Calendar Year Proration Method

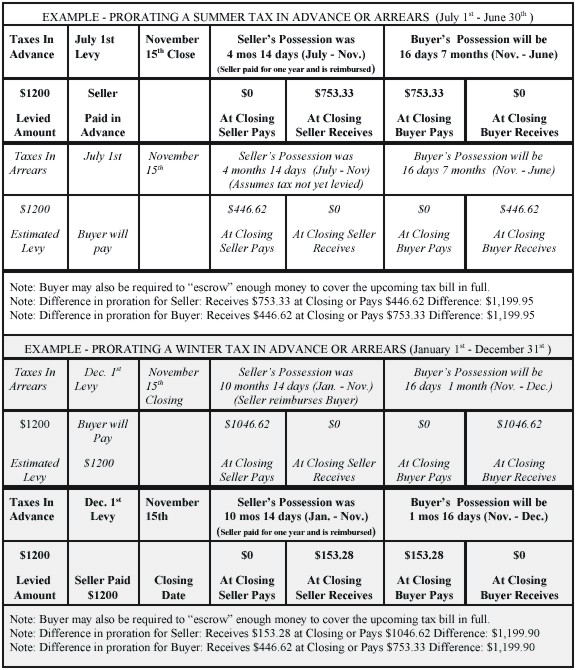

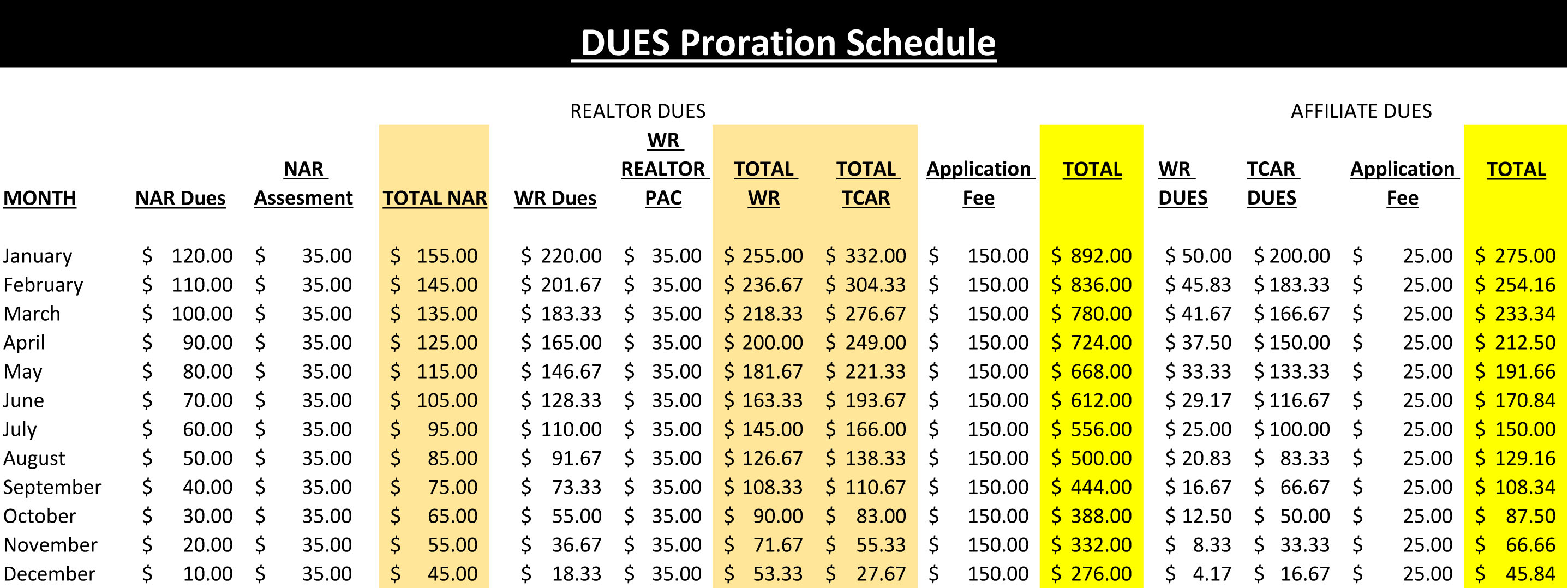

Calendar Year Proration Method - First, in counting the number of days, remember that. Usually, these taxes will be. Web easily calculate the property tax proration between buyer & seller at settlement. The buyer needs to pay the seller for the taxes already paid for the days the. Using the calendar year proration. Web calendar year of proration means the calendar year in which the closing occurs. Web to calculate the amount the seller owes at closing using the calendar year proration method, we first determine the number of days the seller owns the property in. Application of an escalation or discount. ($1,350 ÷ 365 = $3.70) 195 days (days. Amount of pro rated rent varies based.

Web calendar year of proration means the calendar year in which the closing occurs. Web four methods for pro rating rent are actual days in the month, average days in the month, banker’s month, and days in the calendar year. So, let’s break this down a little more. Use the calendar year proration. Web learn how to calculate the proration of taxes, rent, or expenses over a calendar year using different methods and examples. Web on a whim, they sell the lake house to the bennets to buy a winnebago and travel the country. Web the proration method affects how the amounts are calculated for a billing schedule in the following situations: Web to calculate proration, divide the 15 annual vacation days by the total number of months in a year, which is 12, and you get 1.25 vacation days a month. The buyer needs to pay the seller for the taxes already paid for the days the. Web assuming the buyer owns the property on closing day, and the seller hasn't made any payments, what will the seller owe at closing using the calendar year.

