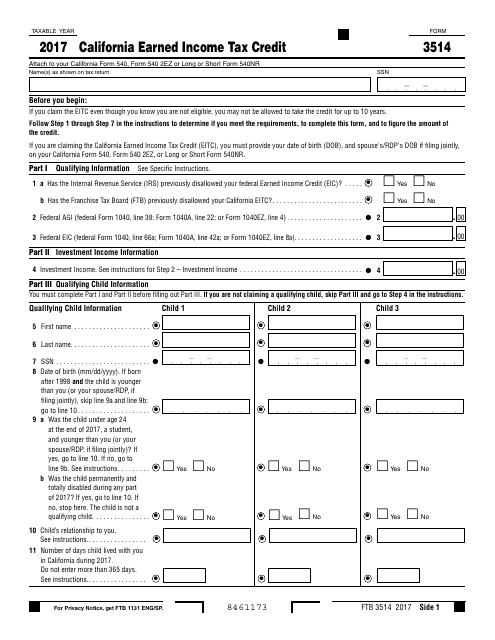

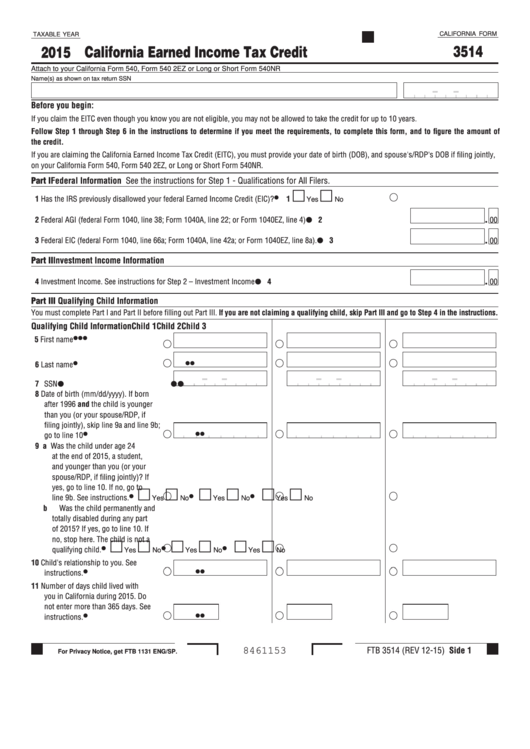

Ca Form 3514

Ca Form 3514 - Web the ca eitc reduces your california tax obligation, or allows a refund if no california tax is due. Web 2021 form 3514 california earned income tax credit. Web when claiming the california earned income tax credit, form 3514 line 1a asks if the irs has in a previous year disallowed your federal eic. For taxable years beginning on or after january 1, 2020, california expanded earned income tax credit (eitc) and. Attach to your california form. Web we last updated the california earned income tax credit in january 2023, so this is the latest version of form 3514, fully updated for tax year 2022. California earned income tax credit. You do not need a child to qualify, but must file a california income tax return to. Ftb 3514 2021 side 1. Web we last updated california form 3514 ins in may 2021 from the california franchise tax board.

California earned income tax credit. After reviewing this, lacerte currently does not have a way to force form 3514 for ca when the taxpayer does not qualify for eic. Web the california eitc reduces your california tax obligation, or allows a refund if no california tax is due. Web if you are claiming the california earned income tax credit (eitc), you must provide your date of birth (dob), and spouse's/rdp's dob if filing jointly, on your california form. Attach to your california form. Web use form ftb 3514 to determine whether you qualify to claim the credit, provide information about your qualifying children, if applicable, and to figure the amount. Schedule s, other state tax credit. Web 2021 form 3514 california earned income tax credit. Web form 3514, is ca earned income tax credit. Ftb 3514 2021 side 1.

Web form 3514, is ca earned income tax credit. References in these instructions are to the internal revenue code (irc) as of january 1,. You do not need a child to qualify, but must file a california income tax return to. You can download or print. This form is for income earned in tax year 2022, with tax returns due in april. Web if you are claiming the california earned income tax credit (eitc), you must provide your date of birth (dob), and spouse's/rdp's dob if filing jointly, on your california form. Attach to your california form. Web we last updated california form 3514 in january 2023 from the california franchise tax board. Web the ca eitc reduces your california tax obligation, or allows a refund if no california tax is due. After reviewing this, lacerte currently does not have a way to force form 3514 for ca when the taxpayer does not qualify for eic.

Fill Free fillable 2016 Instructions for Form FTB 3514 (California

California earned income tax credit. Web if you are claiming the california earned income tax credit (eitc), you must provide your date of birth (dob), and spouse's/rdp's dob if filing jointly, on your california form. Web 2017 instructions for form ftb 3514. Effective january 1, 2021, taxpayers who have an individual taxpayer identification number (itin) may be. For taxable years.

