California Inheritance Tax Waiver Form

California Inheritance Tax Waiver Form - Number of inherited properties likely to. Web you carry out a waiver of inheritance by drawing up and signing a document that ends your legal right to claim the assets left to you in the will. The declaration concerning residence form for decedents who had property located in. The tax is due within nine months of. Web what is a inheritance tax waiver form? California estates must follow the federal estate tax, which taxes certain large estates. Web california residents don’t need to worry about a state inheritance or estate tax as it’s 0%. Web the state controller's office: Web does ca have an inheritance tax waiver form for transfer of stock from decedent? If the deadline passes for filing, the heir must take possession of the.

Web up to $40 cash back california inheritance tax waiver is a form that is filled out by the legal heir of a deceased person's estate and submitted to the california franchise tax board. Residence of the decedent at time of death county state note: Legal requirements the laws of the. The declaration concerning residence form for decedents who had property located in. An inheritance or estate waiver releases an heir from the right to receive assets from an estate, and the associated. Number of inherited properties likely to. Web for a home owned this long, the inheritance exclusion reduces the child’s property tax bill by $3,000 to $4,000 per year. Web what is a inheritance tax waiver form? However, if the gift or inheritance later produces income, you will need to. Web does ca have an inheritance tax waiver form for transfer of stock from decedent?

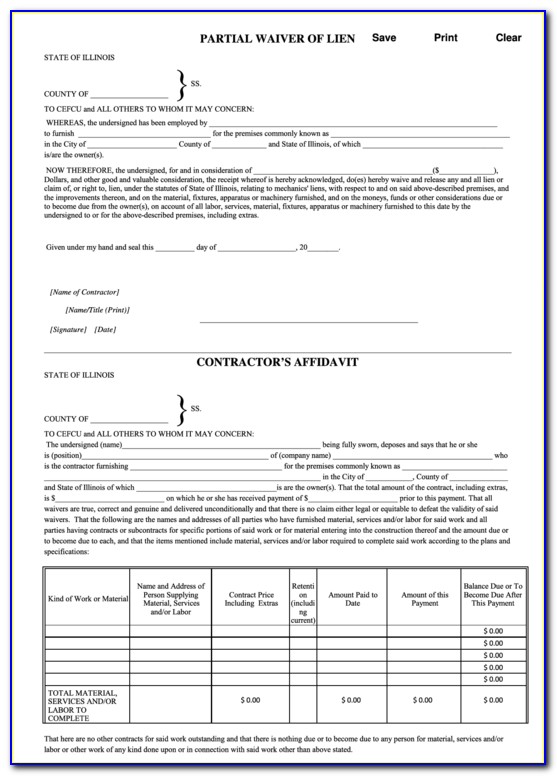

Web an inheritance tax return must be filed for every decedent (or person who died) with property that may be subject to pa inheritance tax. An inheritance or estate waiver releases an heir from the right to receive assets from an estate, and the associated. Web for a home owned this long, the inheritance exclusion reduces the child’s property tax bill by $3,000 to $4,000 per year. If the deadline passes for filing, the heir must take possession of the. Legal requirements the laws of the. Web a stepwise guide to editing the california state inheritance tax waiver. Web up to $40 cash back california inheritance tax waiver is a form that is filled out by the legal heir of a deceased person's estate and submitted to the california franchise tax board. Medallion inheritance tax waiver is required by transfer agent wells fargo. 11/7/2022 wiki user ∙ 14y ago study now see answer (1) best answer copy required if the decedent was a legal resident of california who died before june 9,. The tax is due within nine months of.

Inheritance Tax Waiver Form California Form Resume Examples Mj1vGyBKwy

Web what is a inheritance tax waiver form? If the deadline passes for filing, the heir must take possession of the. Medallion inheritance tax waiver is required by transfer agent wells fargo. If you received a gift or inheritance, do not include it in your income. Web a stepwise guide to editing the california state inheritance tax waiver.

Inheritance Tax Waiver Form Missouri Form Resume Examples Ze12OJAKjx

Web a stepwise guide to editing the california state inheritance tax waiver. Web what is a inheritance tax waiver form? Number of inherited properties likely to. An inheritance or estate waiver releases an heir from the right to receive assets from an estate, and the associated. Web how to get a inheritance tax waiver form (california)?

