Accrued Expenses Are Ordinarily Reported On The Balance Sheet As

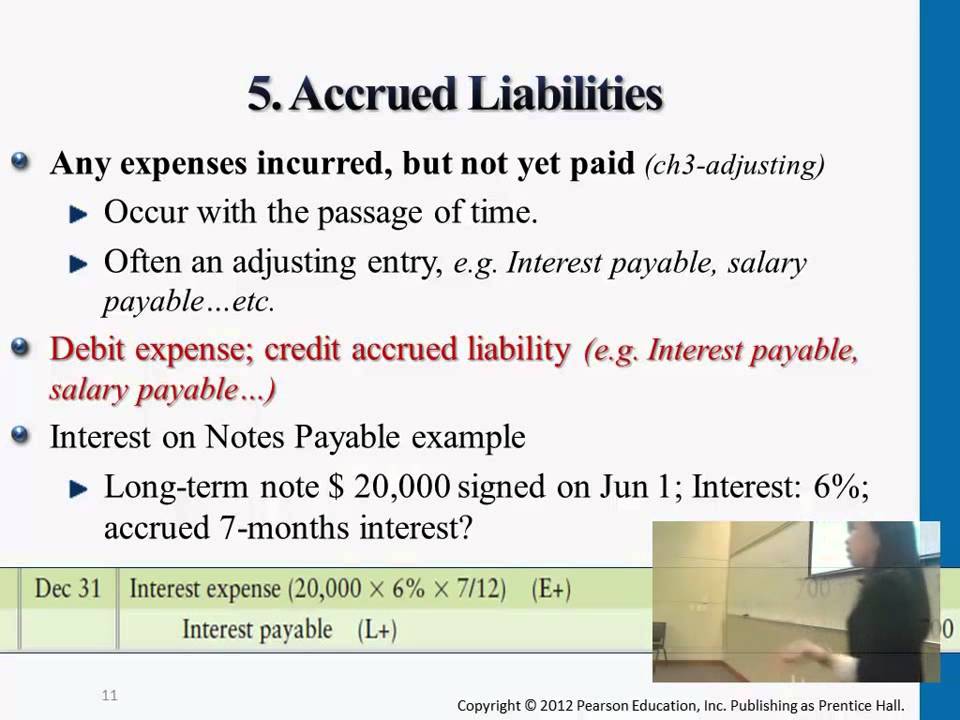

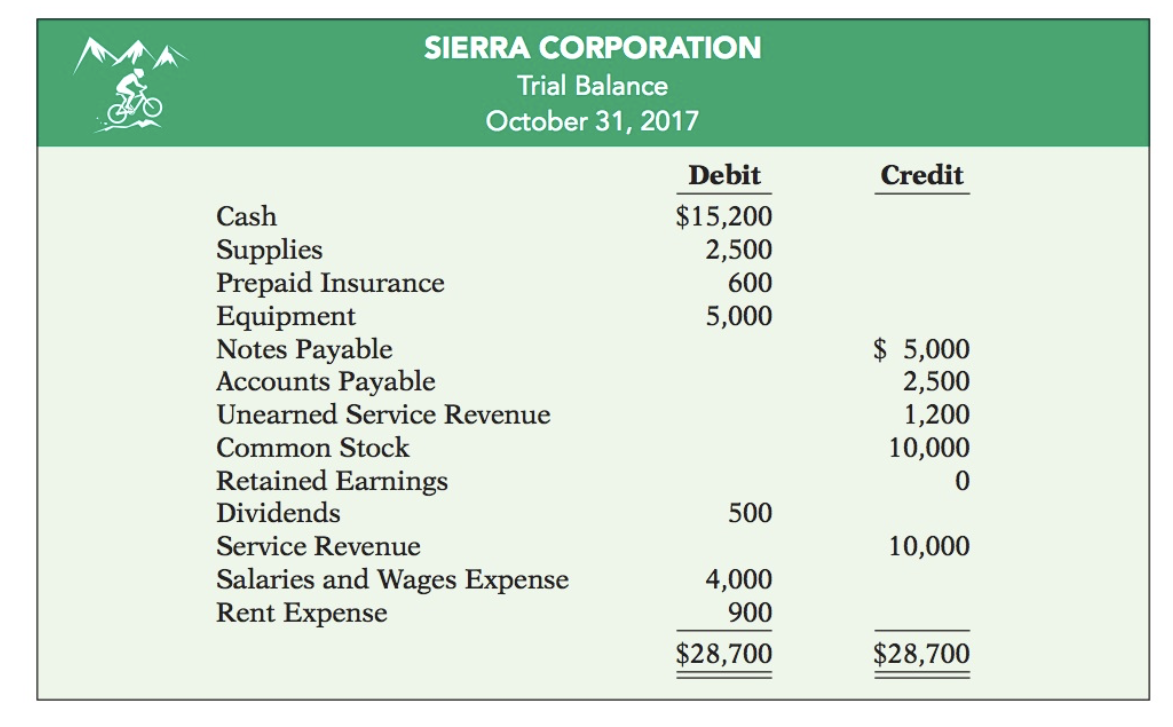

Accrued Expenses Are Ordinarily Reported On The Balance Sheet As - Web an accrual is an expense that has been recognized in the current period for which a supplier invoice has not yet been received, or revenue that has not yet been billed. Web accrued expenses are expenses incurred and for which the payment has not yet been made. As a result, liability for these expenditures is created and recorded as accrued liabilities (short term) on the. Accrued expenses and prepaid expenses are opposites. Accrued expenses haven’t yet been paid, they’re considered an added liability on the balance sheet. An accrued expense can be an. When an accrual is created, it is. In year 0, our historical period, we can calculate the driver as: Web since accrued expenses represent a company's obligation to make future cash payments, they are shown on a company's balance sheet as current liabilities. Accrued expenses % of opex (year 0) = $12m / $80m = 15.0%;

Web accrued expenses = $12m — decline by 0.5% as percentage of opex each year; Web since accrued expenses represent a company's obligation to make future cash payments, they are shown on a company's balance sheet as current liabilities. When an accrual is created, it is. Web accrued expenses are expenses incurred and for which the payment has not yet been made. Web an accrual is an expense that has been recognized in the current period for which a supplier invoice has not yet been received, or revenue that has not yet been billed. Accrued expenses % of opex (year 0) = $12m / $80m = 15.0%; An accrued expense can be an. Accrued expenses haven’t yet been paid, they’re considered an added liability on the balance sheet. In year 0, our historical period, we can calculate the driver as: Accrued expenses and prepaid expenses are opposites.

