Amended 941 Form

Amended 941 Form - What's new social security and medicare tax for 2023. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. In the file forms section, select annual form 940/sch. Otherwise, the irs may assess an “averaged” ftd penalty. Web form 941 and its instructions, such as legislation enacted after they were published, go to irs.gov/form941. To amend form 940 in quickbooks desktop:

In the file forms section, select annual form 940/sch. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Otherwise, the irs may assess an “averaged” ftd penalty. What's new social security and medicare tax for 2023. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding. Web form 941 and its instructions, such as legislation enacted after they were published, go to irs.gov/form941. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. To amend form 940 in quickbooks desktop: April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no.

Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. What's new social security and medicare tax for 2023. Web form 941 and its instructions, such as legislation enacted after they were published, go to irs.gov/form941. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding. To amend form 940 in quickbooks desktop: In the file forms section, select annual form 940/sch. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Otherwise, the irs may assess an “averaged” ftd penalty.

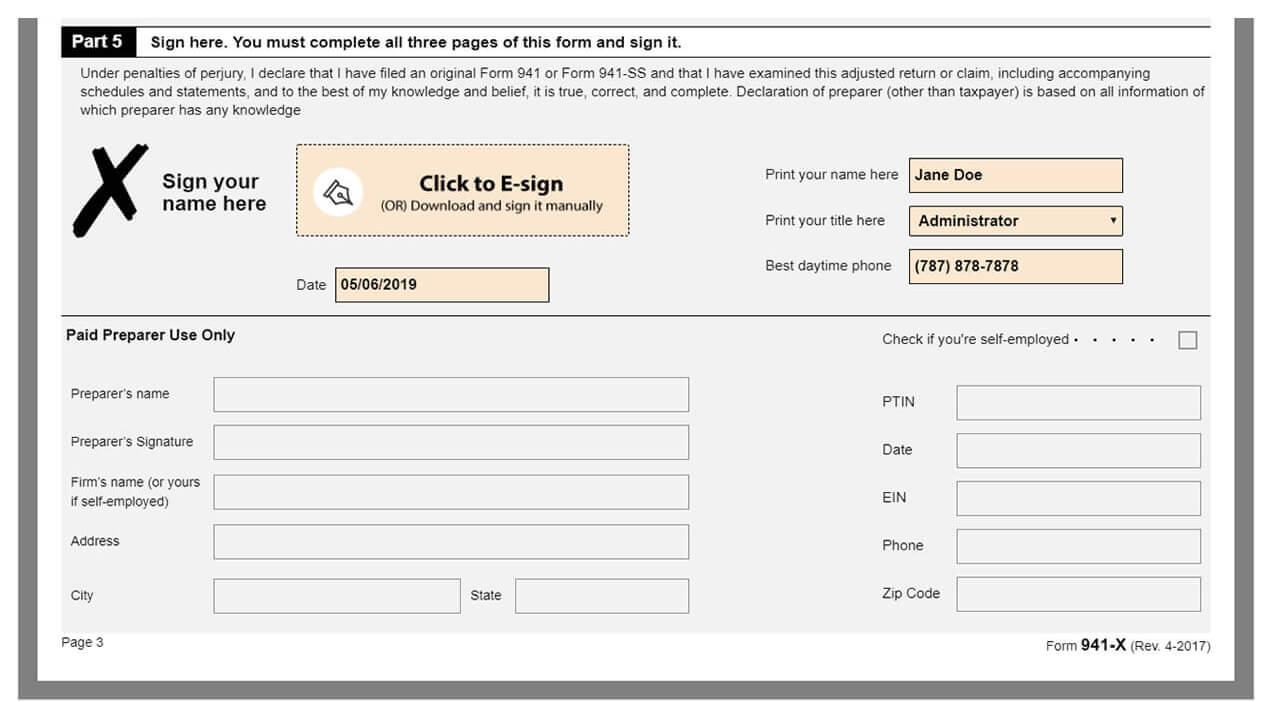

How to Complete & Download Form 941X (Amended Form 941)?

Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding. In the file forms section, select annual form 940/sch. What's new social security and medicare tax for 2023. April 2023) adjusted employer’s quarterly federal tax return or claim for refund.

How to Complete & Download Form 941X (Amended Form 941)?

Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. April 2023) adjusted employer’s quarterly federal tax return or.

