from income tax (2022) instruction in html. Web instructions for form 982 (rev. For instructions and the latest information. Better still, you can download irs form 982 here and fill it electronically. Form 982 is used to find the discharged indebtedness amount that can be excluded from gross income.

understanding irs form 982 Fill Online, Printable, Fillable Blank

Get a free tax quote call us: Debt cancelled in a title 11 bankruptcy; Instructions for form 990 return of organization exempt from income tax (2022) download pdf. We'll automatically generate form 982 if your cancelled debt is due to: Web information about form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment), including.

Form 982 Instructions Reasons Why 9 Is Grad Amended Return —

However, ensure you read the instructions. Get a free tax quote call us: March 2018)) section references are to the internal revenue code unless otherwise noted. Write your name and the identifying number in the column provided for both. December 2021) department of the treasury internal revenue service reduction of tax attributes due to discharge of indebtedness (and section 1082.

Cancellation Of Debt Form 982 Form Resume Examples EpDLA285xR

Web information about form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment), including recent updates, related forms, and instructions on how to file. For instructions and the latest information. Reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment). Form 982 is used to find the discharged indebtedness amount.

Form 982 Insolvency Worksheet

Obtain the form at the irs website. Web learn five ways to reduce or eliminate your cancellation of debt income and avoid the inherent trap tax with the form 982. Reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment). March 2018)) section references are to the internal revenue code unless otherwise noted. Web form 982,.

Form 982 Reduction Of Tax Attributes Due To Discharge Of Indebtedness

Instructions for form 990 return of organization exempt from income tax (2022) download pdf. Better still, you can download irs form 982 here and fill it electronically. Reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment). Attach this form to your income tax return. Step by step instructions comments if you have discharged or forgiven.

Fillable Form 982 Reduction Of Tax Attributes Due To Discharge Of

Instructions for form 990 return of organization exempt from income tax (2022) instruction in html. For instructions and the latest information. However, ensure you read the instructions. Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to excluded from taxable income. 12 minutes watch video get the form!

Debt Form 982 Form 982 Insolvency Worksheet —

However, ensure you read the instructions. Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to excluded from taxable income. Web learn five ways to reduce or eliminate your cancellation of debt income and avoid the inherent trap tax with the form 982. For instructions and the latest information. Better still,.

IRS Form 982 Instructions Discharge of Indebtedness

March 2018)) section references are to the internal revenue code unless otherwise noted. Web information about form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment), including recent updates, related forms, and instructions on how to file. Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled.

March 2018)) Section References Are To The Internal Revenue Code Unless Otherwise Noted.

Obtain the form at the irs website. However, ensure you read the instructions. Attach this form to your income tax return. For instructions and the latest information.

Instructions For Form 990 Return Of Organization Exempt From Income Tax (2022) Download Pdf.

Unless your debt forgiveness falls into a defined category, line 1b may help relieve you of your tax burden. Write your name and the identifying number in the column provided for both. Better still, you can download irs form 982 here and fill it electronically. 12 minutes watch video get the form!

Web Instructions For Form 982 (12/2021) Download Pdf.

Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to excluded from taxable income. Form 982 is used to find the discharged indebtedness amount that can be excluded from gross income. Get a free tax quote call us: Cancellation of qualified principal residence indebtedness, aka mortgage debt relief;

Step By Step Instructions Comments If You Have Discharged Or Forgiven Debt, The Internal Revenue Service Expects You To Include That Debt As Taxable Income.

Reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment). Debt cancelled in a title 11 bankruptcy; Web instructions for form 982 (rev. March 2018) department of the treasury internal revenue service.