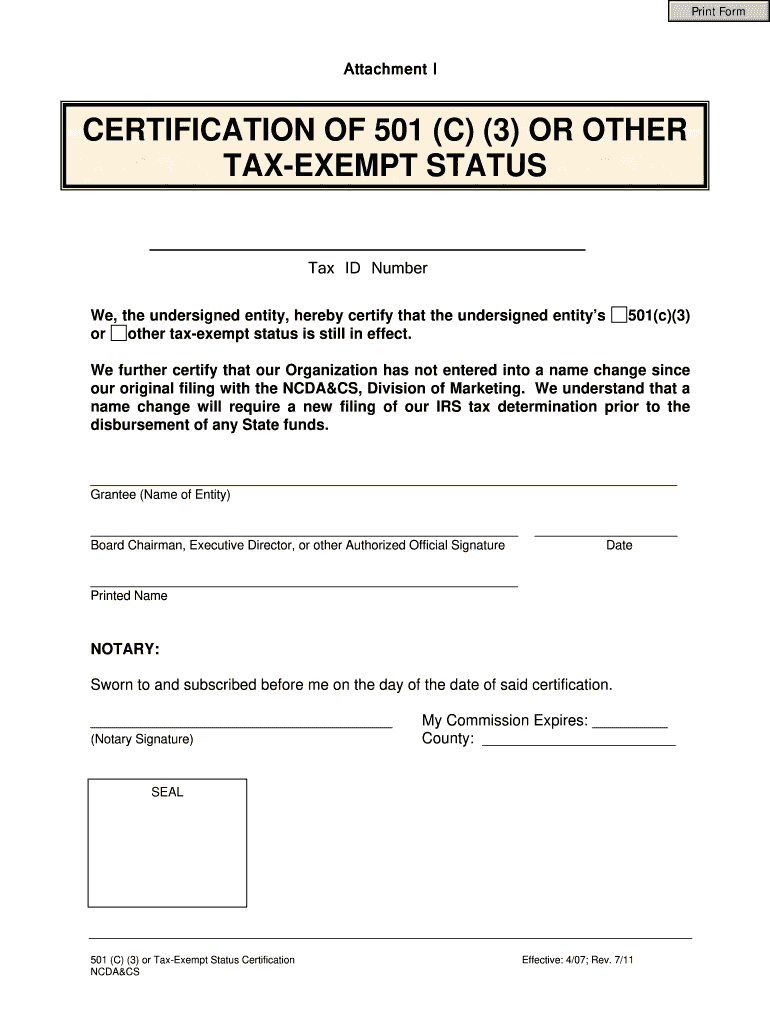

California Non Profit Tax Exempt Form

California Non Profit Tax Exempt Form - State charities regulation state tax filings state filing requirements for political. Web no general exemption for nonprofit and religious organizations although many nonprofit and religious organizations are exempt from federal and state income tax, there is no similar. Web file the initial registration form with the california attorney general’s registry of charitable trusts 8. Yet regardless of the legal form chosen, this. Web exemption application california form 3500 organization information california corporation number/california secretary of state file number fein name of organization. File the statement of information with the california secretary of state 9. Organizations organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary,. Web several legal forms, including as a nonprofitcorporation,trust, or unincorporated association. From side 2, part ii, line. Form 199 2020 side 1.

Form 199 2020 side 1. Web 2020 form 199 california exempt organization annual information return. From side 2, part ii, line. 1gross sales or receipts from other sources. Web all corporations and unincorporated organizations, even if organized on a nonprofit basis, are subject to california corporation franchise or income tax until the franchise tax. Effective 01/01/2021, senate bill 934 eliminates filing fees for nonprofit organizations: Web several legal forms, including as a nonprofitcorporation,trust, or unincorporated association. Web exemption application california form 3500 organization information california corporation number/california secretary of state file number fein name of organization. Web file the initial registration form with the california attorney general’s registry of charitable trusts 8. Web registration process in the registration application process, you will be asked a series of questions.

Web registration process in the registration application process, you will be asked a series of questions. Web exemption application california form 3500 organization information california corporation number/california secretary of state file number fein name of organization. Gather the following information and have it available as you complete your. 1gross sales or receipts from other sources. Web no general exemption for nonprofit and religious organizations although many nonprofit and religious organizations are exempt from federal and state income tax, there is no similar. Web several legal forms, including as a nonprofitcorporation,trust, or unincorporated association. Web all corporations and unincorporated organizations, even if organized on a nonprofit basis, are subject to california corporation franchise or income tax until the franchise tax. Send us an email county assessors and contact information Call us specific nonprofit property tax question? Web 2020 form 199 california exempt organization annual information return.

