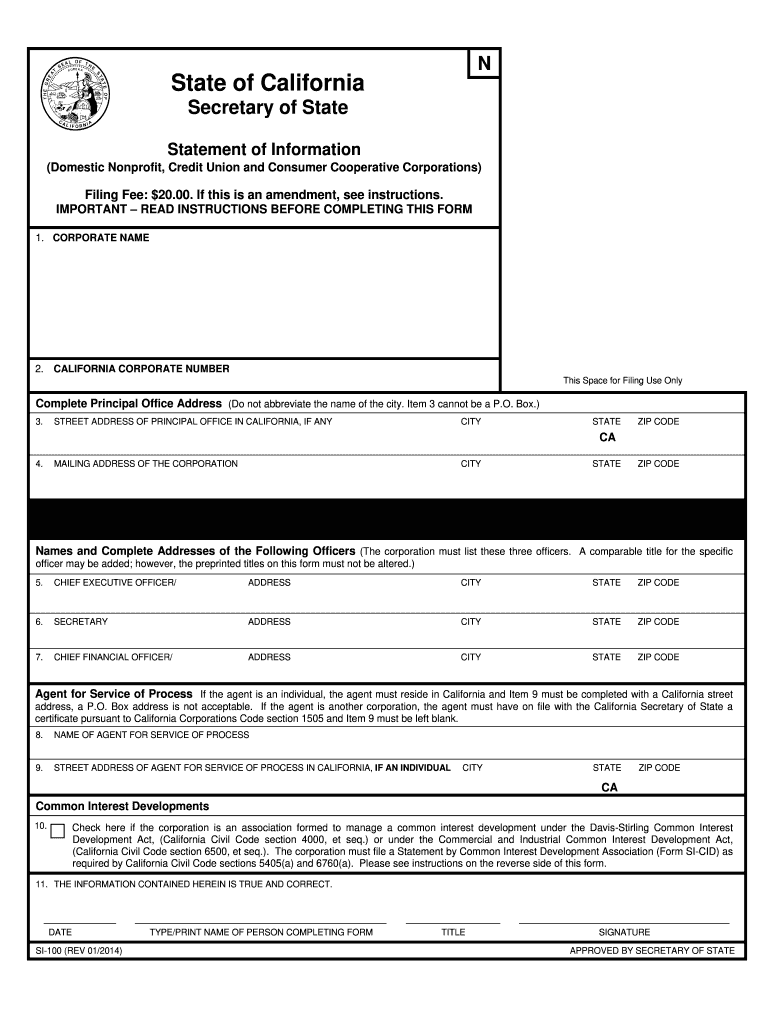

California Secretary Of State Form Si 100

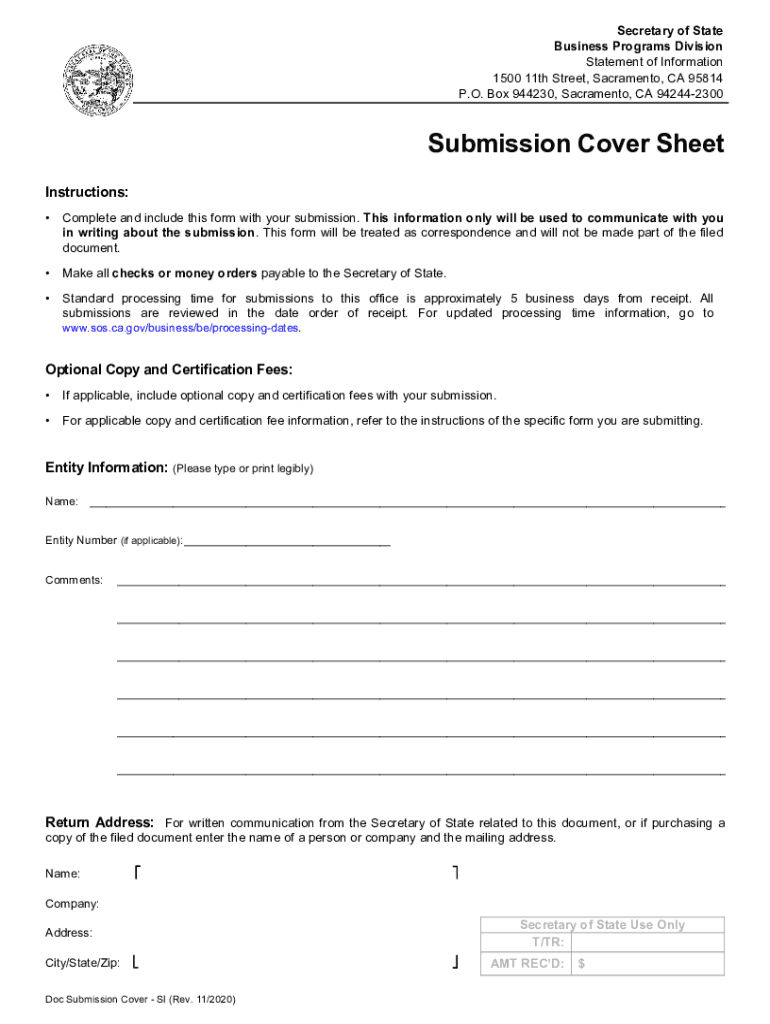

California Secretary Of State Form Si 100 - Save or instantly send your ready documents. Records requests requests for reproduction/certification should be made in writing to the sacramento office. Sufficient fees must accompany all requests. Web form 100 is california’s tax return for corporations, banks, financial corporations, real estate mortgage investment conduits (remics), regulated investment companies (rics), real estate investment trusts (reits), massachusetts or business trusts, publicly traded partnerships (ptps), exempt homeowners’ associations (hoas), political action. Several organizations have been suspended by the california secretary of state for neglecting to provide this information, while others have had their exempt status revoked by the california franchise tax board (ftb) in. Web find links to the various statements required to be filed with the california secretary of state annually or biennially here. Web home business programs business entities forms, samples and fees over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability companies and limited partnerships available online. Note that in order to use form 3500a, your california forms 199 or 199n and 109 for all applicable tax years must. File form 3500a, submission of exemption request (the short version), along with a copy of your irs determination letter. Save or instantly send your ready documents.

