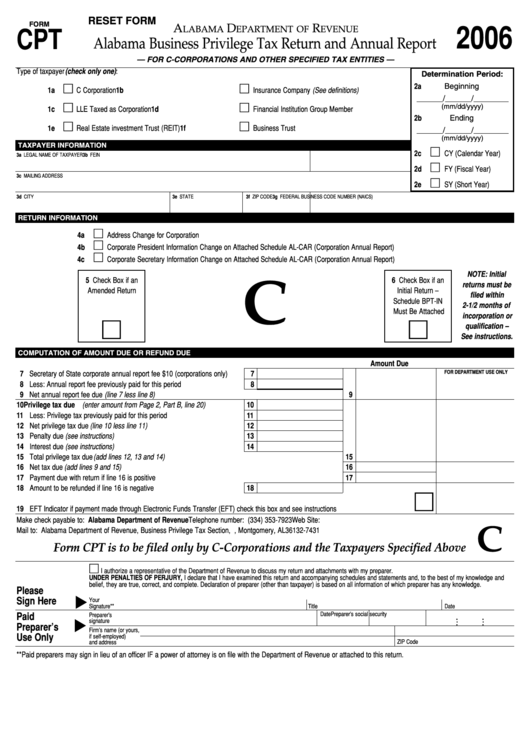

Alabama Form Cpt

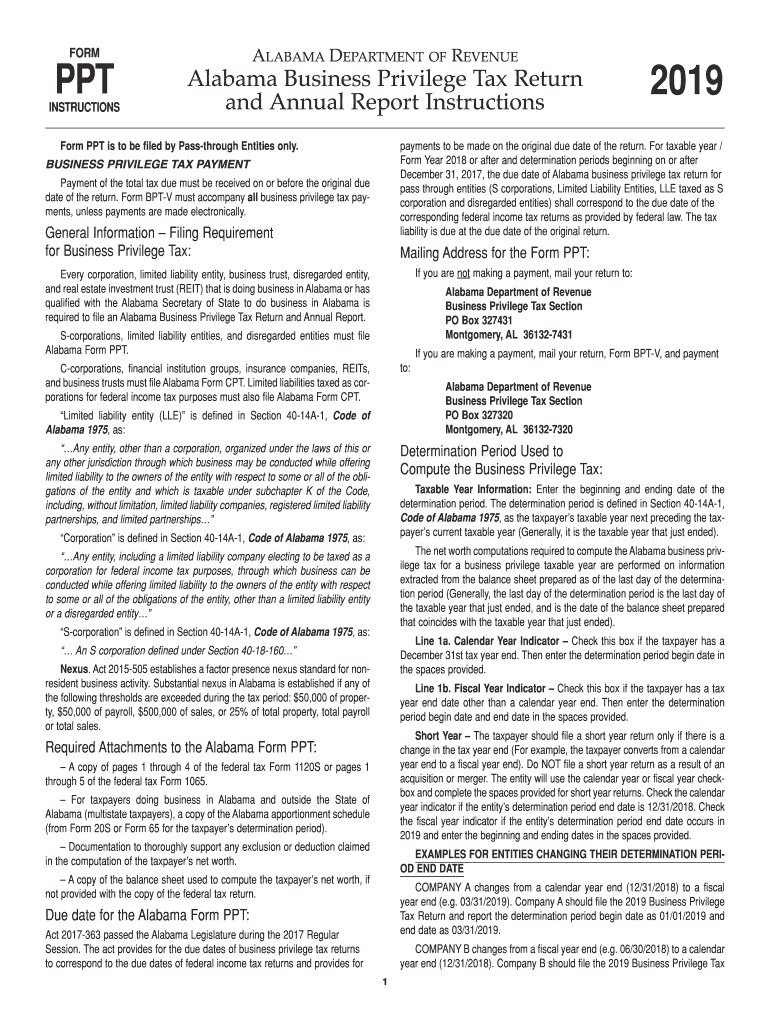

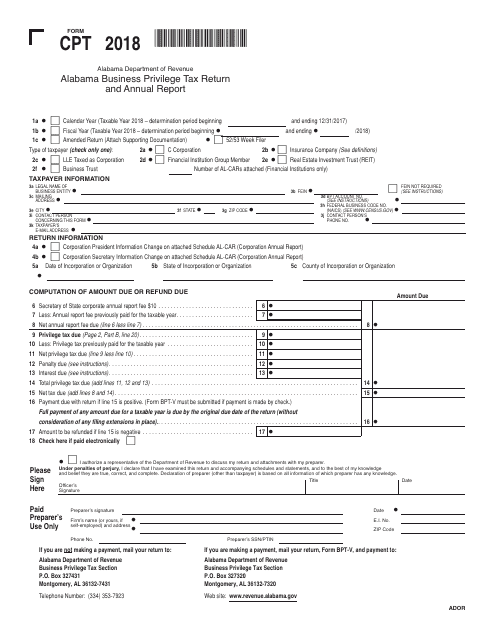

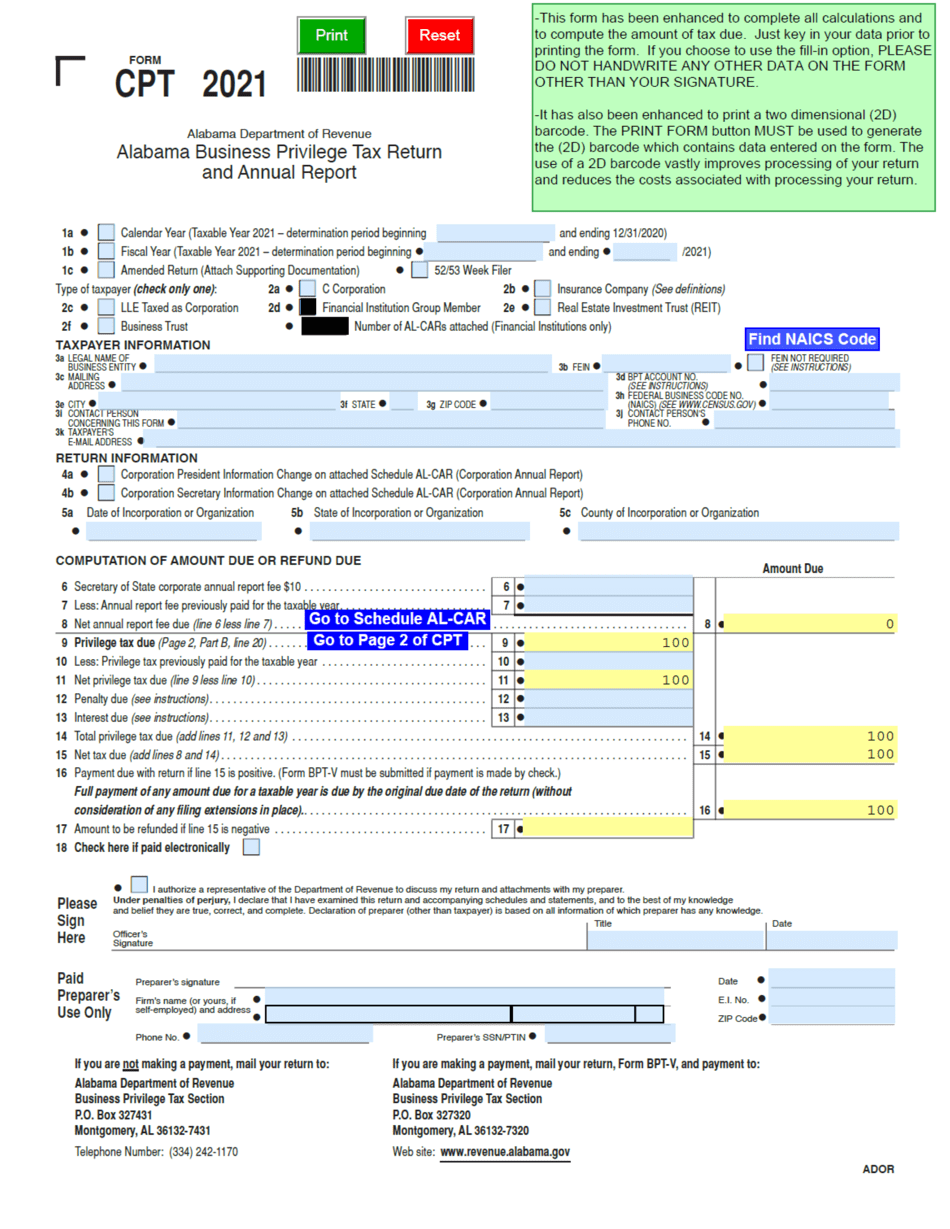

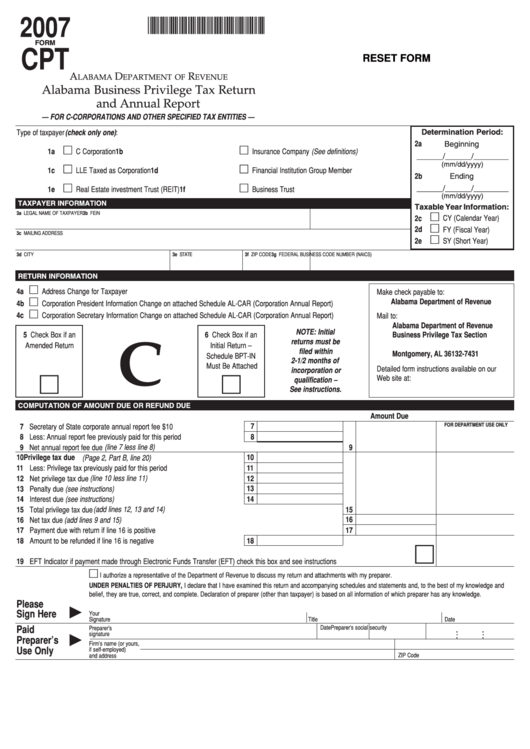

Alabama Form Cpt - Web due date for the alabama form cpt:<br />. This form is for income earned in tax year 2022, with tax returns due in. Web separate alabama business privilege tax returns, but they must file form cpt only, regardless of the type of entity they may be. This tax form is for those taxpayers who will be paying less than $750 for taxes due on forms cpt, ppt, or. The forms are as follows: Web the business privilege tax form cpt in an alabama 1120 return is transmitted separately from al form 20c. Web alabama medicaid requires prior authorizations (pa) for aba therapy except for the initial assessment code. To set the form up for electronic filing, do the following: Web required attachments to the alabama form cpt: Web due date for the alabama form cpt:

