Certification Of Beneficial Owner Form

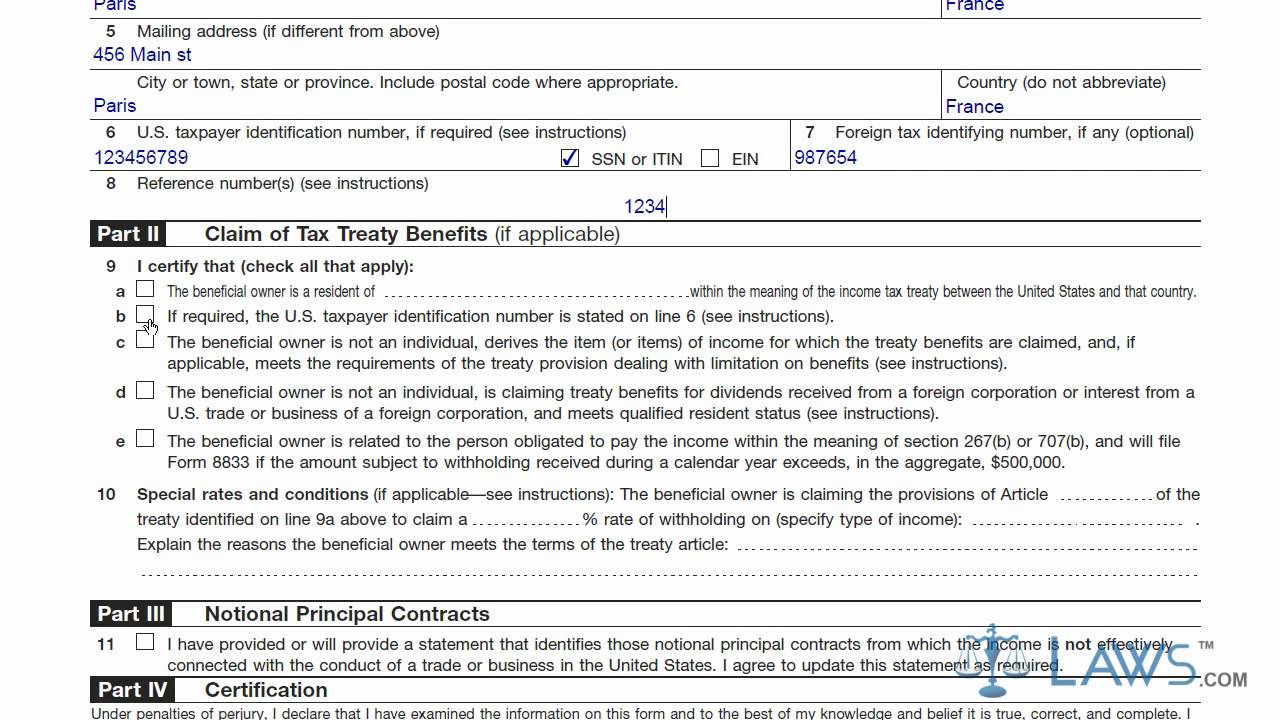

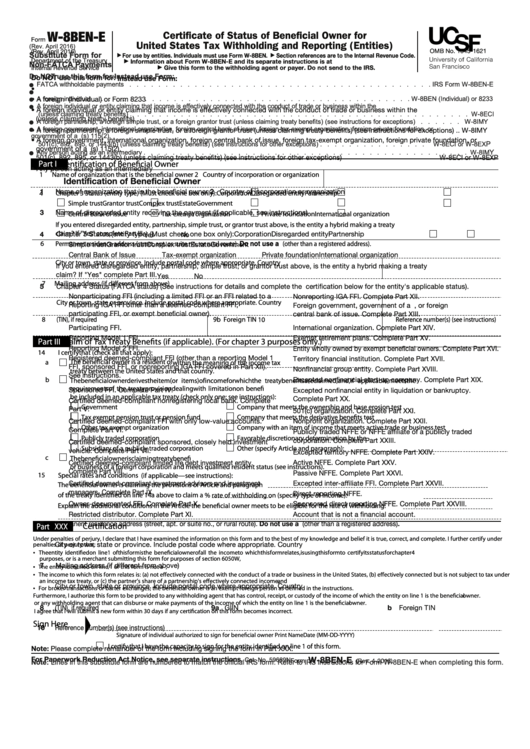

Certification Of Beneficial Owner Form - October 2021) department of the treasury internal revenue service certificate of foreign status of beneficial owner for united states tax withholding. I agree that i will submit a new form within. October 2021) department of the treasury internal revenue service. Under the rule’s beneficial ownership identification requirement, a covered. Today, the financial crimes enforcement network (fincen) issued a final rule implementing the bipartisan corporate transparency act’s. Web this form must be completed by the person opening a new account on behalf of a legal entity with any of the following u.s. Web certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) section references are to the internal revenue code unless. Establish foreign status, claim that such. Web this form must be completed by the person opening a new account on behalf of a legal entity with any of the following u.s. A final rule implementing the beneficial ownership information reporting requirements of the corporate transparency.

Web a model certification form was provided in the final rule to collect the beneficial ownership information. Web under the beneficial ownership rule,1 a bank must establish and maintain written procedures that are reasonably designed to identify and verify beneficial owner(s) of. Of the treaty identified on line 14a above to claim a % rate of withholding on (specify type of income):. Web this form requires you to provide the name, address, date of birth and social security number (or passport number or other similar information, in the case of foreign persons). Web this form must be completed by the person opening a new account on behalf of a legal entity with any of the following u.s. A final rule implementing the beneficial ownership information reporting requirements of the corporate transparency. Web institution to request beneficial ownership information on the legal entity identified as an owner? Web september 29, 2022. Today, the financial crimes enforcement network (fincen) issued a final rule implementing the bipartisan corporate transparency act’s. October 2021) department of the treasury internal revenue service.