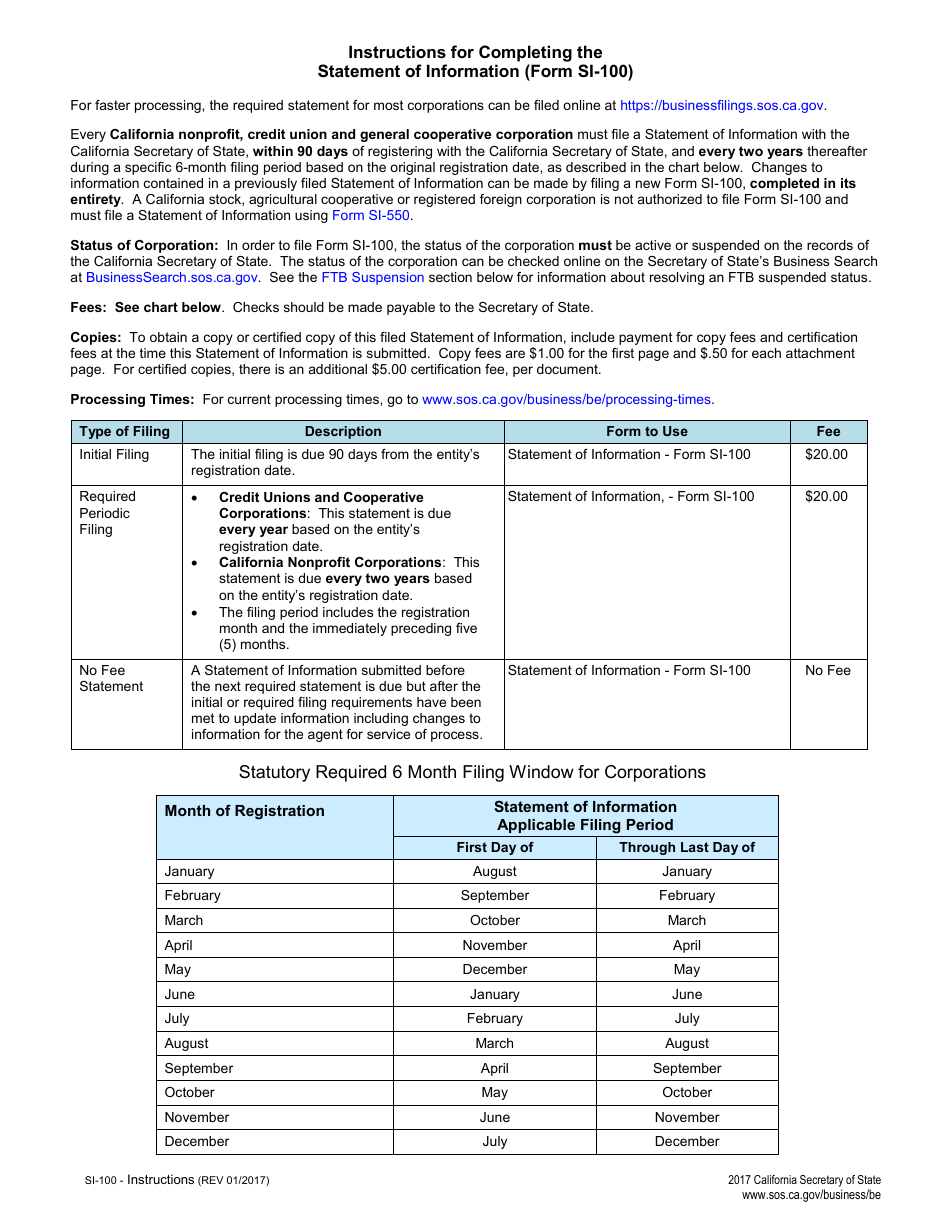

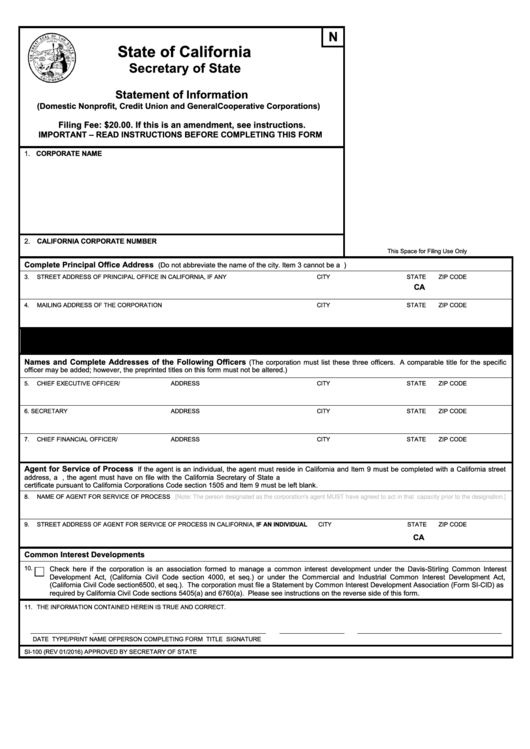

Instructions for completing the statement of (california) form. Records requests requests for reproduction/certification should be made in writing to the sacramento office. Sufficient fees must accompany all requests. © 2023 ca secretary of state Save or instantly send your ready documents. Web form 100 is california’s tax return for corporations, banks, financial corporations, real estate mortgage investment conduits (remics), regulated investment companies (rics), real estate investment trusts (reits), massachusetts or business trusts, publicly traded partnerships (ptps), exempt homeowners’ associations (hoas), political action. Every domestic nonprofit organization must file a statement of information with the secretary of state every other year and while. You can also use this form when changes. Several organizations have been suspended by the california secretary of state for neglecting to provide this information, while others have had their exempt status revoked by the california franchise tax board (ftb) in. Save or instantly send your ready documents.