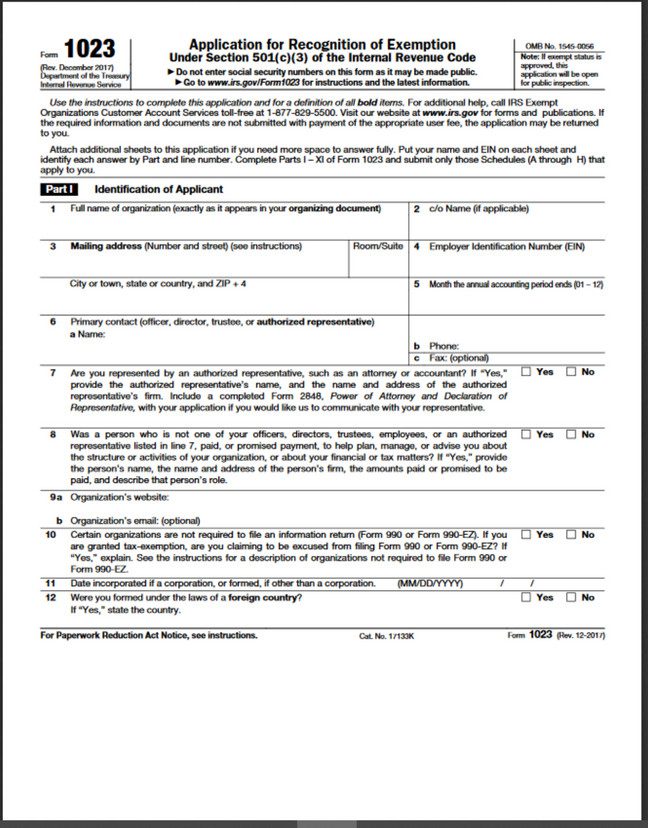

How To Form A 501c3 Form Resume Examples RE3499J86x

Web several legal forms, including as a nonprofitcorporation,trust, or unincorporated association. Form 199 2020 side 1. Web file the initial registration form with the california attorney general’s registry of charitable trusts 8. From side 2, part ii, line. Web all corporations and unincorporated organizations, even if organized on a nonprofit basis, are subject to california corporation franchise or income tax.

California Farm Tax Exemption Form Fill Online, Printable, Fillable

Web several legal forms, including as a nonprofitcorporation,trust, or unincorporated association. State charities regulation state tax filings state filing requirements for political. File the statement of information with the california secretary of state 9. Effective 01/01/2021, senate bill 934 eliminates filing fees for nonprofit organizations: Web 2020 form 199 california exempt organization annual information return.

501c Form Fill Online, Printable, Fillable, Blank pdfFiller

Form 199 2020 side 1. Web all corporations and unincorporated organizations, even if organized on a nonprofit basis, are subject to california corporation franchise or income tax until the franchise tax. Web several legal forms, including as a nonprofitcorporation,trust, or unincorporated association. File the statement of information with the california secretary of state 9. Organizations organized and operated exclusively for.

IRS 3500a Form for California TaxExemption 501(C) Organization

Web registration process in the registration application process, you will be asked a series of questions. Organizations organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary,. 1gross sales or receipts from other sources. State charities regulation state tax filings state filing requirements for political. Call us specific nonprofit property tax question?

Taxexempt Organizations Required to efile Forms

Web file the initial registration form with the california attorney general’s registry of charitable trusts 8. Web no general exemption for nonprofit and religious organizations although many nonprofit and religious organizations are exempt from federal and state income tax, there is no similar. Form 199 2020 side 1. Web exempt organization types. State charities regulation state tax filings state filing.

NonProfit with Full 501(c)(3) Application in FL Patel Law

Web exempt organization types. File the statement of information with the california secretary of state 9. Send us an email county assessors and contact information Web several legal forms, including as a nonprofitcorporation,trust, or unincorporated association. Web no general exemption for nonprofit and religious organizations although many nonprofit and religious organizations are exempt from federal and state income tax, there.

Exempt v. Non Exempt Employees What's The Difference?

Web 2020 form 199 california exempt organization annual information return. Web several legal forms, including as a nonprofitcorporation,trust, or unincorporated association. Web file the initial registration form with the california attorney general’s registry of charitable trusts 8. Send us an email county assessors and contact information 1gross sales or receipts from other sources.

