Ca Form 3840 Instructions 2022

Ca Form 3840 Instructions 2022 - Web 2 weeks ago. Name(s) as shown on your state tax return. Web california form 3840 , and ending (mm/dd/yyyy). Enter amounts from federal form 8824. Get your online template and fill it in using progressive features. Web to ensure that taxpayers do not escape california taxation on capital gains realized from the exchange of california real property, the new form 3840 requires. Web the instructions for form 540, line 77, and get form ftb 3514, or go to ftb.ca.gov and search for fytc. Web how to fill out and sign ca form 3840 instructions 2022 online? Filing status name changed from qualifying widow(er) to quali ying surviving spouse. Web 2022 changes r instructions form 1040 has new lines.

Web 2 weeks ago. Schedule 1 has new lines. Web to ensure that taxpayers do not escape california taxation on capital gains realized from the exchange of california real property, the new form 3840 requires. Web california form 3840 , and ending (mm/dd/yyyy). Filing status name changed from qualifying widow(er) to quali ying surviving spouse. Enter amounts from federal form 8824. The taxpayer checks the “annual ftb. Web the instructions for form 540, line 77, and get form ftb 3514, or go to ftb.ca.gov and search for fytc. When entering the property description, proseries is. Web under california law, the taxpayer has an annual reporting requirement.

Web 2 weeks ago. The taxpayer files a form ftb 3840 for the 2020 taxable year. Schedule 1 has new lines. Get your online template and fill it in using progressive features. For the calendar year 2022 or fiscal year beginning (mm/dd/yyyy) , and ending (mm/dd/yyyy) name(s) as shown on. Web how to fill out and sign ca form 3840 instructions 2022 online? Web to ensure that taxpayers do not escape california taxation on capital gains realized from the exchange of california real property, the new form 3840 requires. Web 2022 changes r instructions form 1040 has new lines. Web simplified income, payroll, sales and use tax information for you and your business The taxpayer checks the “annual ftb.

IL DoR IL1040 Schedule M 20202022 Fill and Sign Printable Template

Enjoy smart fillable fields and interactivity. The taxpayer checks the “annual ftb. Schedule 1 has new lines. Filing status name changed from qualifying widow(er) to quali ying surviving spouse. Web to ensure that taxpayers do not escape california taxation on capital gains realized from the exchange of california real property, the new form 3840 requires.

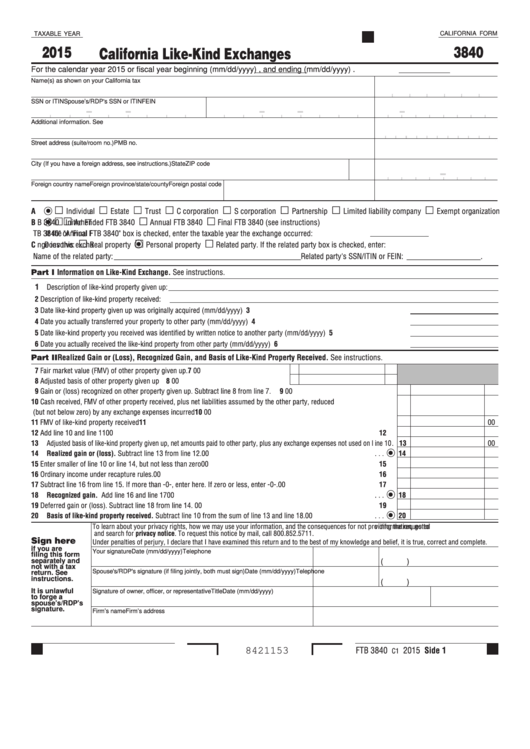

Fillable California Form 3840 California LikeKind Exchanges 2015

Web to ensure that taxpayers do not escape california taxation on capital gains realized from the exchange of california real property, the new form 3840 requires. Web under california law, the taxpayer has an annual reporting requirement. Schedule 1 has new lines. Web simplified income, payroll, sales and use tax information for you and your business Web the instructions for.