Web accrued expenses = $12m — decline by 0.5% as percentage of opex each year; When an accrual is created, it is. Accrued expenses haven’t yet been paid, they’re considered an added liability on the balance sheet. Accrued expenses % of opex (year 0) = $12m / $80m = 15.0%; Web since accrued expenses represent a company's obligation to make future cash payments, they are shown on a company's balance sheet as current liabilities. Accrued expenses and prepaid expenses are opposites. In year 0, our historical period, we can calculate the driver as: Web accrued expenses are expenses incurred and for which the payment has not yet been made. Web an accrual is an expense that has been recognized in the current period for which a supplier invoice has not yet been received, or revenue that has not yet been billed. An accrued expense can be an.

Prepaid Rent Journal Entry slide share

In year 0, our historical period, we can calculate the driver as: Web since accrued expenses represent a company's obligation to make future cash payments, they are shown on a company's balance sheet as current liabilities. Web accrued expenses = $12m — decline by 0.5% as percentage of opex each year; When an accrual is created, it is. Accrued expenses.

Accrued expenses — AccountingTools India Dictionary

Web since accrued expenses represent a company's obligation to make future cash payments, they are shown on a company's balance sheet as current liabilities. In year 0, our historical period, we can calculate the driver as: Web an accrual is an expense that has been recognized in the current period for which a supplier invoice has not yet been received,.