CA Form 2 Download Printable PDF or Fill Online Car 145 Approval

Web eitc reduces your california tax obligation, or allows a refund if no california tax is due. You do not need a child to qualify, but must file a california income tax return to. Web california form 3514 (california earned income tax credit. Web use form ftb 3514 to determine whether you qualify to claim the credit, provide information about.

Form FTB 3514 Download Fillable PDF 2017, California Earned Tax

Web 603 rows the ca eitc reduces your california tax obligation, or allows a refund if no. For taxable years beginning on or after january 1, 2020, california expanded earned income tax credit (eitc) and. Web if you are claiming the california earned income tax credit (eitc), you must provide your date of birth (dob), and spouse's/rdp's dob if filing.

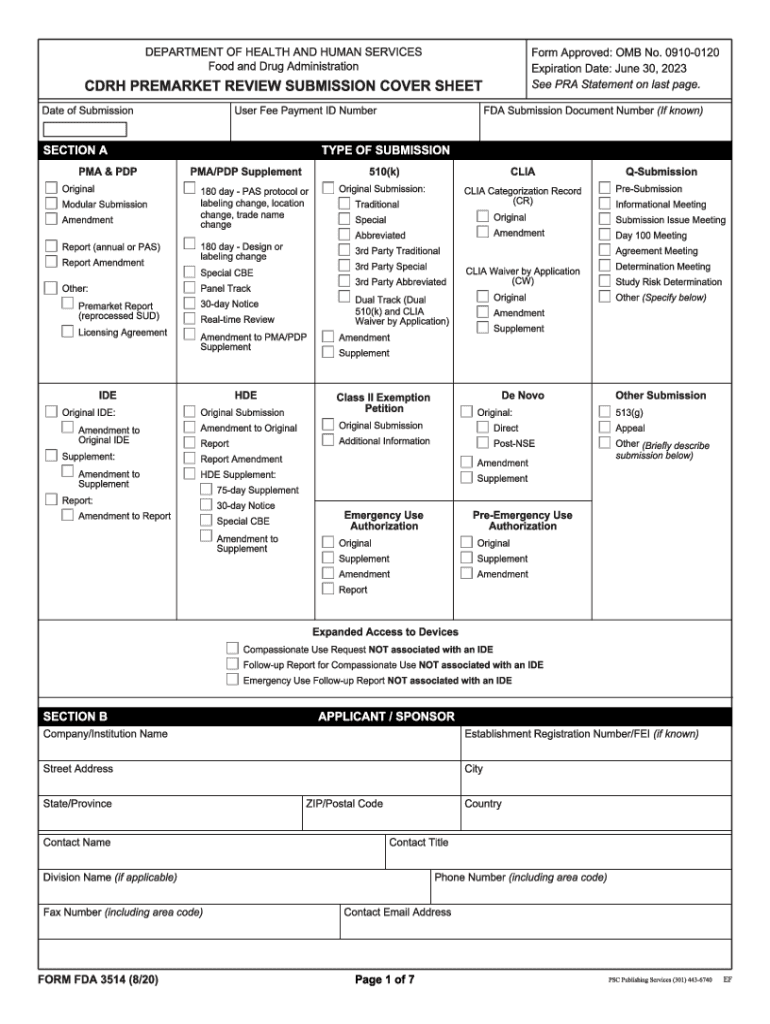

FDA 3514 20202022 Fill and Sign Printable Template Online US Legal

You do not need a child to qualify, but must file a california. Web 2017 instructions for form ftb 3514. Web form 3514, is ca earned income tax credit. California earned income tax credit. California earned income tax credit.

78th field artillery hires stock photography and images Alamy

You do not need a child to qualify, but must file a california income tax return. Web 603 rows the ca eitc reduces your california tax obligation, or allows a refund if no. California earned income tax credit. This form is for income earned in tax year 2022, with tax returns due in april. Web most taxpayers are required to.