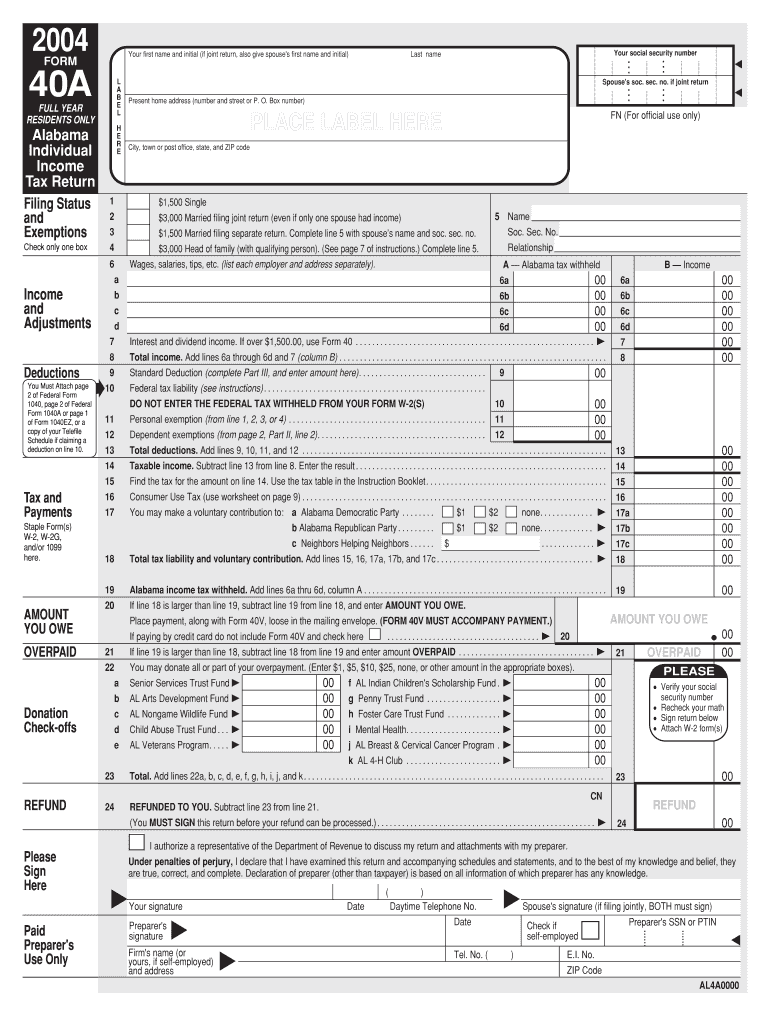

The forms are as follows: Web we last updated alabama form cpt in july 2022 from the alabama department of revenue. Web alabama medicaid requires prior authorizations (pa) for aba therapy except for the initial assessment code. Web each type of business entity in the state of alabama has a specific tax form to fill out each year. Ad register and subscribe now to work on your al business privilege tax return & annual rep. Web alabama department of revenue. Web due date for the alabama form cpt: Web 26 rows annual reconciliation of alabama income tax withheld. This form is for income earned in tax year 2022, with tax returns due in. Web the alabama business privilege tax is levied for the privilege of being organized under the laws of alabama or doing business in alabama (if organized under the laws of.

Web alabama medicaid requires prior authorizations (pa) for aba therapy except for the initial assessment code. Web due date for the alabama form cpt:<br />. Authorization for access to third party records. Web due date for the alabama form cpt: C corps and professional corporations use this dual. Web corporations that should be recorded on page 1, line 6 of form cpt or ppt. Web 2023 alabama workers' compensation prevailing rate/maximum fee schedule for physicians effective march 1, 2023 cpt code max fee cpt code max fee cpt. The act provides for the due dates of business. Web required attachments to the alabama form cpt: Web the alabama business privilege tax is levied for the privilege of being organized under the laws of alabama or doing business in alabama (if organized under the laws of.

Alabama Form 47 Fill Online, Printable, Fillable, Blank pdfFiller

The forms are as follows: Web 2023 alabama workers' compensation prevailing rate/maximum fee schedule for physicians effective march 1, 2023 cpt code max fee cpt code max fee cpt. Application to become a bulk filer. Web alabama department of revenue. Providers must submit initial assessment forms (cpt code 97151) and.

Alabama Form PPT Fill Out and Sign Printable PDF Template signNow

Web c corporations will need to file “form cpt” and s corporations/limited liability entities will need to file “form ppt.” if you own a c or s corporation, you’ll be required to attach an. Web the business privilege tax form cpt in an alabama 1120 return is transmitted separately from al form 20c. Web we last updated alabama form cpt.

Form CPT Download Printable PDF or Fill Online Alabama Business

Web alabama department of revenue. Web corporations that should be recorded on page 1, line 6 of form cpt or ppt. This tax form is for those taxpayers who will be paying less than $750 for taxes due on forms cpt, ppt, or. To set the form up for electronic filing, do the following: Web taxable/form year alabama department of.

