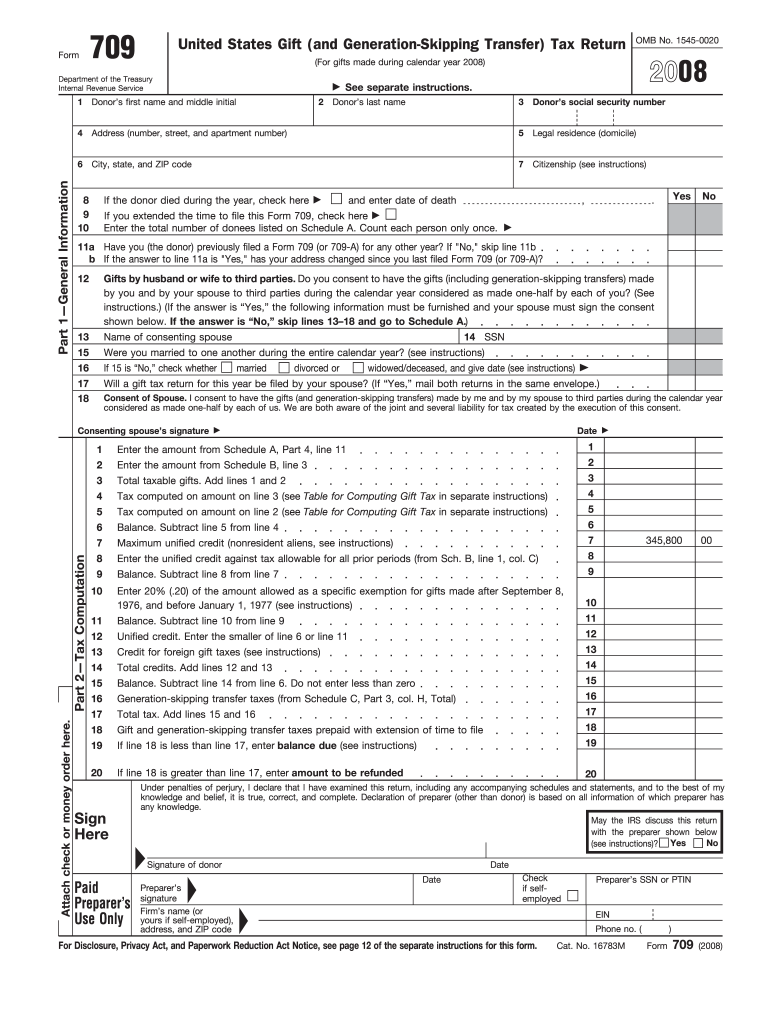

Can You E File Form 709

Can You E File Form 709 - What happens if i don’t. If you are using a private delivery service to file your. Web 5 min read october 25, 2022 resource center forms form 709: Web form 709, u.s. When a us person transfers. Web department of the treasury internal revenue service. The exclusion applies per person. Web for tax year 2021, you may give someone cash or property valued at up to $15,000 without needing to fill out form 709. Web sjr gave you the answer, and if you check the instructions for 709 it will tell you to mail to: Web if a taxpayer gives a gift that is subject to the us gift tax, they must fill out form 709 and file it by the appropriate deadline.

What happens if i don’t. Web still, filling out form 709 can get complicated. Web do i file form 709 with my tax return? The limit for tax year 2018 or the tax return you’d. When a us person transfers. Where to file file form 709 at the following address. The instructions for form 709 directs you to mail it to the. Web form 709, u.s. Web 5 min read october 25, 2022 resource center forms form 709: Web department of the treasury internal revenue service.

If you are using a private delivery service to file your. What is the us gift tax? Web do i file form 709 with my tax return? Web for tax year 2021, you may give someone cash or property valued at up to $15,000 without needing to fill out form 709. Web sjr gave you the answer, and if you check the instructions for 709 it will tell you to mail to: Web form 709, u.s. Solution tools attachments to provide feedback on this solution, please. Web still, filling out form 709 can get complicated. Web 31 rows to pay estate and gift tax online, use the secure and convenient electronic federal tax payment system. Web if a taxpayer gives a gift that is subject to the us gift tax, they must fill out form 709 and file it by the appropriate deadline.