You can also use this form when changes. Records requests requests for reproduction/certification should be made in writing to the sacramento office. Save or instantly send your ready documents. Dissolved surrendered (withdrawn) merged/reorganized irc section 338 sale qsub election enter date (mm/dd/yyyy) b 1. File form 3500a, submission of exemption request (the short version), along with a copy of your irs determination letter. Easily fill out pdf blank, edit, and sign them. Instructions for completing the statement of (california) form. The form can be only completed by a corporate attorney or by the organization itself. The status of the corporation can be checked online on the secretary of state’s business search at businesssearch.sos.ca.gov. Important — read instructions before completing this form this space for filing use only 1.

S1 100 Fill Online, Printable, Fillable, Blank pdfFiller

Easily fill out pdf blank, edit, and sign them. Note that in order to use form 3500a, your california forms 199 or 199n and 109 for all applicable tax years must. Web find links to the various statements required to be filed with the california secretary of state annually or biennially here. Dissolved surrendered (withdrawn) merged/reorganized irc section 338 sale.

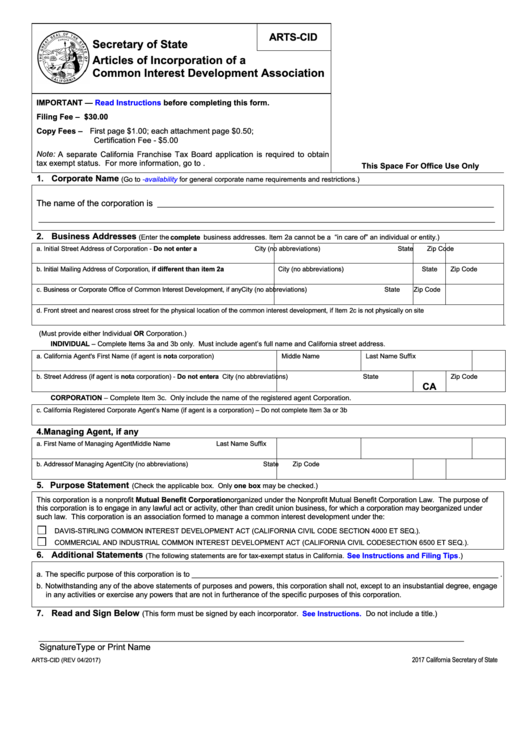

Ca Si Cid Fill Online, Printable, Fillable, Blank pdfFiller

Use fill to complete blank online california pdf forms for free. Several organizations have been suspended by the california secretary of state for neglecting to provide this information, while others have had their exempt status revoked by the california franchise tax board (ftb) in. Every domestic nonprofit organization must file a statement of information with the secretary of state every.

CA SI100 20202022 Fill and Sign Printable Template Online

The form can be only completed by a corporate attorney or by the organization itself. Records requests requests for reproduction/certification should be made in writing to the sacramento office. Web welcome to bizfile california, the secretary of state’s online portal to help businesses file, search, and order business records. © 2023 ca secretary of state Save or instantly send your.

Secretary of State California Secretary of State Expedited Filing Service

Web business programs trademarks and service marks forms and fees 1. Important — read instructions before completing this form this space for filing use only 1. Easily fill out pdf blank, edit, and sign them. Sufficient fees must accompany all requests. Records requests requests for reproduction/certification should be made in writing to the sacramento office.

CA SI550 2017 Fill and Sign Printable Template Online US Legal Forms

You can also use this form when changes. Dissolved surrendered (withdrawn) merged/reorganized irc section 338 sale qsub election enter date (mm/dd/yyyy) b 1. Save or instantly send your ready documents. Use fill to complete blank online california pdf forms for free. Web state of california secretary of state statement of information (domestic nonprofit, credit union and consumer cooperative corporations) filing.

Form SI100 Download Fillable PDF or Fill Online Statement of

Web home business programs business entities forms, samples and fees over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability companies and limited partnerships available online. Once completed you can sign your fillable form or send for signing. Records requests requests for reproduction/certification should be made in writing to the sacramento.