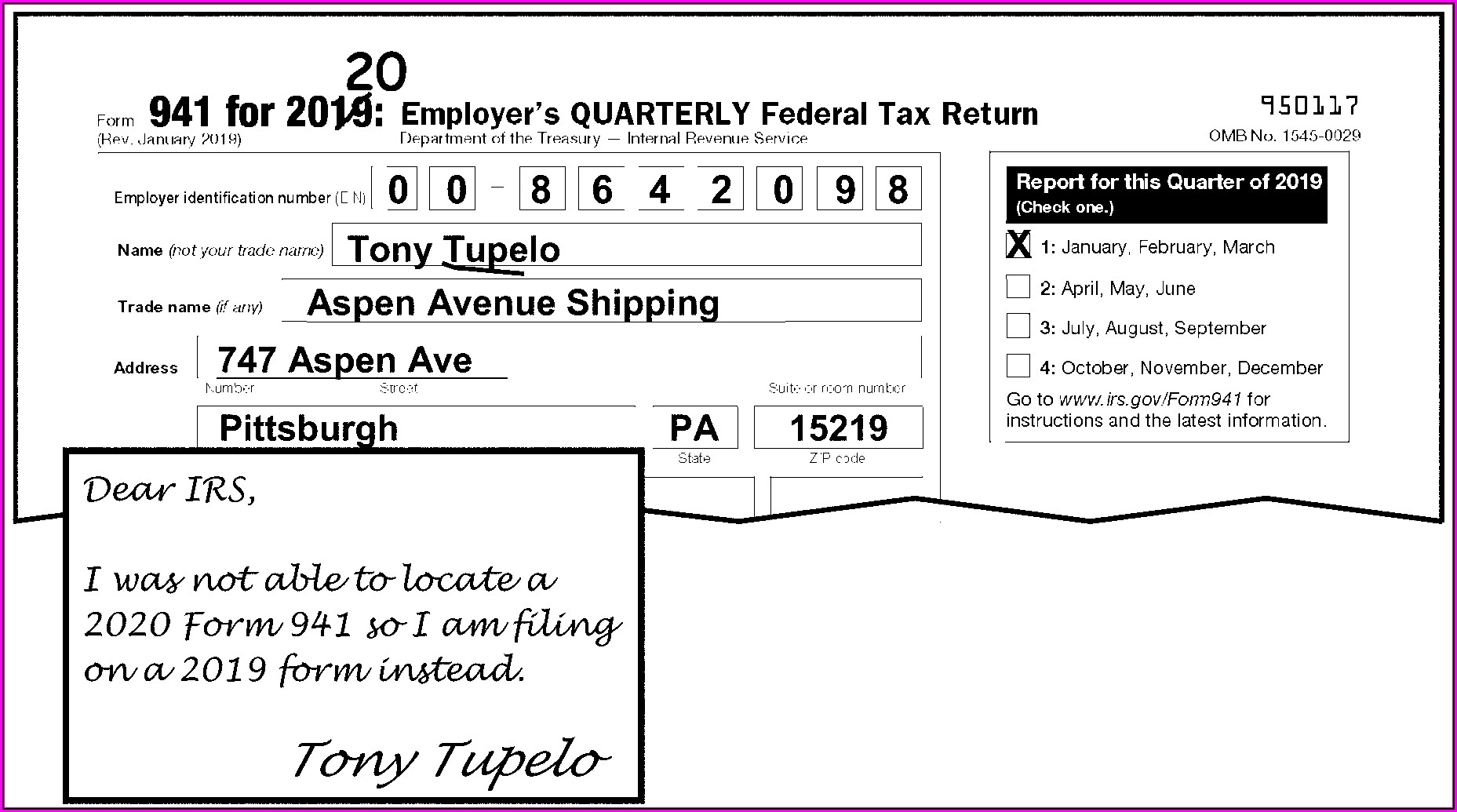

Form 941 For Q2 2021 Includes 23 Changes

To amend form 940 in quickbooks desktop: In the file forms section, select annual form 940/sch. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Web form 941 and its instructions, such as legislation enacted after they were published, go to irs.gov/form941. April 2023) adjusted employer’s quarterly.

