Az Form 348

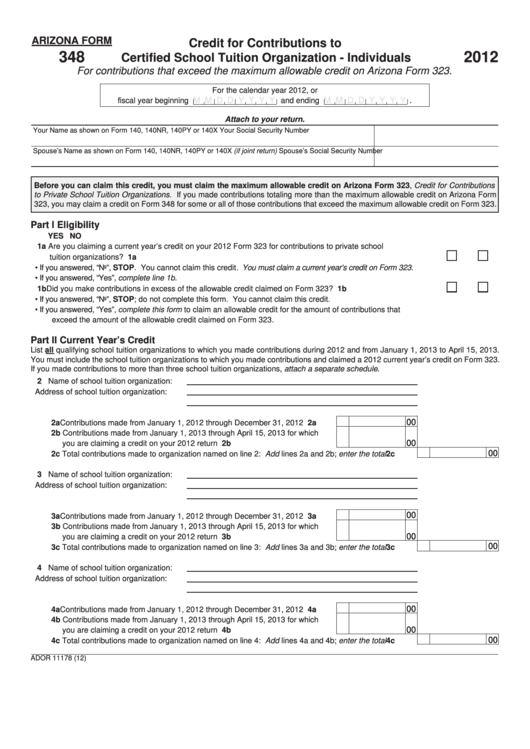

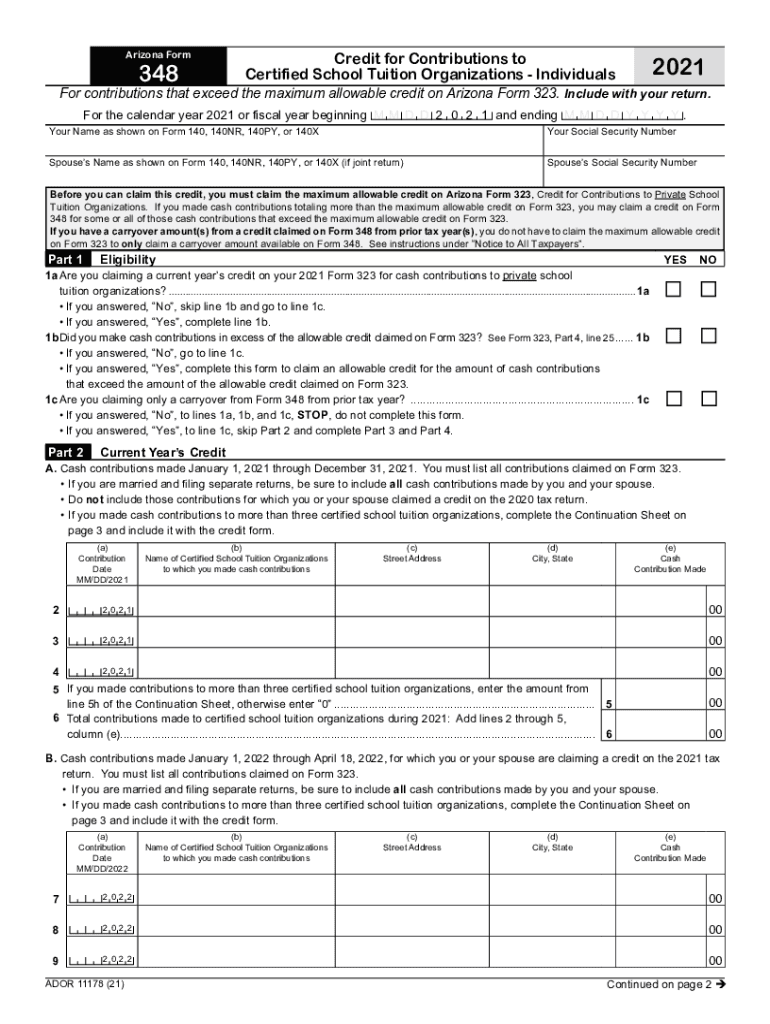

Az Form 348 - Web 12 rows a nonrefundable individual tax credit for cash contributions to a school tuition organization that exceed the original private school tuition organization. For the calendar year 2022 or fiscal year. Save or instantly send your ready documents. Web arizona form 348 ao 111 (22) for contributions that exceed the maximum allowable credit on arizona form 323. Easily fill out pdf blank, edit, and sign them. Ador 11178 (21) az form 348. This form is for income earned in tax year 2022, with tax returns due in april. Web arizona form 348 general instructions arizona law provides an individual income tax credit for the voluntary cash contributions made to a certified school tuition organization. Web arizona form 348 author: Web arizona form 348 credit carryover amount from prior tax years if you claimed an allowable credit on form 348 on your 2017 through 2021 tax returns and your tax liability.

