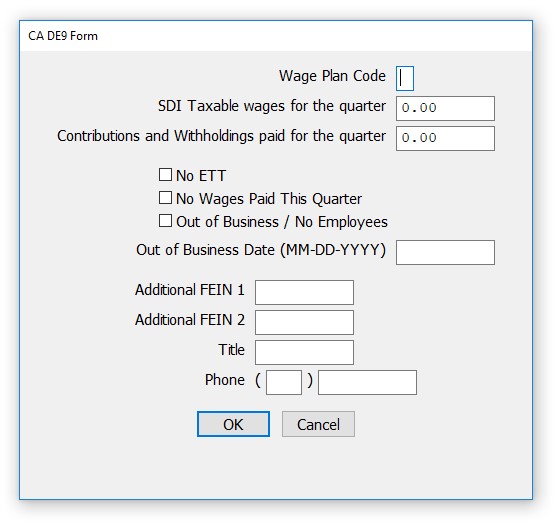

Ca Form De9

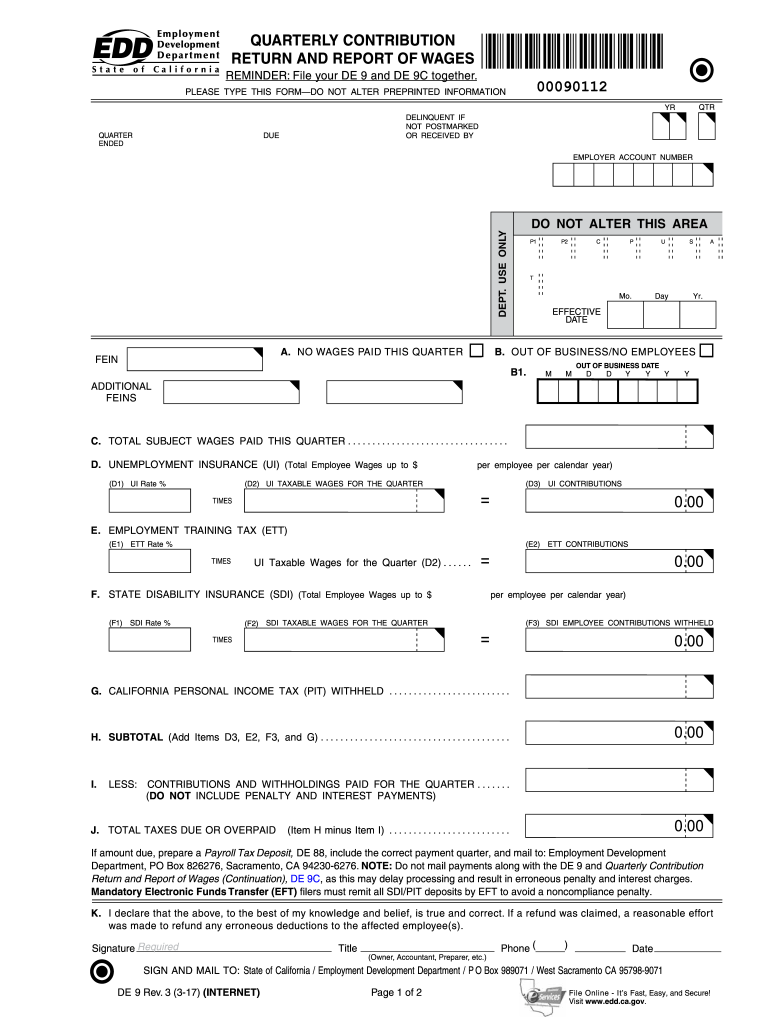

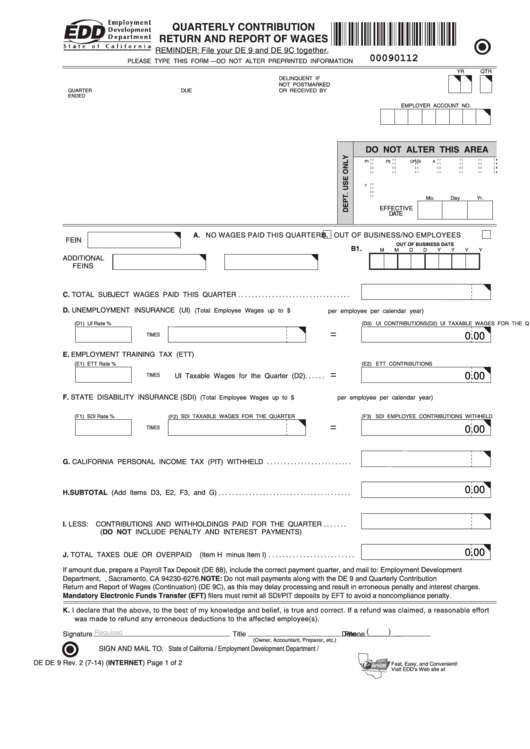

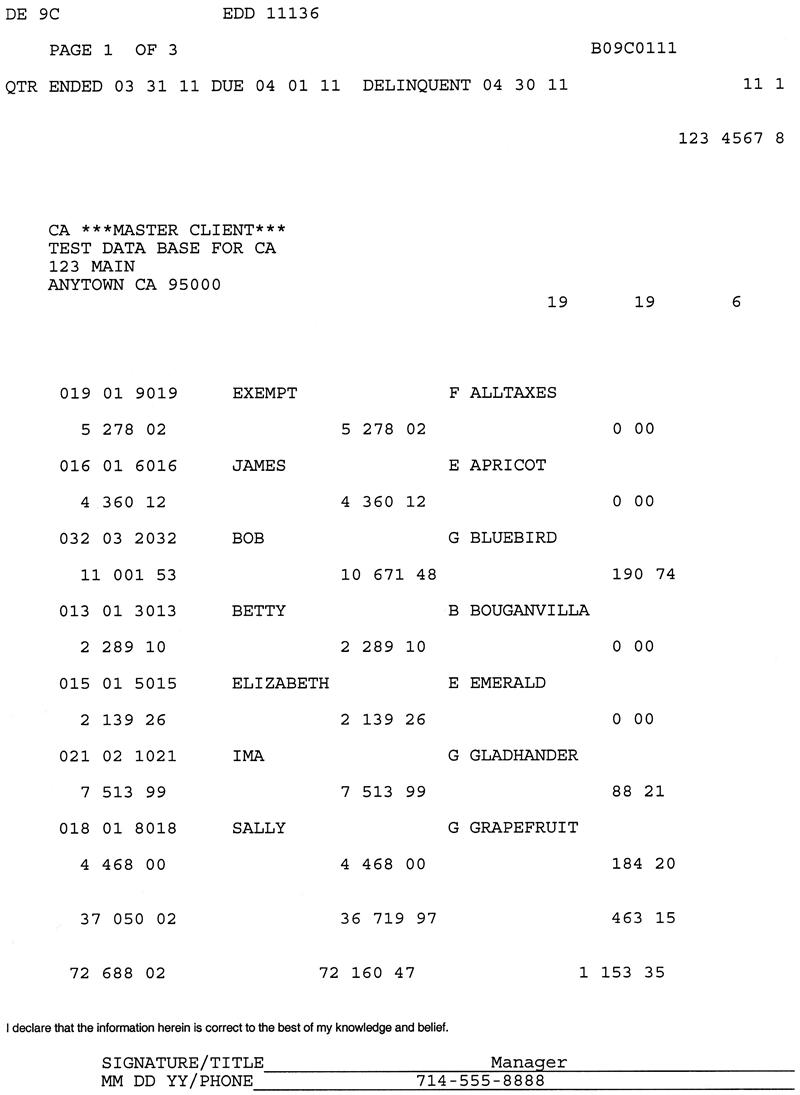

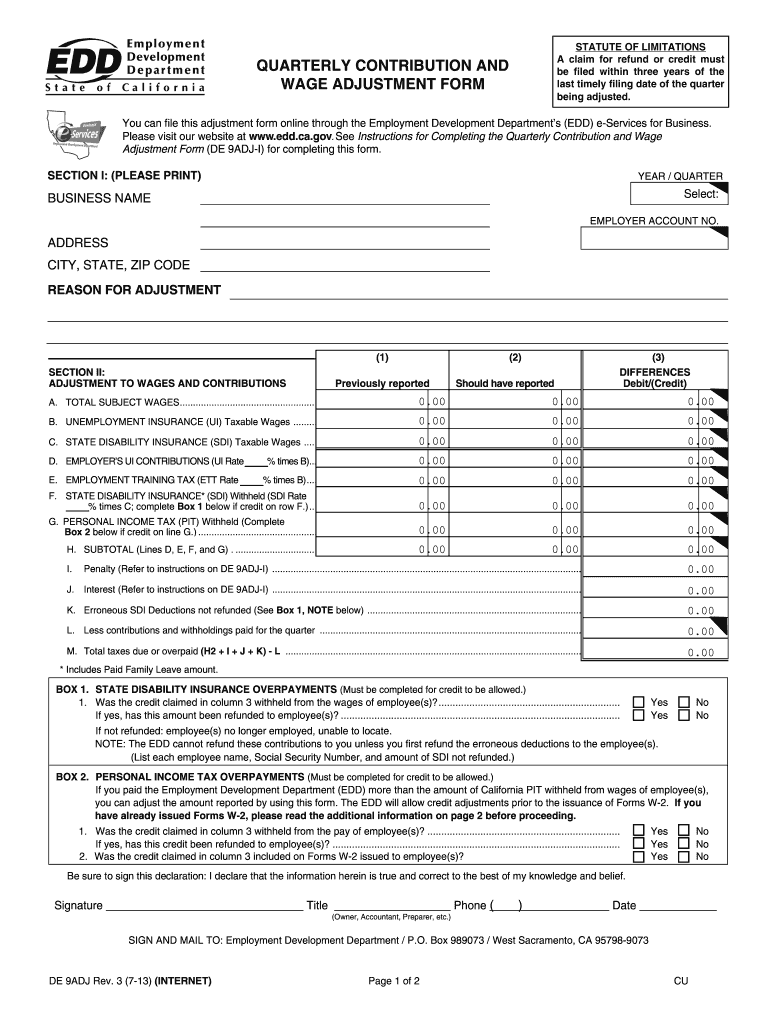

Ca Form De9 - You may be required to electronically file this form. I want to make a. Web to learn how to submit your california payroll tax deposit (form de 88), watch the video from the california employment development department (edd): Web the quarterly contribution and wage adjustment form (de 9adj) (pdf) (edd.ca.gov/pdf_pub_ctr/de9adj.pdf) is used to request corrections to a previously. Select the employees or on the fly menu, then select state tax & wage forms. Web how to correct an employer of household worker (s) annual payroll tax return (de 3hw) or employer of household worker (s) quarterly report of wages and withholdings (de. Web report of new employee (s) (de 34) report of independent contractor (s) (de 542) quarterly contribution return and report of wages (de 9) and (continuation) (de 9c). Web wage adjustment form statute of limitations a claim for refund or credit must be filed within three years of the last timely filing date of the quarter. 00090112 please type this form do not alter. Web this module contains california form de 9, quarterly contribution return and report of wages.