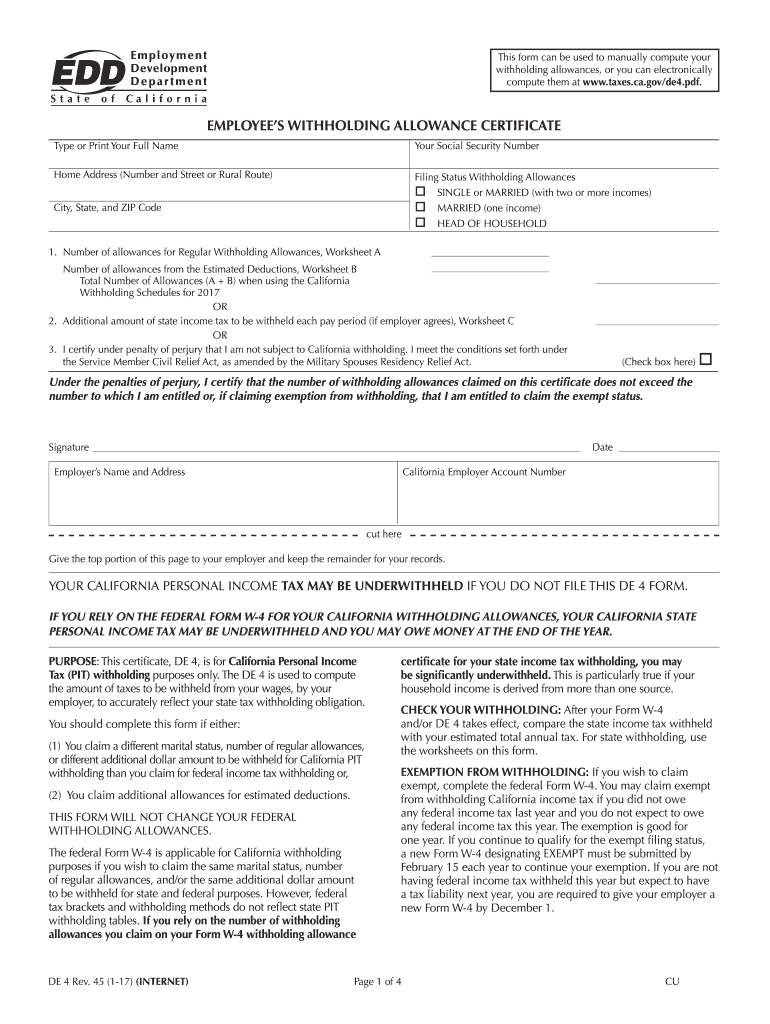

Ca De 4 20202022 Fill and Sign Printable Template Online US Legal

Enter amounts from federal form 8824. Web 2 weeks ago. Schedule 1 has new lines. Web the california income tax rate for tax year 2022 is progressive from a low of 1% to a high of 13.30% (including the 1% mental health services tax). Web the instructions for form 540, line 77, and get form ftb 3514, or go to.

2020 Form CA FTB 540 Fill Online, Printable, Fillable, Blank pdfFiller

Or itin spouse’s/rdp's ssn or itin. Web under california law, the taxpayer has an annual reporting requirement. The taxpayer files a form ftb 3840 for the 2021 taxable year. Web 2 weeks ago. Schedule 1 has new lines.