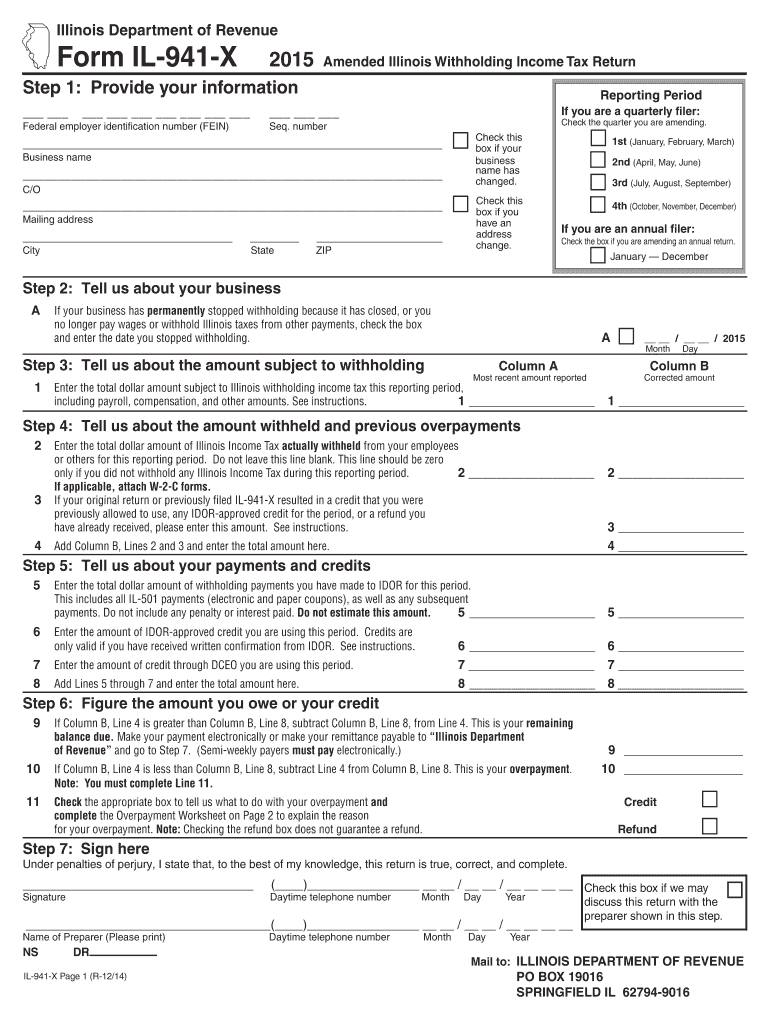

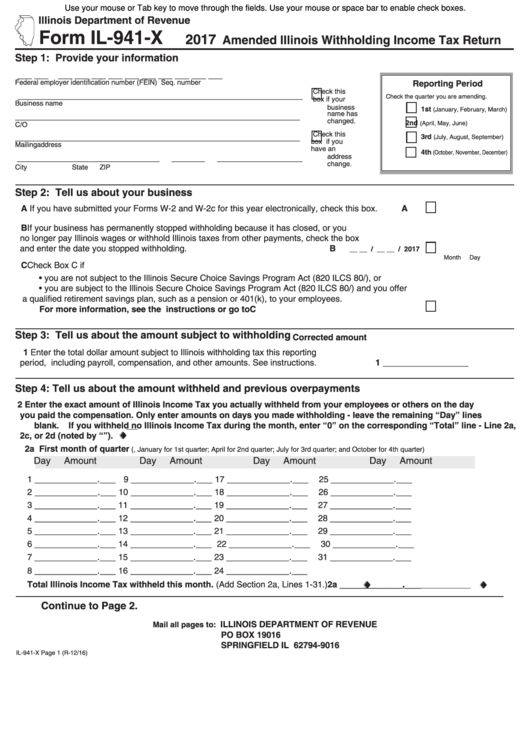

IL 941 X, Amended Illinois Withholding Tax Return Fill Out and

To amend form 940 in quickbooks desktop: Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. In the file forms section, select annual form 940/sch. Form.

Irs.gov Form 941 Amended Form Resume Examples MW9pPdM9AJ

In the file forms section, select annual form 940/sch. Otherwise, the irs may assess an “averaged” ftd penalty. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare.

Fillable Form Il941X Amended Illinois Withholding Tax Return

In the file forms section, select annual form 940/sch. What's new social security and medicare tax for 2023. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web form 941 and its instructions, such as legislation enacted after they were published, go to irs.gov/form941. Therefore, you may need.

