Canada T2 Form

Canada T2 Form - The cra provides two different t2 returns: Section b section c section d may 2022 section when to use this application you can use this application. Web the t2 corporation income tax return or t2 is the form used in canada by corporations to file their income tax return. The canada revenue agency (cra) has created form t2, corporation income tax return, for. Web prepare corporate t2 tax returns and cra efiles with profile. Easily fill out pdf blank, edit, and sign them. It is to be filed with relevant schedules and the gifi. Web the the t2 short return (government of canada) form is 4 pages long and contains: It carried on business in canada; Print the t2 corporation income tax return in pdf format from cra's forms and.

Use these forms to prepare your corporation income tax return. Click verify button in futuretax and fix errors if applicable; It is to be filed with relevant schedules and the gifi. Web there are several ways you can get the t2 corporation income tax return. The cra 's publications and personalized correspondence are available in. Web all incorporated businesses operating within canada must file a t2 return with the cra. Web 5 easy steps to submit your t2 tax return: The canada revenue agency (cra) has created form t2, corporation income tax return, for. Section b section c section d may 2022 section when to use this application you can use this application. You can view this publication in:

Web all incorporated businesses operating within canada must file a t2 return with the cra. Print the t2 corporation income tax return in pdf format from cra's forms and. Use these forms to prepare your corporation income tax return. To view forms that are no longer in use, go to archived forms. Download, install and complete your tax return; Web there are several ways you can get the t2 corporation income tax return. Corporations must submit their t2 forms within six. Web the the t2 short return (government of canada) form is 4 pages long and contains: The cra provides two different t2 returns: Web form t2 application about tenant rights instructions section a:

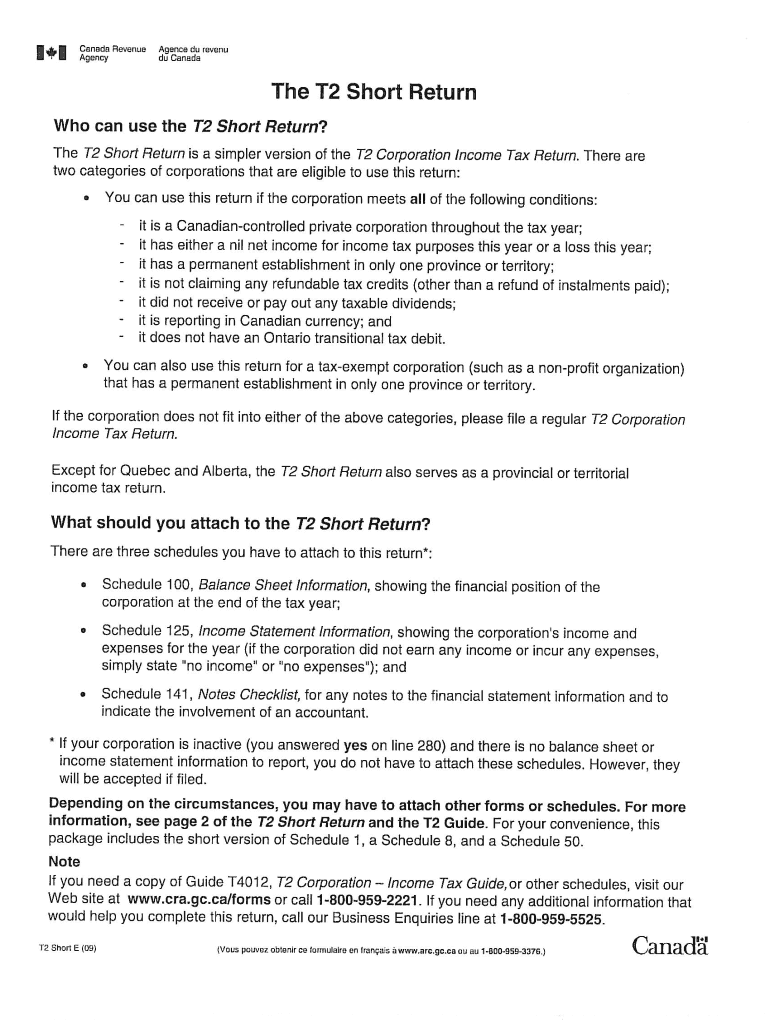

Canada T2 Short 2017 Fill and Sign Printable Template Online US

Web the the t2 short return (government of canada) form is 4 pages long and contains: In this video tutorial, i will show you step by step in detail on how to file y. Save or instantly send your ready documents. Click verify button in futuretax and fix errors if applicable; Web all incorporated businesses operating within canada must file.