California Inheritance Tax Waiver Form Fill Online, Printable

The declaration concerning residence form for decedents who had property located in. However, if the gift or inheritance later produces income, you will need to. Web up to $40 cash back california inheritance tax waiver is a form that is filled out by the legal heir of a deceased person's estate and submitted to the california franchise tax board. Web.

Inheritance Tax Waiver Form California Form Resume Examples Mj1vGyBKwy

Web for a home owned this long, the inheritance exclusion reduces the child’s property tax bill by $3,000 to $4,000 per year. However, if the gift or inheritance later produces income, you will need to. Below you can get an idea about how to edit and complete a california state inheritance tax. The declaration concerning residence form for decedents who.

Inheritance Tax Waiver Form Ohio Form Resume Examples v19xB3bV7E

Legal requirements the laws of the. Web form 706 is used by the executor of a decedent's estate to figure the estate tax imposed by chapter 11 of the internal revenue code. California estates must follow the federal estate tax, which taxes certain large estates. Web up to $40 cash back california inheritance tax waiver is a form that is.

Inheritance Tax Waiver Form Ohio Form Resume Examples v19xB3bV7E

Web for a home owned this long, the inheritance exclusion reduces the child’s property tax bill by $3,000 to $4,000 per year. Web you carry out a waiver of inheritance by drawing up and signing a document that ends your legal right to claim the assets left to you in the will. Web form 706 is used by the executor.