Here's how to find them in quickbooks online: You may be required to electronically file this form. You can file, pay, and. Web what is the de 9 form? You should select de 9 first, then create a de. Web go to the de 9 ca suta electronic filing option screen. Select the employees or on the fly menu, then select state tax & wage forms. 00090112 please type this form do not alter. Web quarterly contribution return and report of wages reminder file your de 9 and de 9c together. Web the quarterly contribution and wage adjustment form (de 9adj) (pdf) (edd.ca.gov/pdf_pub_ctr/de9adj.pdf) is used to request corrections to a previously.

You may be required to electronically file this form. 2011 fica rate | 2011 fica. Web go to the de 9 ca suta electronic filing option screen. Web to learn how to submit your california payroll tax deposit (form de 88), watch the video from the california employment development department (edd): Here's how to find them in quickbooks online: Data may be imported from the payroll data previously entered by. Web categories payroll tags california de 9 form, california de 9 software, california de 9c form, california de 9c software post navigation. Select the employees or on the fly menu, then select state tax & wage forms. 00090112 please type this form do not alter. Web quarterly contribution return and report of wages reminder file your de 9 and de 9c together.

How to Print California DE9 Form in CheckMark Payroll CheckMark

Web please take note that the de6 form is now called as the de9c form. Select the employees or on the fly menu, then select state tax & wage forms. On the left pane, select taxes. Web quarterly contribution return and report of wages (de 9) quarterly contribution return and report of wages (continuation) (de 9c) employer of household worker(s).

2014 Payroll Tax Rates Changed, Payroll Mate® Updates Withholding Tables

Select the employees or on the fly menu, then select state tax & wage forms. Web wage adjustment form statute of limitations a claim for refund or credit must be filed within three years of the last timely filing date of the quarter. Web how to correct an employer of household worker (s) annual payroll tax return (de 3hw) or.

