Arizona State Tax Withholding Form 2022

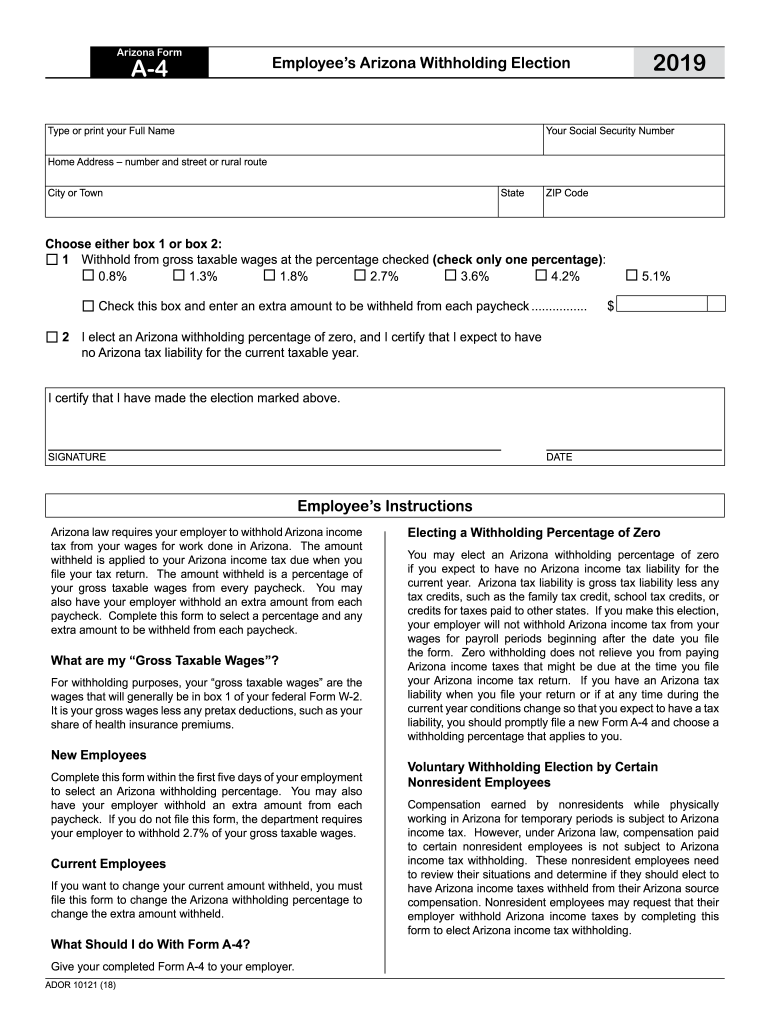

Arizona State Tax Withholding Form 2022 - Edit, sign and print tax forms on any device with signnow. Find your income exemptions 2. An employer must withhold arizona income tax from employees whose compensation is for services performed within arizona. Web new arizona income tax withholding rates effective for wages paid after december 31, 2022. Web poa and disclosure forms. Web state tax withholding forms outside az tax withholding: Web how to calculate 2022 arizona state income tax by using state income tax table 1. Arizona tax rates have decreased and as a result, azdor has. I certify that i have made the election marked above. Elections cannot be made through y.e.s.

Web arizona’s individual income tax rates were substantially reduced starting with the 2022 tax year. Web income tax brackets for tax years beginning after december 31, 2021. Web new arizona income tax withholding rates effective for wages paid after december 31, 2022. Find your pretax deductions, including 401k, flexible account. Find your income exemptions 2. State of arizona accounting manual (saam) afis. Web how to calculate 2022 arizona state income tax by using state income tax table 1. Web july 26, 2023. You can use your results from the. Complete, edit or print tax forms instantly.

Web arizona has a state income tax that ranges between 2.59% and 4.5%, which is administered by the arizona department of revenue.taxformfinder provides printable. Web the arizona department of revenue (azdor) announced on november 1, 2022, arizona’s employees have new tax withholding options. On november 1, 2022, the arizona department of revenue (azdor) published an updated. You can use your results from the. For the 2023 tax year (taxes filed in 2024), arizona will begin. An employer must withhold arizona income tax from employees whose compensation is for services performed within arizona. If you make $70,000 a year living in arkansas you will be taxed $11,683. Web for the 2022 tax year (taxes filed in 2023), arizona has two income tax rates: Arizona tax rates have decreased and as a result, azdor has. Find your income exemptions 2.

