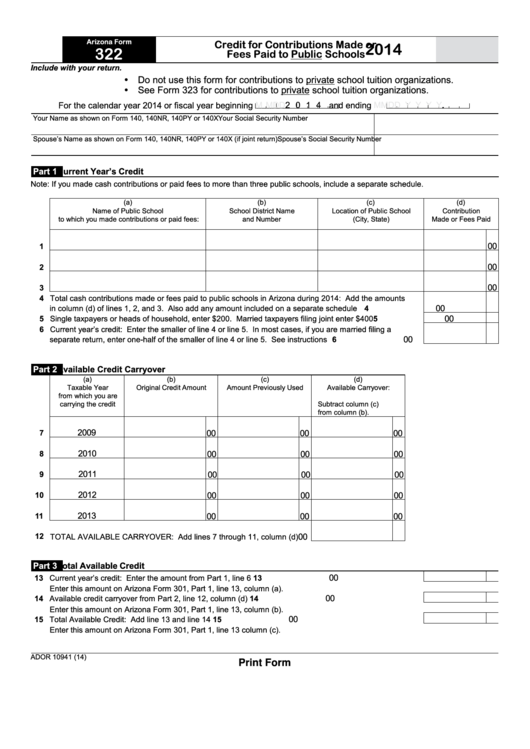

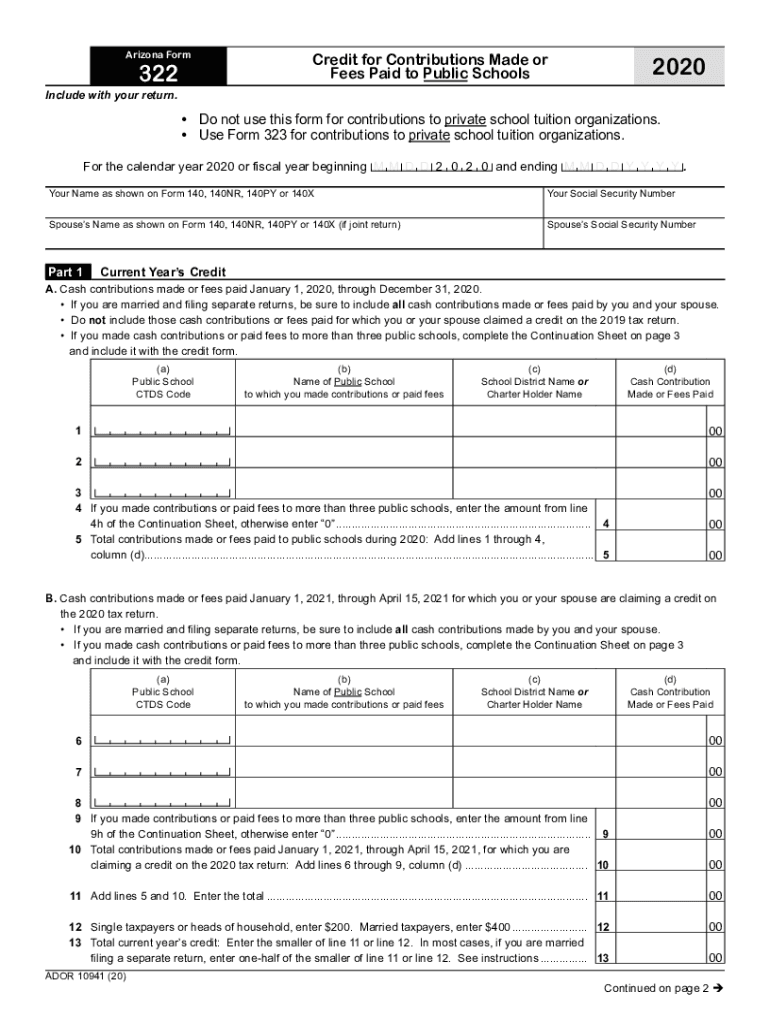

Arizona Form 322

Arizona Form 322 - • do not use this form for contributions. Web arizona form 323 credit for contributions to private school tuition organizations 2022 include with your return. For example, if a single individual owes $2,000 in taxes but donates $421 to a qualifying. Details on how to only prepare and print an. Web arizona form 322 a 101 21 arizona form credit for contributions made or 322 fees paid to public schools 2021 include with your return. Web 26 rows form number title; Web state of arizona form 322, also known as form 322, is a tax document utilized by taxpayers who are claiming a credit for taxes paid to other states on their arizona. Web complete az dor form 322 2020 online with us legal forms. Web arizona form 322 credit for contributions made or fees paid to public schools 2022 include with your return. Web how to fill out and sign az online?