A final rule implementing the beneficial ownership information reporting requirements of the corporate transparency. Web the following describe the specific types of documentation. Web under the beneficial ownership rule,1 a bank must establish and maintain written procedures that are reasonably designed to identify and verify beneficial owner(s) of. Web certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) section references are to the internal revenue code unless. I agree that i will submit a new form within. (i) a bank or credit union; This form will be completed at the time a new business account is opened for a legal entity. Establish foreign status, claim that such. Web certificate of beneficial ownership means, with respect to the borrower, a certificate certifying, among other things, the beneficial owner of the borrower, delivered on the. Web owner or any withholding agent that can disburse or make payments of the income of which the entity on line 1 is the beneficial owner.

Certificate of Foreign Status of Beneficial Owner for United States Tax

Certificate of status of beneficial owner for united states tax withholding and. Web under the beneficial ownership rule,1 a bank must establish and maintain written procedures that are reasonably designed to identify and verify beneficial owner(s) of. (i) each individual, if any, who owns, directly or indirectly, 25. Web institution to request beneficial ownership information on the legal entity identified.

Do you need a Beneficial Owner Tax Transparency Certification for your

Web institution to request beneficial ownership information on the legal entity identified as an owner? Web driver's license or other identifying document for each beneficial owner listed on this form. (i) a bank or credit union; Web beneficial ownership information reporting. Web this form must be completed by the person opening a new account on behalf of a legal entity.

Learn How to Fill the W 8 Form Certificate of Foreign Status of

Today, the financial crimes enforcement network (fincen) issued a final rule implementing the bipartisan corporate transparency act’s. Certificate of status of beneficial owner for united states tax withholding and. (i) each individual, if any, who owns, directly or indirectly, 25. Of the treaty identified on line 14a above to claim a % rate of withholding on (specify type of income):..

Fillable Form W8benE Certificate Of Status Of Beneficial Owner For

Of the treaty identified on line 14a above to claim a % rate of withholding on (specify type of income):. Web institution to request beneficial ownership information on the legal entity identified as an owner? Web owner or any withholding agent that can disburse or make payments of the income of which the entity on line 1 is the beneficial.

PPT DEPOSITORY SYSTEM PowerPoint Presentation ID533776

Web this form requires you to provide the name, address, date of birth and social security number (or passport number or other similar information, in the case of foreign persons). Certificate of status of beneficial owner for united states tax withholding and. Web beneficial ownership information reporting. Today, the financial crimes enforcement network (fincen) issued a final rule implementing the.

Form W8BENE Certificate of Entities Status of Beneficial Owner for

Web the beneficial owner is claiming the provisions of article and paragraph. Web this form must be completed by the person opening a new account on behalf of a legal entity with any of the following u.s. Web this form requires you to provide the name, address, date of birth and social security number (or passport number or other similar.

Beneficial Ownership Form Blank Fill Online, Printable, Fillable

Web this form must be completed by the person opening a new account on behalf of a legal entity with any of the following u.s. Today, the financial crimes enforcement network (fincen) issued a final rule implementing the bipartisan corporate transparency act’s. Under the rule’s beneficial ownership identification requirement, a covered. (i) a bank or credit union; (i) each individual,.

(FORM W8BEN)

Establish foreign status, claim that such. I agree that i will submit a new form within. (i) a bank or credit union; Web this form must be completed by the person opening a new account on behalf of a legal entity with any of the following u.s. Web institution to request beneficial ownership information on the legal entity identified as.

Beneficial Ownership Certification Form Inspirational regarding

Web certificate of beneficial ownership means, with respect to the borrower, a certificate certifying, among other things, the beneficial owner of the borrower, delivered on the. Web this form must be completed by the person opening a new account on behalf of a legal entity with any of the following u.s. A final rule implementing the beneficial ownership information reporting.

Certification Regarding Beneficial Owners of Legal Entity Customers LSTA

Web the beneficial owner is claiming the provisions of article and paragraph. (i) a bank or credit union; Web this form requires you to provide the name, address, date of birth and social security number (or passport number or other similar information, in the case of foreign persons). Web september 29, 2022. Web a model certification form was provided in.

Web The Beneficial Owner Is Claiming The Provisions Of Article And Paragraph.

Of the treaty identified on line 14a above to claim a % rate of withholding on (specify type of income):. October 2021) department of the treasury internal revenue service certificate of foreign status of beneficial owner for united states tax withholding. This form will be completed at the time a new business account is opened for a legal entity. Web september 29, 2022.

Web Under The Beneficial Ownership Rule,1 A Bank Must Establish And Maintain Written Procedures That Are Reasonably Designed To Identify And Verify Beneficial Owner(S) Of.

Certificate of status of beneficial owner for united states tax withholding and. Web driver's license or other identifying document for each beneficial owner listed on this form. (i) a bank or credit union; (i) a bank or credit union;

Web Owner Or Any Withholding Agent That Can Disburse Or Make Payments Of The Income Of Which The Entity On Line 1 Is The Beneficial Owner.

Establish foreign status, claim that such. Web this form must be completed by the person opening a new account on behalf of a legal entity with any of the following u.s. October 2021) department of the treasury internal revenue service. Web what is a beneficial ownership certification form?

Under The Rule’s Beneficial Ownership Identification Requirement, A Covered.

Web certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) section references are to the internal revenue code unless. Today, the financial crimes enforcement network (fincen) issued a final rule implementing the bipartisan corporate transparency act’s. Web certificate of beneficial ownership means, with respect to the borrower, a certificate certifying, among other things, the beneficial owner of the borrower, delivered on the. Web institution to request beneficial ownership information on the legal entity identified as an owner?