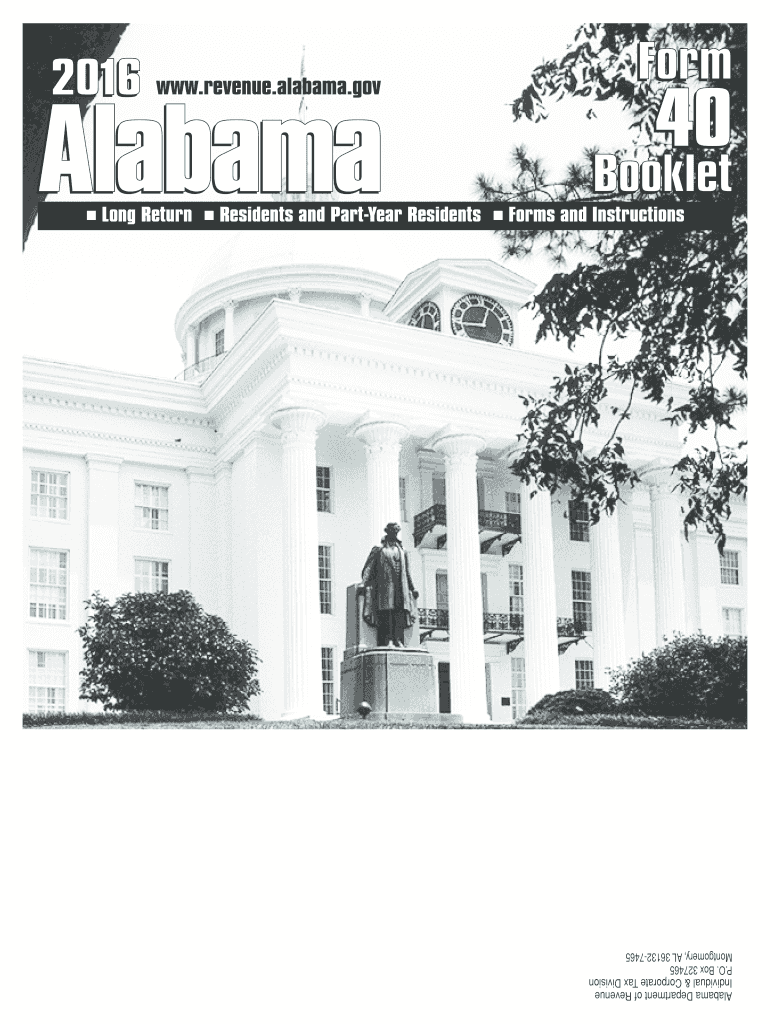

2016 Form AL DoR 40 Booklet Fill Online, Printable, Fillable, Blank

This tax form is for those taxpayers who will be paying less than $750 for taxes due on forms cpt, ppt, or. Web due date for the alabama form cpt: Web corporations that should be recorded on page 1, line 6 of form cpt or ppt. Ad edit, sign and print tax forms on any device with pdffiller. To set.

Form CPT Download Fillable PDF or Fill Online Alabama Business

The act provides for the due dates of business. Web each type of business entity in the state of alabama has a specific tax form to fill out each year. Web 2023 alabama workers' compensation prevailing rate/maximum fee schedule for physicians effective march 1, 2023 cpt code max fee cpt code max fee cpt. Web taxable/form year alabama department of.

Alabama Form 40 Instructions 2019 Fill Out and Sign Printable PDF

C corps and professional corporations use this dual. Web alabama department of revenue. Web the alabama business privilege tax is levied for the privilege of being organized under the laws of alabama or doing business in alabama (if organized under the laws of. To set the form up for electronic filing, do the following: Ad register and subscribe now to.

Fillable Form Cpt Alabama Business Privilege Tax Return And Annual

Ad edit, sign and print tax forms on any device with pdffiller. Web due date for the alabama form cpt: Web required attachments to the alabama form cpt: Web corporations that should be recorded on page 1, line 6 of form cpt or ppt. Web alabama medicaid requires prior authorizations (pa) for aba therapy except for the initial assessment code.