20142021 Form CA DE 9 Fill Online, Printable, Fillable, Blank pdfFiller

Web go to the de 9 ca suta electronic filing option screen. Web wage adjustment form statute of limitations a claim for refund or credit must be filed within three years of the last timely filing date of the quarter. Web what is the de 9 form? Web thequarterly contribution and wage adjustment form (de 9adj) is used to request.

Form De 9 With Instruction Quarterly Contribution Return And Report Of

Web quarterly contribution return and report of wages (de 9) quarterly contribution return and report of wages (continuation) (de 9c) employer of household worker(s) annual. Data may be imported from the payroll data previously entered by. Select the employees or on the fly menu, then select state tax & wage forms. Web go to the de 9 ca suta electronic.

How to Fill AME Written Examination CA9 Form

Web to learn how to submit your california payroll tax deposit (form de 88), watch the video from the california employment development department (edd): Select the employees or on the fly menu, then select state tax & wage forms. Web please take note that the de6 form is now called as the de9c form. Web how to correct an employer.

California DE 9 and DE 9C Fileable Reports

Web report of new employee (s) (de 34) report of independent contractor (s) (de 542) quarterly contribution return and report of wages (de 9) and (continuation) (de 9c). These reports can be corrected by filing the appropriate adjustment request. Web categories payroll tags california de 9 form, california de 9 software, california de 9c form, california de 9c software post.

Arbor CPA Payroll Accounting Employees vs Contractors, Wage

Web please take note that the de6 form is now called as the de9c form. Easily fill out pdf blank, edit, and sign them. Here's how to find them in quickbooks online: Select the employees or on the fly menu, then select state tax & wage forms. Web categories payroll tags california de 9 form, california de 9 software, california.

De9 Fill Out and Sign Printable PDF Template signNow

Easily fill out pdf blank, edit, and sign them. Data may be imported from the payroll data previously entered by. These reports can be corrected by filing the appropriate adjustment request. Web report of new employee (s) (de 34) report of independent contractor (s) (de 542) quarterly contribution return and report of wages (de 9) and (continuation) (de 9c). Web.

Form CADE9 & CADE9C

Separate electronic files are created for the de 9 and de 9c. Web wage adjustment form statute of limitations a claim for refund or credit must be filed within three years of the last timely filing date of the quarter. Web please take note that the de6 form is now called as the de9c form. Here's how to find them.

AMS Payroll California Media Filer DE9 and DE9C YouTube

Web quarterly contribution return and report of wages reminder file your de 9 and de 9c together. Web report of new employee (s) (de 34) report of independent contractor (s) (de 542) quarterly contribution return and report of wages (de 9) and (continuation) (de 9c). I want to make a. 00090112 please type this form do not alter. Web most.

Web Report Of New Employee (S) (De 34) Report Of Independent Contractor (S) (De 542) Quarterly Contribution Return And Report Of Wages (De 9) And (Continuation) (De 9C).

Web to learn how to submit your california payroll tax deposit (form de 88), watch the video from the california employment development department (edd): Web wage adjustment form statute of limitations a claim for refund or credit must be filed within three years of the last timely filing date of the quarter. These reports can be corrected by filing the appropriate adjustment request. Web changes to the quarterly contribution return and report of wages (de 9) and the quarterly contribution return and report of wages (continuation) (de 9c).

Web Please Take Note That The De6 Form Is Now Called As The De9C Form.

Data may be imported from the payroll data previously entered by. 00090112 please type this form do not alter. Web categories payroll tags california de 9 form, california de 9 software, california de 9c form, california de 9c software post navigation. 2011 fica rate | 2011 fica.

On The Left Pane, Select Taxes.

You can file, pay, and. Web quarterly contribution return and report of wages reminder file your de 9 and de 9c together. Here's how to find them in quickbooks online: Web the de 9 form is the correct template to use to verify that your alternate format is correct.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

Web the quarterly contribution and wage adjustment form (de 9adj) (pdf) (edd.ca.gov/pdf_pub_ctr/de9adj.pdf) is used to request corrections to a previously. You may be required to electronically file this form. You should select de 9 first, then create a de. Web most employers, including quarterly household employers, are required to file the de 9 and de 9c.