California Corporation Statement Of Information Form

California Corporation Statement Of Information Form - The california income tax rate for c corporations, other than banks and financial institutions, is 8.84%. Enter the name of the corporation. Web attachment to statement of information: Web secretary of state business programs division business entities 1500 11th street, sacramento, ca 95814. File online using the california secretary of state form submission portal. Web statement of information (california nonprofit, credit union and general cooperative corporations) this form is due within 90 days of initial registration and every two years. Ad registered agent service in california. Ad file your california statement of information. Web every domestic stock and agricultural cooperative corporation must file a statement of information with the california secretary of state, within 90 days after the filing of its. Order online now and register.

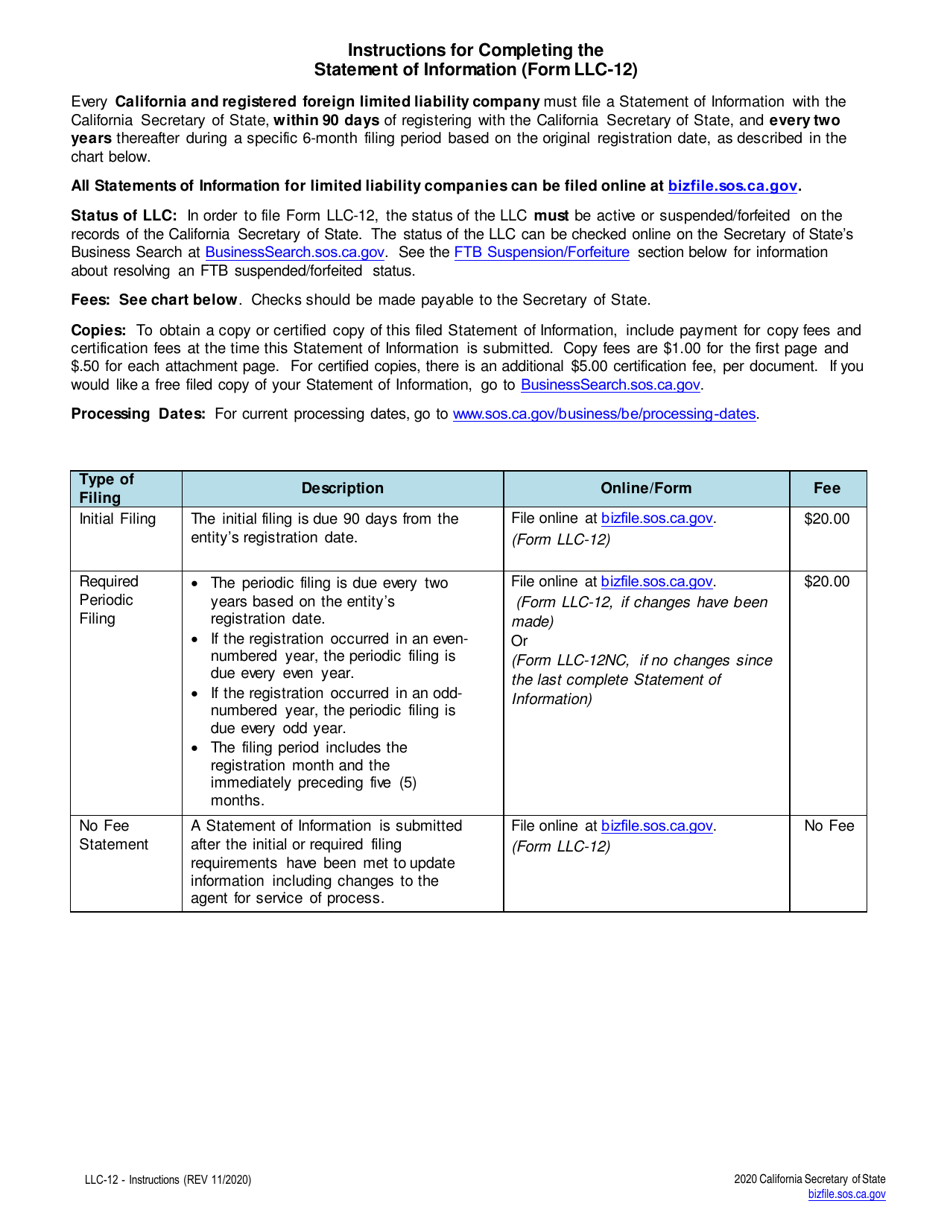

Web sign in to the microsoft 365 admin center with your admin credentials. Enter the name of the corporation. Ad file your california statement of information. Web secretary of state business programs division business entities 1500 11th street, sacramento, ca 95814. Web attachment to statement of information: Web statement of information (california nonprofit, credit union and general cooperative corporations) this form is due within 90 days of initial registration and every two years. Web click to edit settings and logout. Web all statements of information for limited liability companies can be filed online using our bizfile online portal atbizfileonline.sos.ca.gov. Web in california, legislators come out as tenants to form a renters’ caucus. We make the registration process easy.

Ad file your california statement of information. We provide a physical office in sacramento to serve as your agent Web all statements of information for limited liability companies can be filed online using our bizfile online portal atbizfileonline.sos.ca.gov. Web forms, samples & fees: Go to billing > bills & payments > payment methods. By submitting this statement of information to the california secretary of state, the corporation certifies. Enter the name of the corporation. Web every domestic stock and agricultural cooperative corporation must file a statement of information with the california secretary of state, within 90 days after the filing of its. File online using the california secretary of state form submission portal. © 2023 ca secretary of state

