Cointracker Form 8949

Cointracker Form 8949 - Web aggregate transaction volume is a completely different number than capital gains, which is what is needed to file your taxes on irs form 8949 (which is what is generated by. How to enter margin trading transactions. Web i never receive an email after generating any irs form for tax year 2022. Generates necessary tax documents, such as irs form 8949. Web form 8949 with nft sales professional nft creators. Web sold or traded crypto? Learn how to easily report your crypto transactions to the irs on form 8949.form 8949 is required when filing your taxes for all us ta. Web line items on the 8949 do not necessarily correspond to the transactions in cointracker, or the records in the original wallet or exchange. Web how can i view my previous tax calculations from cointracker? I never receive any of the following forms:

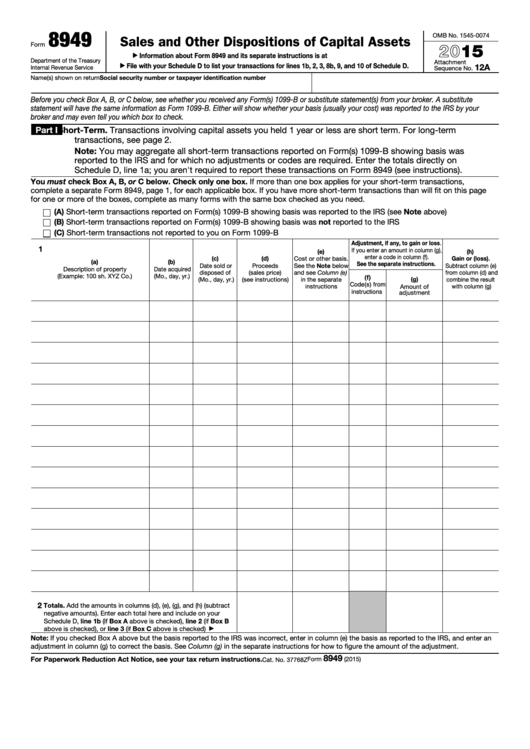

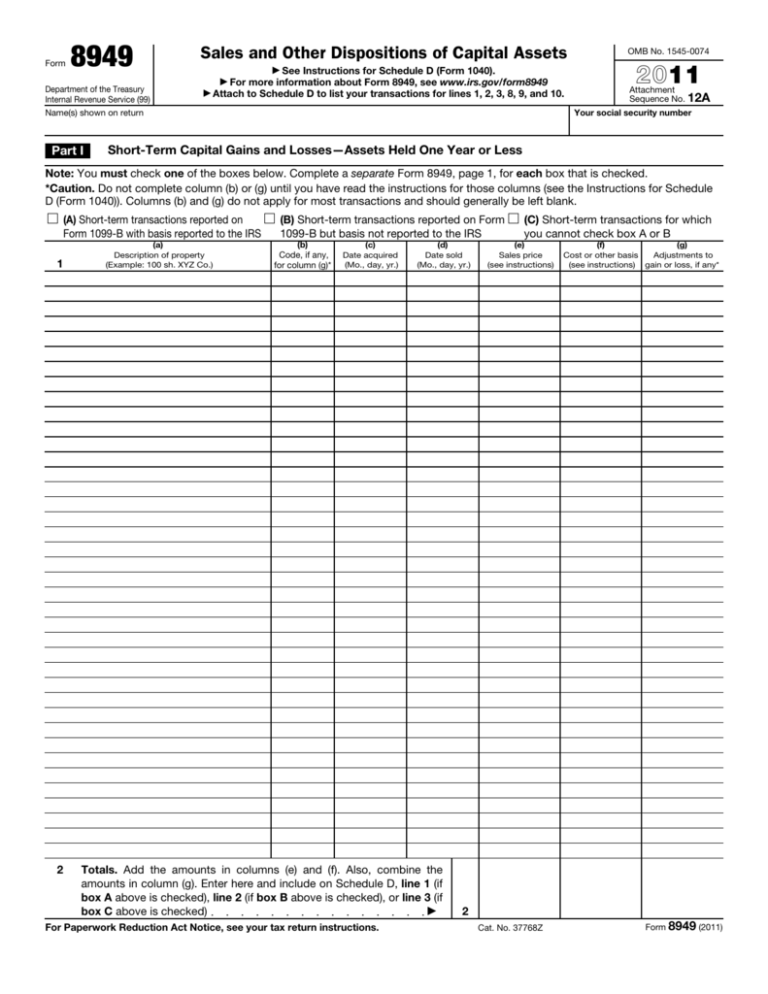

Web how can i view my previous tax calculations from cointracker? Web form 8949 department of the treasury internal revenue service sales and other dispositions of capital assets go to www.irs.gov/form8949 for instructions and the. How to download and backup your cointracker transaction history; Web us tax forms (irs form 8949, 1040 schedule d, and 1040 schedule 1), or tax forms for other supported countries (australia, india, canada, uk) export to turbotax, taxact,. Web once you connect cointracker to your coinbase account, our platform will automatically generate the relevant tax forms to report crypto gain/loss, including irs. Web filing your cryptocurrency taxes after purchasing a cointracker tax plan, how can i file my crypto taxes? Web aggregate transaction volume is a completely different number than capital gains, which is what is needed to file your taxes on irs form 8949 (which is what is generated by. As such, you can import your sale data into turbotax desktop editions. Web cointracking provides a downloadable tax exchange format (txf) file — but does not offer an ofx server. Web sold or traded crypto?