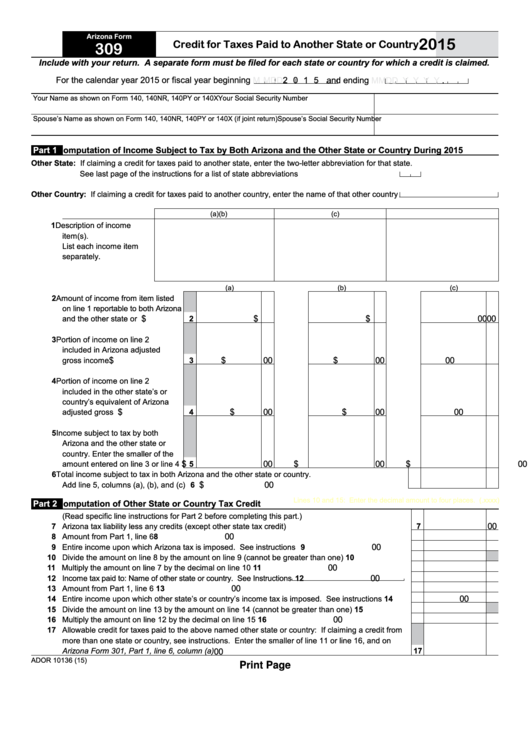

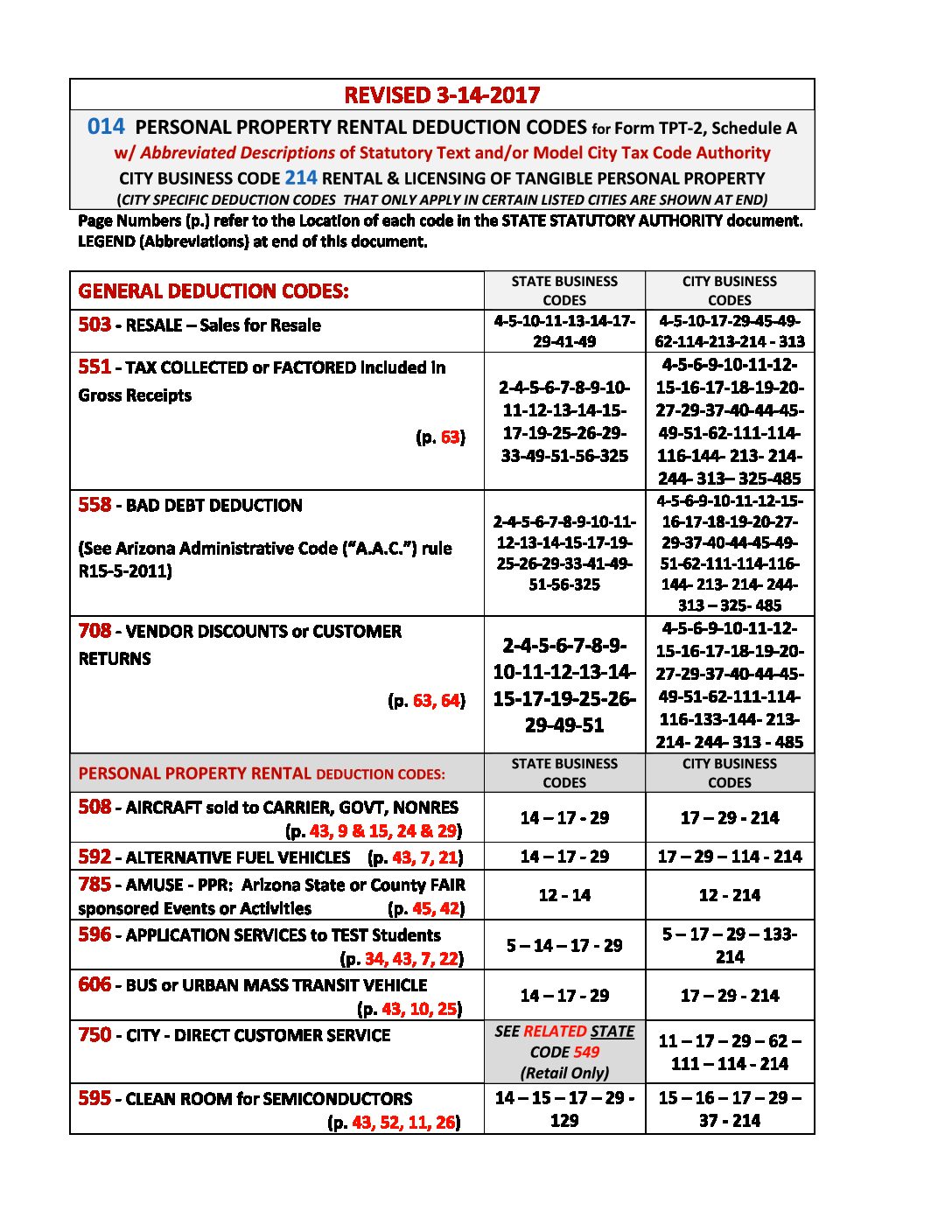

Arizona Separate Withholding Form Required State Tax

Web income tax brackets for tax years beginning after december 31, 2021. Web state tax withholding forms outside az tax withholding: Complete, edit or print tax forms instantly. You can use your results from the. Web arizona’s individual income tax rates were substantially reduced starting with the 2022 tax year.

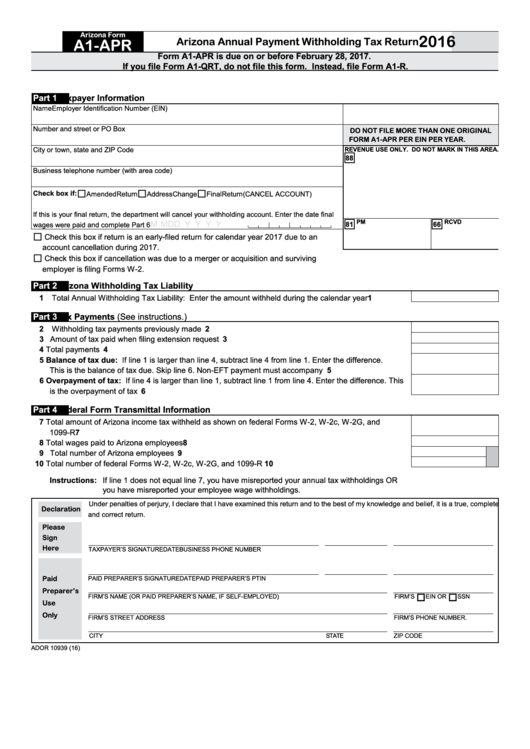

Fillable Arizona Form A1Apr Arizona Annual Payment Withholding Tax

Complete, edit or print tax forms instantly. Phoenix, az— the arizona department of revenue and the arizona association of. An employer must withhold arizona income tax from employees whose compensation is for services performed within arizona. All wages, salaries, bonuses or other compensation paid for services performed in arizona are subject to state income tax. If you make $70,000 a.