Web arizona form 348 credit carryover amount from prior tax years if you claimed an allowable credit on form 348 on your 2017 through 2021 tax returns and your tax liability. For the calendar year 2022 or fiscal year. Web arizona form 348 general instructions arizona law provides an individual income tax credit for the voluntary cash contributions made to a certified school tuition organization. Web arizona form 348 credit carryover amount from prior tax years if you claimed an allowable credit on form 348 on your 2013, through 2017 tax returns and your tax. If you have a carryover amount(s) from a credit claimed on form 348 from. Web arizona form 348 ao 111 (22) for contributions that exceed the maximum allowable credit on arizona form 323. For contributions that exceed the maximum. Ador 11178 (21) az form 348. Web arizona form 348 author: Save or instantly send your ready documents.

Arizona department of revenue subject: Web arizona form 348 credit carryover amount from prior tax years if you claimed an allowable credit on form 348 on your 2013, through 2017 tax returns and your tax. Ador 11178 (21) az form 348. Web arizona form 348 author: Web 12 rows a nonrefundable individual tax credit for cash contributions to a school tuition organization that exceed the original private school tuition organization. Web this tax credit is claimed on form 348 and is available to individual taxpayers who donate the maximum amount allowed under the credit for contributions to private school. Easily fill out pdf blank, edit, and sign them. For contributions that exceed the maximum. For the calendar year 2022 or fiscal year. Web 348 for some or all of those cash contributions that exceed the maximum allowable credit on form 323.

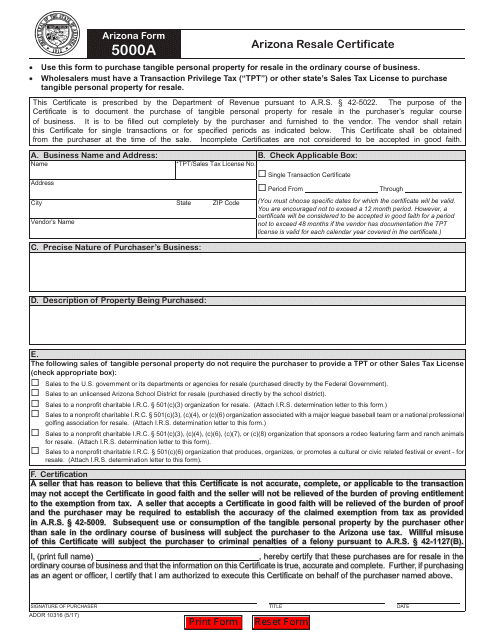

Arizona Form 5000A (ADOR10316) Download Fillable PDF or Fill Online

Web arizona form 348 ao 111 (22) for contributions that exceed the maximum allowable credit on arizona form 323. Web arizona form 348 general instructions arizona law provides an individual income tax credit for the voluntary cash contributions made to a certified school tuition organization. Arizona department of revenue subject: If you have a carryover amount(s) from a credit claimed.

Fillable Arizona Form 348 Credit For Contributions To Certified

Easily fill out pdf blank, edit, and sign them. For the calendar year 2022 or fiscal year. Web we last updated arizona form 348 in february 2023 from the arizona department of revenue. Arizona department of revenue subject: If you have a carryover amount(s) from a credit claimed on form 348 from.

DA form 348 Master Driver Handbook

Web this tax credit is claimed on form 348 and is available to individual taxpayers who donate the maximum amount allowed under the credit for contributions to private school. Save or instantly send your ready documents. This form is for income earned in tax year 2022, with tax returns due in april. Arizona department of revenue subject: Easily fill out.