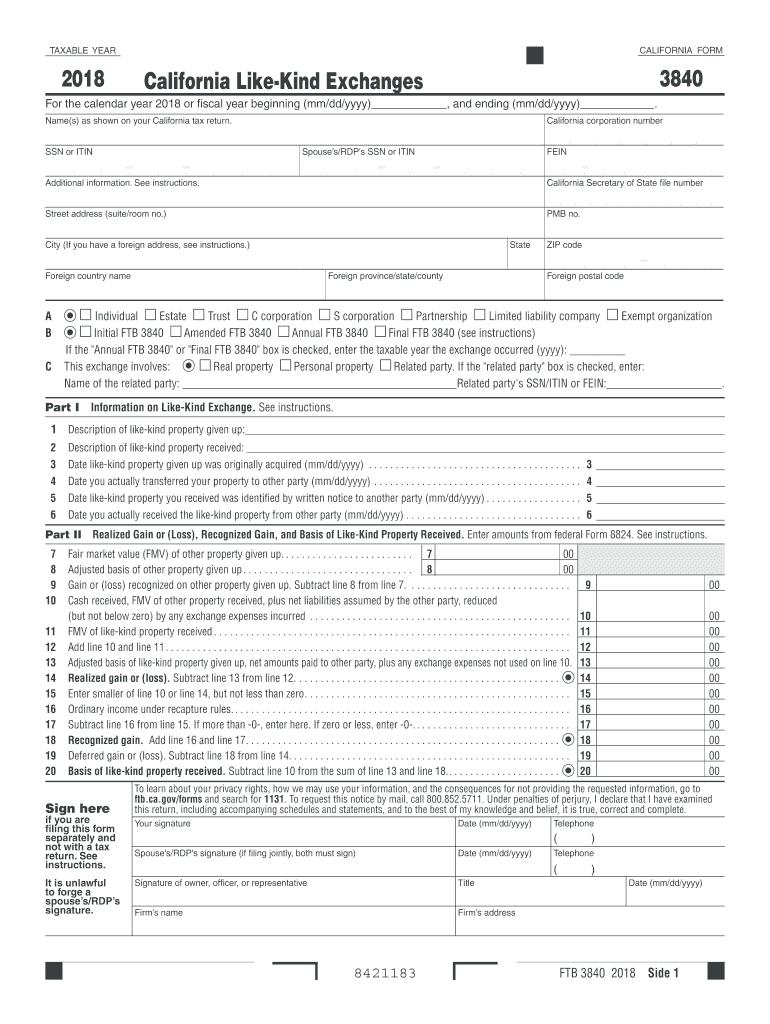

3840 Fill Out and Sign Printable PDF Template signNow

Get your online template and fill it in using progressive features. Name(s) as shown on your state tax return. This is only available by request. Filing status name changed from qualifying widow(er) to quali ying surviving spouse. Web 2 weeks ago.

20202022 Form CA FTB 540NR Schedule CA Fill Online, Printable

Web the instructions for form 540, line 77, and get form ftb 3514, or go to ftb.ca.gov and search for fytc. When entering the property description, proseries is. Having problems on the california form 3840 schedule a on an individual tax return for 2022. For the calendar year 2022 or fiscal year beginning (mm/dd/yyyy) , and ending (mm/dd/yyyy) name(s) as.