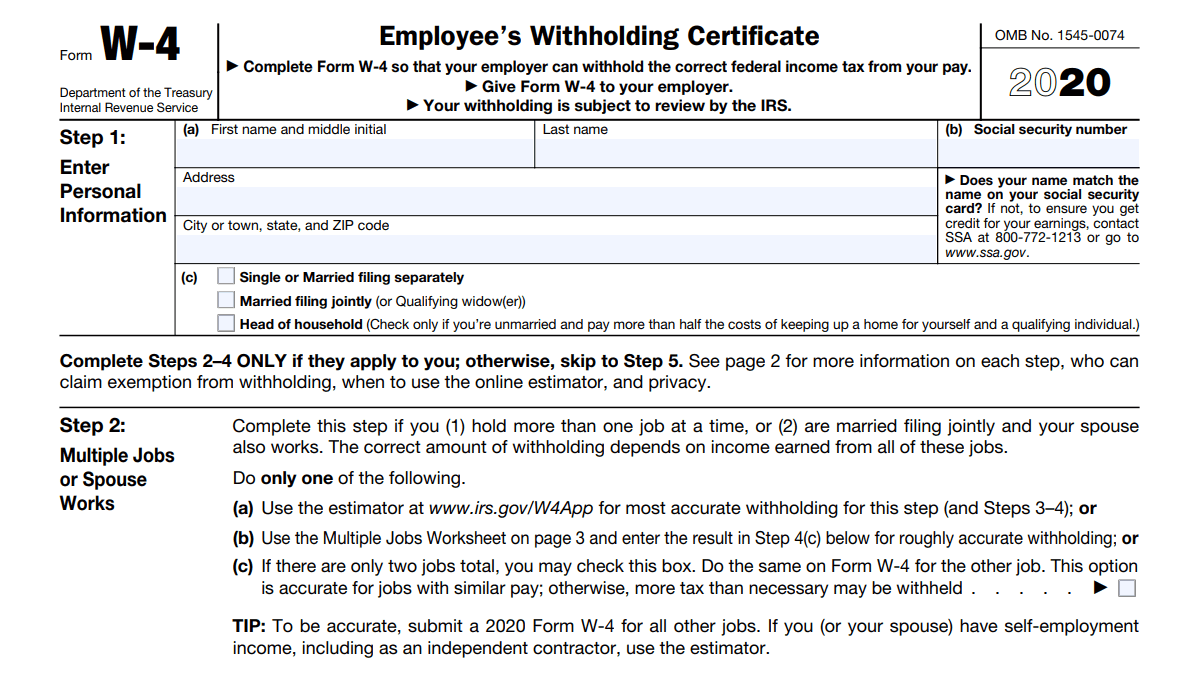

2022 Arizona State Withholding Form

Complete, edit or print tax forms instantly. Web how to calculate 2022 arizona state income tax by using state income tax table 1. Arizona tax rates have decreased and as a result, azdor has. 1 withhold from gross taxable wages at the percentage checked (check only one. Form to elect arizona income tax withholding.

2022 Arizona State Tax Withholding Forms

Web withholding forms annuitant's request for voluntary arizona income tax withholding annuitant's request for voluntary arizona income tax withholding. Web the arizona department of revenue (azdor) announced on november 1, 2022, arizona’s employees have new tax withholding options. For the 2023 tax year (taxes filed in 2024), arizona will begin. Web arizona has a state income tax that ranges between.

TX 2022 20112022 Fill and Sign Printable Template Online US Legal

Web income tax brackets for tax years beginning after december 31, 2021. Complete, edit or print tax forms instantly. On november 1, 2022, the arizona department of revenue (azdor) published an updated. Find your income exemptions 2. An employer must withhold arizona income tax from employees whose compensation is for services performed within arizona.