DA form 348 Master Driver Handbook

This form is for income earned in tax year 2022, with tax returns due in april. Web arizona form 348 credit carryover amount from prior tax years if you claimed an allowable credit on form 348 on your 2017 through 2021 tax returns and your tax liability. Ador 11178 (21) az form 348. Web this tax credit is claimed on.

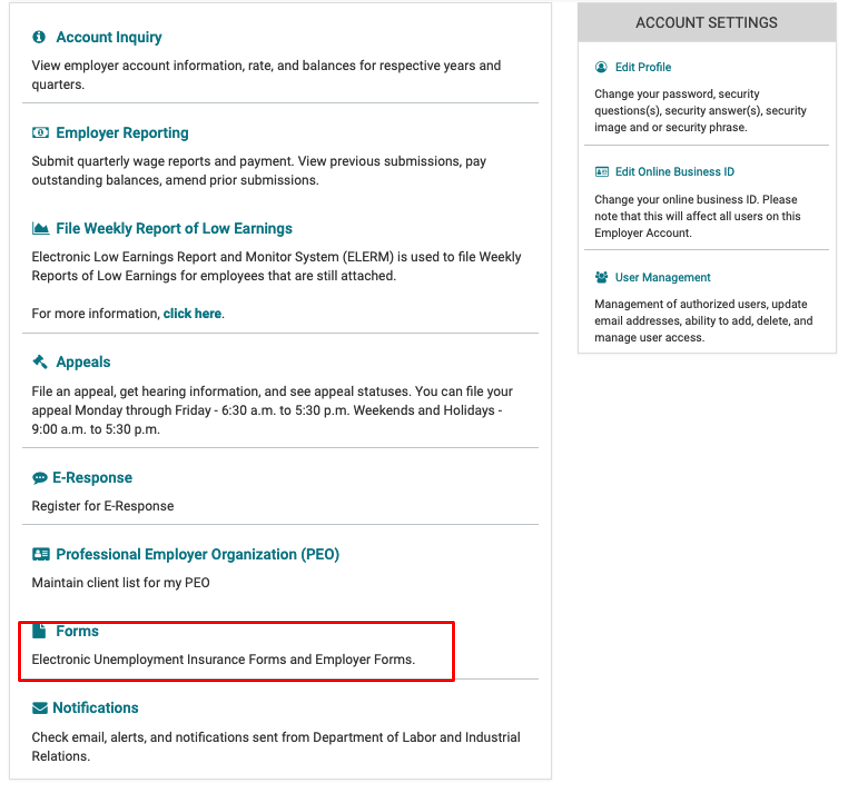

Unemployment Insurance Instructions for Submitting Form UC348

Arizona department of revenue subject: Ador 11178 (21) az form 348. This form is for income earned in tax year 2022, with tax returns due in april. If you have a carryover amount(s) from a credit claimed on form 348 from. Web this tax credit is claimed on form 348 and is available to individual taxpayers who donate the maximum.

Az Form 348 Fill Out and Sign Printable PDF Template signNow

Web 348 for some or all of those cash contributions that exceed the maximum allowable credit on form 323. If you have a carryover amount(s) from a credit claimed on form 348 from. Ador 11178 (21) az form 348. Save or instantly send your ready documents. Web arizona form 348 credit carryover amount from prior tax years if you claimed.

Da Form 348 Fill Online, Printable, Fillable, Blank pdfFiller

Web arizona form 348 ao 111 (22) for contributions that exceed the maximum allowable credit on arizona form 323. If you have a carryover amount(s) from a credit claimed on form 348 from. Web we last updated arizona form 348 in february 2023 from the arizona department of revenue. Web 12 rows a nonrefundable individual tax credit for cash contributions.