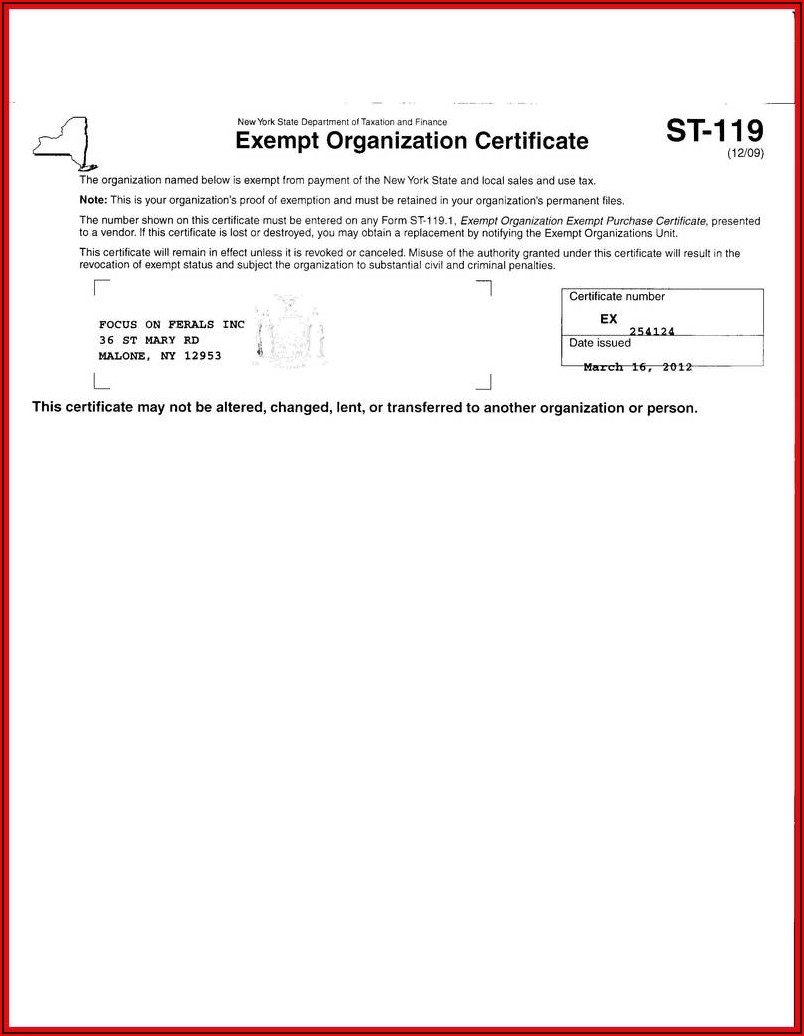

Form St 119 Exempt Organization Certificate Form Resume Examples

State charities regulation state tax filings state filing requirements for political. Effective 01/01/2021, senate bill 934 eliminates filing fees for nonprofit organizations: File the statement of information with the california secretary of state 9. Send us an email county assessors and contact information From side 2, part ii, line.

How to get a Sales Tax Exemption Certificate in Colorado

Web exempt organization types. Gather the following information and have it available as you complete your. Effective 01/01/2021, senate bill 934 eliminates filing fees for nonprofit organizations: Web registration process in the registration application process, you will be asked a series of questions. Web all corporations and unincorporated organizations, even if organized on a nonprofit basis, are subject to california.

California Sales Tax Exemption Certificate Video Bokep Ngentot

Effective 01/01/2021, senate bill 934 eliminates filing fees for nonprofit organizations: Web exempt organization types. Organizations organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary,. Form 199 2020 side 1. From side 2, part ii, line.

Web Several Legal Forms, Including As A Nonprofitcorporation,Trust, Or Unincorporated Association.

Effective 01/01/2021, senate bill 934 eliminates filing fees for nonprofit organizations: 1gross sales or receipts from other sources. From side 2, part ii, line. State charities regulation state tax filings state filing requirements for political.

Web 2020 Form 199 California Exempt Organization Annual Information Return.

Send us an email county assessors and contact information Call us specific nonprofit property tax question? Web no general exemption for nonprofit and religious organizations although many nonprofit and religious organizations are exempt from federal and state income tax, there is no similar. Organizations organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary,.

Gather The Following Information And Have It Available As You Complete Your.

Web registration process in the registration application process, you will be asked a series of questions. Web file the initial registration form with the california attorney general’s registry of charitable trusts 8. Web exemption application california form 3500 organization information california corporation number/california secretary of state file number fein name of organization. Form 199 2020 side 1.

Web Exempt Organization Types.

File the statement of information with the california secretary of state 9. Web all corporations and unincorporated organizations, even if organized on a nonprofit basis, are subject to california corporation franchise or income tax until the franchise tax. Yet regardless of the legal form chosen, this.