This form is for income earned in tax year 2022, with tax returns due in april. Web include either arizona form 321 or arizona form 352, or both, with this return. You must also complete arizona form 301, nonrefundable individual tax credits and recapture, and include forms 301 and 322 with your tax. Credit for increased excise taxes: The advanced tools of the. Web how you can complete the arizona form 323 online: Easily fill out pdf blank, edit, and sign them. For example, if a single individual owes $2,000 in taxes but donates $421 to a qualifying. Web arizona form 321, credit for contributions to qualifying charitable organizations Web state of arizona form 322, also known as form 322, is a tax document utilized by taxpayers who are claiming a credit for taxes paid to other states on their arizona.

Do not use this form for contributions to private school tuition. Web arizona form 322 credit for contributions made or fees paid to public schools 2022 include with your return. Web the public school tax credit is claimed by the individual taxpayer on form 322. Web to enter information for arizona form 322 (credit for contributions made or fees paid to public schools) in turbotax, please take the following steps: Tax credits forms, individual : If a married couple owed $1800 in taxes and donated $800 to a qualifying charitable organization, their tax liability would be reduced. You must also complete arizona form 301, nonrefundable individual tax credits and recapture, and include forms 301 and 322 with your tax. Details on how to only prepare and print an. Web state of arizona form 322, also known as form 322, is a tax document utilized by taxpayers who are claiming a credit for taxes paid to other states on their arizona. Web we last updated arizona form 322 in february 2023 from the arizona department of revenue.