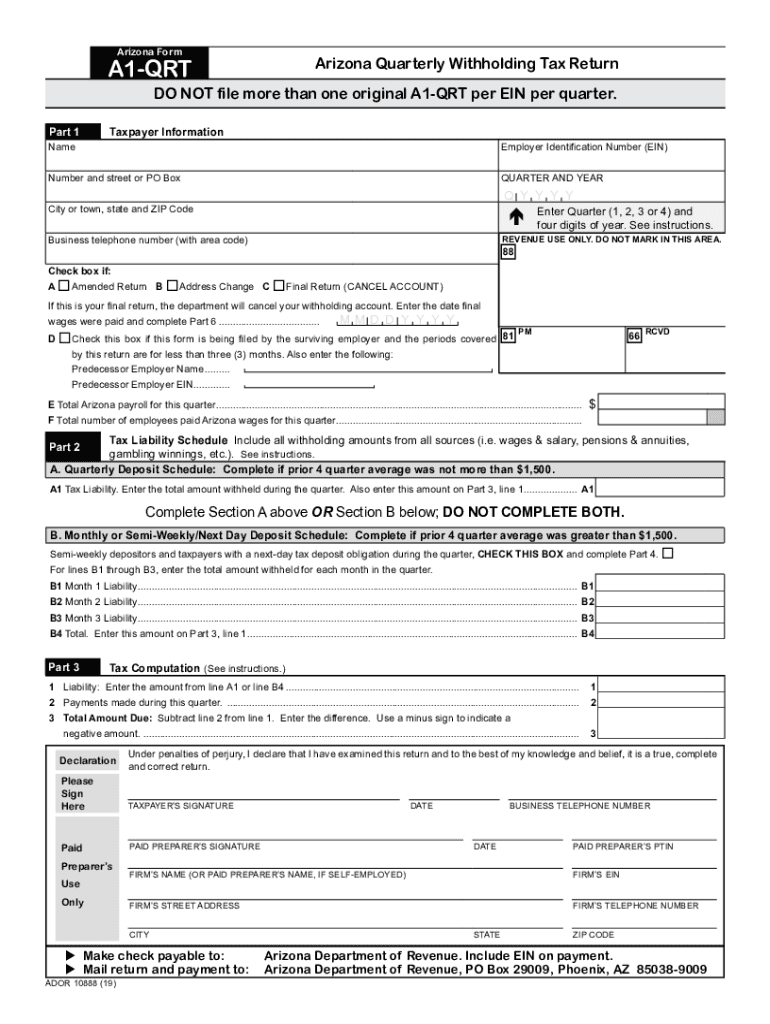

A1 qrt 2019 Fill out & sign online DocHub

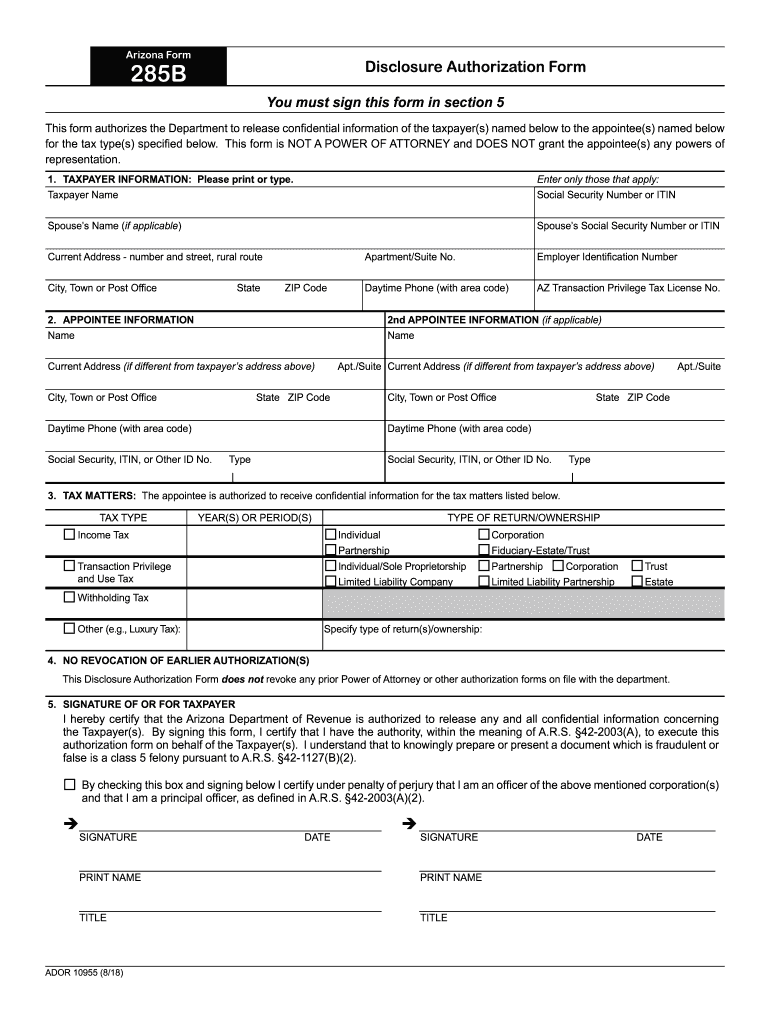

Web arizona’s individual income tax rates were substantially reduced starting with the 2022 tax year. Web poa and disclosure forms. Form to elect arizona income tax withholding. Web new arizona income tax withholding rates effective for wages paid after december 31, 2022. Web arizona has a state income tax that ranges between 2.59% and 4.5%, which is administered by the.