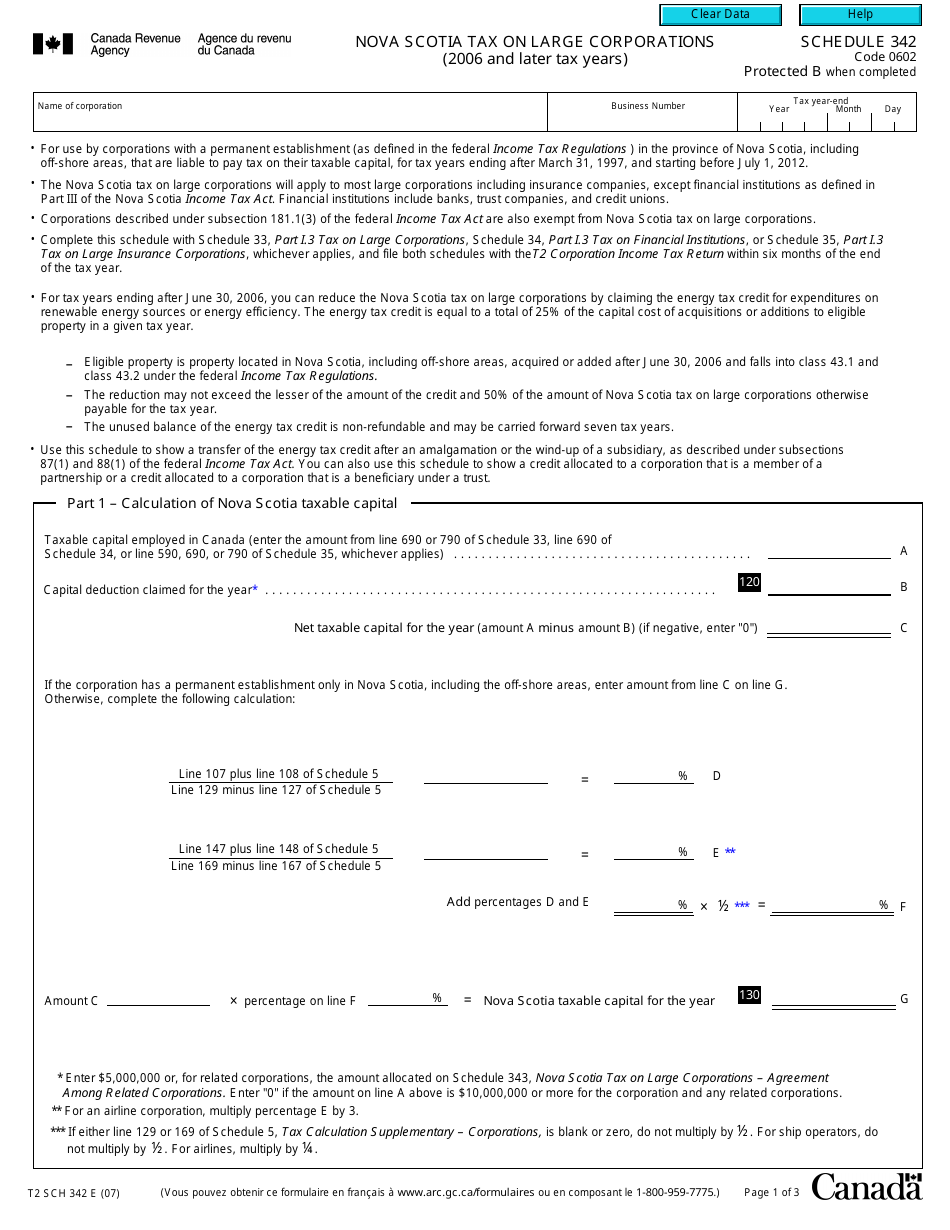

Form T2 Schedule 342 Download Fillable PDF or Fill Online Nova Scotia

Web form t2 application about tenant rights instructions section a: Download, install and complete your tax return; You can view this publication in: To view forms that are no longer in use, go to archived forms. All corporations other than registered charities must file a t2.