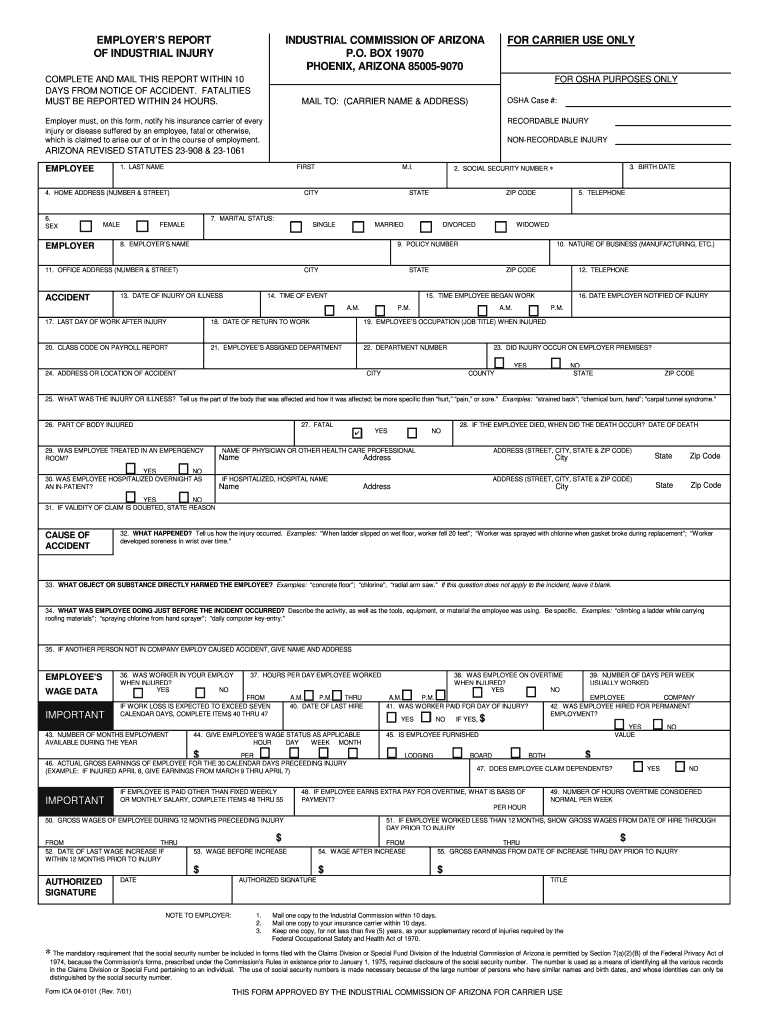

Arizona Report Injury Fill Out and Sign Printable PDF Template signNow

For example, if a single individual owes $2,000 in taxes but donates $421 to a qualifying. Web arizona state income tax forms for tax year 2022 (jan. This form is for income earned in tax year 2022, with tax returns due in april. Do not use this form for cash contributions or fees paid to a. You must also complete.

Fillable Arizona Form 322 Credit For Contributions Made Or Fees Paid

Enjoy smart fillable fields and interactivity. Web how you can complete the arizona form 323 online: Web how to fill out and sign az online? Credit for increased excise taxes: Web arizona form 322 following the close of the taxable year may be applied to either the current or preceding taxable year and is considered to have been made on.

Arizona Form 111 Fill Online, Printable, Fillable, Blank pdfFiller

Web arizona form 322 credit for contributions made or fees paid to public schools 2022 include with your return. To get started on the form, use the fill & sign online button or tick the preview image of the blank. If a married couple owed $1800 in taxes and donated $800 to a qualifying charitable organization, their tax liability would.

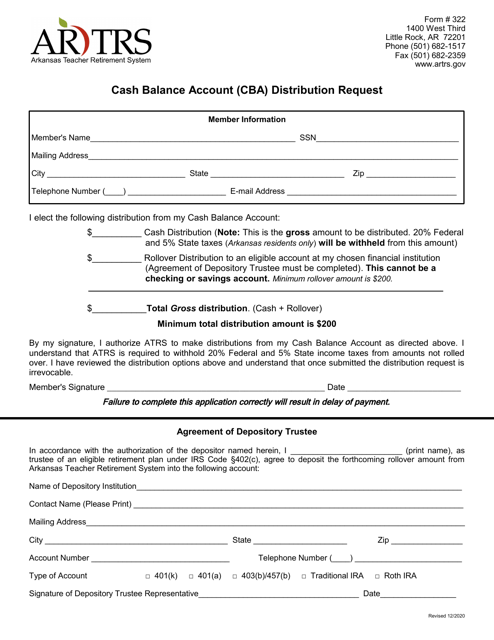

Form 322 Download Printable PDF or Fill Online Cash Balance Account

Easily fill out pdf blank, edit, and sign them. The advanced tools of the. Credit for contributions made or fees paid to public schools 2019 do not use this form for contributions to private school tuition. Web arizona form 322 a 101 21 arizona form credit for contributions made or 322 fees paid to public schools 2021 include with your.

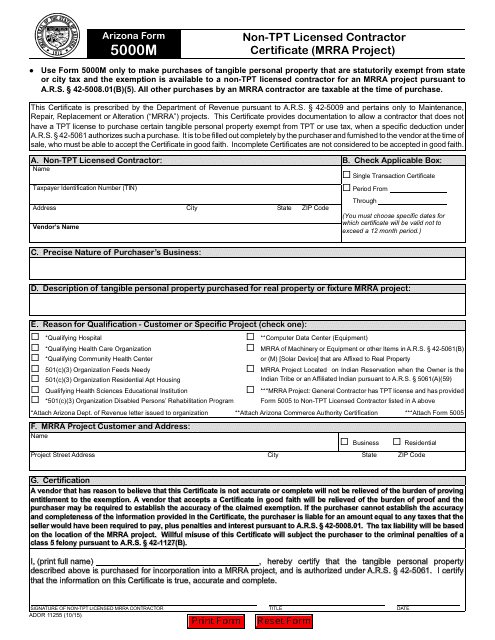

Arizona Form 5000M (ADOR11255) Download Fillable PDF or Fill Online Non

Web 26 rows form number title; Enjoy smart fillable fields and interactivity. Web how you can complete the arizona form 323 online: Web the public school tax credit is claimed by the individual taxpayer on form 322. Do not use this form for contributions to private school tuition.

