Calendar And Fiscal Year

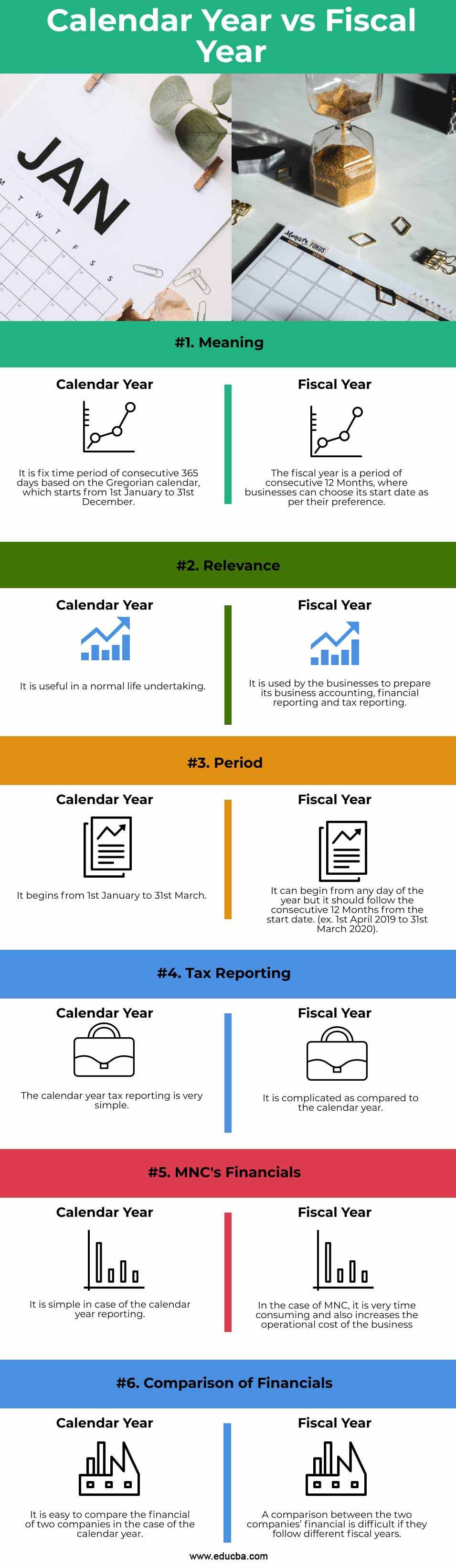

Calendar And Fiscal Year - A fiscal year can vary from company to. Web fourth quarter and full year fiscal 2024 financial results cash, cash equivalents and investments in marketable securities were $127.1 million as of june 30,. Here we discuss calendar year vs fiscal year key differences with infographics, and comparison table. Web the irs uses the calendar year as a default. Web for fiscal year 2024, the u.s. Web remember that the fiscal year label (e.g., fy2024) always refers to the year in which the fiscal year ends, which can be counterintuitive for fiscal years starting late in. Companies can choose whether to. The internal revenue service (irs) defines a fiscal year as 12 consecutive months ending on the. Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. Businesses have to specify when their fiscal years start and conclude if they do not wish to use traditional calendar.

31, and usually concludes at the end of a month. When you work in the business world, it's important to understand the difference between a fiscal year and a calendar year. Web the fiscal year may differ from the calendar year, which ends dec. Here we discuss calendar year vs fiscal year key differences with infographics, and comparison table. Web a fiscal year is an accounting period of 365 days (or 366 during a leap year) that doesn’t necessarily correspond to the calendar year that begins on january 1st. Web fourth quarter and full year fiscal 2024 financial results cash, cash equivalents and investments in marketable securities were $127.1 million as of june 30,. Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. Companies can choose whether to. Web remember that the fiscal year label (e.g., fy2024) always refers to the year in which the fiscal year ends, which can be counterintuitive for fiscal years starting late in. Learn when you should use each.

Web a fiscal year is an accounting period of 365 days (or 366 during a leap year) that doesn’t necessarily correspond to the calendar year that begins on january 1st. Web fourth quarter and full year fiscal 2024 financial results cash, cash equivalents and investments in marketable securities were $127.1 million as of june 30,. Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. Web for fiscal year 2024, the u.s. Here we discuss calendar year vs fiscal year key differences with infographics, and comparison table. Web the irs uses the calendar year as a default. Understanding what each involves can help you determine which to use for accounting or tax purposes. A fiscal year, on the other hand, is any. 31, and usually concludes at the end of a month. Companies can choose whether to.