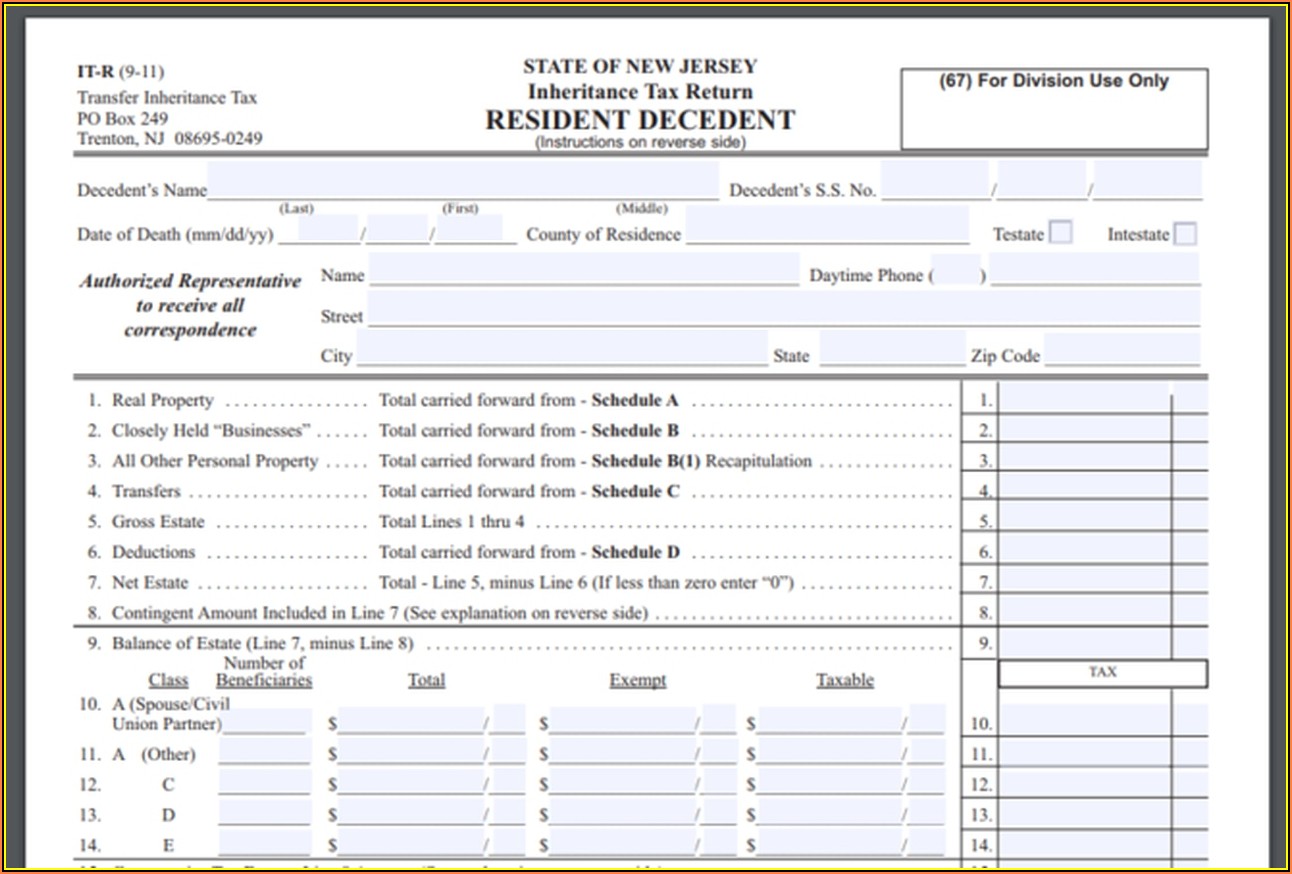

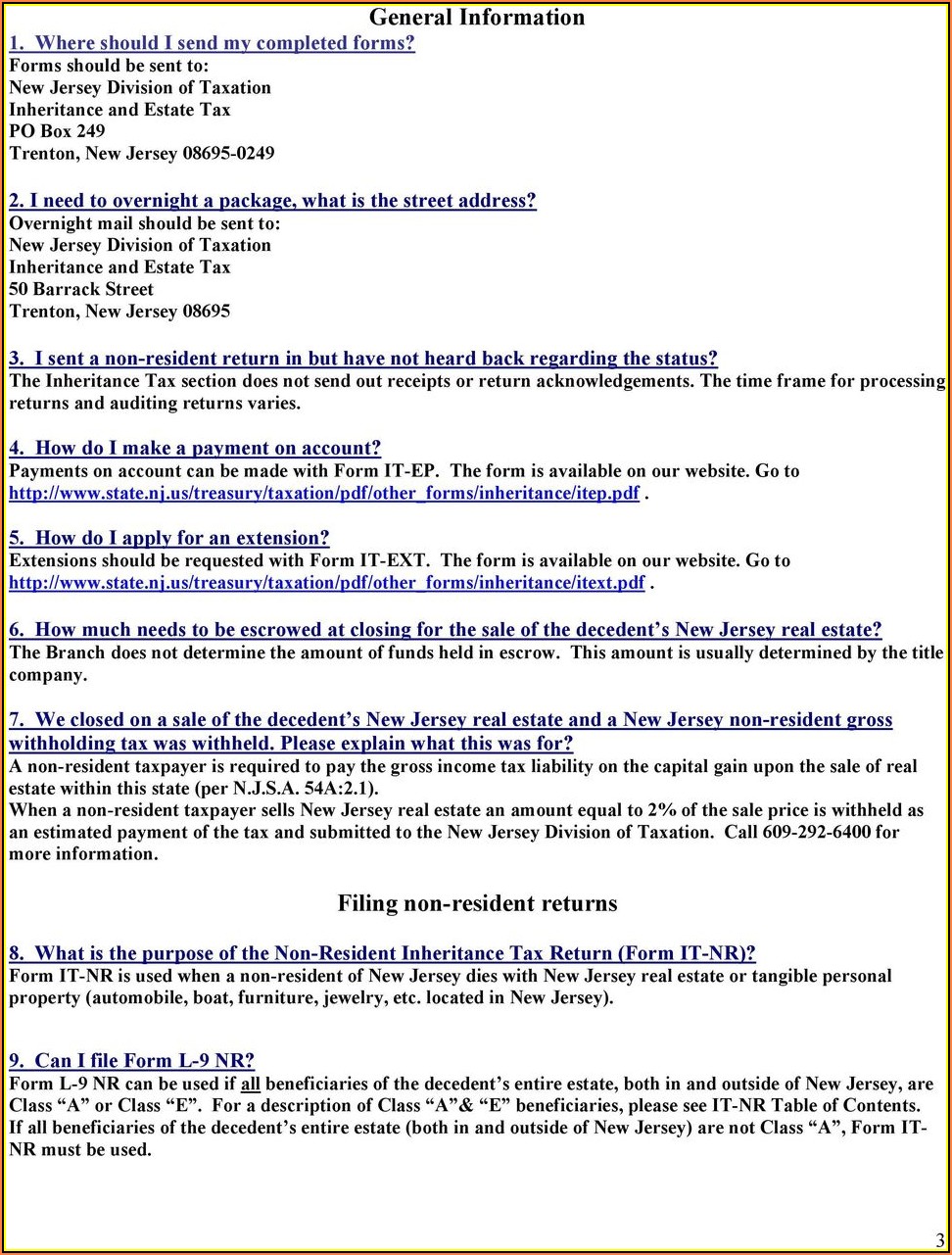

Fillable Form R3313 Inheritance Tax Waiver And Consent To Release

Web does ca have an inheritance tax waiver form for transfer of stock from decedent? An inheritance or estate waiver releases an heir from the right to receive assets from an estate, and the associated. Web form 706 is used by the executor of a decedent's estate to figure the estate tax imposed by chapter 11 of the internal revenue.

Inheritance Tax Waiver Form Missouri Form Resume Examples P32EdpZVJ8

The declaration concerning residence form for decedents who had property located in. Residence of the decedent at time of death county state note: Medallion inheritance tax waiver is required by transfer agent wells fargo. 11/7/2022 wiki user ∙ 14y ago study now see answer (1) best answer copy required if the decedent was a legal resident of california who died.

