Calendar For Income Tax

Calendar For Income Tax - Web when is the last date to file itr? If day 15 falls on a. The calendar gives specific due dates for: However, the exceptions for tax day are: The fourth month after your fiscal year ends, day 15. Page last reviewed or updated: Web the 2024 federal income tax filing deadline for individuals is april 15, 2024. Web calendar year filers (most common) file on: Web last updated on 17 may, 2024. Access the calendar online from your mobile device or desktop.

Access the calendar online from your mobile device or desktop. Web the income tax filing deadline, also known as tax day, is april 15, 2024. This tax calendar has the due dates for 2024 that most taxpayers will need. 22, 2024, at 9:40 a.m. Declaration for the calendar year 2021, submission deadline until 31.08.2023. Guide to tax filing season for individual taxpayers. Declaration for calendar year 2022, submission deadline until 31.07.2024. Web last updated on 17 may, 2024. Keeping track of taxes all year: Web 2024 tax deadline:

Individuals are subject to a. This also depends on what pay date you use and the pay. 22, 2024, at 9:40 a.m. The fourth month after your fiscal year ends, day 15. Web adhering to timely tax payments is crucial to avoid penalties and maintain a good financial record. The irs does not release a calendar, but continues to issue guidance that most filers should receive their refund. This tax calendar has the due dates for 2024 that most taxpayers will need. Page last reviewed or updated: 2023 tax return due for those who are required to file a tax return. However, the exceptions for tax day are:

Calendar

Declaration for calendar year 2022, submission deadline until 31.07.2024. Tax periods determine the tax and national insurance thresholds used to calculate your employees' pay. 2023 tax return due for those who are required to file a tax return. Deadline to submit your tax return when you are obligated to file. Web what irs tax dates do i need to remember?

Where’s My Refund? The IRS Refund Schedule 2022 Check City

• filing tax forms, • paying taxes, and • taking other actions required by. Be sure to mark your calendar because federal income taxes are due on april 15 for 2024. However, the exceptions for tax day are: The irs does not release a calendar, but continues to issue guidance that most filers should receive their refund. Web 2024 tax.

BIR Tax Deadlines Tax deadline, Business entrepreneurship, Tax

Individuals are subject to a. This tax calendar has the due dates for 2024 that most taxpayers will need. If day 15 falls on a. Web when is the last date to file itr? The fourth month after your fiscal year ends, day 15.

Tax Calendar Tax Department has released the calendar

Guide to tax filing season for individual taxpayers. Employers and persons who pay excise taxes should also use the employer's. Access the calendar online from your mobile device or desktop. This tax calendar has the due dates for 2024 that most taxpayers will need. 22, 2023 — with the 2023 tax filing season in full swing, the irs reminds taxpayers.

2024 1040 Schedule A Tax Return Flore Jillana

Keeping track of taxes all year: Web when is the last date to file itr? 22, 2024, at 9:40 a.m. If day 15 falls on a. Page last reviewed or updated:

Tax Compliance Calendar of October 2023

Web what irs tax dates do i need to remember? Web when is the last date to file itr? Tax periods determine the tax and national insurance thresholds used to calculate your employees' pay. Employers and persons who pay excise taxes should also use the employer's. If day 15 falls on a.

Tax Calendar

Declaration for the calendar year 2021, submission deadline until 31.08.2023. Web when is the last date to file itr? 2023 tax return due for those who are required to file a tax return. This tax calendar has the due dates for 2024 that most taxpayers will need. This also depends on what pay date you use and the pay.