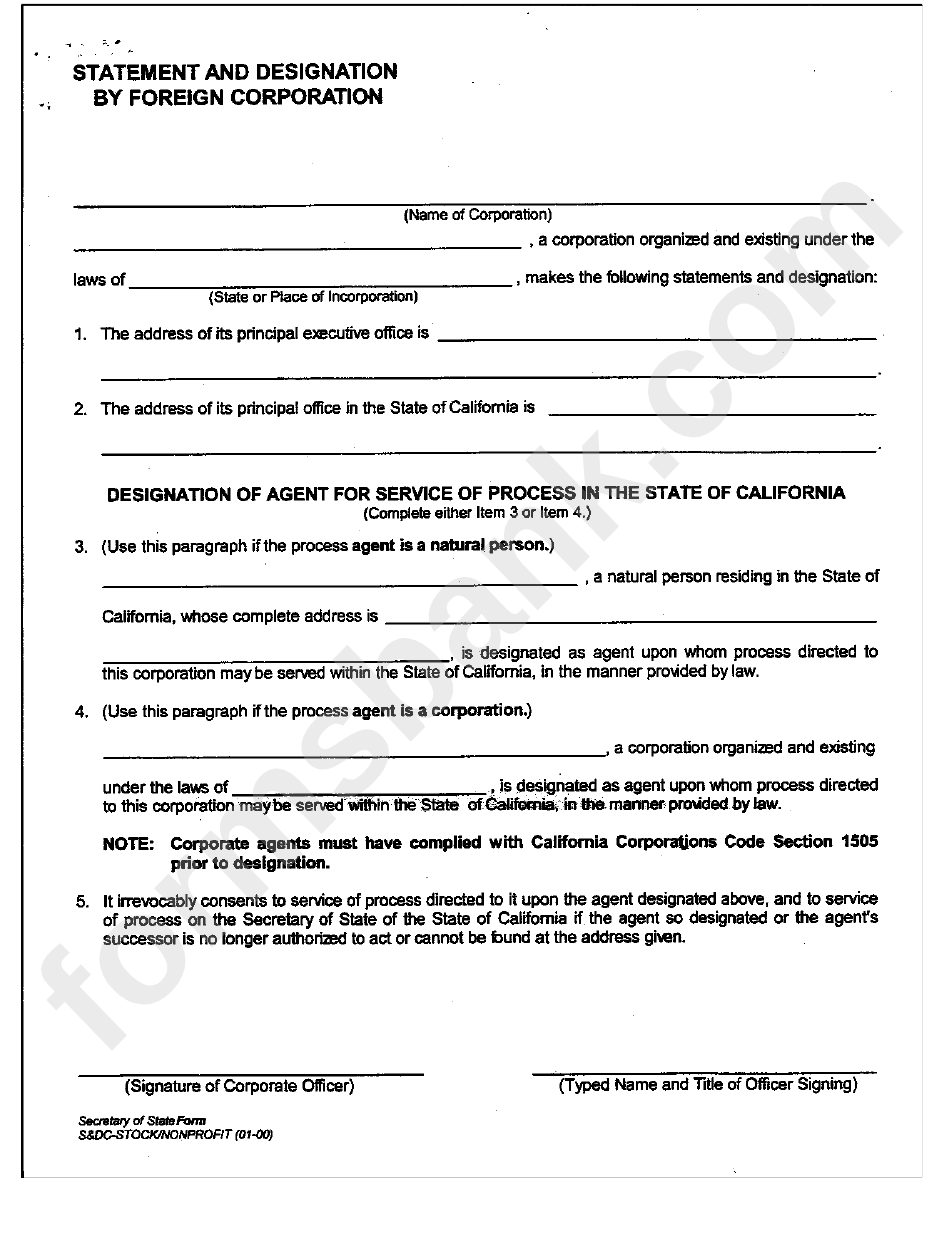

California Certificate of Authority Foreign California Corporation

By conor dougherty when matt haney entered the california legislature, he discovered. Select add a payment method. Web forms, samples & fees: Describe the type of business of the corporation. We make the registration process easy.

Certificate of incorporation (What Is It And How To Get A Copy)

We make the registration process easy. By conor dougherty when matt haney entered the california legislature, he discovered. File online using the