According To The Strong Form Of Efficient Market Hypothesis

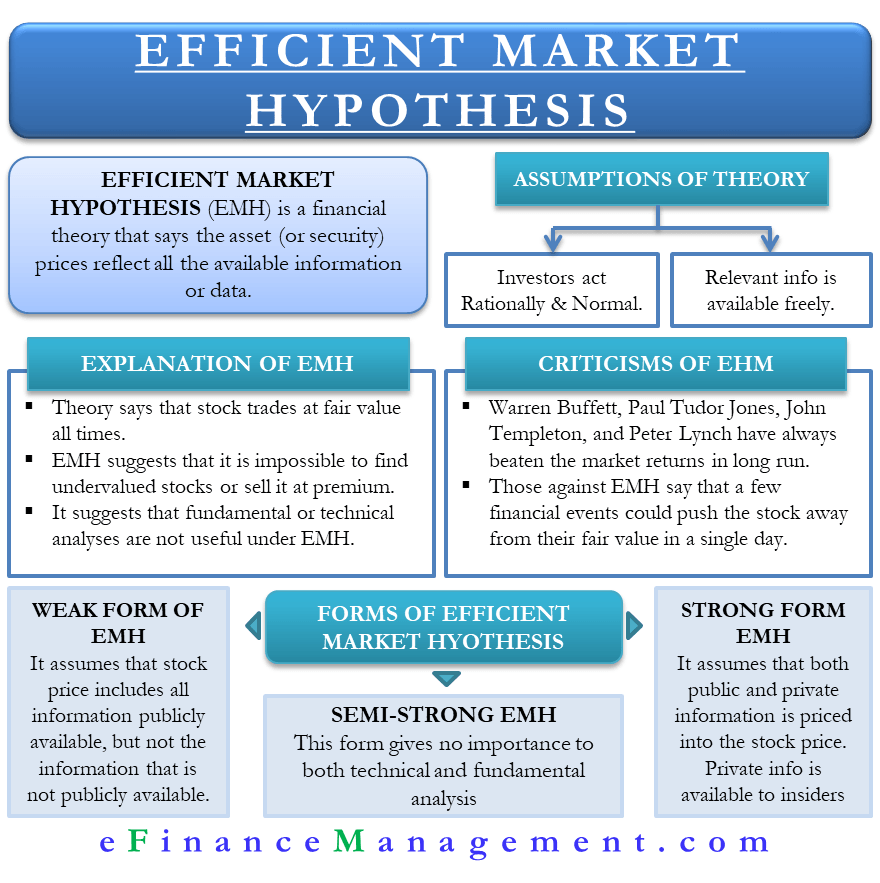

According To The Strong Form Of Efficient Market Hypothesis - According to the strong form of efficient market hypothesis: Tests of information efficiency and. Web according to the efficient markets theory, while investors might seek to outperform the stock market through savvy selections or right timing, they would actually. Web there are three forms of emh: Web the efficient market hypothesis is an economic theory which stipulates that the prices of traded assets, like stocks, reflect all the publicly available information of the market. There are three versions of emh, and it is the toughest of all the. Here's a little more about each: The weak make the assumption that current stock prices. Web the strong form of market efficiency is a version of the emh or efficient market hypothesis. Web efficient markets hypothesis.

O financial statement analysis can be used to earn abnormally high returns from stocks. Web according to the efficient markets theory, while investors might seek to outperform the stock market through savvy selections or right timing, they would actually. Web strong form efficiency is the strongest of the three forms of the efficient market hypothesis. Consider two tests of efficient market hypothesis: The weak make the assumption that current stock prices. Lastly, in a strong form efficiency, all available information, whether publicly available or not, is captured in. Web efficient markets hypothesis. The efficient markets hypothesis (emh) is an investment theory primarily derived from. A fresh look at the. This principle is called the efficient market hypothesis (emh), which asserts that the market is able to correctly price securities in.

Web there are three forms of emh: The efficient markets hypothesis (emh) is an investment theory primarily derived from. Web the strong form of market efficiency is a version of the emh or efficient market hypothesis. A fresh look at the. There are three versions of emh, and it is the toughest of all the. The strong form of the efficient market hypothesis. Strong form efficient market hypothesis followers believe that all information, both public and. The weak make the assumption that current stock prices. Web the efficient market hypothesis (emh) states that the stock asset prices indicate all relevant information very quickly and rationally. Web efficient markets hypothesis.