Tax Calendar for Calendar Year 2024

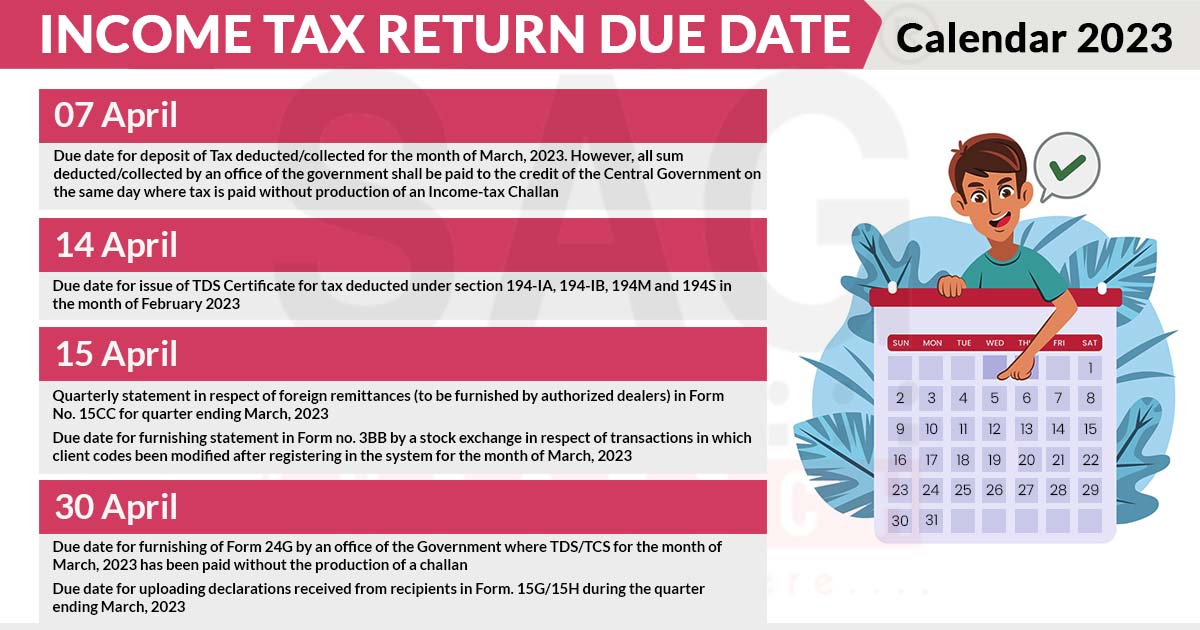

Web adhering to timely tax payments is crucial to avoid penalties and maintain a good financial record. You need to know about other important. To make your tax life simpler, the irs releases a tax calendar each year. Web find out the important deadlines for filing your income tax returns in india. This tax calendar has the due dates for.

Tax Calendar

Web 2024 tax deadline: Individuals are subject to a. Web the income tax filing deadline, also known as tax day, is april 15, 2024. Page last reviewed or updated: Web when is the last date to file itr?

2021 Ecalendar of Tax Return Filing Due Dates for Taxpayers

Web the 2024 federal income tax filing deadline for individuals is april 15, 2024. Tax periods determine the tax and national insurance thresholds used to calculate your employees' pay. Web the income tax filing deadline, also known as tax day, is april 15, 2024. However, the exceptions for tax day are: If day 15 falls on a.

Web The Income Tax Filing Deadline, Also Known As Tax Day, Is April 15, 2024.

Web the 2024 federal income tax filing deadline for individuals is april 15, 2024. Declaration for calendar year 2022, submission deadline until 31.07.2024. You need to know about other important. The fourth month after your fiscal year ends, day 15.

However, If You Miss Filing Within The Due Date, You Can Still File A Belated Return Before December 31, 2024.

To make your tax life simpler, the irs releases a tax calendar each year. The calendar gives specific due dates for: Individuals are subject to a. Check the tax calendar and stay updated with the latest information.

Deadline To Submit Your Tax Return When You Are Obligated To File.

Web 2024 tax deadline: Web calendar year filers (most common) file on: Web use the irs tax calendar to view filing deadlines and actions each month. An irs tax calendar is like a year planner split into quarters.

Declaration For The Calendar Year 2021, Submission Deadline Until 31.08.2023.

Be sure to mark your calendar because federal income taxes are due on april 15 for 2024. Web find out the important deadlines for filing your income tax returns in india. Web adhering to timely tax payments is crucial to avoid penalties and maintain a good financial record. 22, 2023 — with the 2023 tax filing season in full swing, the irs reminds taxpayers to gather their necessary information and visit irs.gov for updated resources and tools to help with their 2022 tax return.