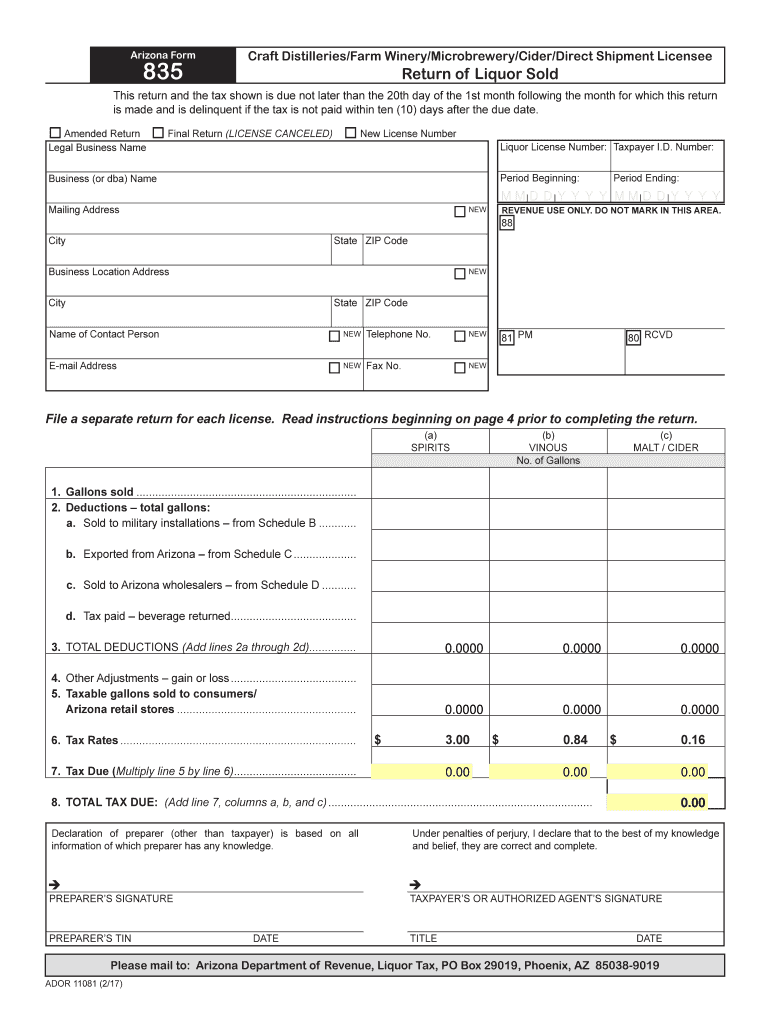

AZ Form 835 20172022 Fill out Tax Template Online US Legal Forms

Web arizona form 348 author: Web 12 rows a nonrefundable individual tax credit for cash contributions to a school tuition organization that exceed the original private school tuition organization. Save or instantly send your ready documents. Web arizona form 348 credit carryover amount from prior tax years if you claimed an allowable credit on form 348 on your 2017 through.

