Calendar Spread Using Calls

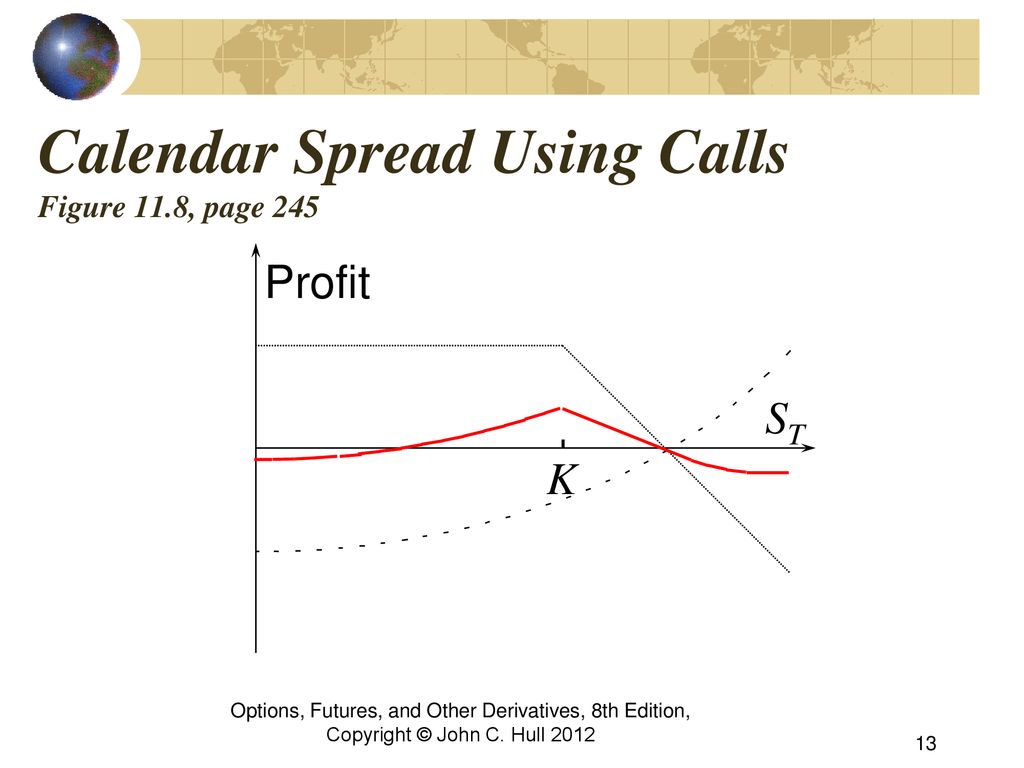

Calendar Spread Using Calls - Web when you invest in a calendar spread, you buy and sell the same type of option (either a call or a put) for the same underlying stock at identical strike prices but. Web a short calendar spread with calls realizes its maximum profit if the stock price is either far above or far below the strike price on the expiration date of the long call. Click the bid or ask price of the options you already own to add them as legs of the spread. Web click the “calls and puts” tab at the top to switch to the chain view. Web calendar spreads can be done with calls or with puts, which are virtually equivalent if using same strikes and expirations. I had briefly introduced the concept of calendar spreads in chapter 10 of the futures trading module. Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. Web calendar spreads enable traders to collect weekly to monthly options premium income with defined risk. Web short one call option and long a second call option with a more distant expiration is an example of a long call calendar spread. Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same underlying asset and strike.

Web a long calendar spread with calls is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the strategy profits from time decay. Web click the “calls and puts” tab at the top to switch to the chain view. Web calendar spreads enable traders to collect weekly to monthly options premium income with defined risk. Web when you invest in a calendar spread, you buy and sell the same type of option (either a call or a put) for the same underlying stock at identical strike prices but. Click the bid or ask price of the options you already own to add them as legs of the spread. They can use atm (at the money). Web a short calendar spread with calls realizes its maximum profit if the stock price is either far above or far below the strike price on the expiration date of the long call. I had briefly introduced the concept of calendar spreads in chapter 10 of the futures trading module. Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. Web short one call option and long a second call option with a more distant expiration is an example of a long call calendar spread.