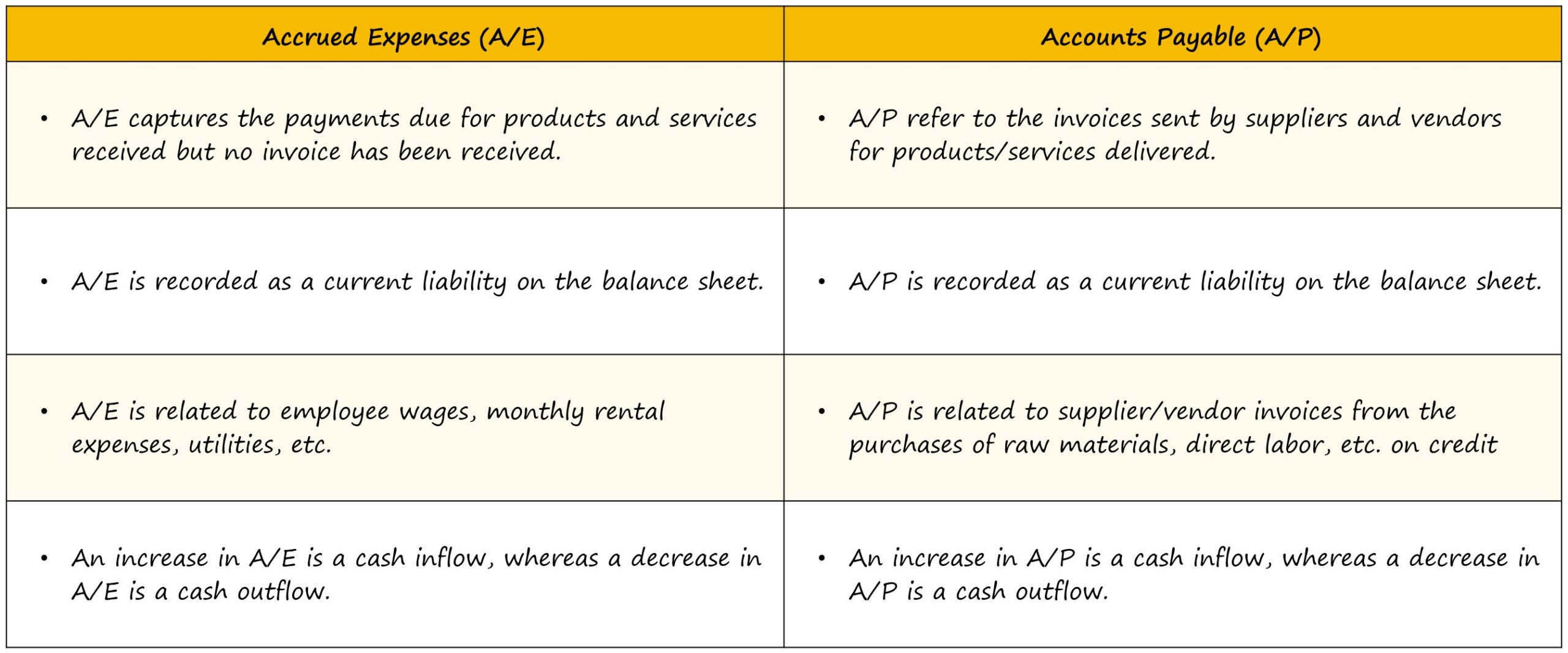

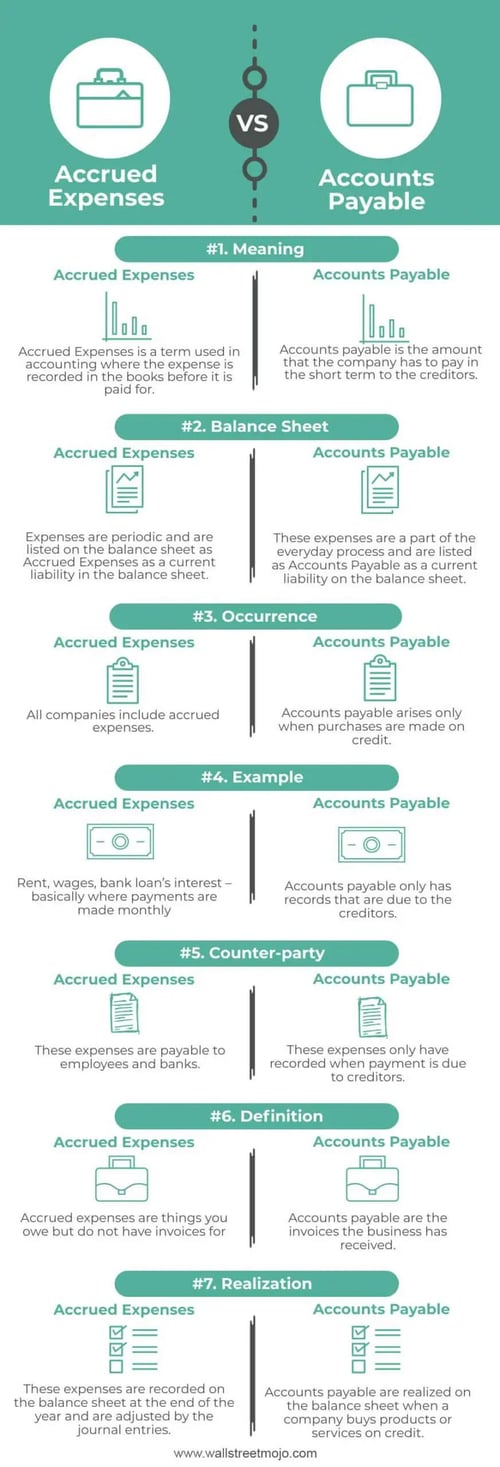

Accrued Expense vs. Accounts Payable, Differences + Examples

Accrued expenses and prepaid expenses are opposites. As a result, liability for these expenditures is created and recorded as accrued liabilities (short term) on the. Accrued expenses % of opex (year 0) = $12m / $80m = 15.0%; When an accrual is created, it is. Web accrued expenses are expenses incurred and for which the payment has not yet been.

Accrued Expenses vs Accounts Payable Head to Head Difference Accounts

An accrued expense can be an. When an accrual is created, it is. As a result, liability for these expenditures is created and recorded as accrued liabilities (short term) on the. Web accrued expenses are expenses incurred and for which the payment has not yet been made. Web accrued expenses = $12m — decline by 0.5% as percentage of opex.

Accrued Expenses Definition + Balance Sheet Example

Accrued expenses haven’t yet been paid, they’re considered an added liability on the balance sheet. In year 0, our historical period, we can calculate the driver as: As a result, liability for these expenditures is created and recorded as accrued liabilities (short term) on the. Accrued expenses and prepaid expenses are opposites. Web accrued expenses are expenses incurred and for.