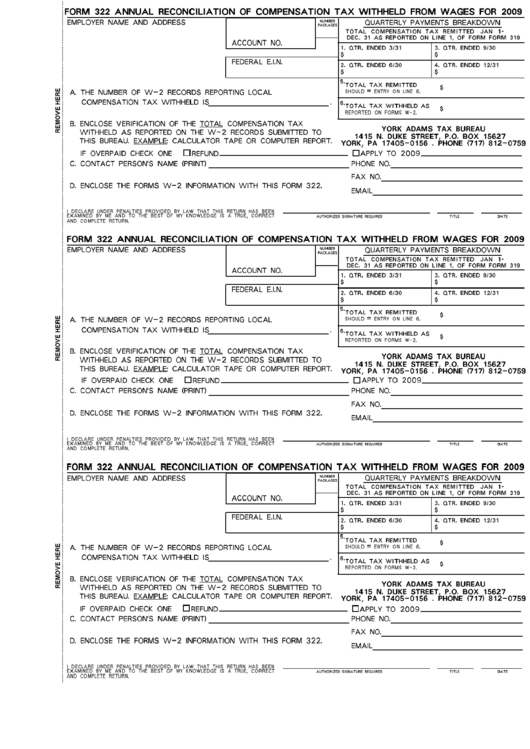

Form 322 Annual Reconciliation Of Compenstaion Tax Withheld From

Save or instantly send your ready documents. Follow the simple instructions below:. Web arizona form 322 include with your return. Web how to fill out and sign az online? Details on how to only prepare and print an.

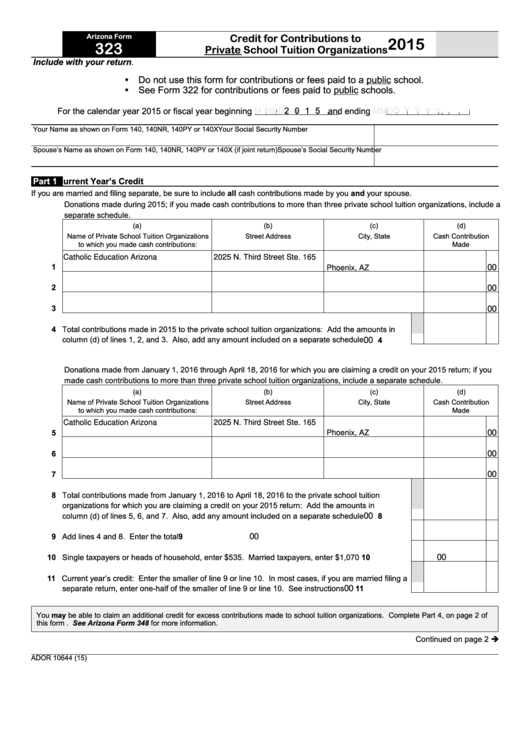

Fillable Arizona Form 323 Credit For Contributions To Private School

Web 26 rows form number title; Web include either arizona form 321 or arizona form 352, or both, with this return. Details on how to only prepare and print an. Credit for contributions made or fees paid to public schools 2019 do not use this form for contributions to private school tuition. Web arizona form 322 credit for contributions made.

Printable Arizona Form 322 Credit for Contributions Made or Fees Paid

You must also complete arizona form 301, nonrefundable individual tax credits and recapture, and include forms 301 and 322 with your tax. Web arizona form 323 credit for contributions to private school tuition organizations 2022 include with your return. Details on how to only prepare and print an. Web we last updated arizona form 322 in february 2023 from the.