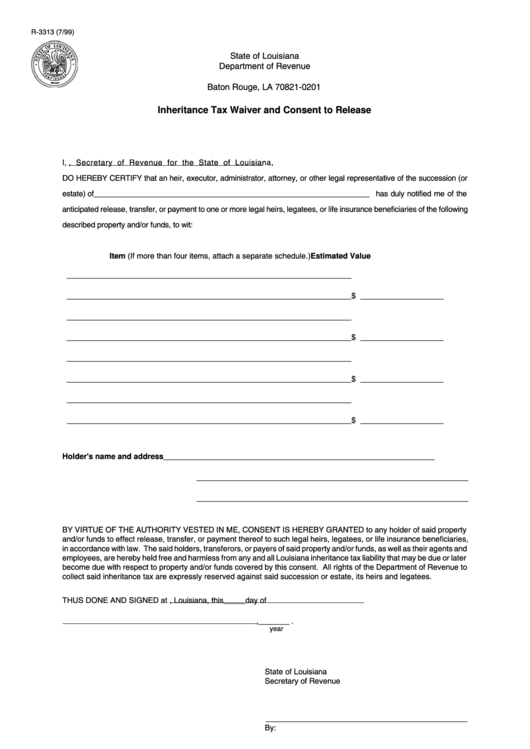

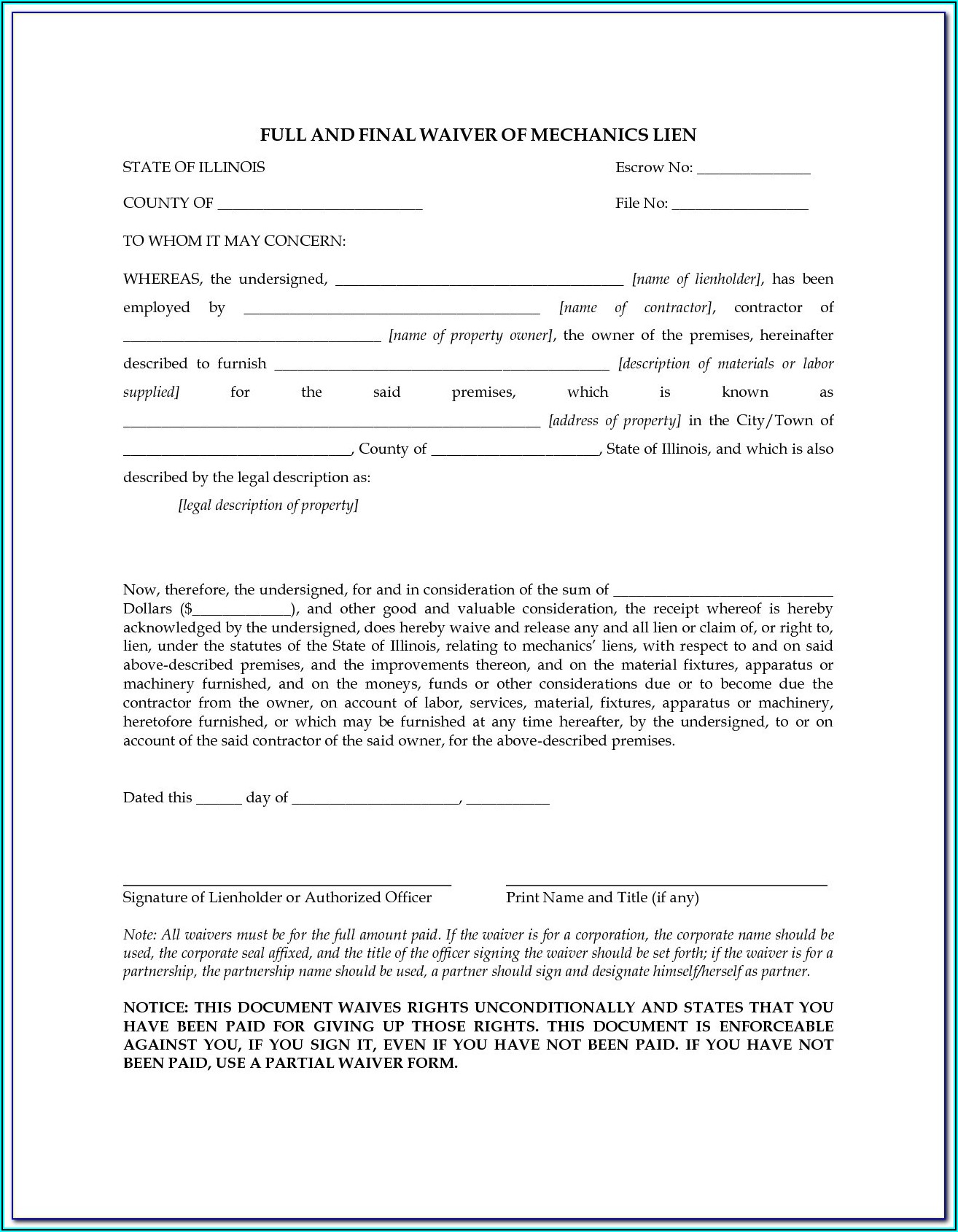

Inheritance Tax Waiver Form Illinois Form Resume Examples aEDvBW8D1Y

Number of inherited properties likely to. If you received a gift or inheritance, do not include it in your income. However, if the gift or inheritance later produces income, you will need to. Web you carry out a waiver of inheritance by drawing up and signing a document that ends your legal right to claim the assets left to you.

Inheritance Tax Waiver Form Pa Form Resume Examples kLYrL0326a

If you received a gift or inheritance, do not include it in your income. The tax is due within nine months of. Web an inheritance tax return must be filed for every decedent (or person who died) with property that may be subject to pa inheritance tax. Web a stepwise guide to editing the california state inheritance tax waiver. Web.

Below You Can Get An Idea About How To Edit And Complete A California State Inheritance Tax.

Web the state controller's office: However, if the gift or inheritance later produces income, you will need to. Web you carry out a waiver of inheritance by drawing up and signing a document that ends your legal right to claim the assets left to you in the will. A waiver is typically due up to nine months after the decedent's death.

Web For A Home Owned This Long, The Inheritance Exclusion Reduces The Child’s Property Tax Bill By $3,000 To $4,000 Per Year.

Web up to $40 cash back california inheritance tax waiver is a form that is filled out by the legal heir of a deceased person's estate and submitted to the california franchise tax board. Web california residents don’t need to worry about a state inheritance or estate tax as it’s 0%. Legal requirements the laws of the. Number of inherited properties likely to.

Web A Stepwise Guide To Editing The California State Inheritance Tax Waiver.

11/7/2022 wiki user ∙ 14y ago study now see answer (1) best answer copy required if the decedent was a legal resident of california who died before june 9,. An inheritance or estate waiver releases an heir from the right to receive assets from an estate, and the associated. Medallion inheritance tax waiver is required by transfer agent wells fargo. Web form 706 is used by the executor of a decedent's estate to figure the estate tax imposed by chapter 11 of the internal revenue code.

Web Does Ca Have An Inheritance Tax Waiver Form For Transfer Of Stock From Decedent?

Residence of the decedent at time of death county state note: If you received a gift or inheritance, do not include it in your income. The declaration concerning residence form for decedents who had property located in. If the deadline passes for filing, the heir must take possession of the.