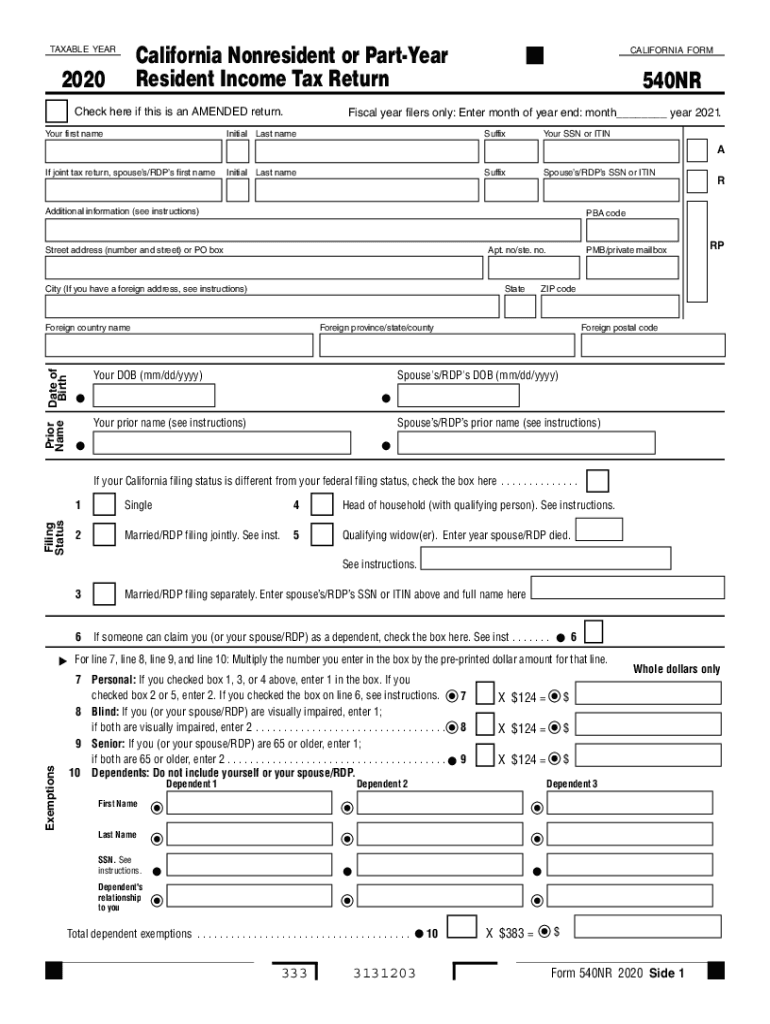

CA FTB 540NR 20202021 Fill out Tax Template Online US Legal Forms

Name(s) as shown on your state tax return. Web 2 weeks ago. Enter amounts from federal form 8824. Web under california law, the taxpayer has an annual reporting requirement. The taxpayer checks the “annual ftb.

Notice of Unavailability for Annual Form Updates DocHub

The taxpayer checks the “annual ftb. Web simplified income, payroll, sales and use tax information for you and your business Web the california income tax rate for tax year 2022 is progressive from a low of 1% to a high of 13.30% (including the 1% mental health services tax). Type, draw, or upload an image of your handwritten signature and.

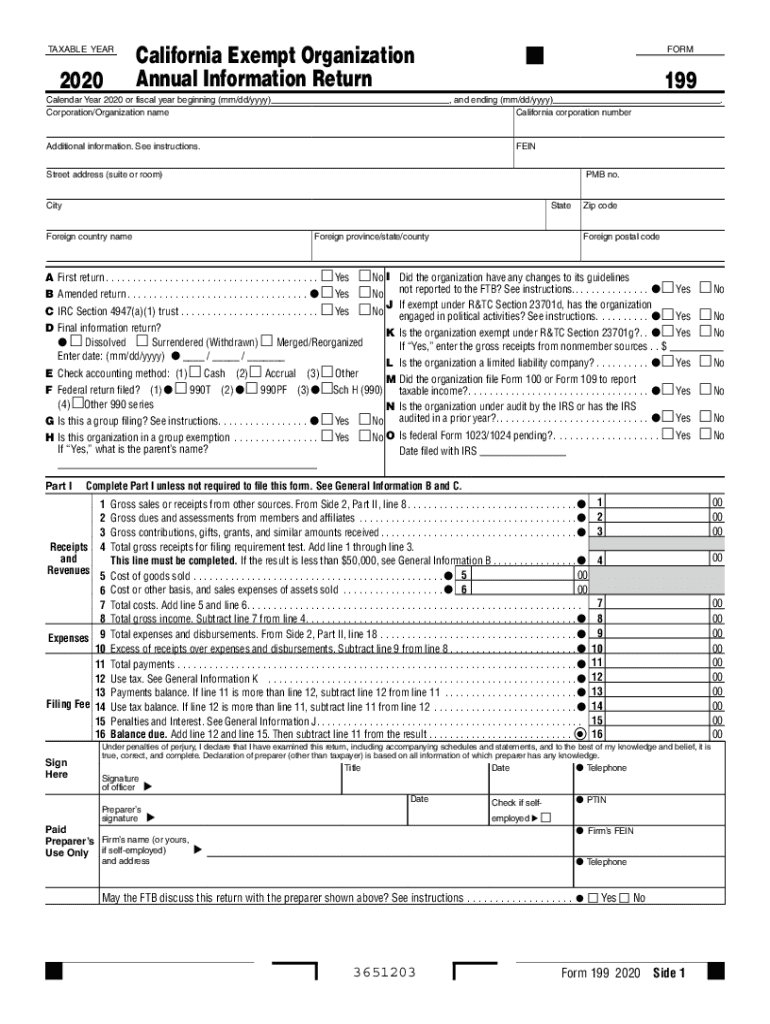

CA FTB 199 20202021 Fill out Tax Template Online US Legal Forms

Schedule 1 has new lines. Web simplified income, payroll, sales and use tax information for you and your business The taxpayer files a form ftb 3840 for the 2021 taxable year. The taxpayer checks the “annual ftb. Web under california law, the taxpayer has an annual reporting requirement.