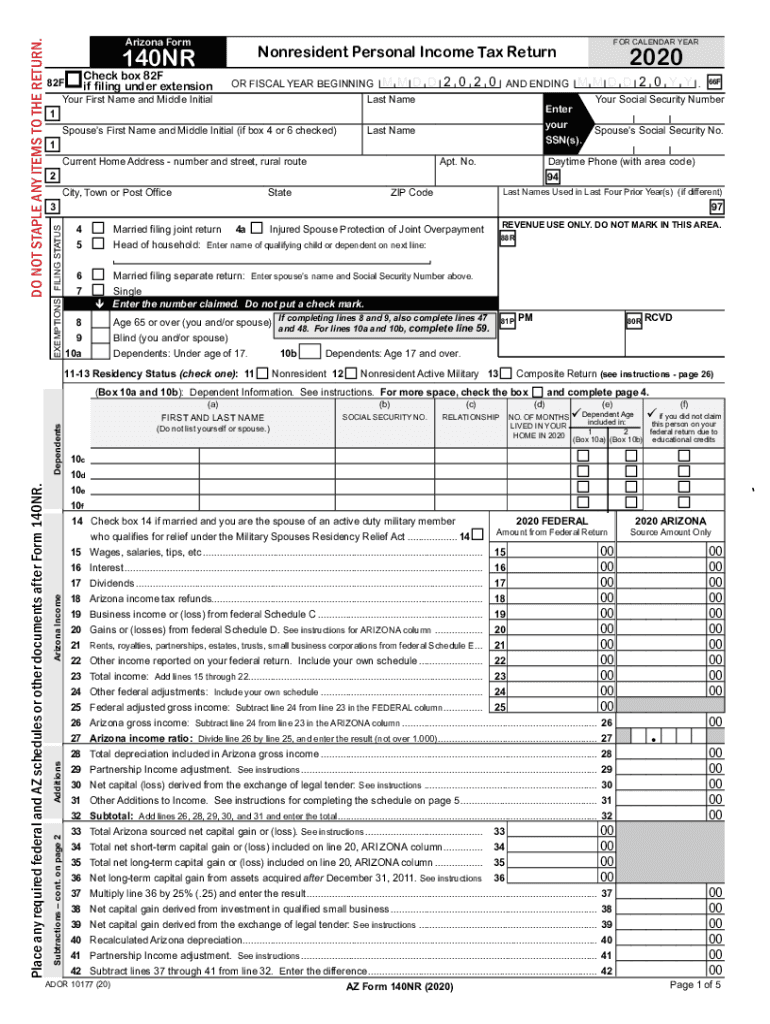

PDF Arizona Form 140NR Arizona Department of Revenue Fill Out and

Web arizona state income tax forms for tax year 2022 (jan. Web arizona form 322 credit for contributions made or fees paid to public schools 2022 include with your return. The maximum credit allowed is $400 for married filing joint filers and $200 for single, heads of. Tax credits forms, individual : You must also complete arizona form 301, nonrefundable.