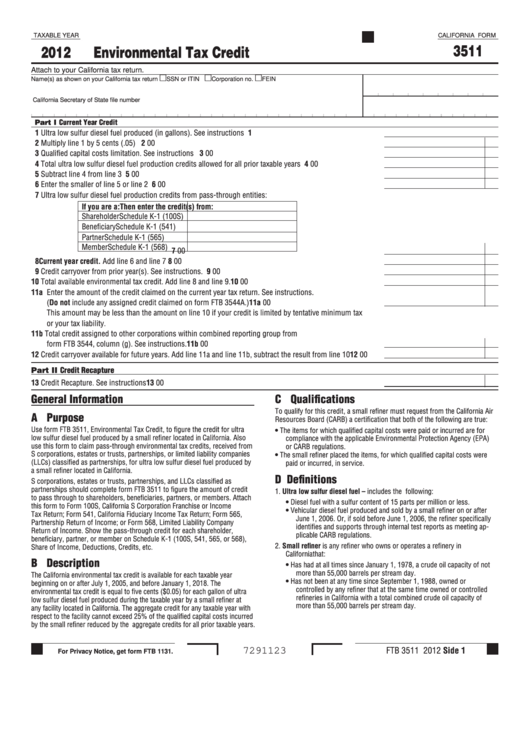

Fillable California Form 3511 Environmental Tax Credit 2012

Web eitc reduces your california tax obligation, or allows a refund if no california tax is due. You do not need a child to qualify, but must file a california income tax return to. This form is for income earned in tax year 2022, with tax returns due in april. Web we last updated california form 3514 in january 2023.

Fill Free fillable 2016 Instructions for Form FTB 3514 (California

Web we last updated the california earned income tax credit in january 2023, so this is the latest version of form 3514, fully updated for tax year 2022. You do not need a child to qualify, but must file a california income tax return. Web eitc reduces your california tax obligation, or allows a refund if no california tax is.

Form 3514 California Earned Tax Credit 2015 printable pdf

Attach to your california form. You do not need a child to qualify, but must file a california income tax return. You can download or print. References in these instructions are to the internal revenue code (irc) as of january 1,. Web use form ftb 3514 to determine whether you qualify to claim the credit, provide information about your qualifying.

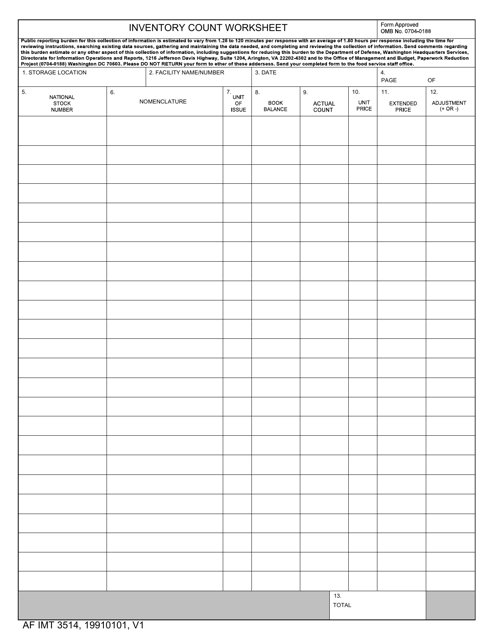

AF IMT Form 3514 Download Fillable PDF or Fill Online Inventory Count

Web use form ftb 3514 to determine whether you qualify to claim the credit, provide information about your qualifying children, if applicable, and to figure the amount. Web eitc reduces your california tax obligation, or allows a refund if no california tax is due. California earned income tax credit. California earned income tax credit. Web the ca eitc reduces your.

California Tax Table 540 2ez Review Home Decor

This form is for income earned in tax year 2022, with tax returns due in april. You do not need a child to qualify, but must file a california income tax return. Web form 3514, is ca earned income tax credit. You do not need a child to qualify, but must file a california income tax return to. For taxable.

Web We Last Updated California Form 3514 In January 2023 From The California Franchise Tax Board.

You do not need a child to qualify, but must file a california income tax return. Schedule s, other state tax credit. This form is for income earned in tax year 2022, with tax returns due in april. Web 2021 form 3514 california earned income tax credit.

California Earned Income Tax Credit.

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Effective january 1, 2021, taxpayers who have an individual taxpayer identification number (itin) may be. Web if you are claiming the california earned income tax credit (eitc), you must provide your date of birth (dob), and spouse's/rdp's dob if filing jointly, on your california form. Web form 3514, is ca earned income tax credit.

You Do Not Need A Child To Qualify, But Must File A California.

This form is for income earned in tax year 2022, with tax returns due in april. Web when claiming the california earned income tax credit, form 3514 line 1a asks if the irs has in a previous year disallowed your federal eic. Web use form ftb 3514 to determine whether you qualify to claim the credit, provide information about your qualifying children, if applicable, and to figure the amount. Web we last updated california form 3514 ins in may 2021 from the california franchise tax board.

Web 2017 Instructions For Form Ftb 3514.

Web eitc reduces your california tax obligation, or allows a refund if no california tax is due. Attach to your california form. Web the ca eitc reduces your california tax obligation, or allows a refund if no california tax is due. Web 603 rows the ca eitc reduces your california tax obligation, or allows a refund if no.