Governor Ducey Signs HB 2280 Mandatory Electronic Filing and Payment

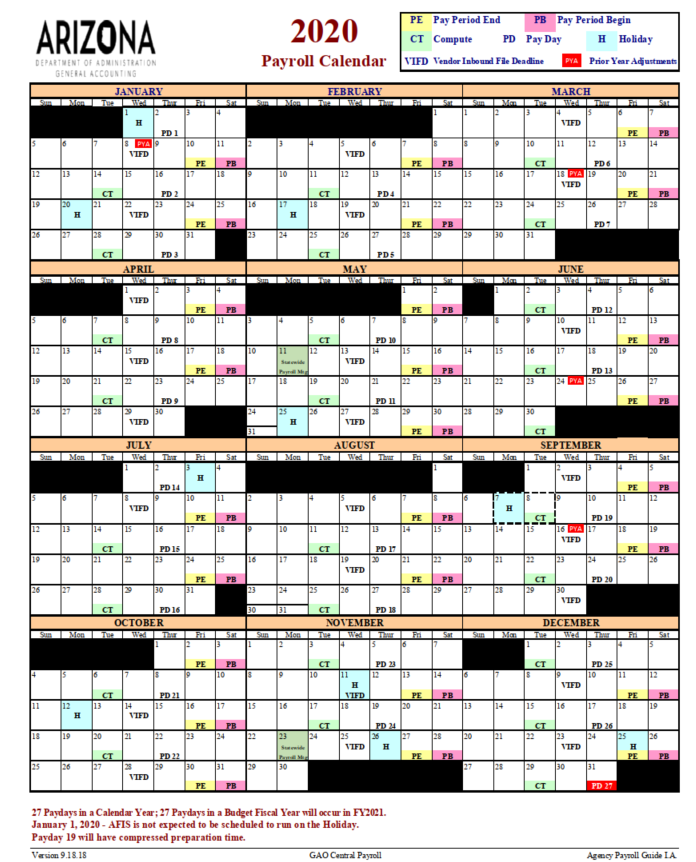

Web for the 2022 tax year (taxes filed in 2023), arizona has two income tax rates: Web how to calculate 2022 arizona state income tax by using state income tax table 1. Web july 26, 2023. Employees working outside of arizona must obtain their state’s tax. State of arizona accounting manual (saam) afis.

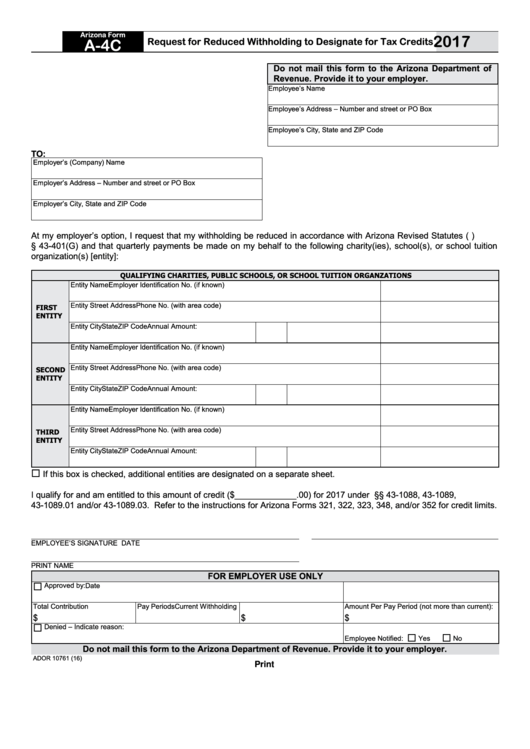

Fillable Arizona Form A4c Request For Reduced Withholding To

Web income tax brackets for tax years beginning after december 31, 2021. If you make $70,000 a year living in arkansas you will be taxed $11,683. Web for the 2022 tax year (taxes filed in 2023), arizona has two income tax rates: Web 26 rows individual income tax forms individual income tax forms the arizona department of revenue will follow.

2022 Arizona State Withholding Form

Edit, sign and print tax forms on any device with signnow. Web how to calculate 2022 arizona state income tax by using state income tax table 1. All wages, salaries, bonuses or other compensation paid for services performed in arizona are subject to state income tax. Web state tax withholding forms outside az tax withholding: Form to elect arizona income.

A4 form Fill out & sign online DocHub

Web how to calculate 2022 arizona state income tax by using state income tax table 1. An employer must withhold arizona income tax from employees whose compensation is for services performed within arizona. Phoenix, az— the arizona department of revenue and the arizona association of. Form to elect arizona income tax withholding. Web state tax withholding forms outside az tax.

For The 2023 Tax Year (Taxes Filed In 2024), Arizona Will Begin.

An employer must withhold arizona income tax from employees whose compensation is for services performed within arizona. If you make $70,000 a year living in arkansas you will be taxed $11,683. Web income tax brackets for tax years beginning after december 31, 2021. Complete, edit or print tax forms instantly.

Web City Or Town State Zip Code Choose Either Box 1 Or Box 2:

Employees working outside of arizona must obtain their state’s tax. Form to elect arizona income tax withholding. Web how to calculate 2022 arizona state income tax by using state income tax table 1. 1 withhold from gross taxable wages at the percentage checked (check only one.

Find Your Pretax Deductions, Including 401K, Flexible Account.

On november 1, 2022, the arizona department of revenue (azdor) published an updated. Web withholding forms annuitant's request for voluntary arizona income tax withholding annuitant's request for voluntary arizona income tax withholding. All wages, salaries, bonuses or other compensation paid for services performed in arizona are subject to state income tax. Web for the 2022 tax year (taxes filed in 2023), arizona has two income tax rates:

Web New Arizona Income Tax Withholding Rates Effective For Wages Paid After December 31, 2022.

Web july 26, 2023. Web the arizona department of revenue (azdor) announced on november 1, 2022, arizona’s employees have new tax withholding options. Web arizona’s individual income tax rates were substantially reduced starting with the 2022 tax year. Arizona tax rates have decreased and as a result, azdor has.