Difference Between Accrued Expense and Accounts Payable

As a result, liability for these expenditures is created and recorded as accrued liabilities (short term) on the. An accrued expense can be an. Accrued expenses haven’t yet been paid, they’re considered an added liability on the balance sheet. In year 0, our historical period, we can calculate the driver as: Web accrued expenses are expenses incurred and for which.

Prepaid expenses balance sheet laderfivestar

An accrued expense can be an. When an accrual is created, it is. As a result, liability for these expenditures is created and recorded as accrued liabilities (short term) on the. Web accrued expenses = $12m — decline by 0.5% as percentage of opex each year; Accrued expenses and prepaid expenses are opposites.

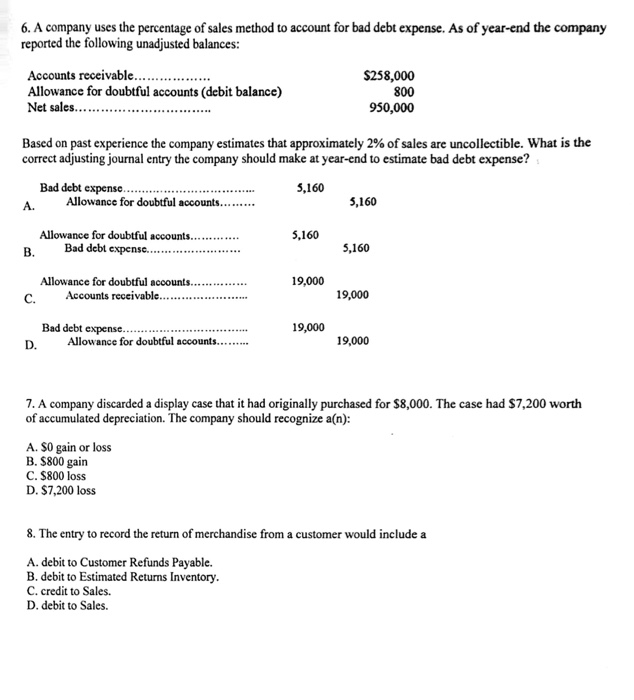

Solved I. Accrued expenses are ordinarily reported on the

Accrued expenses and prepaid expenses are opposites. Web since accrued expenses represent a company's obligation to make future cash payments, they are shown on a company's balance sheet as current liabilities. Web accrued expenses are expenses incurred and for which the payment has not yet been made. An accrued expense can be an. Web accrued expenses = $12m — decline.