Fillable Form Si100 Statement Of Information printable pdf download

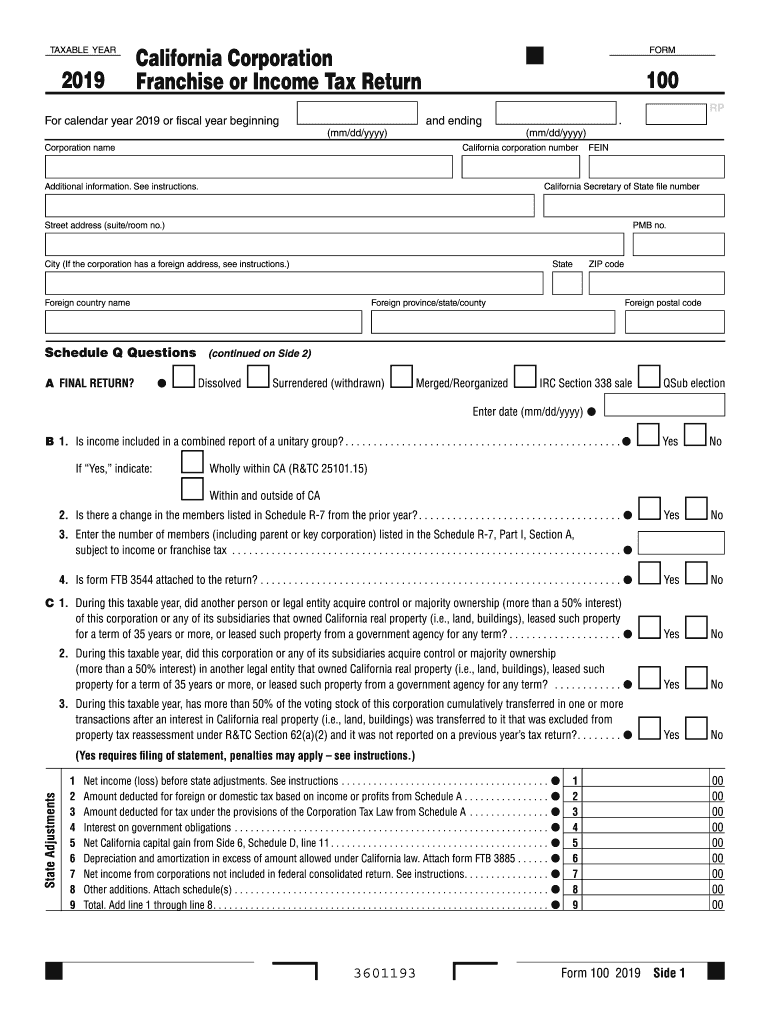

© 2023 ca secretary of state Web 3601213form 100 2021 side 1 taxable year 2021 california corporation franchise or income tax return form 100 schedule q questions (continued on side 2) a final return? Instructions for completing the statement of (california) form. Several organizations have been suspended by the california secretary of state for neglecting to provide this information, while.