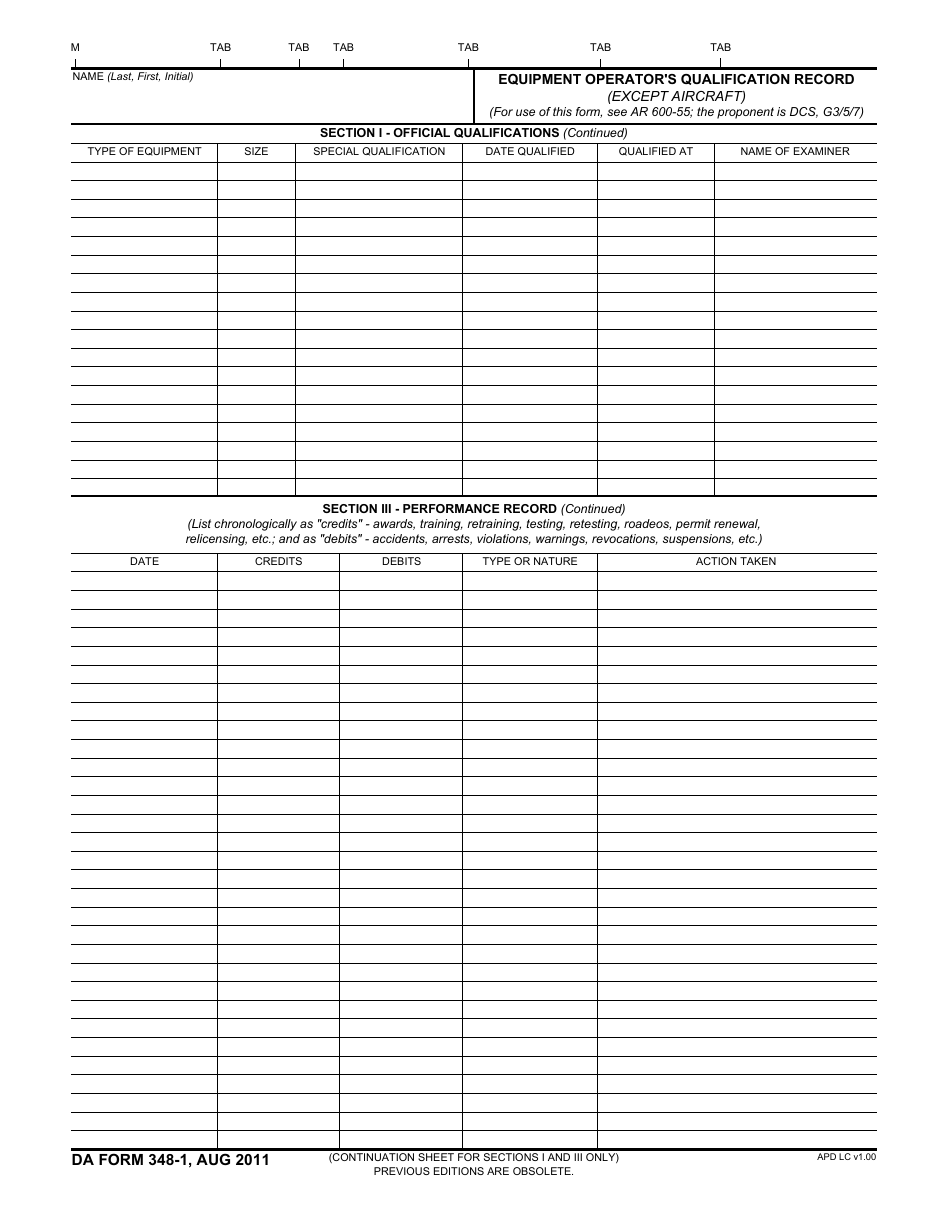

DA Form 3481 Download Fillable PDF or Fill Online Equipment Operator's

Web this tax credit is claimed on form 348 and is available to individual taxpayers who donate the maximum amount allowed under the credit for contributions to private school. Web arizona form 348 credit carryover amount from prior tax years if you claimed an allowable credit on form 348 on your 2017 through 2021 tax returns and your tax liability..