Form T2 Schedule 97 Download Fillable PDF or Fill Online Additional

Use these forms to prepare your corporation income tax return. Web form t2 application about tenant rights instructions section a: Web what is a t2 form? Web prepare corporate t2 tax returns and cra efiles with profile. Web t2 returns and schedules.

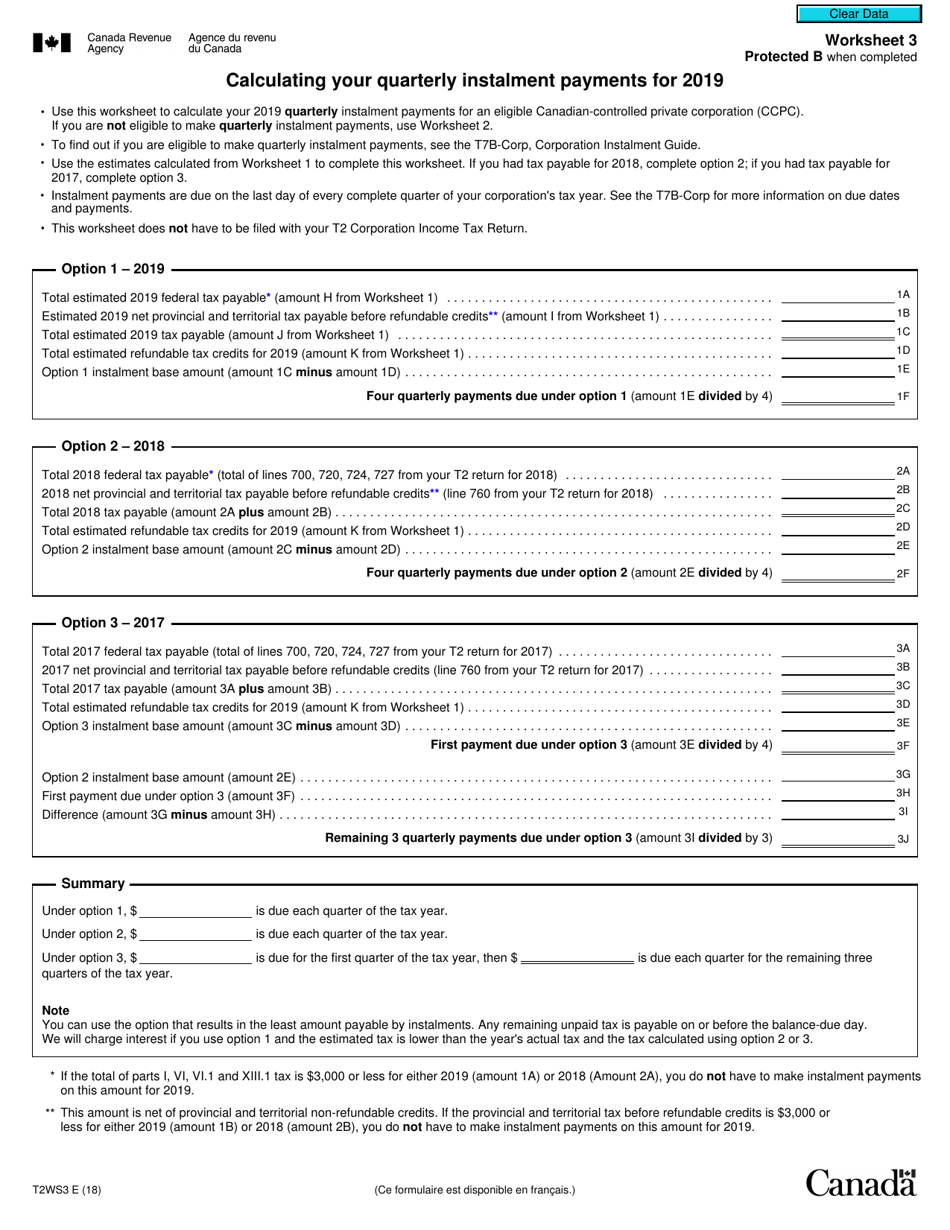

Form T2 Worksheet 3 Download Fillable PDF or Fill Online Calculating

Features include efiling, canada tax forms, & more in our tax preparation software. The cra 's publications and personalized correspondence are available in. Web there are several ways you can get the t2 corporation income tax return. Section b section c section d may 2022 section when to use this application you can use this application. In this video tutorial,.