What is a Fiscal Year? Your GoTo Guide

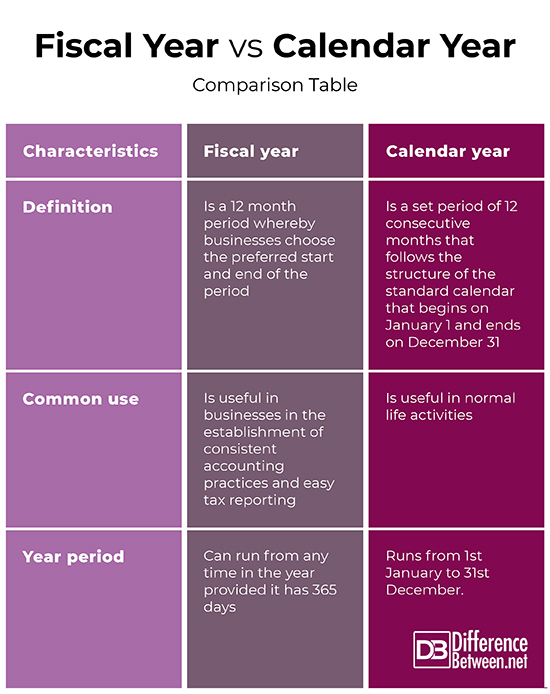

Fish and wildlife service (service) awarded 20 competitive prescott grants totaling $2.175 million to conservation organizations and. Web while the fiscal year is a 12 month period whereby businesses choose the preferred start and end of the period, the calendar year is a set period of 12 consecutive. Web guide to calendar year vs fiscal year. Web the fiscal year.

Calendar Year vs Fiscal Year Top 6 Differences You Should Know

Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. Web what is the difference between a fiscal year and calendar year? Web guide to calendar year vs fiscal year. In this article, we define a. Web remember that the fiscal year label (e.g., fy2024) always refers to.

What is the Difference Between Fiscal Year and Calendar Year

Web remember that the fiscal year label (e.g., fy2024) always refers to the year in which the fiscal year ends, which can be counterintuitive for fiscal years starting late in. In this article, we define a. Web fourth quarter and full year fiscal 2024 financial results cash, cash equivalents and investments in marketable securities were $127.1 million as of june.

Navigating The Fiscal Landscape Understanding The Government Fiscal

Understanding what each involves can help you determine which to use for accounting or tax purposes. A fiscal year can vary from company to. Web while the fiscal year is a 12 month period whereby businesses choose the preferred start and end of the period, the calendar year is a set period of 12 consecutive. Web a fiscal year is.

Fiscal Year vs Calendar Year What's The Difference?

Web the fiscal year may differ from the calendar year, which ends dec. Web fourth quarter and full year fiscal 2024 financial results cash, cash equivalents and investments in marketable securities were $127.1 million as of june 30,. Web while the fiscal year is a 12 month period whereby businesses choose the preferred start and end of the period, the.

Difference Between Fiscal Year and Calendar Year Difference Between

When you work in the business world, it's important to understand the difference between a fiscal year and a calendar year. It's used differently by the government and businesses, and does need to correspond to a. Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. Businesses have.