Alabama Fillable Tax Form Printable Forms Free Online

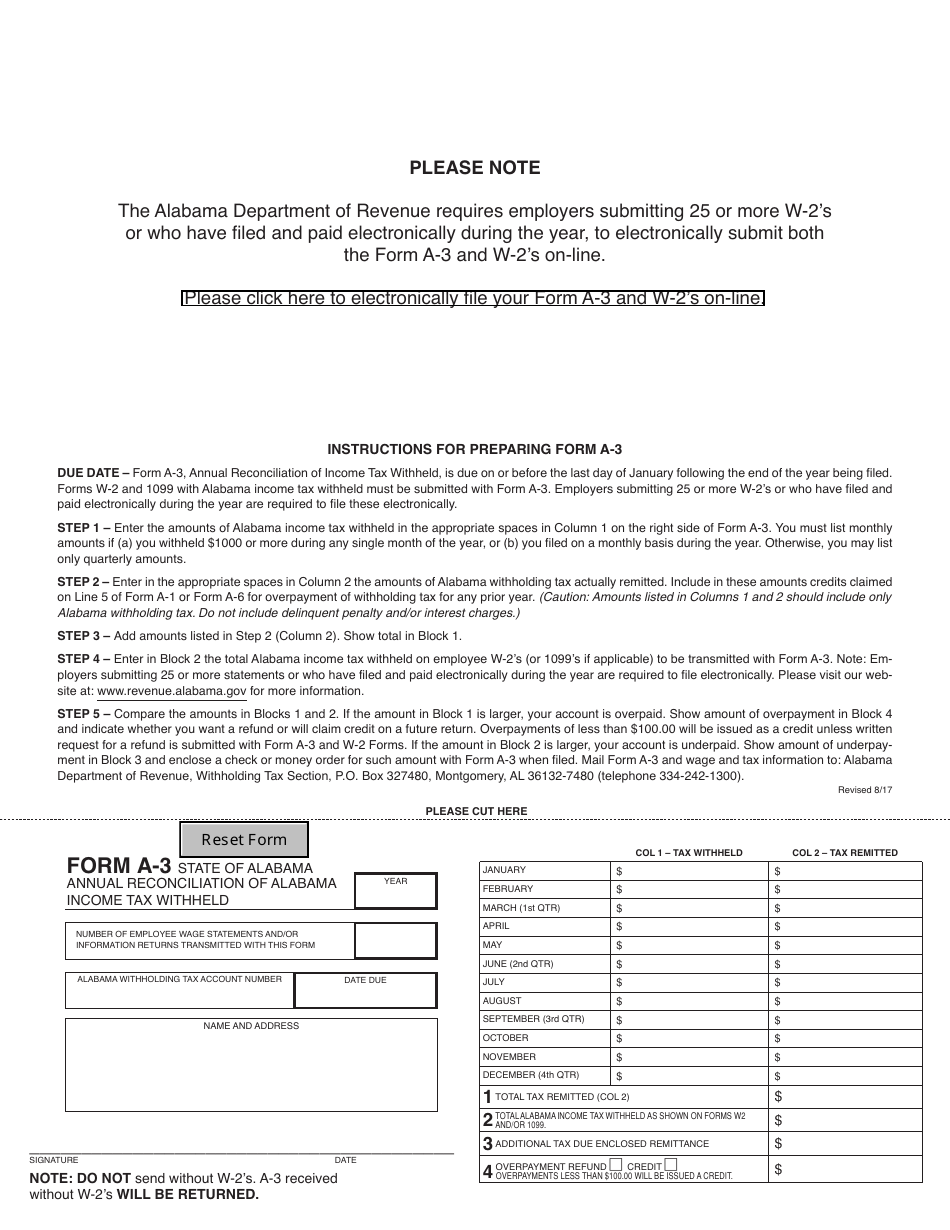

Web 26 rows annual reconciliation of alabama income tax withheld. Web separate alabama business privilege tax returns, but they must file form cpt only, regardless of the type of entity they may be. Ad register and subscribe now to work on your al business privilege tax return & annual rep. Web taxable/form year alabama department of revenue business privilege tax.

Form A3 Download Fillable PDF or Fill Online Annual Reconciliation of

Application to become a bulk filer. Web 26 rows annual reconciliation of alabama income tax withheld. Web alabama medicaid requires prior authorizations (pa) for aba therapy except for the initial assessment code. This form is for income earned in tax year 2022, with tax returns due in. The forms are as follows:

Fillable Form Cpt Alabama Business Privilege Tax Return And Annual

Web 2023 alabama workers' compensation prevailing rate/maximum fee schedule for physicians effective march 1, 2023 cpt code max fee cpt code max fee cpt. Get ready for tax season deadlines by completing any required tax forms today. Authorization for access to third party records. Web due date for the alabama form cpt:<br />. Web we last updated alabama form cpt.