Form 1065 E File Requirements Universal Network

The exclusion applies per person. Web form 709, u.s. Web do i file form 709 with my tax return? Web department of the treasury internal revenue service. Yes, form 709 is filed with your federal tax return if you exceeded the annual gift tax exclusion.

Completed Sample IRS Form 709 Gift Tax Return for 529 Superfunding

Web for tax year 2021, you may give someone cash or property valued at up to $15,000 without needing to fill out form 709. What happens if i don’t. Web department of the treasury internal revenue service. When a us person transfers. Can i file the gift tax form 709 separately (paper version since turbo tax does not support it).

Form 709 Gift Tax Return Deadline Approaching Morris Estate Planning

Web 5 min read october 25, 2022 resource center forms form 709: Web if a taxpayer gives a gift that is subject to the us gift tax, they must fill out form 709 and file it by the appropriate deadline. What happens if i don’t. The instructions for form 709 directs you to mail it to the. If you are.

Can You E File Form 1065 Universal Network

Web 31 rows to pay estate and gift tax online, use the secure and convenient electronic federal tax payment system. Yes, form 709 is filed with your federal tax return if you exceeded the annual gift tax exclusion. Can i file the gift tax form 709 separately (paper version since turbo tax does not support it) even though my tax.

IRS Form 709 Definition and Description

Where to file file form 709 at the following address. Solution tools attachments to provide feedback on this solution, please. Web still, filling out form 709 can get complicated. Web 31 rows to pay estate and gift tax online, use the secure and convenient electronic federal tax payment system. What happens if i don’t.

Completed Sample IRS Form 709 Gift Tax Return for 529 Superfunding

Web 5 min read october 25, 2022 resource center forms form 709: Can i file the gift tax form 709 separately (paper version since turbo tax does not support it) even though my tax returns have been filed online? Web form 709, u.s. What is the us gift tax? When a us person transfers.

Form 1065 E File Waiver Request Universal Network

Web department of the treasury internal revenue service. The exclusion applies per person. The limit for tax year 2018 or the tax return you’d. The instructions for form 709 directs you to mail it to the. If you are using a private delivery service to file your.

709 gift tax return instructions

Web if a taxpayer gives a gift that is subject to the us gift tax, they must fill out form 709 and file it by the appropriate deadline. The exclusion applies per person. When a us person transfers. What happens if i don’t. Web 5 min read october 25, 2022 resource center forms form 709:

2008 709 Form Fill Out and Sign Printable PDF Template signNow

Web department of the treasury internal revenue service. The instructions for form 709 directs you to mail it to the. Web sjr gave you the answer, and if you check the instructions for 709 it will tell you to mail to: The limit for tax year 2018 or the tax return you’d. Web for tax year 2021, you may give.

E File For Form 2290 Excise Tax Filers Form Resume Examples erkKPR3DN8

When a us person transfers. If you are using a private delivery service to file your. Where to file file form 709 at the following address. Web do i file form 709 with my tax return? Web for tax year 2021, you may give someone cash or property valued at up to $15,000 without needing to fill out form 709.

Web 5 Min Read October 25, 2022 Resource Center Forms Form 709:

Web for tax year 2021, you may give someone cash or property valued at up to $15,000 without needing to fill out form 709. Web department of the treasury internal revenue service. If you are using a private delivery service to file your. Web form 709, u.s.

Web Do I File Form 709 With My Tax Return?

Can i file the gift tax form 709 separately (paper version since turbo tax does not support it) even though my tax returns have been filed online? What is the us gift tax? Web if a taxpayer gives a gift that is subject to the us gift tax, they must fill out form 709 and file it by the appropriate deadline. The instructions for form 709 directs you to mail it to the.

Web Still, Filling Out Form 709 Can Get Complicated.

Where to file file form 709 at the following address. Yes, form 709 is filed with your federal tax return if you exceeded the annual gift tax exclusion. What happens if i don’t. When a us person transfers.

Web 31 Rows To Pay Estate And Gift Tax Online, Use The Secure And Convenient Electronic Federal Tax Payment System.

The limit for tax year 2018 or the tax return you’d. Solution tools attachments to provide feedback on this solution, please. Web sjr gave you the answer, and if you check the instructions for 709 it will tell you to mail to: The exclusion applies per person.

/Form-709-57686e0d3df78ca6e42bf9cc.png)