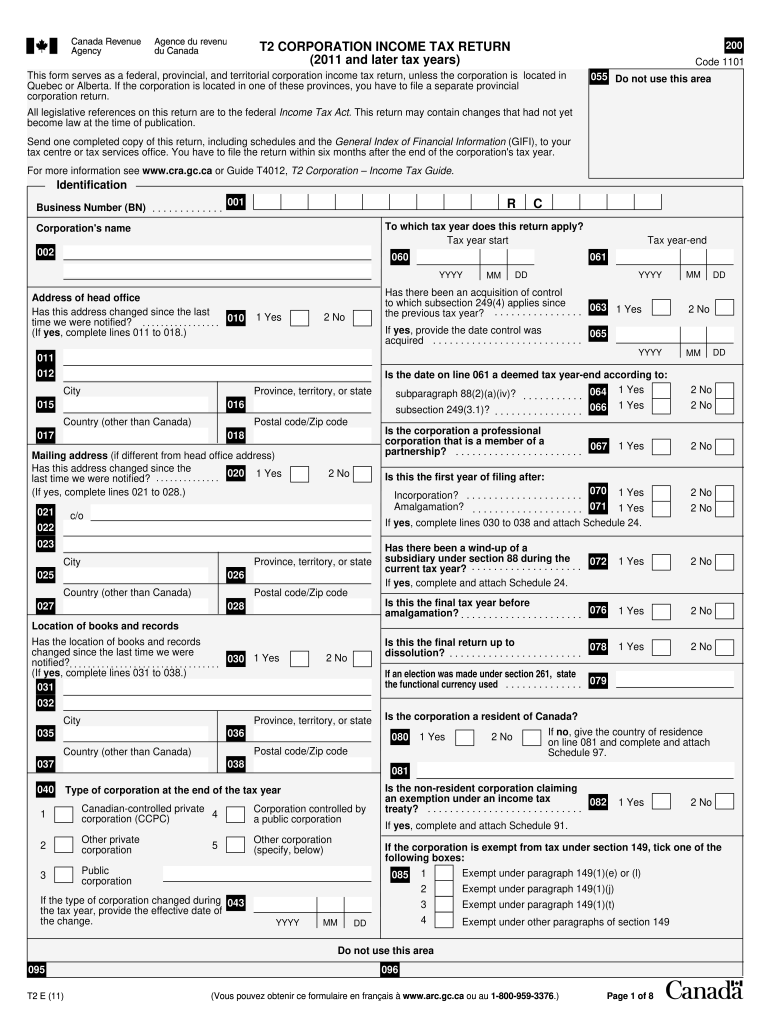

2011 Form Canada T2 Corporation Tax Return Fill Online

All corporations other than registered charities must file a t2. Print the t2 corporation income tax return in pdf format from cra's forms and. Click verify button in futuretax and fix errors if applicable; Use these forms to prepare your corporation income tax return. The canada revenue agency (cra) has created form t2, corporation income tax return, for.

Canada T2 Short 2009 Fill and Sign Printable Template Online US

Web 5 easy steps to submit your t2 tax return: Web all incorporated businesses operating within canada must file a t2 return with the cra. It carried on business in canada; Save or instantly send your ready documents. A t2 form is a taxpayer form for all canadian corporations to file their income tax.