Accrual Of Wages Expense Balance Sheet PATCHED

Accrued expenses haven’t yet been paid, they’re considered an added liability on the balance sheet. When an accrual is created, it is. An accrued expense can be an. As a result, liability for these expenditures is created and recorded as accrued liabilities (short term) on the. Web since accrued expenses represent a company's obligation to make future cash payments, they.

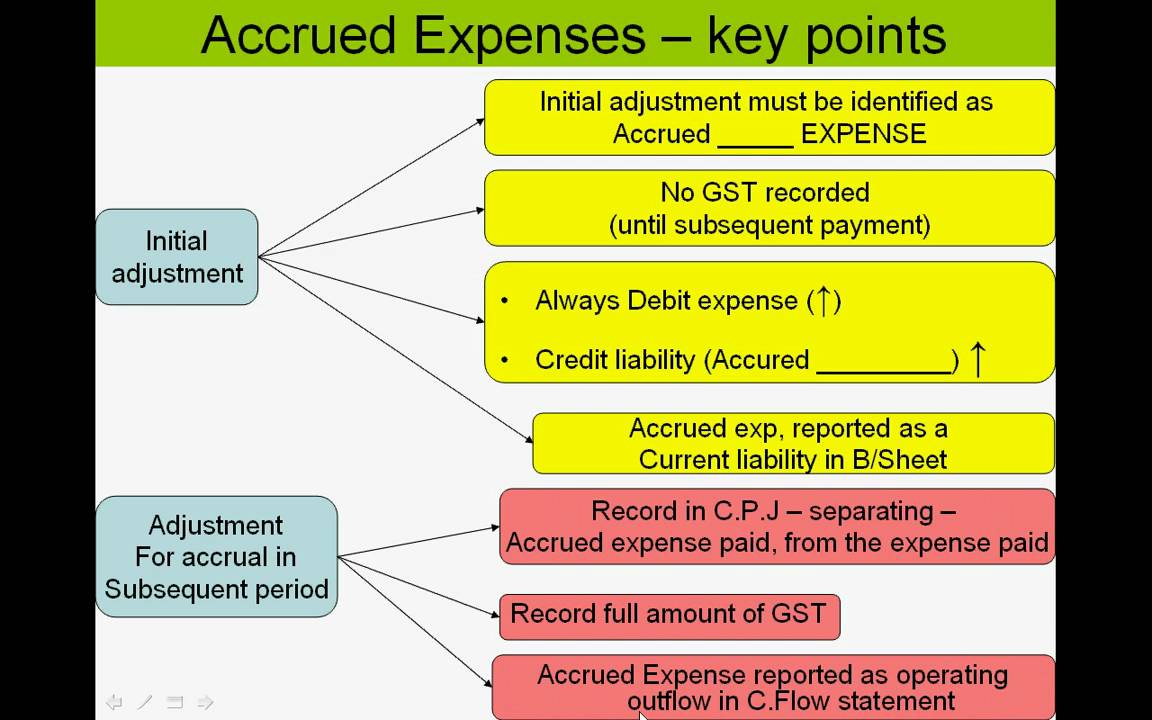

Unit 3 VCE Accounting Accrued Expenses YouTube

Accrued expenses % of opex (year 0) = $12m / $80m = 15.0%; When an accrual is created, it is. Accrued expenses and prepaid expenses are opposites. Web since accrued expenses represent a company's obligation to make future cash payments, they are shown on a company's balance sheet as current liabilities. In year 0, our historical period, we can calculate.

Web Accrued Expenses Are Expenses Incurred And For Which The Payment Has Not Yet Been Made.

In year 0, our historical period, we can calculate the driver as: Accrued expenses haven’t yet been paid, they’re considered an added liability on the balance sheet. Accrued expenses and prepaid expenses are opposites. Web an accrual is an expense that has been recognized in the current period for which a supplier invoice has not yet been received, or revenue that has not yet been billed.

An Accrued Expense Can Be An.

When an accrual is created, it is. Web since accrued expenses represent a company's obligation to make future cash payments, they are shown on a company's balance sheet as current liabilities. Accrued expenses % of opex (year 0) = $12m / $80m = 15.0%; Web accrued expenses = $12m — decline by 0.5% as percentage of opex each year;