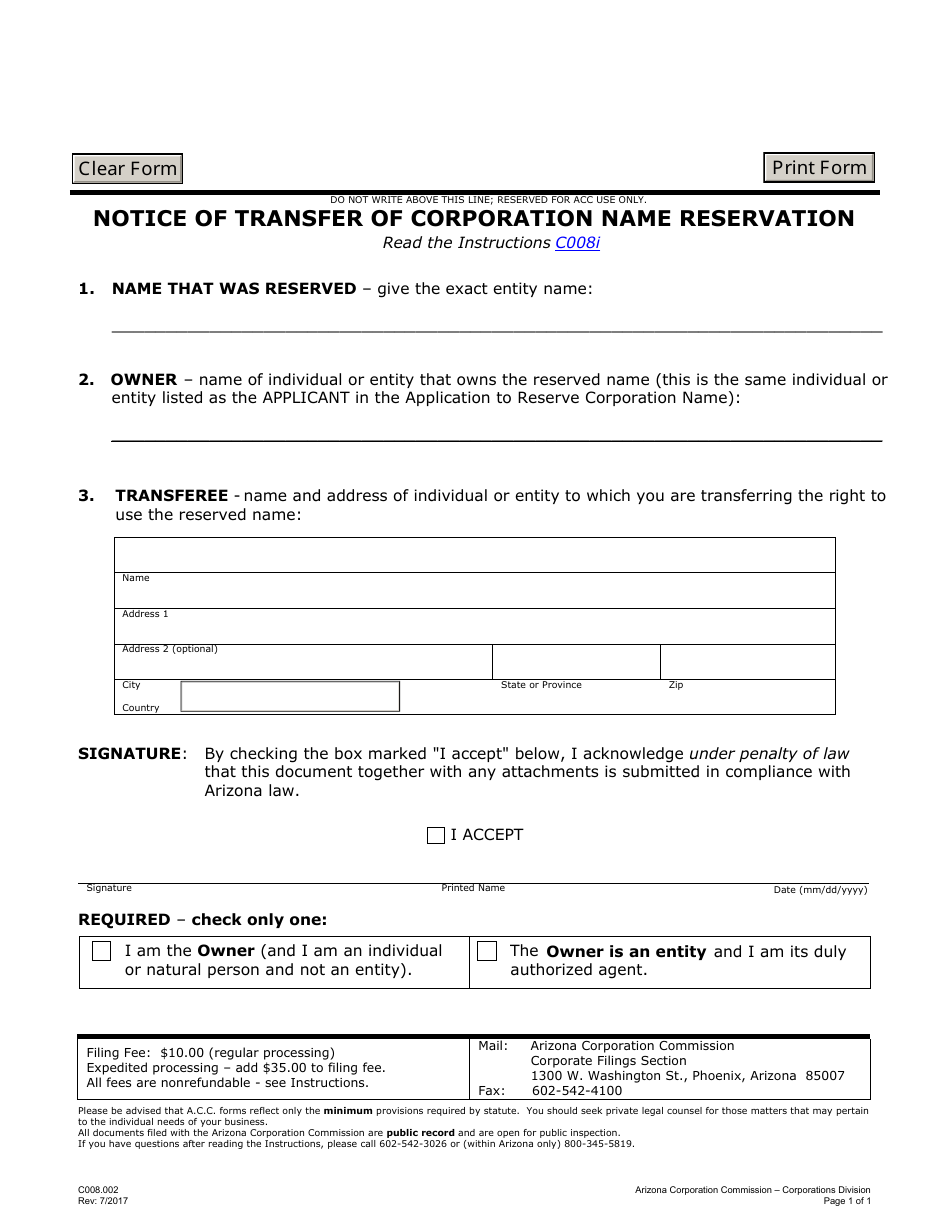

Form C008.002 Download Fillable PDF or Fill Online Notice of Transfer

Web arizona form 322 credit for contributions made or fees paid to public schools 2022 include with your return. • do not use this form for contributions. Web arizona form 322 a 101 21 arizona form credit for contributions made or 322 fees paid to public schools 2021 include with your return. Enjoy smart fillable fields and interactivity. Web arizona.

Web Arizona Form 322 Following The Close Of The Taxable Year May Be Applied To Either The Current Or Preceding Taxable Year And Is Considered To Have Been Made On The Last Day.

Web we last updated arizona form 322 in february 2023 from the arizona department of revenue. Details on how to only prepare and print an. To get started on the form, use the fill & sign online button or tick the preview image of the blank. Enjoy smart fillable fields and interactivity.

Web 26 Rows Form Number Title;

Get your online template and fill it in using progressive features. Application for bingo license packet: Web how to fill out and sign az online? Web 26 rows form number title;

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

Save or instantly send your ready documents. Tax credits forms, individual : Follow the simple instructions below:. The maximum credit allowed is $400 for married filing joint filers and $200 for single, heads of.

Web To Enter Information For Arizona Form 322 (Credit For Contributions Made Or Fees Paid To Public Schools) In Turbotax, Please Take The Following Steps:

Web arizona form 321, credit for contributions to qualifying charitable organizations Easily fill out pdf blank, edit, and sign them. Web state of arizona form 322, also known as form 322, is a tax document utilized by taxpayers who are claiming a credit for taxes paid to other states on their arizona. Do not use this form for cash contributions or fees paid to a.