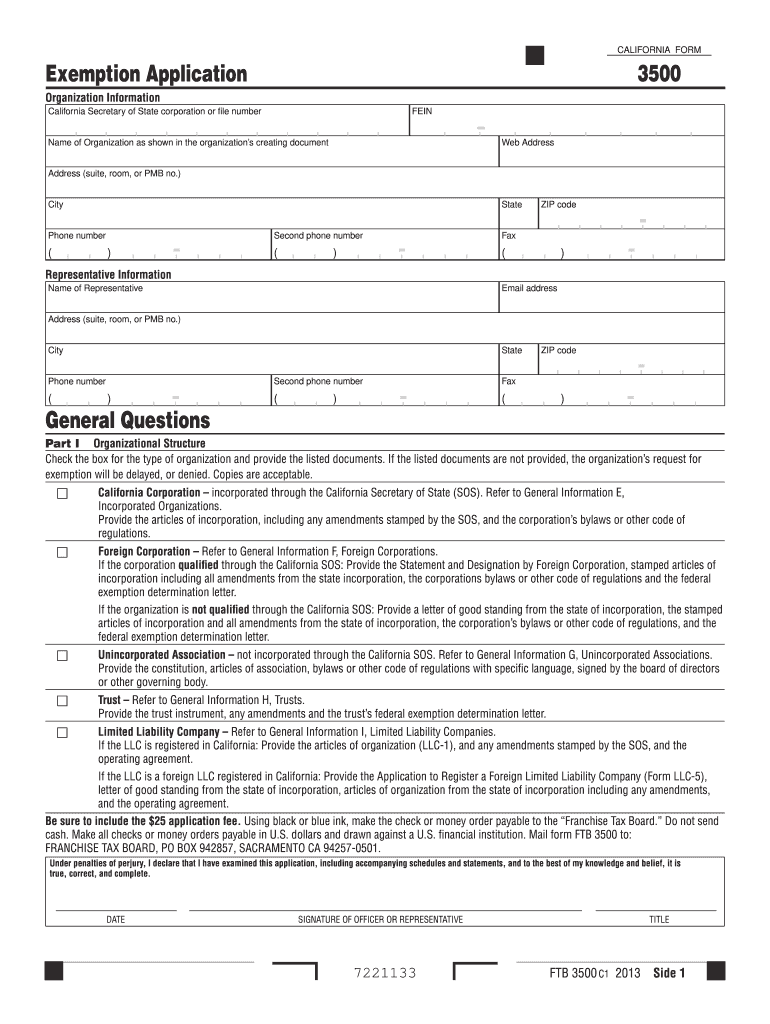

California Secretary Of State Form 3500 Fill Out and Sign Printable

Save or instantly send your ready documents. Save or instantly send your ready documents. Records requests requests for reproduction/certification should be made in writing to the sacramento office. Web business programs trademarks and service marks forms and fees 1. The status of the corporation can be checked online on the secretary of state’s business search at businesssearch.sos.ca.gov.

218 California Secretary Of State Forms And Templates free to download

Save or instantly send your ready documents. Save or instantly send your ready documents. Whether you are filing a financing statement pursuant to the uniform commercial code (ucc), searching for a corporation (corp), limited liability company (llc), limited partnership (lp) filing or looking for an. The form can be only completed by a corporate attorney or by the organization itself..

CA FTB 100 2019 Fill out Tax Template Online US Legal Forms

All forms are printable and downloadable. Important — read instructions before completing this form this space for filing use only 1. Every domestic nonprofit organization must file a statement of information with the secretary of state every other year and while. © 2023 ca secretary of state Instructions for completing the statement of (california) form.

You Can Also Use This Form When Changes.

The form can be only completed by a corporate attorney or by the organization itself. Use fill to complete blank online california pdf forms for free. Save or instantly send your ready documents. Web welcome to bizfile california, the secretary of state’s online portal to help businesses file, search, and order business records.

Web State Of California Secretary Of State Statement Of Information (Domestic Nonprofit, Credit Union And Consumer Cooperative Corporations) Filing Fee:

Easily fill out pdf blank, edit, and sign them. Web find links to the various statements required to be filed with the california secretary of state annually or biennially here. Every domestic nonprofit organization must file a statement of information with the secretary of state every other year and while. Web due within 90 days of initial registration and every two years thereafter for nonprofit mutual benefit corporations and every year thereafter for general cooperative corporations.

Several Organizations Have Been Suspended By The California Secretary Of State For Neglecting To Provide This Information, While Others Have Had Their Exempt Status Revoked By The California Franchise Tax Board (Ftb) In.

Records requests requests for reproduction/certification should be made in writing to the sacramento office. Web home business programs business entities forms, samples and fees over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability companies and limited partnerships available online. Important — read instructions before completing this form this space for filing use only 1. © 2023 ca secretary of state

Web Form 100 Is California’s Tax Return For Corporations, Banks, Financial Corporations, Real Estate Mortgage Investment Conduits (Remics), Regulated Investment Companies (Rics), Real Estate Investment Trusts (Reits), Massachusetts Or Business Trusts, Publicly Traded Partnerships (Ptps), Exempt Homeowners’ Associations (Hoas), Political Action.

The status of the corporation can be checked online on the secretary of state’s business search at businesssearch.sos.ca.gov. All forms are printable and downloadable. Dissolved surrendered (withdrawn) merged/reorganized irc section 338 sale qsub election enter date (mm/dd/yyyy) b 1. Web 3601213form 100 2021 side 1 taxable year 2021 california corporation franchise or income tax return form 100 schedule q questions (continued on side 2) a final return?