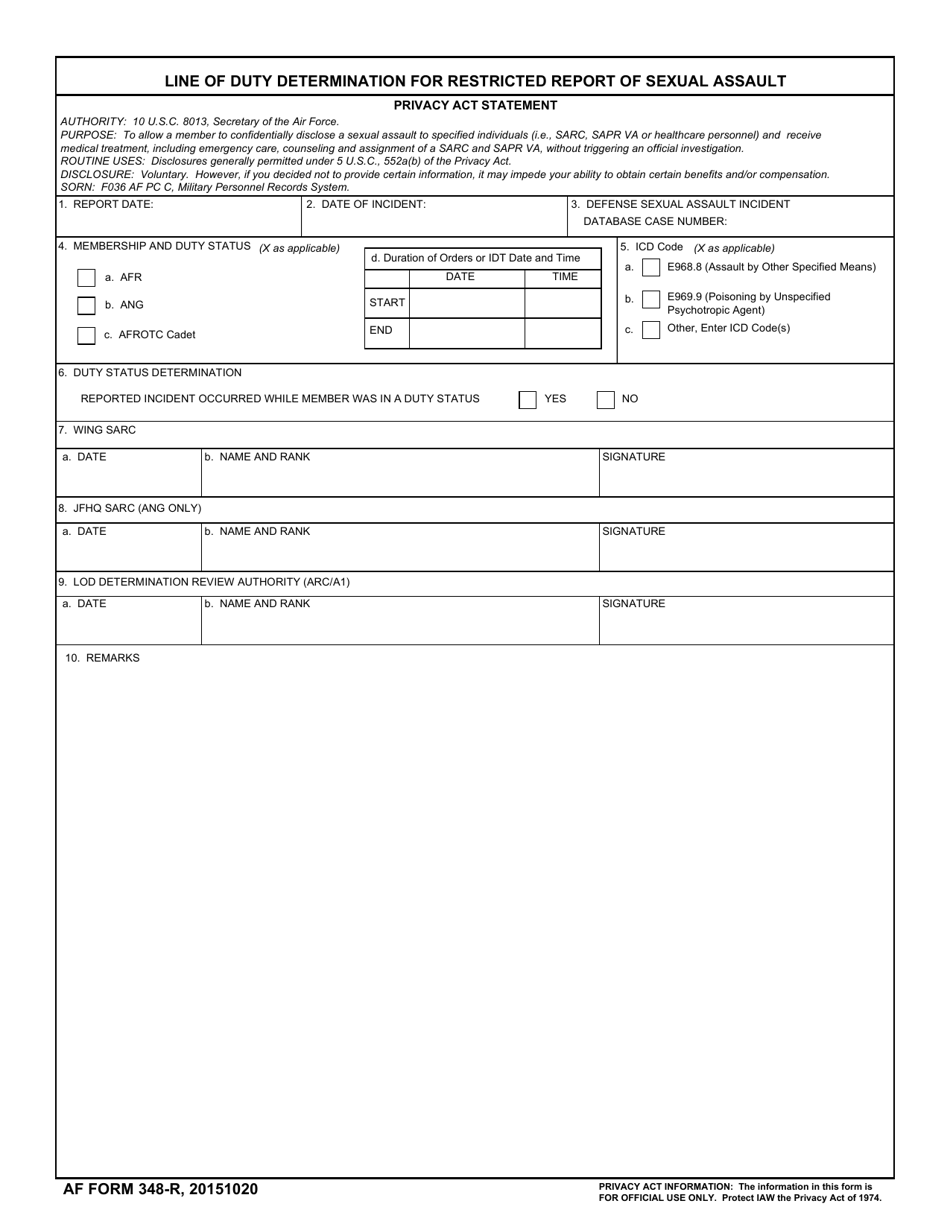

AF Form 348R Download Fillable PDF or Fill Online Line of Duty

Arizona department of revenue subject: Web this tax credit is claimed on form 348 and is available to individual taxpayers who donate the maximum amount allowed under the credit for contributions to private school. Ador 11178 (21) az form 348. Web 348 for some or all of those cash contributions that exceed the maximum allowable credit on form 323. For.

If You Have A Carryover Amount(S) From A Credit Claimed On Form 348 From.

Save or instantly send your ready documents. Web arizona form 348 author: Easily fill out pdf blank, edit, and sign them. Ador 11178 (21) az form 348.

Web This Tax Credit Is Claimed On Form 348 And Is Available To Individual Taxpayers Who Donate The Maximum Amount Allowed Under The Credit For Contributions To Private School.

Web arizona form 348 ao 111 (22) for contributions that exceed the maximum allowable credit on arizona form 323. This form is for income earned in tax year 2022, with tax returns due in april. Web 12 rows a nonrefundable individual tax credit for cash contributions to a school tuition organization that exceed the original private school tuition organization. Web arizona form 348 credit carryover amount from prior tax years if you claimed an allowable credit on form 348 on your 2017 through 2021 tax returns and your tax liability.

Web 348 For Some Or All Of Those Cash Contributions That Exceed The Maximum Allowable Credit On Form 323.

Web arizona form 348 general instructions arizona law provides an individual income tax credit for the voluntary cash contributions made to a certified school tuition organization. For the calendar year 2022 or fiscal year. Arizona department of revenue subject: Web we last updated arizona form 348 in february 2023 from the arizona department of revenue.

Web Arizona Form 348 Credit Carryover Amount From Prior Tax Years If You Claimed An Allowable Credit On Form 348 On Your 2013, Through 2017 Tax Returns And Your Tax.

For contributions that exceed the maximum.