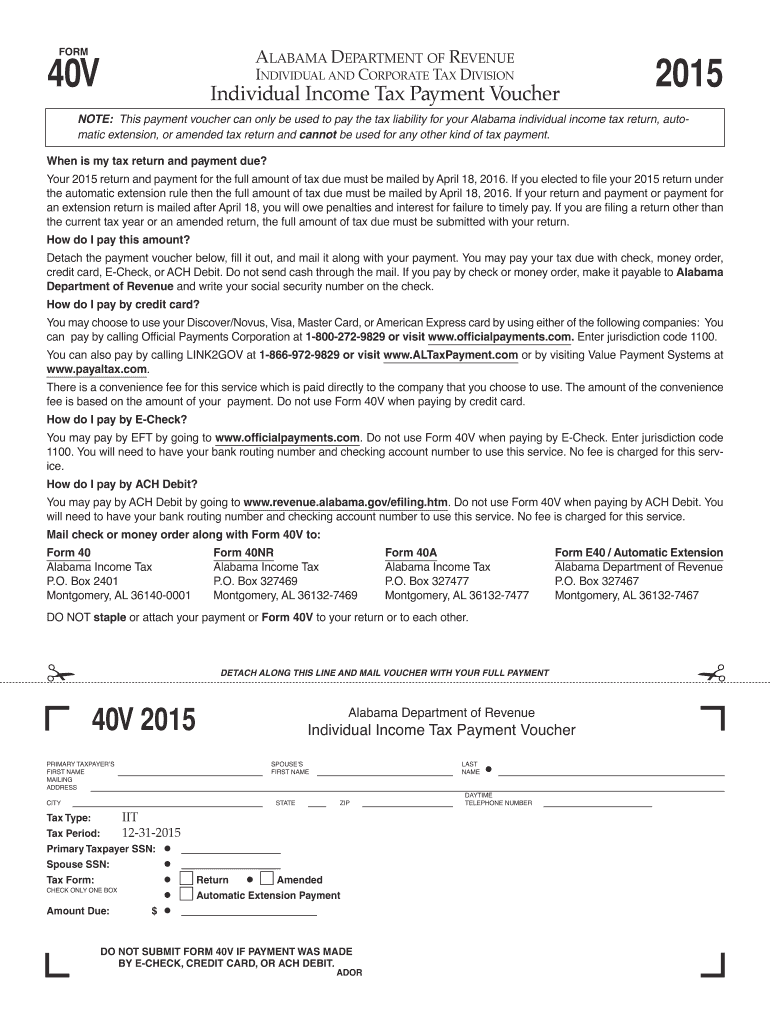

Web Taxable/Form Year Alabama Department Of Revenue Business Privilege Tax Payment Voucher Detach Along This Line And Mail Voucher With Your Full.

Web 2023 alabama workers' compensation prevailing rate/maximum fee schedule for physicians effective march 1, 2023 cpt code max fee cpt code max fee cpt. Web c corporations will need to file “form cpt” and s corporations/limited liability entities will need to file “form ppt.” if you own a c or s corporation, you’ll be required to attach an. This form is for income earned in tax year 2022, with tax returns due in. Ad register and subscribe now to work on your al business privilege tax return & annual rep.

Web The Alabama Business Privilege Tax Is Levied For The Privilege Of Being Organized Under The Laws Of Alabama Or Doing Business In Alabama (If Organized Under The Laws Of.

Web the business privilege tax form cpt in an alabama 1120 return is transmitted separately from al form 20c. The forms are as follows: Web due date for the alabama form cpt: Web due date for the alabama form cpt:

.

Authorization For Access To Third Party Records.

The act provides for the due dates of business. Get ready for tax season deadlines by completing any required tax forms today. This tax form is for those taxpayers who will be paying less than $750 for taxes due on forms cpt, ppt, or. Web we last updated alabama form cpt in july 2022 from the alabama department of revenue.

To Set The Form Up For Electronic Filing, Do The Following:

Application to become a bulk filer. Web alabama department of revenue. Web separate alabama business privilege tax returns, but they must file form cpt only, regardless of the type of entity they may be. Providers must submit initial assessment forms (cpt code 97151) and.