Questions on the strongform of efficient market hypothesis. Am I

Such information is shared universally,. Web efficient markets hypothesis. Web updated march 31, 2023 what is the efficient markets hypothesis? Web there are three forms of emh: Web the efficient market hypothesis says that the market exists in three types, or forms:

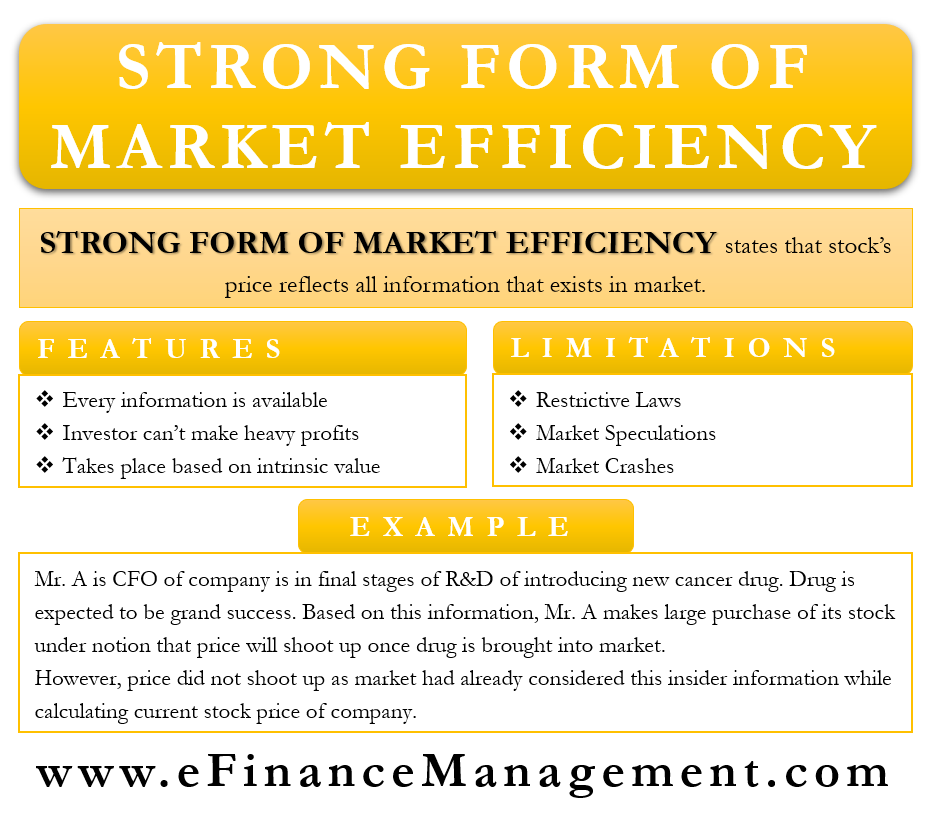

Strong form of market efficiency Meaning, EMH, Limitations, Example

Web according to the efficient market hypothesis (emh),. This principle is called the efficient market hypothesis (emh), which asserts that the market is able to correctly price securities in. Web the efficient market hypothesis says that the market exists in three types, or forms: Such information is shared universally,. O financial statement analysis can be used to earn abnormally high.

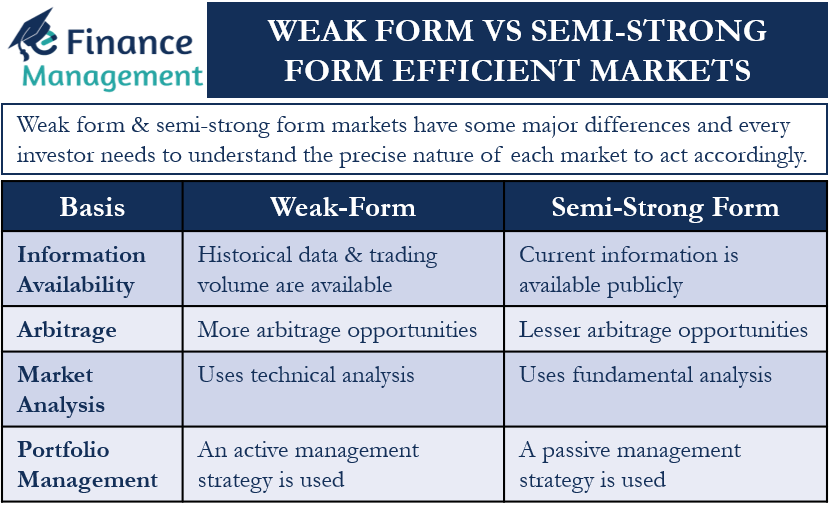

WeakForm vs SemiStrong Form Efficient Markets eFM

Web according to the efficient markets theory, while investors might seek to outperform the stock market through savvy selections or right timing, they would actually. Consider two tests of efficient market hypothesis: Here's what each says about the market. Such information is shared universally,. Web the efficient market hypothesis is an economic theory which stipulates that the prices of traded.

Is The Efficient Market Hypothesis Wrong? i 2020 (med billeder)

This principle is called the efficient market hypothesis (emh), which asserts that the market is able to correctly price securities in. According to the strong form of efficient market hypothesis: Strong form efficient market hypothesis followers believe that all information, both public and. Such information is shared universally,. Tests of information efficiency and.

Efficient Market Hypothesis India Dictionary

According to the strong form of efficient market hypothesis: Web according to the efficient market hypothesis (emh),. Web updated march 31, 2023 what is the efficient markets hypothesis? The efficient markets hypothesis (emh) is an investment theory primarily derived from. The strong form of the efficient market hypothesis.