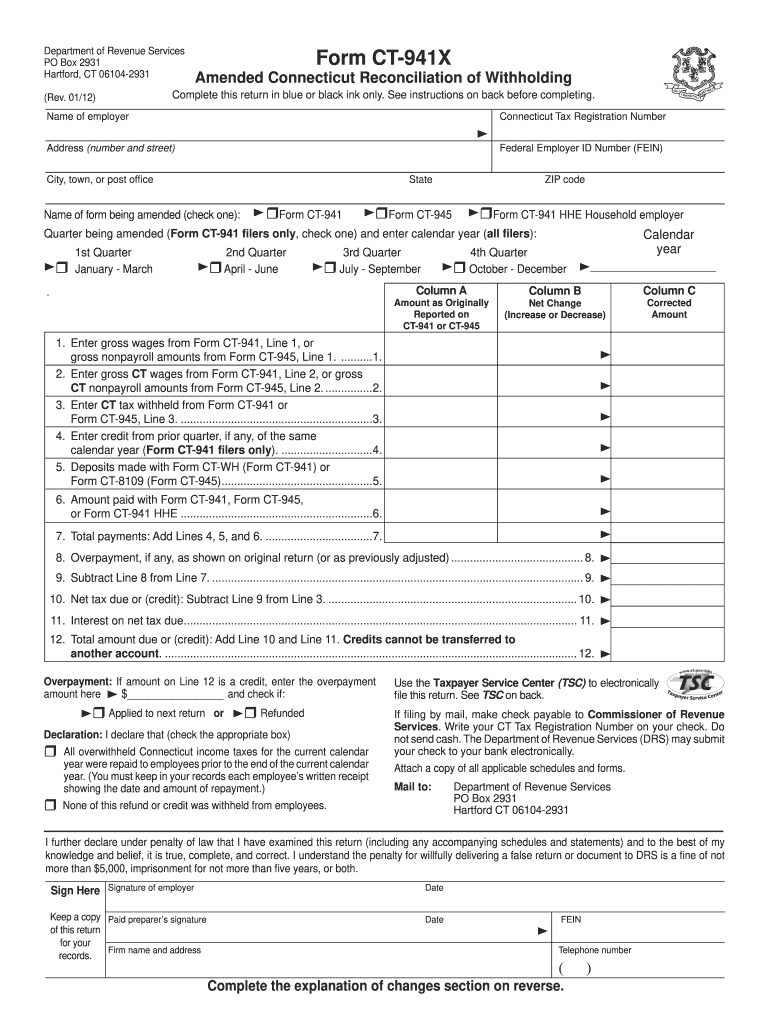

2012 Form CT DRS CT941X Fill Online, Printable, Fillable, Blank

In the file forms section, select annual form 940/sch. To amend form 940 in quickbooks desktop: Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Web form 941 and its instructions, such as legislation enacted after they were published, go to irs.gov/form941. Employee wages, income tax withheld from.

941 X Form Fill Out and Sign Printable PDF Template signNow

Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. To amend form 940 in quickbooks desktop: April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Therefore, you may need to amend your income tax return.

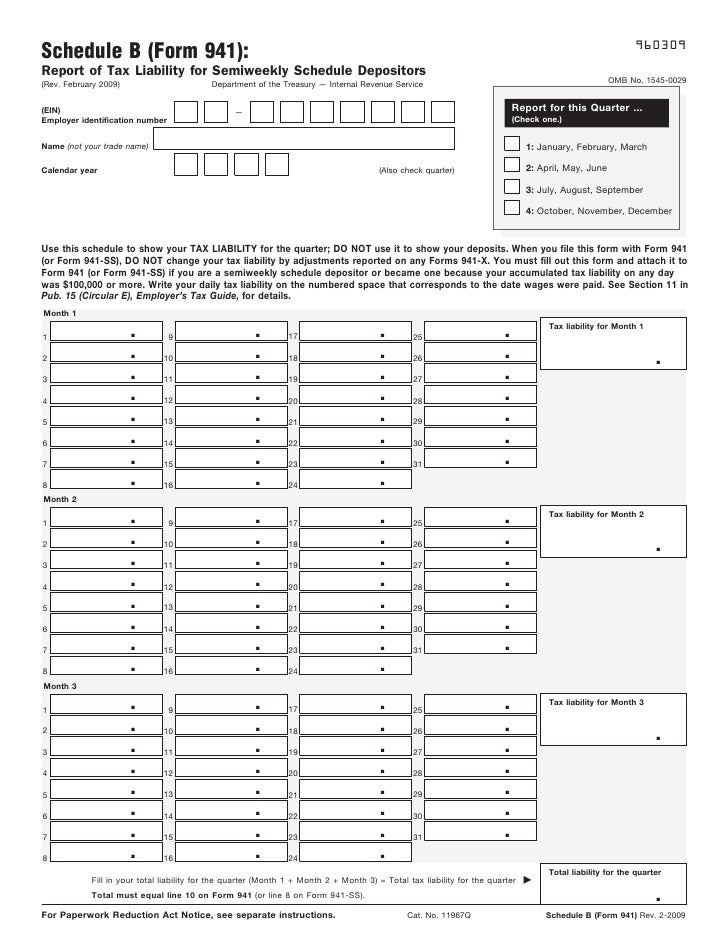

Form 941 (Schedule B) Report of Tax Liability for Semiweekly Schedul…

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. In the file forms section, select annual form 940/sch. What's new social security and medicare tax for 2023. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced.

Irs.gov Form 941 Amended Form Resume Examples MW9pPdM9AJ

Web form 941 and its instructions, such as legislation enacted after they were published, go to irs.gov/form941. To amend form 940 in quickbooks desktop: Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Form 941 is used by employers who withhold income taxes from wages or who.

Therefore, You May Need To Amend Your Income Tax Return (For Example, Forms 1040, 1065, 1120, Etc.) To Reflect That Reduced Deduction.

To amend form 940 in quickbooks desktop: Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no.

Web Form 941 And Its Instructions, Such As Legislation Enacted After They Were Published, Go To Irs.gov/Form941.

Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Otherwise, the irs may assess an “averaged” ftd penalty. In the file forms section, select annual form 940/sch. What's new social security and medicare tax for 2023.