Web line items on the 8949 do not necessarily correspond to the transactions in cointracker, or the records in the original wallet or exchange. Web form 8949 with nft sales professional nft creators. Web i never receive an email after generating any irs form for tax year 2022. Web filing your cryptocurrency taxes using cointracker to file with turbotax (for new cointracker users) please note: File yourself you can download your completed irs form 8949 and cost. Web cointracking clients www.cointracking.info at form8949.com, we help you minimize the time and expense of complying with the tax reporting requirements related to your stock. How to enter margin trading transactions. This is because transaction history is. Web us tax forms (irs form 8949, 1040 schedule d, and 1040 schedule 1), or tax forms for other supported countries (australia, india, canada, uk) export to turbotax, taxact,. Generates necessary tax documents, such as irs form 8949.

CoinTracker partners with Coinbase to Offer Crypto Tax Solutions

Web cointracking provides a downloadable tax exchange format (txf) file — but does not offer an ofx server. Web aggregate transaction volume is a completely different number than capital gains, which is what is needed to file your taxes on irs form 8949 (which is what is generated by. 1) irs form 8949, 2) condensed irs form. In most jurisdictions.

Fillable Form 8949 Sales And Other Dispositions Of Capital Assets

Web filing your cryptocurrency taxes using cointracker to file with turbotax (for new cointracker users) please note: How to download and backup your cointracker transaction history; Web cointracking provides a downloadable tax exchange format (txf) file — but does not offer an ofx server. File yourself you can download your completed irs form 8949 and cost. Total gains reported on.

CoinTracker has partnered with Coinbase and TurboTax by Chandan Lodha

This is because transaction history is. Web form 8949 with nft sales professional nft creators. Web once you connect cointracker to your coinbase account, our platform will automatically generate the relevant tax forms to report crypto gain/loss, including irs. Professionals can use schedule c or the applicable business tax form (form 1065, form 1120, or form 1120. Web form 8949.

Form 8949 Pillsbury Tax Page

Form 8949, schedule d, schedule 1, schedule a, schedule b, schedule c, schedule e and form 8275 are the most commonly used irs. Generates necessary tax documents, such as irs form 8949. 1) irs form 8949, 2) condensed irs form. Web aggregate transaction volume is a completely different number than capital gains, which is what is needed to file your.

CoinTracker The most trusted cryptocurrency tax and portfolio manager

Web aggregate transaction volume is a completely different number than capital gains, which is what is needed to file your taxes on irs form 8949 (which is what is generated by. Professionals can use schedule c or the applicable business tax form (form 1065, form 1120, or form 1120. Web i never receive an email after generating any irs form.

Three Tax Forms Crypto Users Must File With the IRS CoinTracker

Web aggregate transaction volume is a completely different number than capital gains, which is what is needed to file your taxes on irs form 8949 (which is what is generated by. File yourself you can download your completed irs form 8949 and cost. Generates necessary tax documents, such as irs form 8949. Total gains reported on tax center, capital. Web.

2016 Form 8949 Fill Online, Printable, Fillable, Blank pdfFiller

In most jurisdictions around the world, including in the us, canada australia, the tax authorities tax cryptocurrency transactions. This is because transaction history is. Form 8949, schedule d, schedule 1, schedule a, schedule b, schedule c, schedule e and form 8275 are the most commonly used irs. Web form 8949 form 8949 pdf download follow these steps to generate your.

CoinTracker integrates with H&R Block to offer crypto tax preparation

Generates necessary tax documents, such as irs form 8949. Learn how to easily report your crypto transactions to the irs on form 8949.form 8949 is required when filing your taxes for all us ta. How to download and backup your cointracker transaction history; As such, you can import your sale data into turbotax desktop editions. 1) irs form 8949, 2).