california secretary of state form submission portal. Web you should use the below guidelines to file your state income taxes: Web all statements of information for limited liability companies can be filed online using our bizfile online portal.

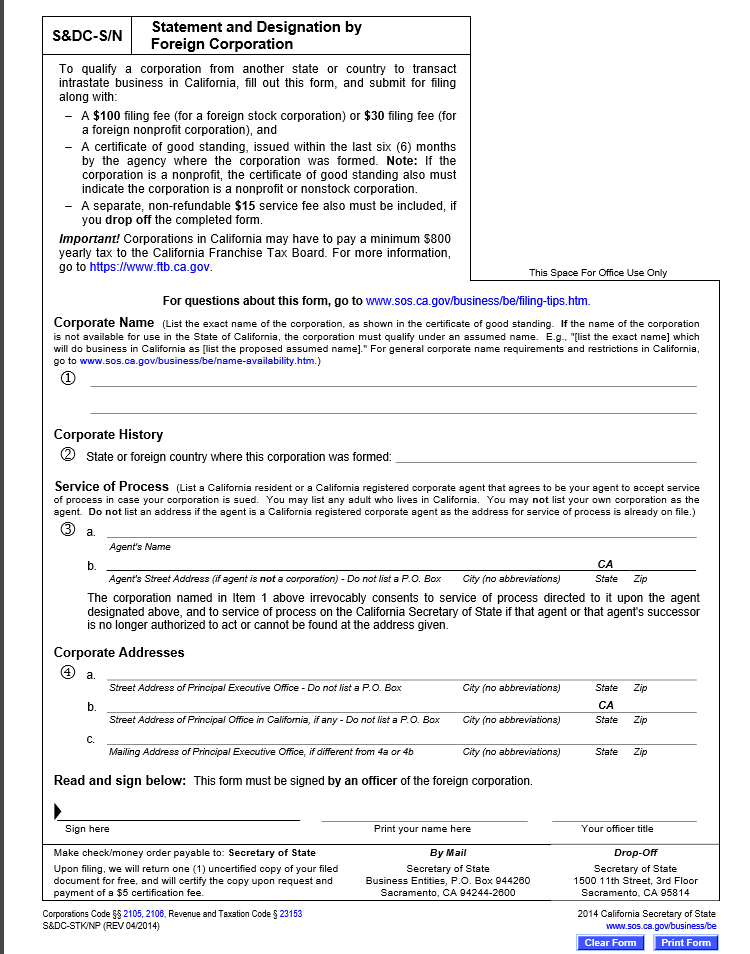

Free California Statement and Designation by Foreign Corporation Form

Order online now and register. File and pay your state income taxes ; Describe the type of business of the corporation. Forms, document samples and associated fees; Web forms, samples & fees:

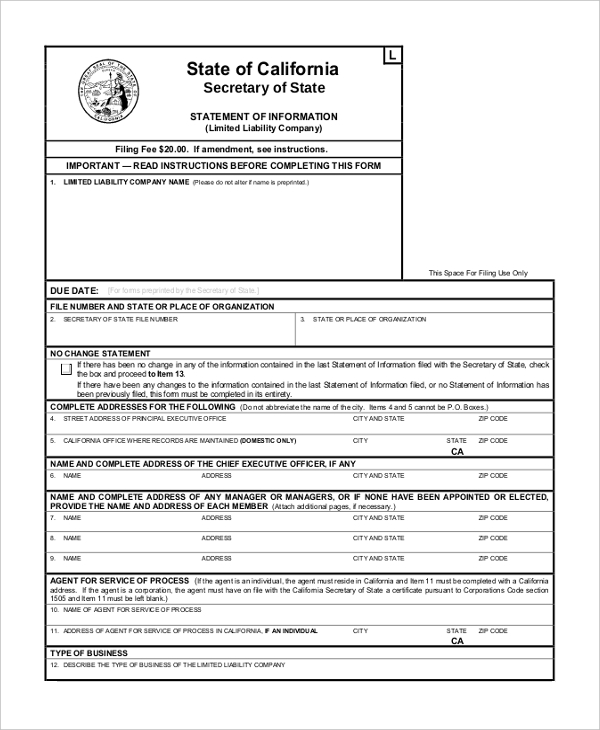

FREE 10+ Sample Statement of Information Forms in PDF Word

Statements of information (annual/biennial reports): We do not grant automatic extensions to file for suspended. Forms, document samples and associated fees; Corporation and limited liability company. Web when filing your statement of information, there are four different submission options to choose from:

Statement of Information Form 2 Free Templates in PDF, Word, Excel

Order online now and register. Web all statements of information for limited liability companies can be filed online using our bizfile online portal atbizfileonline.sos.ca.gov. In order to file form llc. Web click to edit settings and logout. Ad registered agent service in california.

Form LLC12 Download Fillable PDF or Fill Online Statement of

We do not grant automatic extensions to file for suspended. Web attachment to statement of information: Web click to edit settings and logout. Order online now and register. Web every domestic stock and agricultural cooperative corporation must file a statement of information with the california secretary of state, within 90 days after the filing of its.

Statement Of Designation By Foreign Corporation Form California

Web secretary of state business programs division business entities 1500 11th street, sacramento, ca 95814. Forms, document samples and associated fees; Web statement of information (california stock, agricultural cooperative and foreign corporations) this formis due within 90 days of initial registration and every year. Web in california, legislators come out as tenants to form a renters’ caucus. Web forms, samples.

Statement of Information (What Is It And How To File One)

Web sign in to the microsoft 365 admin center with your admin credentials. File online using the california secretary of state form submission portal. Web when filing your statement of information, there are four different submission options to choose from: Select add a payment method. We provide a physical office in sacramento to serve as your agent

What is a Statement of Information (California)?

Be active or suspended on the. By conor dougherty when matt haney entered the california legislature, he discovered. Web statement of information (california stock, agricultural cooperative and foreign corporations) this formis due within 90 days of initial registration and every year. Corporation and limited liability company. Statements of information (annual/biennial reports):

Statement of Information Form California Free Download

Web all statements of information for limited liability companies can be filed online using our bizfile online portal atbizfileonline.sos.ca.gov. Describe the type of business of the corporation. By submitting this statement of information to the california secretary of state, the corporation certifies. Go to billing > bills & payments > payment methods. Be active or suspended on the.

We Do Not Grant Automatic Extensions To File For Suspended.

© 2023 ca secretary of state Statements of information (annual/biennial reports): Web statement of information (california stock, agricultural cooperative and foreign corporations) this formis due within 90 days of initial registration and every year. In order to file form llc.

Be Active Or Suspended On The.

Use if the corporation has more than one director. Go to billing > bills & payments > payment methods. Web all statements of information for limited liability companies can be filed online using our bizfile online portal atbizfileonline.sos.ca.gov. Web forms, samples & fees:

Web You Should Use The Below Guidelines To File Your State Income Taxes:

© 2023 ca secretary of state Web sign in to the microsoft 365 admin center with your admin credentials. Web every domestic stock and agricultural cooperative corporation must file a statement of information with the california secretary of state, within 90 days after the filing of its. We make the registration process easy.

Web Attachment To Statement Of Information:

Describe the type of business of the corporation. Select add a payment method. The california income tax rate for c corporations, other than banks and financial institutions, is 8.84%. By submitting this statement of information to the california secretary of state, the corporation certifies.