Balance Sheet Dividends Example

Balance Sheet Dividends Example - Web the answer represents the total amount of dividends paid. As such, the balance sheet is divided into two sides (or sections). Assets = liabilities + equity. The total value of the dividend is $0.50 x 500,000, or. For example, say a company earned $100 million in a given year. Before dividends are paid, there is no impact on the. Web for example, a company that pays a 2% cash dividend, should experience a 2% decline in the price of its stock. Large stock dividends, of more than 20% or 25%, could also be considered to be. It started with $50 million in retained earnings and ended the year. Web the balance sheet is based on the fundamental equation:

Web dividends in the balance sheet. Assets = liabilities + equity. Before dividends are paid, there is no impact on the. The total value of the dividend is $0.50 x 500,000, or. Web for example, a company that pays a 2% cash dividend, should experience a 2% decline in the price of its stock. Web the balance sheet is based on the fundamental equation: Web the answer represents the total amount of dividends paid. Large stock dividends, of more than 20% or 25%, could also be considered to be. It started with $50 million in retained earnings and ended the year. As such, the balance sheet is divided into two sides (or sections).

Large stock dividends, of more than 20% or 25%, could also be considered to be. Web for example, a company that pays a 2% cash dividend, should experience a 2% decline in the price of its stock. As such, the balance sheet is divided into two sides (or sections). Web dividends in the balance sheet. Before dividends are paid, there is no impact on the. Assets = liabilities + equity. The total value of the dividend is $0.50 x 500,000, or. Web the balance sheet is based on the fundamental equation: It started with $50 million in retained earnings and ended the year. Web the answer represents the total amount of dividends paid.

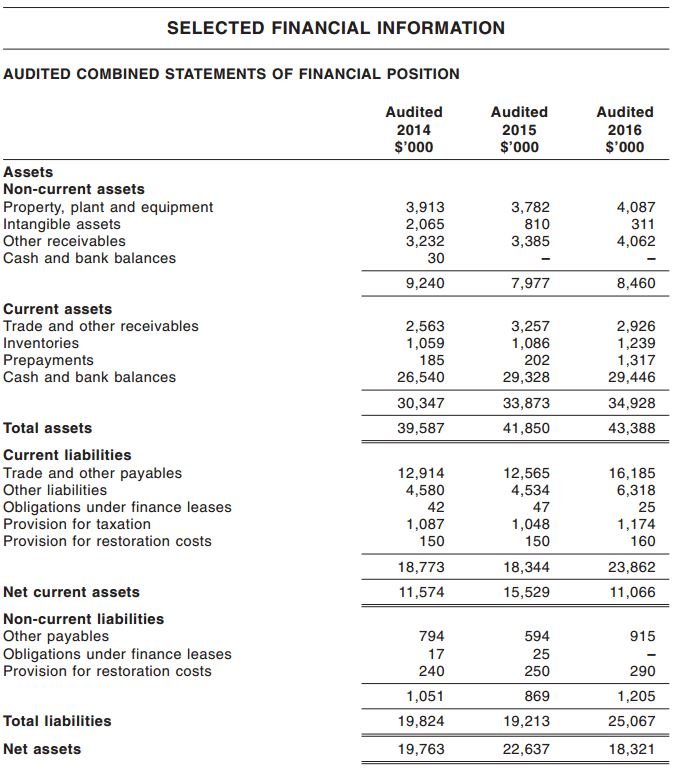

5 Minute Guide For All You Need to Know About Kimly’s IPO

It started with $50 million in retained earnings and ended the year. Assets = liabilities + equity. Web the balance sheet is based on the fundamental equation: Web for example, a company that pays a 2% cash dividend, should experience a 2% decline in the price of its stock. The total value of the dividend is $0.50 x 500,000, or.

What are Retained Earnings? Formula + Calculator

Web the balance sheet is based on the fundamental equation: Before dividends are paid, there is no impact on the. Assets = liabilities + equity. Web dividends in the balance sheet. For example, say a company earned $100 million in a given year.

Below is the comparative balance sheet for Stevie Wonder Corporation

Large stock dividends, of more than 20% or 25%, could also be considered to be. The total value of the dividend is $0.50 x 500,000, or. Assets = liabilities + equity. It started with $50 million in retained earnings and ended the year. Web the answer represents the total amount of dividends paid.

möglich Wald Trauben 22 44 uhr bedeutung Star erwachsen So viele

Web the answer represents the total amount of dividends paid. As such, the balance sheet is divided into two sides (or sections). Web for example, a company that pays a 2% cash dividend, should experience a 2% decline in the price of its stock. Assets = liabilities + equity. The total value of the dividend is $0.50 x 500,000, or.

5 Percent Stock Dividend On Balance Sheet Best Moving Stocks FullQuick

The total value of the dividend is $0.50 x 500,000, or. Web dividends in the balance sheet. For example, say a company earned $100 million in a given year. Before dividends are paid, there is no impact on the. Web for example, a company that pays a 2% cash dividend, should experience a 2% decline in the price of its.

27 Advanced Accounting Dividend Balance Sheet

Web for example, a company that pays a 2% cash dividend, should experience a 2% decline in the price of its stock. It started with $50 million in retained earnings and ended the year. Web dividends in the balance sheet. Assets = liabilities + equity. Web the balance sheet is based on the fundamental equation:

View Single Post Kimly Ltd *Official* (SGX1D0)

Web dividends in the balance sheet. Assets = liabilities + equity. Web the balance sheet is based on the fundamental equation: For example, say a company earned $100 million in a given year. Web for example, a company that pays a 2% cash dividend, should experience a 2% decline in the price of its stock.

Cool Net Balance Sheet Formula Profit And Loss Adjustment

Assets = liabilities + equity. Web the answer represents the total amount of dividends paid. Before dividends are paid, there is no impact on the. For example, say a company earned $100 million in a given year. Web dividends in the balance sheet.

Dividend Recap LBO Tutorial With Excel Examples

For example, say a company earned $100 million in a given year. Web the balance sheet is based on the fundamental equation: Before dividends are paid, there is no impact on the. It started with $50 million in retained earnings and ended the year. Web for example, a company that pays a 2% cash dividend, should experience a 2% decline.

Stockholders Equity Balance Sheet Dividends Ppt Powerpoint Presentation

Web the answer represents the total amount of dividends paid. Assets = liabilities + equity. Before dividends are paid, there is no impact on the. Large stock dividends, of more than 20% or 25%, could also be considered to be. For example, say a company earned $100 million in a given year.

Before Dividends Are Paid, There Is No Impact On The.

Web for example, a company that pays a 2% cash dividend, should experience a 2% decline in the price of its stock. The total value of the dividend is $0.50 x 500,000, or. Large stock dividends, of more than 20% or 25%, could also be considered to be. Web dividends in the balance sheet.

Web The Answer Represents The Total Amount Of Dividends Paid.

As such, the balance sheet is divided into two sides (or sections). Web the balance sheet is based on the fundamental equation: It started with $50 million in retained earnings and ended the year. For example, say a company earned $100 million in a given year.

:max_bytes(150000):strip_icc()/FacebookbalancesheetREDec2018-5c73549b46e0fb00014ef630.jpg)