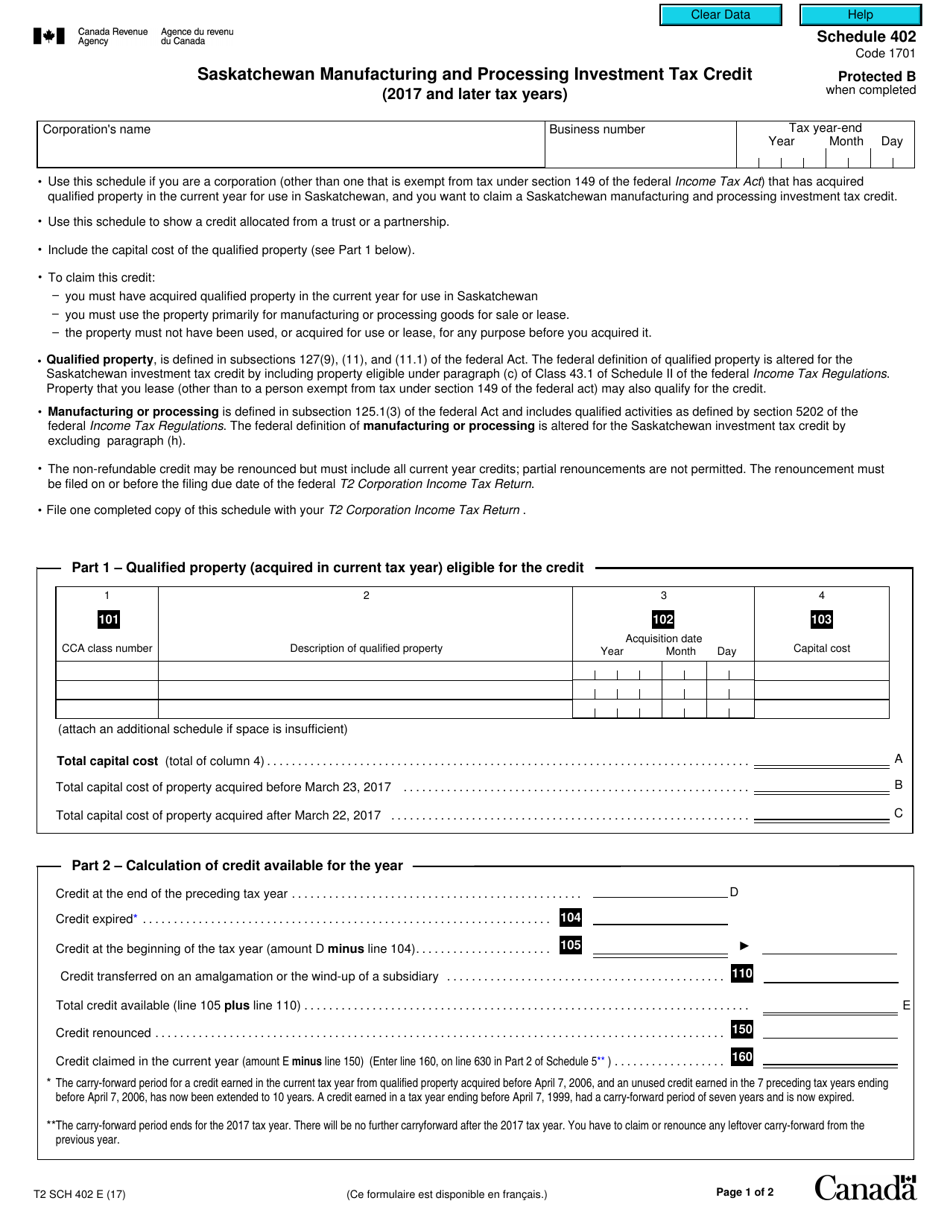

Form T2 Schedule 402 Download Fillable PDF or Fill Online Saskatchewan

It carried on business in canada; In this video tutorial, i will show you step by step in detail on how to file y. All corporations other than registered charities must file a t2. Web all incorporated businesses operating within canada must file a t2 return with the cra. Print the t2 corporation income tax return in pdf format from.