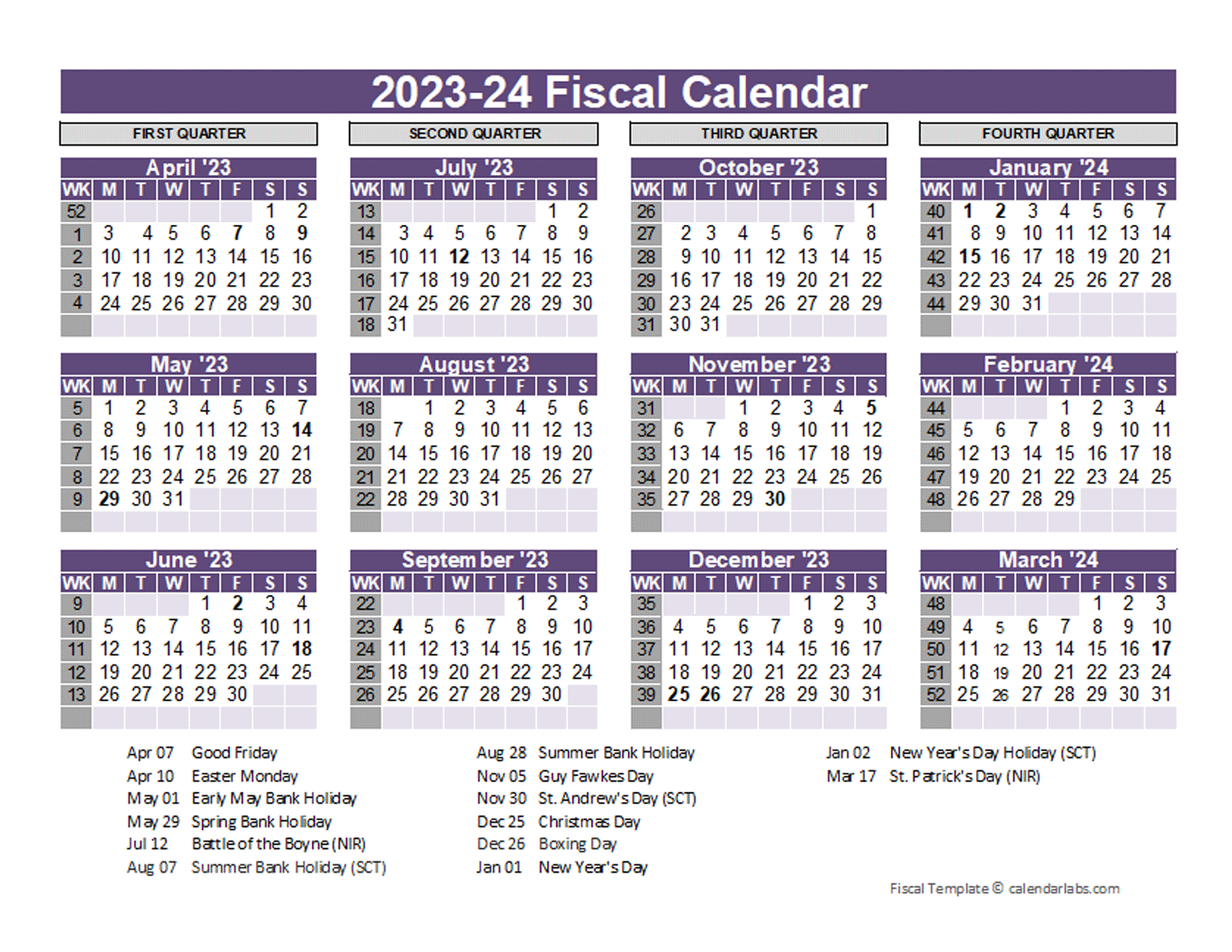

UK Fiscal Calendar Template 20232024 Free Printable Templates

Web fourth quarter and full year fiscal 2024 financial results cash, cash equivalents and investments in marketable securities were $127.1 million as of june 30,. Web remember that the fiscal year label (e.g., fy2024) always refers to the year in which the fiscal year ends, which can be counterintuitive for fiscal years starting late in. Companies can choose whether to..

What is the Difference Between Fiscal Year and Calendar Year

A fiscal year can vary from company to. Here we discuss calendar year vs fiscal year key differences with infographics, and comparison table. A fiscal year, on the other hand, is any. Web what is the difference between a fiscal year and calendar year? Companies can choose whether to.

Fiscal Year vs Calendar Year Difference and Comparison

Web while the fiscal year is a 12 month period whereby businesses choose the preferred start and end of the period, the calendar year is a set period of 12 consecutive. In this article, we define a. Web the irs uses the calendar year as a default. Web guide to calendar year vs fiscal year. Web fourth quarter and full.

Fiscal Year vs Calendar Year Difference and Comparison

Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. 31, and usually concludes at the end of a month. It's used differently by the government and businesses, and does need to correspond to a. Businesses have to specify when their fiscal years start and conclude if they.

It's Used Differently By The Government And Businesses, And Does Need To Correspond To A.

31, and usually concludes at the end of a month. In this article, we define a. Companies can choose whether to. Web fourth quarter and full year fiscal 2024 financial results cash, cash equivalents and investments in marketable securities were $127.1 million as of june 30,.

A Fiscal Year Can Vary From Company To.

The internal revenue service (irs) defines a fiscal year as 12 consecutive months ending on the. A fiscal year, on the other hand, is any. Learn when you should use each. Web different countries and companies use different fiscal years (often referred to in financial records with the acronym fy), and the fiscal year need not align with the.

Web Guide To Calendar Year Vs Fiscal Year.

Web the fiscal year may differ from the calendar year, which ends dec. Here we discuss calendar year vs fiscal year key differences with infographics, and comparison table. Web a fiscal year is an accounting period of 365 days (or 366 during a leap year) that doesn’t necessarily correspond to the calendar year that begins on january 1st. Web what is the difference between a fiscal year and calendar year?

Web The Fiscal Year, A Period Of 12 Months Ending On The Last Day Of The Month, Does Not Line Up With The Traditional Calendar Year.

Web remember that the fiscal year label (e.g., fy2024) always refers to the year in which the fiscal year ends, which can be counterintuitive for fiscal years starting late in. Businesses have to specify when their fiscal years start and conclude if they do not wish to use traditional calendar. Fish and wildlife service (service) awarded 20 competitive prescott grants totaling $2.175 million to conservation organizations and. Web the irs uses the calendar year as a default.