Web a long calendar spread with calls is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the strategy profits from time decay. Click the bid or ask price of the options you already own to add them as legs of the spread. Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. Web click the “calls and puts” tab at the top to switch to the chain view. Web short one call option and long a second call option with a more distant expiration is an example of a long call calendar spread. The strategy most commonly involves calls with. Web calendar spreads can be done with calls or with puts, which are virtually equivalent if using same strikes and expirations. Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same underlying asset and strike. They can use atm (at the money). I had briefly introduced the concept of calendar spreads in chapter 10 of the futures trading module.

Calendar Call Spread Options Edge

Web when you invest in a calendar spread, you buy and sell the same type of option (either a call or a put) for the same underlying stock at identical strike prices but. The strategy most commonly involves calls with. Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a.

Calendar Spread using Calls YouTube

Click the bid or ask price of the options you already own to add them as legs of the spread. Web short one call option and long a second call option with a more distant expiration is an example of a long call calendar spread. Web a calendar spread, also known as a horizontal spread, is created with a simultaneous.

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

The strategy most commonly involves calls with. Web click the “calls and puts” tab at the top to switch to the chain view. Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same underlying asset and strike. Click the bid or ask price of the options.

Calendar Call Spread Strategy

The strategy most commonly involves calls with. Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same underlying asset and strike. Web a short calendar spread with calls realizes its maximum profit if the stock price is either far above or far below the strike price.

Long Calendar Spread with Calls Strategy With Example

Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. Web a short calendar spread with calls realizes its maximum profit if the stock price is either far above or far below the strike price on.

PPT Trading Strategies Involving Options PowerPoint Presentation

I had briefly introduced the concept of calendar spreads in chapter 10 of the futures trading module. Web a long calendar spread with calls is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the strategy profits from time decay. Web calendar spreads can be done with calls or.

Chapter 11 Trading Strategies Involving Options ppt download

Web when you invest in a calendar spread, you buy and sell the same type of option (either a call or a put) for the same underlying stock at identical strike prices but. Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same underlying asset and.

Calendar Call Spread Strategy

They can use atm (at the money). Click the bid or ask price of the options you already own to add them as legs of the spread. I had briefly introduced the concept of calendar spreads in chapter 10 of the futures trading module. Web the calendar call spread is a neutral options trading strategy, which means you can use.

PPT Trading Strategies Involving Options PowerPoint Presentation

Web click the “calls and puts” tab at the top to switch to the chain view. I had briefly introduced the concept of calendar spreads in chapter 10 of the futures trading module. Web a short calendar spread with calls realizes its maximum profit if the stock price is either far above or far below the strike price on the.

Long Call Calendar Spread Explained (Options Trading Strategies For

They can use atm (at the money). Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position.

Web Click The “Calls And Puts” Tab At The Top To Switch To The Chain View.

They can use atm (at the money). Web calendar spreads enable traders to collect weekly to monthly options premium income with defined risk. Web when you invest in a calendar spread, you buy and sell the same type of option (either a call or a put) for the same underlying stock at identical strike prices but. Web short one call option and long a second call option with a more distant expiration is an example of a long call calendar spread.

Web The Calendar Call Spread Is A Neutral Options Trading Strategy, Which Means You Can Use It To Generate A Profit When The Price Of A Security Doesn't Move, Or Only Moves A Little.

Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same underlying asset and strike. The strategy most commonly involves calls with. I had briefly introduced the concept of calendar spreads in chapter 10 of the futures trading module. Web a long calendar spread with calls is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the strategy profits from time decay.

Web Calendar Spreads Can Be Done With Calls Or With Puts, Which Are Virtually Equivalent If Using Same Strikes And Expirations.

Click the bid or ask price of the options you already own to add them as legs of the spread. Web a short calendar spread with calls realizes its maximum profit if the stock price is either far above or far below the strike price on the expiration date of the long call.

![Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019ad90afc0a18011924af0_3Ui8KuFuRxcjUyFQ2mvscNmGIXALxE0ESnrXkoAAqNejP5Ygrj-dyv3Kfo-1jmOjFg2axgrXs-MriQsNl-6is4rU-lDczPVaDzlttqUjTEJIvT6pRF0GK8qSlYVoNo6r5r07P-gi.png)