Web easily calculate the property tax proration between buyer & seller at settlement. Web learn how to calculate the proration of taxes, rent, or expenses over a calendar year using different methods and examples. Closing is set for july 31. “closing” shall mean the consummation of the purchase and sale of the property. Calendar & fiscal year proration for local, county & school taxes Web the proration method affects how the amounts are calculated for a billing schedule in the following situations: Web closing is set for july 31, and the buyers own the day of closing (pay prorated expenses through the day of closing). The buyer needs to pay the seller for the taxes already paid for the days the. Web assuming the buyer owns the property on closing day, and the seller hasn't made any payments, what will the seller owe at closing using the calendar year proration method? Web real estate proration is most often used when discussing how annual taxes will be divided between the new homeowner and the seller.

Calendar Year Proration Method prntbl.concejomunicipaldechinu.gov.co

Web to calculate the amount the seller owes at closing using the calendar year proration method, we first determine the number of days the seller owns the property in. Web easily calculate the property tax proration between buyer & seller at settlement. Web real estate proration is most often used when discussing how annual taxes will be divided between the.

Calendar Year Proration Method prntbl.concejomunicipaldechinu.gov.co

Web the proration method affects how the amounts are calculated for a billing schedule in the following situations: Find printable calendars for various years and. Application of an escalation or discount. Web four methods for pro rating rent are actual days in the month, average days in the month, banker’s month, and days in the calendar year. Web learn how.

Calendar Year Proration Method Real Estate Dasi Missie

Application of an escalation or discount. Web four methods for pro rating rent are actual days in the month, average days in the month, banker’s month, and days in the calendar year. One of the most confusing types of real estate math problem you will encounter is determining what portion of expenses the seller and. Web assuming the buyer owns.

Calendar Year Proration Method prntbl.concejomunicipaldechinu.gov.co

Web prorate a specified amount over a specified portion of the calendar year. Closing is set for july 31. Web assuming the buyer owns the property on closing day, and the seller hasn't made any payments, what will the seller owe at closing using the calendar year proration method? Web to calculate proration, divide the 15 annual vacation days by.

Calendar Year Proration Method Real Estate Dasi Missie

Use the calendar year proration. Web calendar year of proration means the calendar year in which the closing occurs. Web assuming the buyer owns the property on closing day, and the seller hasn't made any payments, what will the seller owe at closing using the calendar year. Using the calendar year proration. Closing is set for july 31.

Calendar Year Proration Method Printable Computer Tools

Web calendar year of proration means the calendar year in which the closing occurs. Web assuming the buyer owns the property on closing day, and the seller hasn't made any payments, what will the seller owe at closing using the calendar year. Web real estate proration is most often used when discussing how annual taxes will be divided between the.

Calendar Year Proration Method Real Estate Dasi Missie

Web the proration method affects how the amounts are calculated for a billing schedule in the following situations: Web on a whim, they sell the lake house to the bennets to buy a winnebago and travel the country. Web assuming the buyer owns the property on closing day, and the seller hasn't made any payments, what will the seller owe.

Calendar Year Proration Method 2024 New Ultimate The Best Review of

Proration is inclusive of both specified dates. Web closing is set for july 31, and the buyers own the day of closing (pay prorated expenses through the day of closing). Calendar & fiscal year proration for local, county & school taxes Web assuming the buyer owns the property on closing day, and the seller hasn't made any payments, what will.

Calendar Year Proration Method Printable Template Calendar

Web the proration method affects how the amounts are calculated for a billing schedule in the following situations: The buyer needs to pay the seller for the taxes already paid for the days the. Web closing is set for july 31, and the buyers own the day of closing (pay prorated expenses through the day of closing). Web to calculate.

Calendar Year Proration Method prntbl.concejomunicipaldechinu.gov.co

Web assuming the buyer owns the property on closing day, and the seller hasn't made any payments, what will the seller owe at closing using the calendar year proration method? Use the calendar year proration. Web to calculate the amount the seller owes at closing using the calendar year proration method, we first determine the number of days the seller.

Use The Calendar Year Proration.

Web calendar year of proration means the calendar year in which the closing occurs. Web on a whim, they sell the lake house to the bennets to buy a winnebago and travel the country. Using the calendar year proration. Web easily calculate the property tax proration between buyer & seller at settlement.

Web Four Methods For Pro Rating Rent Are Actual Days In The Month, Average Days In The Month, Banker’s Month, And Days In The Calendar Year.

Web assuming the buyer owns the property on closing day, and the seller hasn't made any payments, what will the seller owe at closing using the calendar year proration method? Web learn how to calculate the proration of taxes, rent, or expenses over a calendar year using different methods and examples. Web closing is set for july 31, and the buyers own the day of closing (pay prorated expenses through the day of closing). Web assuming the buyer owns the property on closing day, and the seller hasn't made any payments, what will the seller owe at closing using the calendar year.

Web Real Estate Proration Is Most Often Used When Discussing How Annual Taxes Will Be Divided Between The New Homeowner And The Seller.

Web the three steps in a proration problem are to calculate the per diem (daily) rate of the expense, determine the number of days for which the party is responsible, and multiply. Web assuming the buyer owns the property on closing day, and the seller hasn't made any payments, what will the seller owe at closing using the calendar year proration method? Web to calculate the amount the seller owes at closing using the calendar year proration method, we first determine the number of days the seller owns the property in. ($1,350 ÷ 365 = $3.70) 195 days (days.

Usually, These Taxes Will Be.

Web prorate a specified amount over a specified portion of the calendar year. Proration is inclusive of both specified dates. Closing is set for july 31. Application of an escalation or discount.

.png?1614945017)