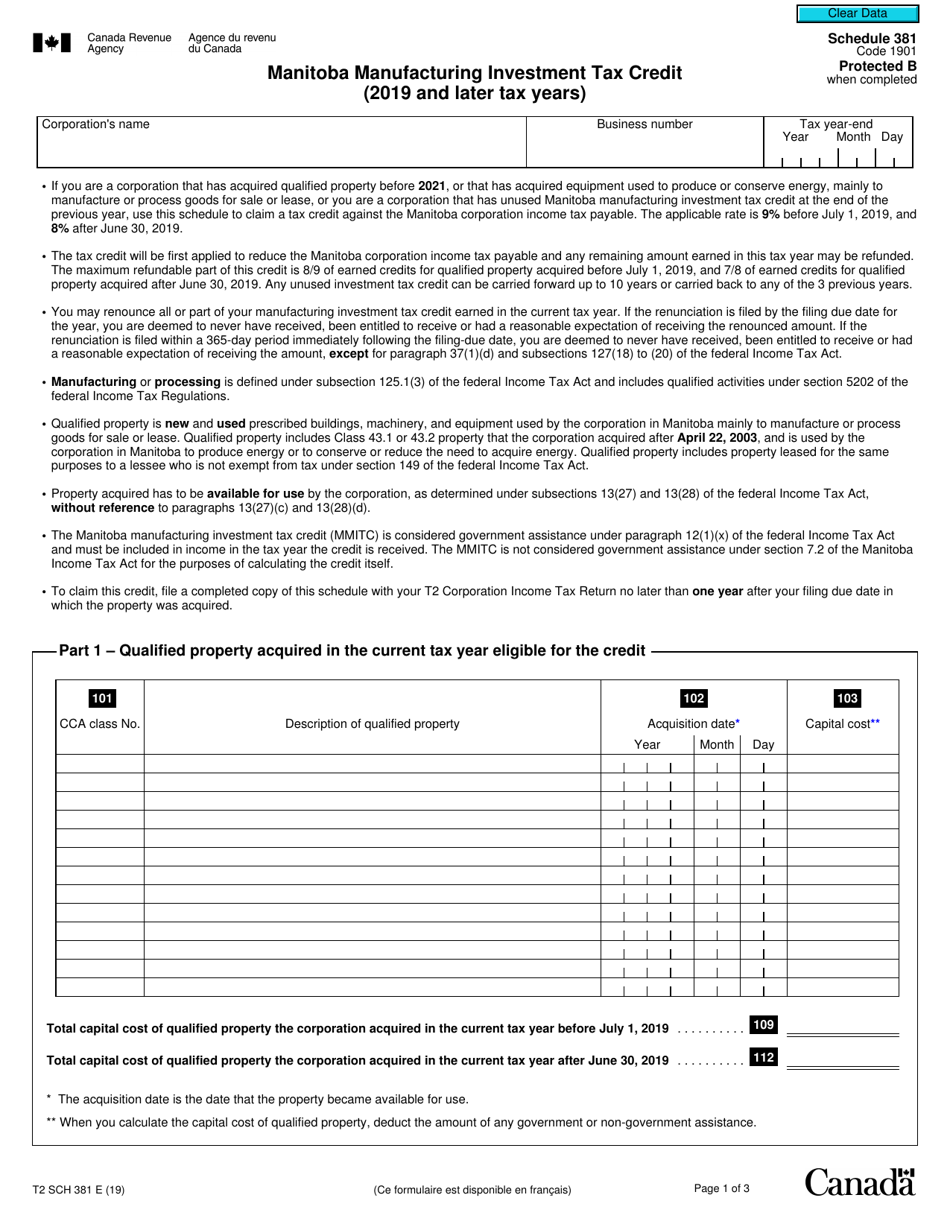

Form T2 Schedule 381 Download Fillable PDF or Fill Online Manitoba

Web 5 easy steps to submit your t2 tax return: Features include efiling, canada tax forms, & more in our tax preparation software. Web there are several ways you can get the t2 corporation income tax return. Web form t2 application about tenant rights instructions section a: The cra 's publications and personalized correspondence are available in.

20142022 Form Canada T2 Schedule 91 Fill Online, Printable, Fillable

Print the t2 corporation income tax return in pdf format from cra's forms and. Web t2 returns and schedules. Web prepare corporate t2 tax returns and cra efiles with profile. Web corporations are charged income tax just like individuals are. The cra provides two different t2 returns:

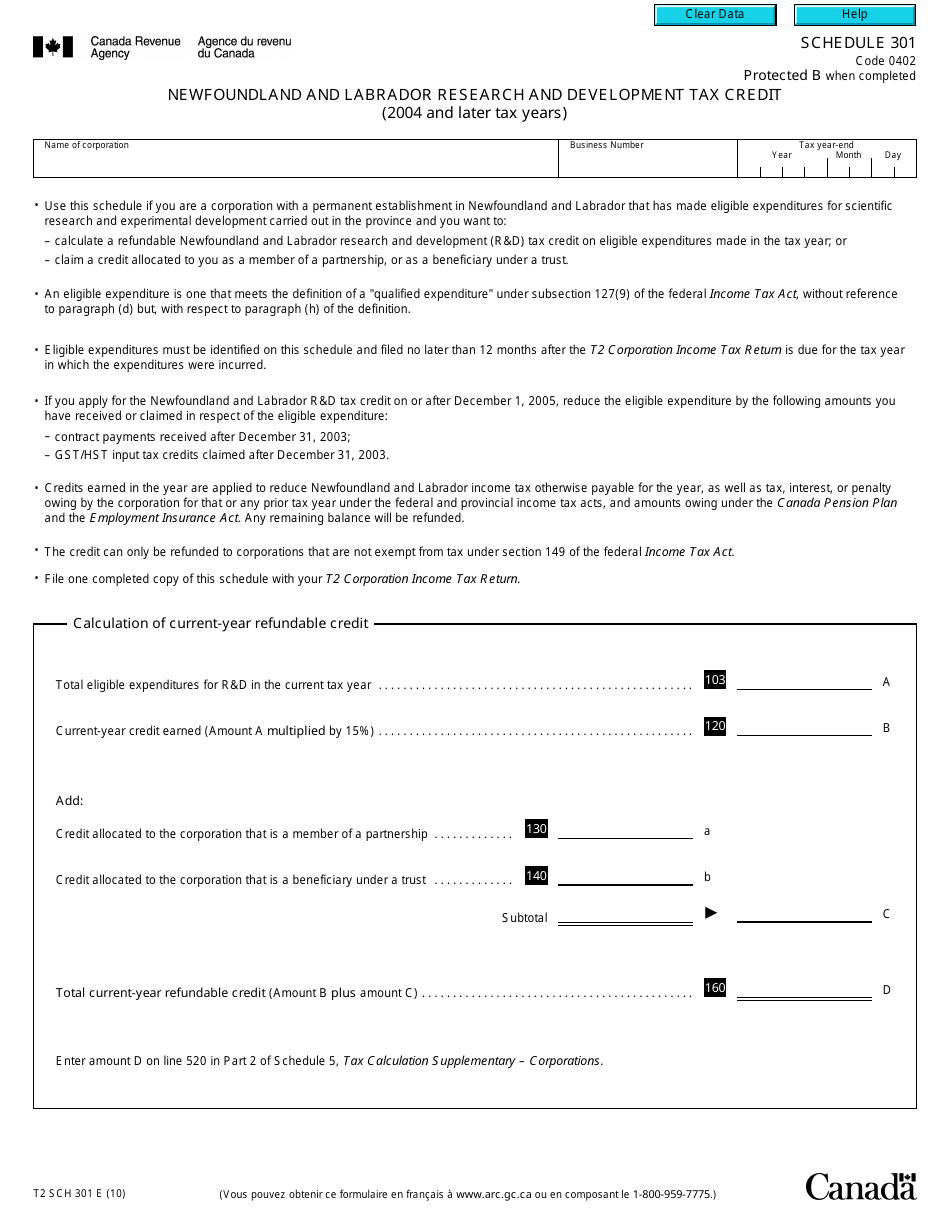

Form T2 Schedule 301 Download Fillable PDF or Fill Online Newfoundland

You can view this publication in: Web t2 returns and schedules. Easily fill out pdf blank, edit, and sign them. Section b section c section d may 2022 section when to use this application you can use this application. Save or instantly send your ready documents.

Web The T2 Corporation Income Tax Return Or T2 Is The Form Used In Canada By Corporations To File Their Income Tax Return.

Web there are several ways you can get the t2 corporation income tax return. Print the t2 corporation income tax return in pdf format from cra's forms and. Section b section c section d may 2022 section when to use this application you can use this application. Web corporations are charged income tax just like individuals are.

It Is To Be Filed With Relevant Schedules And The Gifi.

Web what is a t2 form? In this video tutorial, i will show you step by step in detail on how to file y. It carried on business in canada; The cra 's publications and personalized correspondence are available in.

Save Or Instantly Send Your Ready Documents.

Web t2 returns and schedules. Web all incorporated businesses operating within canada must file a t2 return with the cra. The cra provides two different t2 returns: Download, install and complete your tax return;

Web 5 Easy Steps To Submit Your T2 Tax Return:

Use these forms to prepare your corporation income tax return. Web the the t2 short return (government of canada) form is 4 pages long and contains: A t2 form is a taxpayer form for all canadian corporations to file their income tax. To view forms that are no longer in use, go to archived forms.