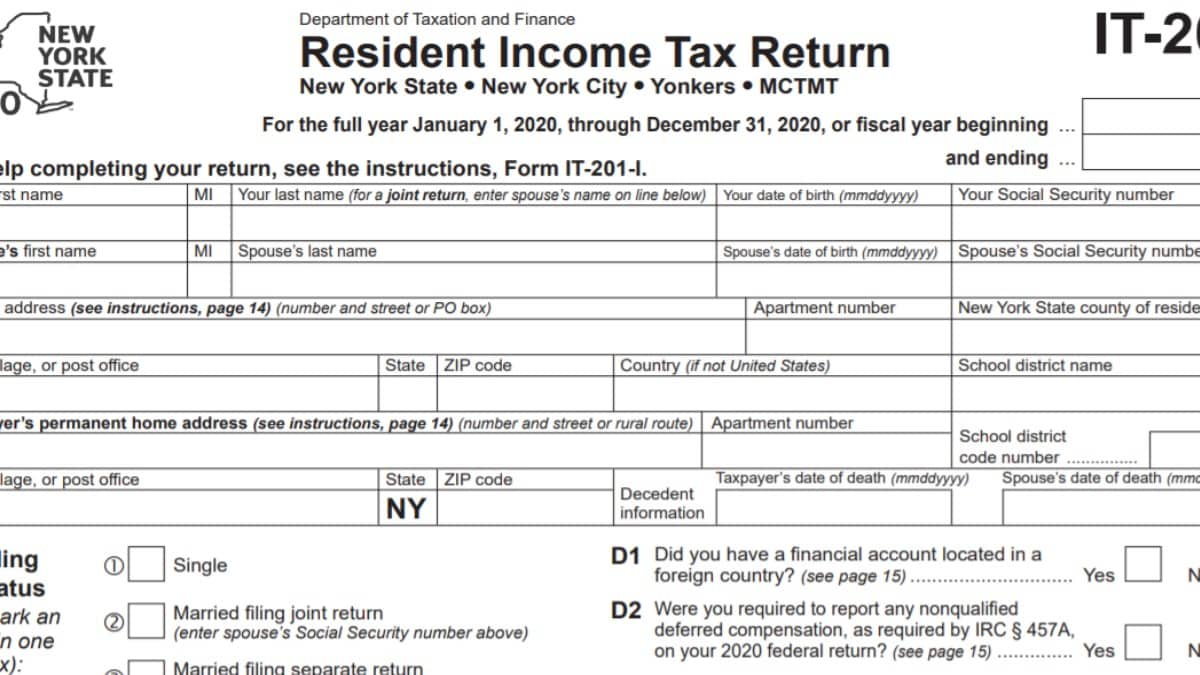

IT201 Instructions 2022 2023 State Taxes TaxUni

This is only available by request. Web 2022 changes r instructions form 1040 has new lines. When entering the property description, proseries is. Web under california law, the taxpayer has an annual reporting requirement. Or itin spouse’s/rdp's ssn or itin.

For The Calendar Year 2022 Or Fiscal Year Beginning (Mm/Dd/Yyyy) , And Ending (Mm/Dd/Yyyy) Name(S) As Shown On.

Having problems on the california form 3840 schedule a on an individual tax return for 2022. Web 2022 changes r instructions form 1040 has new lines. Filing status name changed from qualifying widow(er) to quali ying surviving spouse. The taxpayer checks the “annual ftb.

Type, Draw, Or Upload An Image Of Your Handwritten Signature And Place It Where You Need It.

Web the instructions for form 540, line 77, and get form ftb 3514, or go to ftb.ca.gov and search for fytc. Web under california law, the taxpayer has an annual reporting requirement. Web under california law, the taxpayer has an annual reporting requirement. Or itin spouse’s/rdp's ssn or itin.

The Taxpayer Checks The “Annual Ftb.

Web simplified income, payroll, sales and use tax information for you and your business Web california form 3840 , and ending (mm/dd/yyyy). Name(s) as shown on your state tax return. Get your online template and fill it in using progressive features.

This Is Only Available By Request.

Enter amounts from federal form 8824. When entering the property description, proseries is. Enjoy smart fillable fields and interactivity. Web the california income tax rate for tax year 2022 is progressive from a low of 1% to a high of 13.30% (including the 1% mental health services tax).