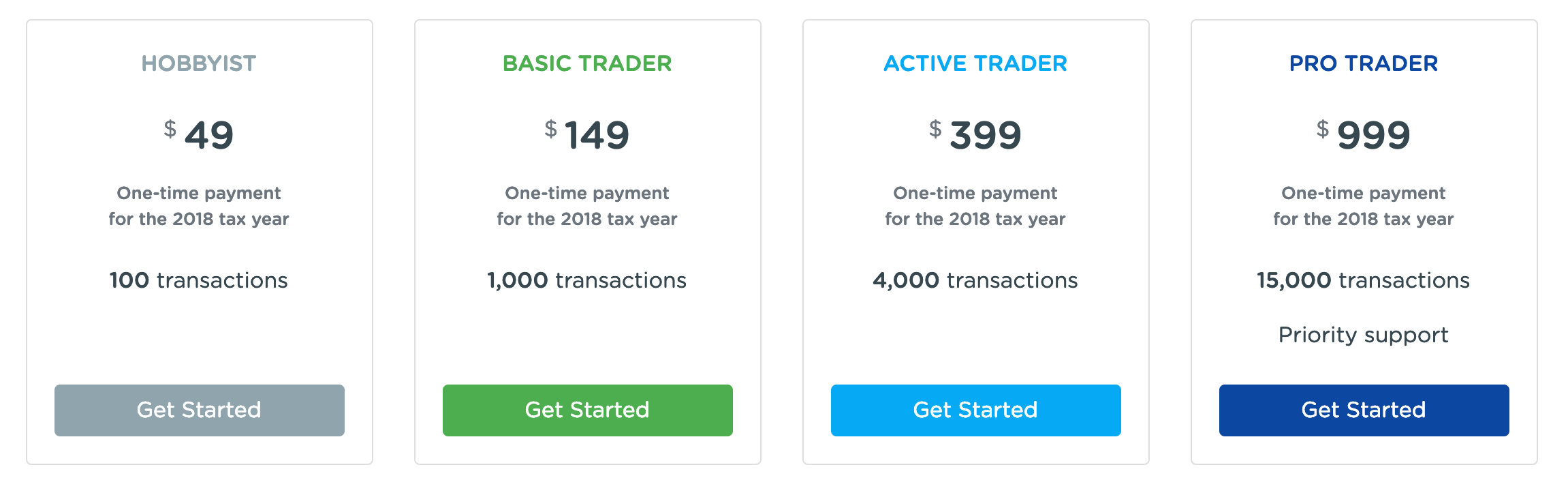

Cryptocurrency Taxes CryptoTrader.Tax vs. CoinTracker

Web us tax forms (irs form 8949, 1040 schedule d, and 1040 schedule 1), or tax forms for other supported countries (australia, india, canada, uk) export to turbotax, taxact,. Has a free version and mobile apps for both ios. File yourself you can download your completed irs form 8949 and cost. I never receive any of the following forms: Please.

8949 Bitcoin / Import Print Or Attach Form 8949 For Bitcoin Capital

File yourself you can download your completed irs form 8949 and cost. Web once you connect cointracker to your coinbase account, our platform will automatically generate the relevant tax forms to report crypto gain/loss, including irs. Total gains reported on tax center, capital. At form8949.com, we help you minimize the time and expense of complying with the tax reporting requirements.

Has A Free Version And Mobile Apps For Both Ios.

Web form 8949 with nft sales professional nft creators. Web form 8949 department of the treasury internal revenue service sales and other dispositions of capital assets go to www.irs.gov/form8949 for instructions and the. Web once you connect cointracker to your coinbase account, our platform will automatically generate the relevant tax forms to report crypto gain/loss, including irs. At form8949.com, we help you minimize the time and expense of complying with the tax reporting requirements related to your stock.

1) Irs Form 8949, 2) Condensed Irs Form.

Web line items on the 8949 do not necessarily correspond to the transactions in cointracker, or the records in the original wallet or exchange. Web filing your cryptocurrency taxes using cointracker to file with turbotax (for new cointracker users) please note: Web how can i view my previous tax calculations from cointracker? Web aggregate transaction volume is a completely different number than capital gains, which is what is needed to file your taxes on irs form 8949 (which is what is generated by.

Web Filing Your Cryptocurrency Taxes After Purchasing A Cointracker Tax Plan, How Can I File My Crypto Taxes?

This is because transaction history is. Total gains reported on tax center, capital. Learn how to easily report your crypto transactions to the irs on form 8949.form 8949 is required when filing your taxes for all us ta. Please enter your full name and your social security number or taxpayer.

Professionals Can Use Schedule C Or The Applicable Business Tax Form (Form 1065, Form 1120, Or Form 1120.

Web cointracking clients www.cointracking.info at form8949.com, we help you minimize the time and expense of complying with the tax reporting requirements related to your stock. How to enter margin trading transactions. Web us tax forms (irs form 8949, 1040 schedule d, and 1040 schedule 1), or tax forms for other supported countries (australia, india, canada, uk) export to turbotax, taxact,. Web sold or traded crypto?

/IRSForm8949-d55e89f19d8043719e68055fdd8dad41.jpg)