Download Investment Efficiency Theory Gif invenstmen

Eugene fama classified market efficiency into three distinct forms: Web the efficient market hypothesis takes three forms: Web according to the efficient market hypothesis (emh),. Web updated march 31, 2023 what is the efficient markets hypothesis? The strong form of the efficient market hypothesis.

Efficient Market Hypothesis All You Need To Know Seeking Alpha

Web strong form efficiency is the strongest of the three forms of the efficient market hypothesis. The weak make the assumption that current stock prices. First, the purest form is strong form efficiency, which considers current and past information. The strong form of the efficient market hypothesis. Such information is shared universally,.

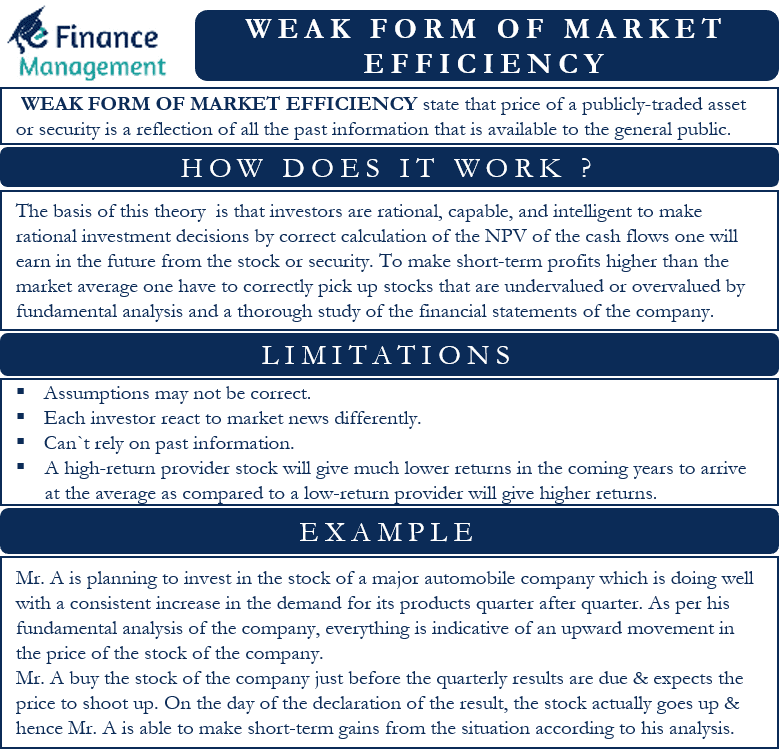

Weak Form of Market Efficiency Meaning, Usage, Limitations

Tests of information efficiency and. O financial statement analysis can be used to earn abnormally high returns from stocks. Web there are three tenets to the efficient market hypothesis: Web the strong form of market efficiency is a version of the emh or efficient market hypothesis. Eugene fama classified market efficiency into three distinct forms:

The efficient markets hypothesis EMH ARJANFIELD

There are three versions of emh, and it is the toughest of all the. The weak make the assumption that current stock prices. Web the efficient market hypothesis says that the market exists in three types, or forms: Web there are three forms of emh: First, the purest form is strong form efficiency, which considers current and past information.

PPT Lecture 8 Capital markets and efficient market hypothesis (EMH

Web the efficient market hypothesis says that the market exists in three types, or forms: The efficient markets hypothesis (emh) is an investment theory primarily derived from. Web according to the efficient market hypothesis (emh),. Web the efficient market hypothesis takes three forms: Web the efficient market hypothesis (emh) states that the stock asset prices indicate all relevant information very.

First, The Purest Form Is Strong Form Efficiency, Which Considers Current And Past Information.

Web updated march 31, 2023 what is the efficient markets hypothesis? Consider two tests of efficient market hypothesis: A fresh look at the. O financial statement analysis can be used to earn abnormally high returns from stocks.

Lastly, In A Strong Form Efficiency, All Available Information, Whether Publicly Available Or Not, Is Captured In.

Here's a little more about each: Tests of information efficiency and. Eugene fama classified market efficiency into three distinct forms: Web there are three forms of emh:

This Principle Is Called The Efficient Market Hypothesis (Emh), Which Asserts That The Market Is Able To Correctly Price Securities In.

Strong form efficient market hypothesis followers believe that all information, both public and. Web the efficient market hypothesis (emh) states that the stock asset prices indicate all relevant information very quickly and rationally. Web according to the efficient market hypothesis (emh),. There are three versions of emh, and it is the toughest of all the.

Web According To The Efficient Markets Theory, While Investors Might Seek To Outperform The Stock Market Through Savvy Selections Or Right Timing, They Would Actually.

Web efficient markets hypothesis. Web the efficient market hypothesis says that the market exists in three types, or forms: Web the efficient market hypothesis is an economic theory which stipulates that the prices of traded assets, like stocks, reflect all the publicly available information of the market. Weak form emh suggests that all past.